Everything you need to know about the UTI AMC IPO

India’s oldest AMC, UTI Asset Management Company Limited is set to hit the IPO market on 29th September issuing 38,987,081 shares and aims to raise around Rs 2,160 cr (at the higher end of the price band).

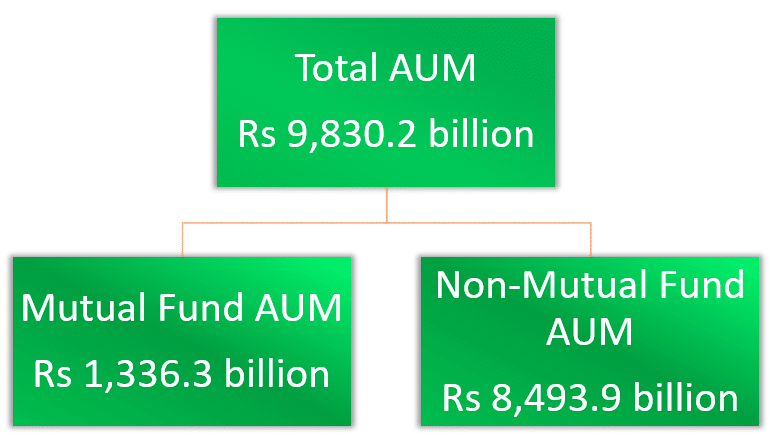

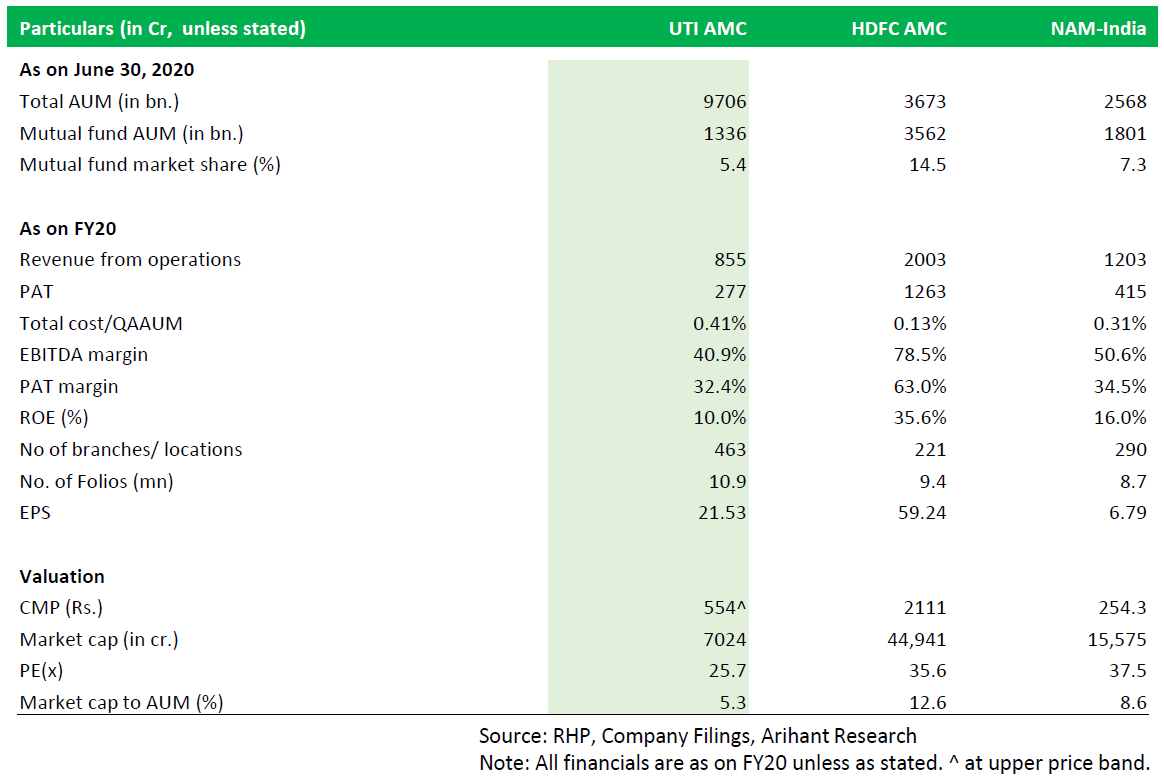

UTI AMC is the second-largest asset management company (AMC) in India in terms of total AUM and the eighth-largest asset management company in India in terms of mutual fund Quarterly Average Assets Under Management (QAAUM) as of June 30, 2020, according to CRISIL. UTI AMC commands a 5.4% share of the Indian mutual fund market, by AUM. The company and its predecessor (Unit Trust of India) have been active in the industry for more than 55 years. They have practically made history in the Indian financial industry by setting up the country’s first mutual fund!

The company caters to a diverse group of individual and institutional investors through a wide variety of funds and services. The company manages the domestic mutual funds of UTI Mutual Fund, provides portfolio management services (PMS) to institutional clients and high-net-worth individuals (HNIs), and manages retirement funds, offshore funds, and alternative investment funds. It has a national footprint and offers its schemes through a diverse range of distribution channels.

This will be the third AMC to get listed on the stock exchanges after Nippon Life India Asset Management (NAM) and HDFC AMC.

Click here to apply for UTI AMC IPO.

Objects of the Issue

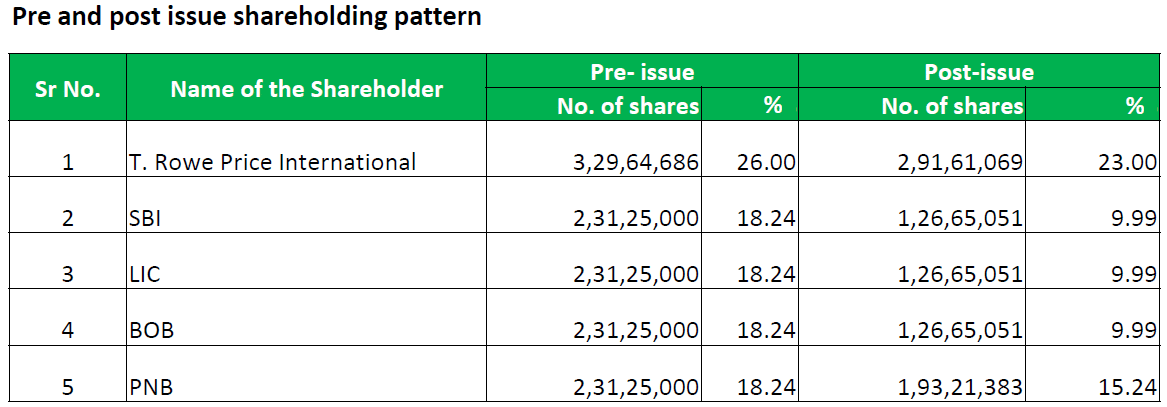

- Provide liquidity to the existing shareholders: The UTI AMC IPO will see its existing shareholders, i.e. four sponsors namely State Bank of India, Punjab National Bank, Bank of Baroda, Life Insurance Corporation of India, and its major shareholder T Rowe Price International reduce their stake in the AMC by a total of around 30.75%. SBI, BoB, and LIC will divest an 8.25% stake each, while T Rowe and PNB will sell 3% each.

- To achieve the benefits of listing equity shares on the Stock Exchanges

- Enhance visibility and brand name among existing and potential customers.

Competitive Strengths and Opportunities

- Underpenetration of mutual funds: Well-positioned to capitalise on favourable industry dynamics, including the under-penetration of mutual fund products. At present, the AMC manages 153 mutual fund schemes comprising equity, hybrid, income, liquid, and money market funds with a QAAUM of around ₹1. 3 lakh crore as on June 2020.

Diverse portfolio and strong brand recognition: A pure-play independent asset manager with strong brand recognition and a diverse portfolio of funds and services.

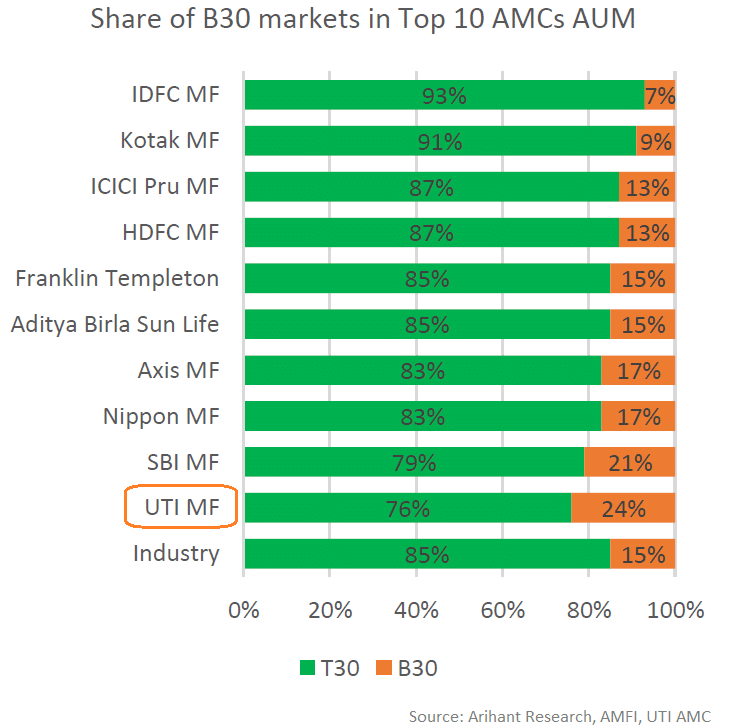

- Multiple distribution channels: The AMC has a very wide network of IFAs, distributors, and its own centres. It is one of the few AMCs with a great foothold in tier 2 and 3 cities as well. As of June 30, 2020, its distribution network included 163 UTI Financial Centres (UFCs), 257 Business Development Associates (BDAs) and Chief Agent (40 of whom operate Official Points of Acceptance (OPAs) and 43 other OPAs, most of which are in each case located in B30 cities). It also boasts of approximately 53,000 Independent Financial Advisors (IFAs) as of June 30, 2020. The company’s banks and distributors (BND) channel involves distribution arrangements with domestic and foreign banks, as well as with national and regional distributors. In addition, the AMC has dedicated sales teams for institutional and public sector undertaking (PSU) clients and also offers products directly through their UFCs, digital applications, and website.

- Long and proven track record: UTI AMC and its predecessor have been in the asset management business for over 55 years. It’s no small feat. It has a long-term track record of product innovation, consistent and stable investment performance, and AUM growth.

- Retirement Solutions:

It has established itself as the largest retirement benefit pension fund in the retirement fund category through product innovation and large retirement fund mandates.

- Sound management: Experienced management and investment teams supported by strong governance structures and human resources programs.

Size and product mix.

Weaknesses and Key Risks

- Low presence in the equity segment and declining revenues: It’s a well-known fact that equity funds attract a high expense ratio for investors, which means higher income in terms of mutual funds compared to its debt schemes. UTI AMC’s presence in the equity segment is 32% of its AUM, which is less than that of its listed peers and also below the industry average of 39%. As a result, while AMC is registering growth in its total AUM, the company’s total revenue, as well as its profits, have been declining for the last 3 years.

- Declining market share: The company’s market share has declined consistently over the past years and may continue to do so. This could have an adverse impact on the business, financial condition, and results of operations.

- Concentration risk: The company’s top 6 active equity funds account for 73 5% of the total QAAUM of active equity funds while the top 5 passive funds account for 98.7% of the total QAAUM of passive equity funds. Even the top six hybrid funds constituted 94.3% of the total QAAUM of all its hybrid funds. Any adverse performance in any of these concentrated funds will affect the company’s earnings and thus forms a risk for the company

- Client concentration: The PMS and offshore funds managed by the company consists of a few high-ticket marquee clients like the EPFO, NSDF, and many pension funds which form client concentration risk for the company. If any of these big clients withdraw or choose to pursue other investment managers, it will lead to a substantial decrease in AUM in their respective categories and a consequent drop in revenues.

- Reliance on third-party distribution network: The company depends on third-party distribution channels and other intermediaries. Any problems with these distribution channels and intermediaries, or failure to continue to expand the current third-party distribution channels and intermediaries, could adversely affect the business and financial performance.

- Risk of underperformance: The underperformance of its investment portfolio could lead to a loss of clients and a reduction in AUM and result in a decline in its income.

IPO Snapshot

- Price band: Rs 552-554

- Face value: Rs 10 per equity share

- Number of shares on offer: 3,89,87,081

- Minimum investment: Rs 14,958 (bid lot size of 27 shares)

- Subscription dates: 29th Sep 29 to 1st Oct

- Listing on: NSE and BSE

- Listing date: ~12 October 2020

- Revenue (FY20): Rs 855 crore

- Profit after tax (FY20): Rs. 273 crore

- Post-IPO, market cap: Rs 6,999-7,024 crore

- Book-running lead managers: Kotak Mahindra Capital Company, Axis Capital, Citigroup Global Markets India, DSP Merrill Lynch, ICICI Securities, JM Financial, and SBI Capital Markets are the book-running lead managers to the offer.

Should you invest?

Now that’s the most important question – whether or not you should invest in UTI AMC IPO.

We ran through some numbers, did the competitive analysis of UTI AMC vis-a-vis other players in the industry, and also the growth in its AUM in the last few years. Here’s our take.

At the upper price band of Rs 554, the company is being valued at Rs 7,024 cr. At 25.7 x FY20 PE, the IPO is fairly lower priced than its peers. HDFC AMC and Nippon India AMC are commanding a valuation of 35-38 x FY20 PE.

The valuation gap between UTI AMC and other listed players is primarily due to UTI’s weak return ratios, higher cost metrics, lower profit growth, and stagnant equity AUM. However, any improvement in cost parameters as stated by management and growth in AUM will augur well for the company. For that, we need to wait and watch its AUM growth (compared to the industry average), increase in equity AUM, and performance of its funds in the coming months.

In simple English? While the issue is attractively priced, given its relatively weaker return ratios, timid AUM growth and unfavorable AUM mix, we think that UTI AMC IPO is not a very attractive investment at this time, if you are a long-term investor. Hence, We have a ‘NEUTRAL’ rating on this issue.

However, given the issue is attractively priced and given the fact that this year itself the company granted ESOPs at Rs. 728 per share while its price band is at Rs. 552-554 per share, there is a chance of good listing gains. So, if you are a high-risk investor looking to cash out on listing gains, you can consider investing in the UTI AMC IPO.

How to apply for IPO Online

How to accept a mandate through UPI App

How to create UPI ID

Click here to apply for UTI AMC IPO.