Global Markets’ Pre-Holi Bash, FIIs Bring in Cash, BSE Makes History- Weekly Market Wrap-Up

From all of us at Arihant Capital, we wish you a Happy Holi, may your lives be colorful and your portfolios green!

In this Weekly Market Newsletter:

- Market Wrap Up

- Expect from the Market

- Market Outlook

- Stock Picks

- Options Hub

- Quick Bites

- IPO Corner

- Sustainability Corner

Had fun this Holi? So did the global markets. The Russia-Ukraine tensions had eroded almost $12 trillion from global stocks. But, positive cues from the Chinese market and Wall Street coloured all the major indices green. Although all global markets are in the green, most still trade 4-18% below their 200 DMA. Nifty 50 stands closer to its 200 DMA, showing that the Indian markets faced less pressure. Did it have something to do with FinMin’s announcement that India Inc is ready to tackle any external shocks? Were FIIs just waiting for this to start buying in the Indian market again?

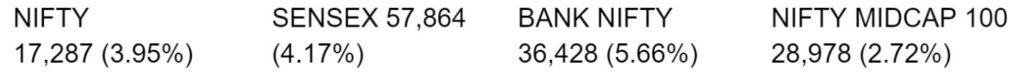

See how all major Indian indices went up.

In other news, mercury rises creating demand for summer products, and companies relook at their sustainability goals on world recycling day. Bitcoin crossed 41,000 mark and BSE made history when it crossed the 100 crore mark of registered investor accounts!

The financial year is about to end. Still confused about where to invest? Check out the Do’s and Don’ts of tax saving options in our next blog. Subscribe below and we will let you know as it gets posted.

All sectoral indices went up, but Nifty Financial Services outshined all other indices by topping the list of best-performing sectors, gaining ▲6.21% to close at 17,137. Now let us see how the other sectors performed.

📈Top Gainers and Loserse

| Top Gainers | Top Losers | ||

| Titan | 9.5% | Hindalco | -2.9% |

| Shree Cement | 8.5% | ONGC | -2.3% |

| HDFC | 7.9% | Coal | -1.3% |

| Asian Paints | 7.7% | Tata Steel | -0.4% |

| M&M | 7.5% | NTPC | -0.0% |

📈What to Expect from the Markets?

-Mr. Abhishek Jain, Arihant Capital’s Research Head

India’s stock benchmark indices logged the best week in over a year since Feb’ 21. They were aided by gains in banking, auto and realty stocks, led by U.S. Federal Reserve’s 25bps rate hike in its first bid towards monetary policy normalisation.

Things look much better globally as the impact of the Russia-Ukraine crisis has been limited against earlier fears of the tensions turning into a full-blown war. Rising inflation may impact demand going forward. India is swept with a heatwave causing a rising demand trend in summer stocks, especially in the consumer durables sector.

🔭Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst

Nifty

The daily chart of Nifty closed above 200 SMA and was trading above the downward sloping trendline. On the weekly front, a positive candle is now activated. Together we conclude that stock-specific activity may continue and need to maintain “buy” on deep strategy. If Nifty crosses the 17,350 level it may see a bounce towards 17,500 and 17,750 levels, while on the downside support if it crosses below 17,100 then it can test the levels of 16,800 and 16,650

Bank Nifty

The daily chart of Bank Nifty is still trading below 200 SMA. On the weekly chart, the index has shown positive formation. If both the data are combined and analysed then Bank Nifty may perform after consolidation. This week Bank Nifty futures closed at 36,400 levels. In the coming trading session if it holds below 36,100 then weakness could take it to 35,500 and 35,200 whereas minor resistance on the upside is capped around 37,200-37,500 levels.

💰Stock Picks

From the Fundamental Desk

-Fundamental Stock Picks from Mr. Abhishek Jain, Arihant Capital’s Research Head

Whirlpool stock can be added at CMP of 1,652 in tranches to the portfolio. Heatwave is very strong and demand for key products like air conditioners and refrigerators is expected to be strong as per channel checks. Dealer level inventories are at lower levels currently. This is a positive sign for the industry which has been impacted by slowdown and inflationary push.

We are valuing the stock at 45x FY24 EPS of ₹51 and arrived at a price objective of ₹2,301 in the next 12 months. Financials have done great in the last few days as per expectations. We maintain a positive outlook on them, however, some profits can be booked at higher levels.

From the Technical Desk

-Technical Stock Picks from Sr. Equity Research Analyst Kavita Jain’s Desk

1. Buy Kansai Nerolac

CMP: 475, Tgt: 503/525 SL: 465 Duration: 1-2 Week

Rational: Stock has regained 20 days moving average with ample volume. The leading indicator shows further strength for northward direction movement.

2. Buy ICICIpru

CMP: 492,Tgt: 525/530 SL: 480 Duration: 1-2 Week

Risky Trader: Buy ICICIpru 500 CE @ 10.6 SL 7 Tgt 20

Rational: Stock has regained 20 days moving average with decent volume and has turned from the oversold territory on the weekly chart.

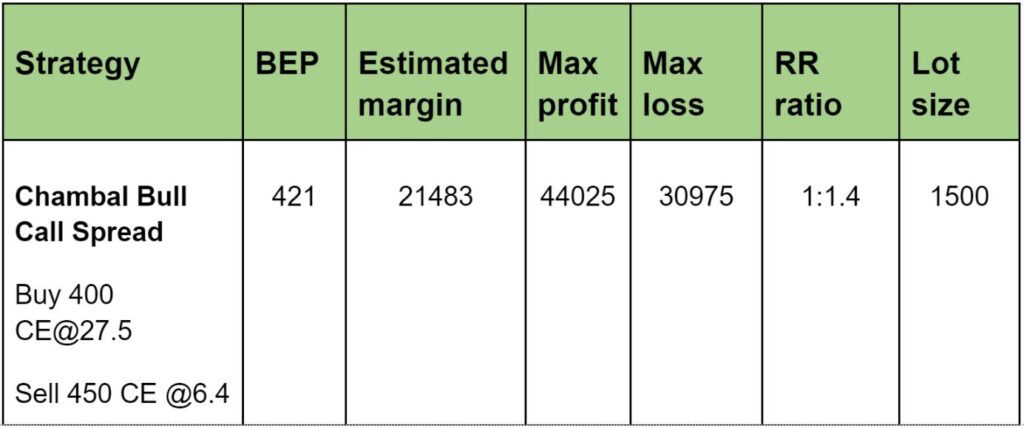

📊Options Hub

Stock option strategy

Technical setup: Chambal Fertilizer counter has closed above all its moving averages and has formed trough on its upward sloping trendline support with decent volume after three days downside move. Leading indicator 56 is showing added power to move up.

🔎Quick Bites

Global:

- The number of new pandemic deaths reported worldwide fell by 17% in the last week.

- Brent crude extended losses sliding 6.11% to a two-week low of $100.4 a barrel.

- The US has banned the import of crude oil from Russia, and the UK announces 350 new sanctions on Russia. As a result of all sanctions, 2 million barrels per day of Russian oil may not reach the market.

- Amazon has suspended shipment of retail products to customers based in Russia and Belarus.

Economy:

- India invests! The number of registered investor accounts at BSE has hit the 100 million milestone.

- Retail inflation, as measured by the consumer price index (CPI), rose to 6.07% in February as compared to 5.03% reported in the year-ago period.On the other hand, wholesale price inflation (WPI) for the month of February increased to 13.11%.

- India’s merchandise exports have crossed $380 billion so far and are expected to reach $410 billion in 2021-22.

- Finance Minister Nirmala Sitharaman presented a ₹1.42 lakh crore budget for the union territory of Jammu and Kashmir for the year 2022-23 in the Lok Sabha.

- Govt to make calibrated interventions to keep fuel prices under control.

- Finance ministry says the economy is well prepared to absorb any upcoming external shock. India’s forex reserves stood at a record high and are large enough to finance more than 12 months of import.

- RBI has projected CPI inflation at 4.5% for FY 2022-23.

Banking and Finance:

- Good news for micro-finance institutions as RBI announces new MFI lending guidelines and brokerage upgrades. Under the new directions, a microfinance loan has been defined as a ‘collateral-free’ loan granted to a household with an annual household income of up to ₹3 lakhs.

- Banks have recovered ₹7,34,542 crore in NPAs and written-off loan accounts in the past 6.5 financial years.

- DCB Bank announced the opening of its 50th branch in Bhubaneswar, Odisha.

- HDFC Bank reported an increase of 21,503 permanent employees in the current financial year. It has also crossed ₹2 lakh crore in total business in Karnataka, making it the largest private sector bank in the state.

- ICICI Bank has announced its partnership with Emirates Skywards to launch a range of co-branded credit cards.

- PNB has reported a fraud of ₹2,060 crore in the NPA account of IL&FS Tamil Nadu Power Company Limited (ITPCL).

- RBI announced the launch of UPI for feature phones called UPI123Pay.

- RBI, IIT M to work together to scale fintech startups.

- NXT Digital- Hinduja Leyland Finance merger on the cards.

- Manappuram Finance plans to raise funds through the issuance of redeemable non-convertible debentures, notes, bonds (debt securities) in the onshore/offshore market by way of private placement and/or public issue.

- Bank of Baroda’s Baroda Asset Management & BNP Paribas Asset Management India to merge.

- SEBI imposed a penalty of ₹5 lakh on Future Enterprises (FEL) for violation of disclosure norms pertaining to arbitration proceedings before the Singapore International Arbitration Centre (SIAC).

Energy and Infrastructure:

- Torrent Power all set to acquire a 51% stake in the discom Dadra and Nagar Haveli and Daman and Diu Power Distribution Corporation.

- NHAI arm’s ₹5,000 crore bonds get 50X bids.

- Lodha’s Macrotech Developers prepays $170 million or around ₹1,300 crore out of total debt of $225 million.

- Oil India, Assam Gas announce a JV. It also approved an investment of ₹6,555 crore by Numaligarh Refinery for a petrochemical project.

- Adani Power has completed the acquisition of Essar Power MP Ltd. under the Insolvency and Bankruptcy Code for a total consideration ₹4,250 crore for the 1200 MW power plant.

- The income tax department conducted search operations against Omaxe Limited.

- DLF is planning to invest close to ₹550 crore to set up a 1 million sq ft office building for Standard Chartered Global Business Services’ campus in Chennai.

- UP Power Corp revives plan to raise up to ₹8,000 crore debt.

- PNC Infratech has received ₹82.68 crores as a bonus from Uttar Pradesh Expressways Industrial Development Authority for the early completion of its project.

- IOC given nod to invest ₹7,282 crores in developing a CGD network in 9 areas.

Automobile:

The production-linked incentive (PLI) scheme for the automobile and auto component industry in India has attracted a proposed investment of ₹74,850 crore. The target estimate for the investment was ₹42,500 crore over a period of five years. Maruti Suzuki, Hero MotoCorp, Lucas-TVS, Tata Cummins among 75 cos to get sops.

IT and Telecommunications:

- Wipro, Speira partner to strengthen the latter’s technology infrastructure and cybersecurity.

- TCS BaNCS to power NSE IFSC-SGX gift connect to enable trade execution and clearing of Nifty products on behalf of its members in Singapore and worldwide.

- Formula 1 and Tata Communications announced a multi-year strategic collaboration. Tata Communications will be the Official Broadcast Connectivity Provider of Formula 1.

- Vodafone Idea has launched Vi Games, a dedicated games store within its ‘Vi’ mobile app, in partnership with gaming firm Nazara Technologies.

- April IPL bash may see Tata Neu app debut.

- Bharti group backed OneWeb bags satellite broadband permit.

- Wipro has joined the governing board of Open Source Security Foundation to help address the growing threat to the software supply chain.

- Tech Mahindra to acquire Third ware Solutions in an all-cash deal of USD 42 million. Third ware is an IT services company that focuses on ERP, BIA, Cloud, and business technologies, has over 850 employees.

- Data Infrastructure Trust completed the acquisition of Space Teleinfra for ₹899.76 crore. STPL is engaged in the business of providing passive telecom infrastructure services to telecom service providers.

Manufacturing:

- Mahindra & Mahindra is looking to increase its stake in Carnot Technologies Pvt Ltd to 52.69% with an investment of around ₹14 crores.

- Anupam Rasayan has completed the acquisition of 24.96% of the total equity shareholding of and joint control of Tanfac Industries.

- Softbank in talks with Tata and Mahindra for potential investments.

- Yasho Industries announces capital expenditure of ₹350 crore in Phase 1 for its greenfield project at Pakhajan (Dahej), Gujarat. The company plans to manufacture lubricant additives and rubber chemicals with a total capacity of 15,500 MT per annum in phase 1 at this new facility.

- Shyam Metalics and Energy announced ₹990 crore capital expenditure plans to further expand the capacity by 2.85 MTPA.

- Dredging Corporation of India will sign a contract with Cochin Shipyard for the construction of 12,000 cubic metre hopper capacity trailer suction hopper dredger for euro 104 million under the make in India program.

Other:

- Amazon says transfer to RIL fraud, talks fail.

- Zomato has acquired a 16.66% stake in Mukunda Foods Private, a food robotics company, for cash consideration of $5 million.

- Zomato has held discussions to acquire Blinkit (formerly Grofers) in a share swap deal, as per media reports.The company has also approved a loan of up to $150 million to Blinkit (Grofers India) in one or more tranches.

- DGCI has granted restricted emergency use authorization to Serum Institute of India’s vaccine Covovax for the 12-17 years age group.

- Strides Pharma’s subsidiary gets USFDA approval for colchicine tablets used for treatment of gout.

- Jet fuel prices rise 18% amid global oil price surge.

- E-tourist and paper visas restored to nationals of all countries with a valid 5 yr visas to India.

- Hatsun Agro Product’s chairman buys shares worth nearly ₹25 crore.

- Natco Pharma gets CDSCO nod to manufacture, market anti neoplastic drug Idelalisib.

- Godrej Consumer has completed divestment of its entire stake in Bhabani Blunt Hairdressing and the right to use the brand name to manufacture and sell BBLUNT branded products.

- Voltas to form a JV with Highly International (Hong Kong) for sale of air-conditioner parts.

- ITC has acquired 1,040 compulsorily convertible preference shares worth ₹10 each of Mother Sparsh Baby Care.

- Lupin receives USFDA approval for Vigabatrin for oral solution.

🚀IPO Corner

- Rainbow Children’s Medicare Ltd and eMudhra Ltd have received SEBI’s approval to raise funds through initial public offerings.

- Ebixcash has filed draft papers with SEBI to raise Rs 6,000 crore through an initial public offering.

- HexagonNutrition has received SEBI’s approval to raise up to Rs 600 crore through an initial public offering.

🔌Sustainability Corner

- Global electric car sales doubled in 2021.

- Tata Motors is planning to invest ₹15,000 crore in the EV segment in the next five years.

- India will issue at least ₹24,000 crore ($3.3 billion) in sovereign green bonds as the country marks a shift towards a low-carbon economy.

- JSW Renew Energy (Kar), JSW Renewable Energy (Dolvi), JSW Energy (Kutehr) and JSW Hydro Energy have become wholly owned subsidiaries of JSW Neo Energy (JSWNEL).

- Maruti to increase CNG output to over 5 Lakh in FY 23.

- Niti Aayog wants to eliminate all price restrictions on locally produced natural gas.

- Ajit Pawar announced a massive cut in value-added tax on natural gas from 13.5% cent to 3%, making CNG significantly cheaper in Maharashtra.

- Torrent Power has completed the acquisition of wind energy firm Surya Vidyut Limited from CESC Limited.

- Surge in lithium, nickel and cobalt rates might push up prices of electric vehicles.

- Reliance New Energy acquired assets of Lithium Werks for USD 61 million. Assets include the entire patent portfolio of Lithium Werks, manufacturing facility in China, key business contracts and hiring of existing employees.

- EV sales in the country were up 163% in 2021 as against last year. UP registered the highest sales, followed by Karnataka and Tamil Nadu with the registration of 3,24,840 EVs when compared to the year-ago period.

- Delhi discoms are pushing EV shift by facilitating public charging stations, installing charging points for a growing fleet of their own. The company plans to scale up to 150 charging points in the next two years and convert its entire fleet of vehicles to electric by 2030.

- Tata Motors to invest ₹15,000 cr in EV segment in 5 years; plans to develop 10 new products with different body styles, price, driving range options.

- Delhi govt launches portal for purchasing, registering e-autos: Buyers to get additional relief. The government will also provide a 5% interest subsidy on the purchase of e-autos on loans. This will provide an additional incentive of ₹ 25,000 over the purchase incentive of ₹ 30,000.

- Tata Power Delhi Distribution Ltd announced partnership with Battery Smart, to set up swap stations for two-and three-wheelers at various locations across North Delhi in 2022.

- More than 80 percent of Li-Ion batteries for EVs sold in India are made locally: Gadkari.

- Gadkari launches the green hydrogen-based fuel cell electric vehicle Toyota Mirai.

- EV-focused Rockets Capital raises $200 million from Xpeng, others.

- Bombay HC allows Tata Power to destroy 477 mangroves for construction of a transmission line near Kalwa.

- The upcoming two-door MG EV to be India’s cheapest electric car.

That’s all for now folks! See you next week!

Bulls Charge, Yogi raaj. What next? | Weekly market wrap-up 11 Mar