Leapfrogging from ICE to EV? Early times…

India ready for mass EV adoption? not really…

India predominantly has been the fastest growing automobile market in the world. The Indian auto sector presently manufactures ~30mn vehicles annually (contribute 7.5% to GDP) and employ >37mn people (directly and indirectly). The Govt’s push for the electric mobility coupled with incentivization of EVs (GST reduced to 5%) makes a strong case for higher EV penetration in India over the next decade. Govt is advocating the faster EV adoption to curb the pollution, combat the high crude import bill (17% of total imports) and thus improve India’s balance of payments.

However, we believe that the shift towards EV will happen rather gradually and the growth will largely be driven by the establishment of a robust EV ecosystem which the country lacks at present. A number of measures would be needed to create a sustainable EV demand in the long term such as

1) The setting up of charging infrastructure

2) Localize battery technology through setup of gigafactory (battery facility)

3) Incentivise the sector through duty cuts on battery related technologies

4) Make the vehicles affordable (2- 3x the cost of ICE (Internal combustion engine) based vehicle) with renewed focus on localization

5) Improvement in rural and urban roads and infrastructure. Given the current scenario, the EV ecosystem needs a massive overhaul without which EV penetration failing which the efforts for EV adoption would remain a futile proposition. We hereby, assess the underlying opportunities as well as the challenges which emerge along with EV adoption.

Global Electric mobility outlook

The global electric mobility gathered sharp momentum in 2018. The cumulative global passenger car fleet stood at 5.1mn up 90% YoY. China remained world’s largest car market with 45% market share followed by Europe and USA with 23% and 22% market share respectively. India remains the third-largest automobile market in the world. Norway has the world’s highest EV penetration at 46% followed by Iceland and Sweden at 17% and 8% respectively.

In 2W/3Ws, the cumulative EV fleet stood at >300mn worldwide in 2018 largely driven by strong acceptance for electric bikes in China. The global electric buses stock stood at 460k units (up by 28% YoY).

The total EV chargers in 2018 stood at 5.2mn worldwide and consumed a combined 58 TW of electricity. Out of the total electricity consumed by EVs globally, China’s consumption stood at 80% in 2018.

Globally, the EV penetration has largely followed a favourable macro policy and a strong charging eco-system. India will have to invest upto >20-50bn US$ over next decade to become an EV power-house.

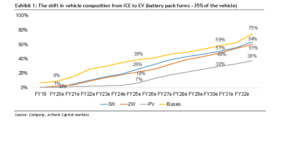

Exhibit 1: Developed economies have seen a rapid growth in EVs…

India EV outlook: Mass EV adoption can lead to metamorphosis across the industry…

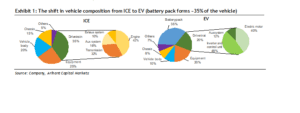

EVs have a simpler manufacturing mechanism vs the ICE vehicle (parts get reduced by 2/3rd in EV) and thus will definitely lead to entry from the global peers in this segment. As we can see in exhibit 1, the shift from ICE to EV will lead to battery pack will form 35% of the vehicle cost and the drivetrain will undergo significant transformation as the electric motors, inverter and control units replaces the exhaust system and transmission. We expect a lot of auto component players to undergo significant amount of de-risking of their businesses over next five years through introduction of new products with JVs/tie-ups with international players.

Challenges and opportunities in EV

Challenges and opportunities in EV

- Sprucing up the charging infrastructure remains key for EV adoption :

The success of EVs will be driven by Pan-India installation of charging stations. The Govt is taking necessary steps to address this challenge through adequate tie-ups coupled with incentivization through the FAME II scheme (Rs 10k Cr subsidy) to attract EV buyers. Presently, there are 150 public charging stations in India (vs 976k stations in China including 401k public stations). We thus believe the installation of public charging stations will be required to firmly roll out EV adoption. The charging stations shall attract investments upto~$15-25bn over next five to eight years which remains a concern. Companies in India such as ABB, Acme Industries, Fortum India have shown interest to setup battery charging stations in India. - Breakthrough in battery storage technology shall drive EV affordability:

The high battery costs attached (35% of vehicle cost) coupled with low volumes lead to high cost of ownership for EVs and make them unaffordable. Any breakthrough towards reduction of the cost of battery modules can make the EVs inexpensive. The most common battery modules comprise of 1) NMC-graphite batteries cells – which use the nickel-manganese-cobalt as cathode and Graphite as anode. These are the most commonly used battery cells and cost $ 150-200/kWh however have a low life-cycle of 500 chargings. 2) NMC-LTO – These cells use lithium-titanium-oxide as anode vs the graphite and come with life-cycles of 10,000 charging and costs $450/kWh. 3) LFP-Graphite – lithium-ferrous-phosphate-graphite higher life-cycles vs the NMC-LTO battery cells costs. Research is underway to increase the battery storage by 10x thus making the vehicle more affordable. - EV adoption – Buses – 2Ws/3Ws – PVs:

Public transport, specially the intra-city transport buses could see earliest EV adoption as they are known to emit highest polluting materials followed by 3Ws/2Ws in tandem. The PVs could be the last segment for EV adoption due to high costs attached. The Govt had recently drafted a proposal for all 3Ws and all 2Ws <150cc to convert to electric by 2023 and 2025 respectively. However, the OEM backlash coupled with the unviability of the charging infrastructure resulted in a softer stance by the Govt recently. This underlines the hurdles towards EV adoption. - We expect EVs to see gradual adoption over FY19-FY32e :

We firmly believe EV adoption likely to see a gradual increase on account of 1) a viable charging infrastructure;2) Increased awareness about EV; 3) Focus on cost reduction in battery storage through localization. We thus believe, FY20e to be an inflection point for Indian automobile industry where OEMs will be technologically well verse with the EV adoption by FY32e thus leading to fastest adoption in buses (75%) followed by 2W/3W with 61%/64% respectively and the PVs to adopt gradually (38%) until FY32 on account of higher cost of ownership vs ICE vehicles.

- Hero in 2Ws and Maruti in PVs to drive the e-mobility over next decade:

We firmly believe, amongst the 2Ws, Hero shall benefit from the 2W adoption on account of its strong presence in EV segment with proprietary products and its investment in Ather Energy (electric 2W startup). The company shall enable smooth transition to EVs over the next decade. Other 2W OEMs like Bajaj Auto and TVS are working on electric bikes/scooters however tie-ups with other OEMs. In PVs, we firmly believe, Maruti shall lead the pack with a strong technology partner available at its behest and thus drive the affordable electric mobility juggernaut over the next decade. While M&M has been vocal about EV aspirations and also remains a pioneer in this space, its present models have not able to garner decent volumes in EVs.

Rating scale

|

Company |

CMP (Rs) | TP (Rs) |

Reco |

EPS (Rs) | P/E (x) | ROE (%) | ||||||

| FY19 | FY20e | FY21e | FY19 | FY20e | FY21e | FY19 | FY20e | FY21e | ||||

| Ashok Leyland | 60 | 75 | ACCUMULATE | 7 | 5 | 6 | 9 | 12 | 10 | 26 | 17 | 17 |

| Bajaj Auto | 2750 | 3021 | ACCUMULATE | 151 | 165 | 183 | 18 | 17 | 15 | 21 | 21 | 21 |

| Maruti Suzuki | 6250 | 6004 | HOLD | 248 | 257 | 286 | 25 | 24 | 22 | 17 | 16 | 16 |

| TVS Motor Co | 365 | 431 | HOLD | 14 | 16 | 19 | 26 | 23 | 19 | 22 | 21 | 22 |

| Hero Motocorp | 2642 | 2114 | REDUCE | 169 | 166 | 184 | 16 | 16 | 14 | 27 | 25 | 25 |

| M&M | 533 | 590 | HOLD | 39 | 33 | 32 | 9 | 10 | 10 | 17 | 11 | 10 |

| Fiem Industries | 367 | 599 | BUY | 42 | 47 | 60 | 9 | 8 | 6 | 12 | 12 | 14 |