Petrol pinches, IPL crowd quartered! All this and more in the Weekly Market Wrap up | 25 March

In this Weekly Market Newsletter:

- What to expect from the markets

- Market Outlook

- Stock Recommendation

- Options Hub

- Quick Bites

- IPO Corner

- Sustainability Corner

Well, nothing can stop us Indians from enjoying cricket! Not even the ongoing Russia-Ukraine crisis, the high inflation, or the surge in fuel prices. Good news for TV broadcasters and advertisers – only 25% attendance allowed in the physical matches. As fans gear up for the nail-biting showdown between CSK and KKR, we analyse how the markets ended this week. While IPL fever is in the air for Tata, Byju’s will sponsor the FIFA World Cup 2022.

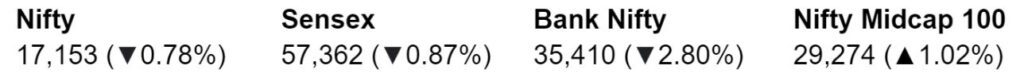

Indians start to feel the petrol pinch, as fuel prices unfreeze post the assembly elections. The prices of diesel and petrol were hiked four times in 5 days due to the crude oil price rise globally. The major indices broke their rising streak, Sensex and Nifty both ended in red losing 0.87% and 0.78% respectively. Bank Nifty also fell by 2.8%. Bleak returns (1.02%) were seen in the Nifty Midcap

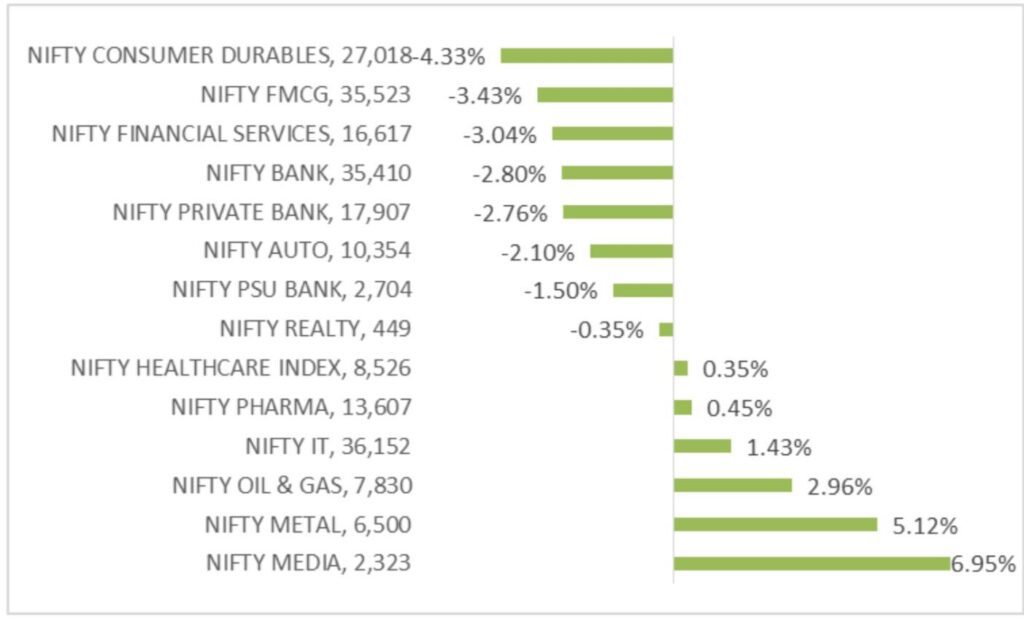

Let us see how the sectoral indices fared this week.

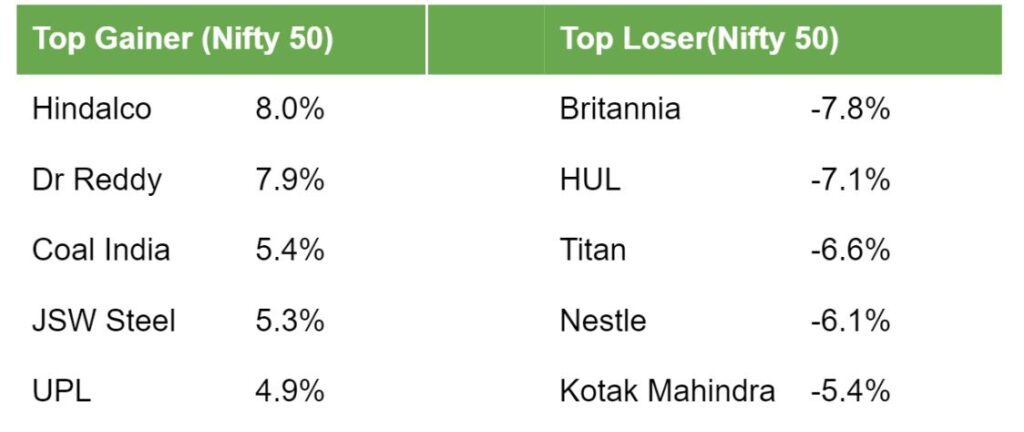

📈Top Gainers and Losers

📊What to Expect from the Markets?

-Mr. Abhishek Jain, Arihant Capital’s Research Head

Nifty and BSE Sensex declined in four of the last five sessions, led by a decline in banking and FMCG. Media index surged in the week aided by Invesco’s decision to not call for an EGM and back Zee Entertainment’s merger with Sony.

Two important global events which have pushed crude prices higher are an attack on the Aramco facility in Jeddah and escalation of the crisis between Ukraine and Russia. However, global markets were stable and ended up with gains this week.

We continue to maintain a positive stance on the market however the recent rally offers less margin of safety at current levels.

🔭Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst

Nifty

The daily chart of Nifty closed above its 200 SMA but it is still trading below its 100 SMA. With the F&O expiring this week, the “Doji” candle is visible on the weekly chart. Analysing the charts together we conclude that stock-specific activity may continue and we need to maintain “buy” on deep strategy. Now it has to cross the 17,320 level to see a bounce towards 17,500 and 17,750 levels, while on the downside support if it crosses below 17,100 then it can test the 16,800 and 16,650 levels.

Bank Nifty

The daily chart of Bank Nifty is still trading below its 200 SMA. On the weekly chart, the index has shown a positive formation. Together we conclude that Bank Nifty may perform after consolidation. This week, Bank Nifty futures closed at 35,637. In the coming trading session, if it holds below 35,400 then weakness could take it to 35,100 and 34,700 levels whereas minor resistance on the upside is capped around 36,500-36,800 levels.

💰Stock Recommendation

From the Fundamental Desk

-Fundamental Stock Picks from Mr. Abhishek Jain, Arihant Capital’s Research Head

Stock to be on the radar can be Infratel limited which was hammered on Friday when Bharti’s management announced that they would buy the shares of the company from Vodafone at ₹190 per share. We believe there has not been any change in the fundamentals of the company and the stock looks attractive at 8x fy24 eps.

We have met the management of KPI Global Limited and continue to maintain a positive stance on the company. We believe that the stock can be added in tranches with a price objective of ₹750 in the next 12-18 months. We are positive on this largest private player in Gujarat in the solar segment with its healthy financials and strong order book which gives revenue visibility for the next 24 months.

We continue to believe investors need to maintain a stock-specific approach as we are entering into the result season next month. We maintain our positive outlook on financials with strong disbursement and recoveries at ground level.

From the Technical Desk

-Technical Stock Picks from Sr. Equity Research Analyst Kavita Jain’s Desk

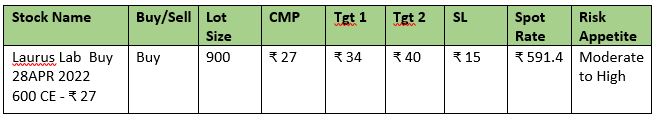

🏷️Options Hub

A Naked Options

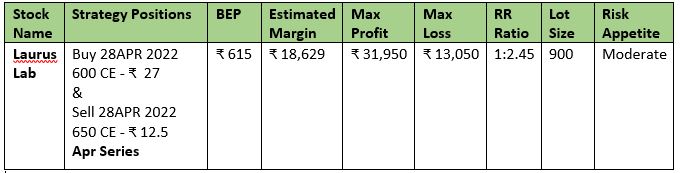

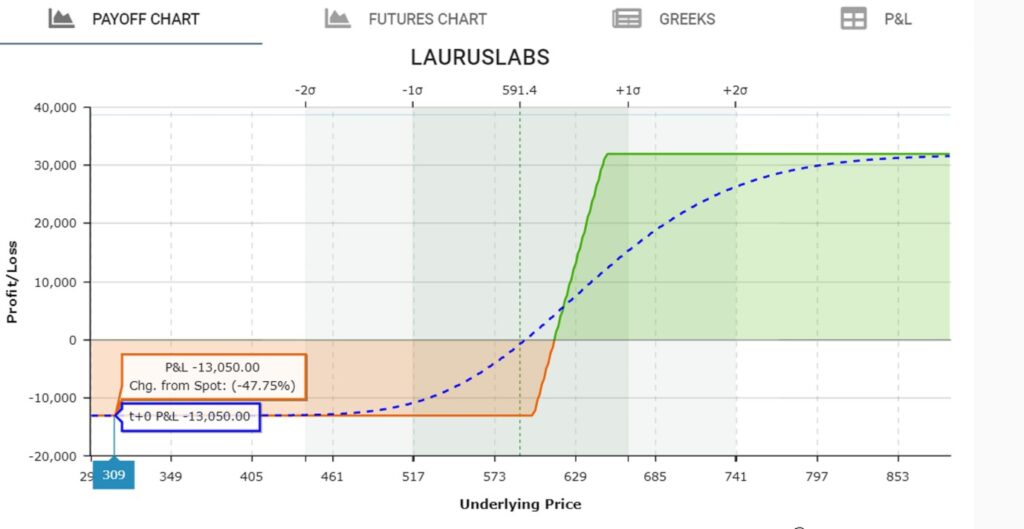

B Option Strategy

🔎Quick Bites

Economy:

- India feels the impact of the war. Petrol and diesel prices rose 4 times in 5 days. CNG, domestic piped natural gas, and Domestic cooking gas LPG prices hiked.

- Lok Sabha approved the Finance Bill on Friday – completing the Budgetary exercise for 2022-23 fiscal.

- Jyotiraditya Scindia says the airline sector is seeing a revival, and expects 40 crore passenger traffic by FY24.

- RBI discusses trade payment options with Russian banks.

- India crosses $400 billion exports milestone for FY 2021-22.

- Assets worth ₹19 thousand crores, belonging to Vijay Mallya, Nirav Modi, and Mehul Choksi, have been seized so far, the government mentioned. About ₹15 thousand crores have been restituted to the public sector banks.

- Global rating agency Fitch sharply cut its FY23 growth forecast for India to 8.5% from 10.3% announced earlier, citing “sharply higher energy prices” in the aftermath of the Russia-Ukraine war.

- India’s urban unemployment rate declined to 9.8% in July-Sep from 12.6% in Apr-Jun.

Banking and Finance:

- HDFC witnesses highest ever loan approval; crosses ₹2 lakh crore in FY22.

- Paytm assures BSE that its business fundamentals are strong following the sharp fall in the stock.

- RBI has approved SBI Funds Management to acquire up to a 9.99% stake in ICICI bank.

- Indiabulls Housing to raise capital of up to ₹50,000 crores through bonds.

- PNB Housing entered into a strategic co-lending agreement with the State Bank of India to offer retail loans to homebuyers. The two financial institutions will co-originate loans at an agreed ratio of 20:80 interest rates.

- HDFC Bank, Kotak Mahindra Bank, PNB, SBI, and Axis Bank have purchased a stake in Open Network for Digital Commerce (ONDC).

- Canada Pension Plan Investment Board sold its stake in Kotak Mahindra Bank via a bulk deal. The base deal size was 28 million shares, with an upsize of 12 million shares.

- Equitas Small Finance Bank to merge with its promoter Equitas Holdings.

- Karnataka Bank plans to raise ₹300 crores by issuing Basel III compliant bonds on a private placement basis. Bank of Maharastra has raised ₹290 crores by issuing Basel III compliant bonds.

- IIFL Finance has approved the allotment of 600 Non Convertible Debentures (NCDs) aggregating ₹110 crores on a private placement basis.

- State Bank of India has acquired a 9.9% stake in National Assets Reconstruction Company.

- PE investors Carlyle Group, Baring Private Equity Asia, and Bain Capital are in talks to buy a controlling stake in India Infoline’s wealth management business, IIFL Wealth.

Energy and Infrastructure:

- The National Company Law Tribunal (NCLT) declared real estate firm Supertech insolvent. The tribunal has initiated insolvency proceedings against it.

- Omaxe leased over one lakh sq ft of retail space in World Street, Faridabad in 2021-22.

- Birla Estates Pvt, the real estate arm of Century Textiles and Industries to jointly develop a 52-acre land parcel in North Bengaluru with M S Ramaiah Realty LLP.

- HDFC sold over 2% stake in Hindustan Oil Exploration during July-March for ₹61 crores.

- Anil Ambani resigns as RPower and RInfra director following SEBI order. Piramal Capital and Housing Finance has initiated bankruptcy proceedings against Reliance Power and its subsidiary Reliance Natural Resources.

- Stanza Living has raised ₹425 crores in debt financing led by Kotak Mahindra Bank and RBL Bank.

- Adani Ports cargo volumes accelerate to 300 million metric tonnes. India’s largest transport utility on course to achieve 500 MMT by 2025.

Automobile:

- Taxman raids offices of two-wheeler maker Hero MotoCorp Ltd to inspect suspected bogus expenses.

- M&M to auction Thar SUV NFT (non-fungible token) in collaboration with Tech Mahindra.

- Tata Motors to increase the price of its products in the range of 2-2.5% from 1st April 2022.

- Motherson Sumi received an order from Boeing to manufacture and supply aftermarket moulded polymer parts for commercial airplane interiors.

IT and Telecommunications:

- TCS’s ₹18,000-crore share buyback scheme of Tata Consultancy Services was subscribed over 7.5 times. It set the buyback acceptance ratio at 26%, which was lower than expected.

- 5G services are expected before the end of the year according to the Minister of State for Communications.

- Airtel prepays ₹8,815 crores to the government towards part out of deferred liabilities from the spectrum acquisition in 2015.

- Zen Technologies bags order from the Indian Army for the design and development of a prototype of Integrated Air Defence Combat Simulator (IADCS).

- Infosys acquires Oddity, a German digital marketing, experience, and commerce agency.

- Railtel Corp received an order worth ₹11.57 crore from Rail Vikas Nigam for installing Multi-protocol label switching virtual private network (MPLS-VPN) services for five years.

- Indoco Remedies gets USFDA nod For Lacosamide tablets.

- Nelco signed an agreement with Omnispace to enable and distribute 5G non-terrestrial network direct-to-device satellite services.

- TCS is positioned as a leader in Global Oracle Cloud Applications Services by Everest Group.

Other Stocks in the news:

- Indigo to launch 100 domestic flights for the summer schedule.

- Sun Pharma to acquire an 11.28% stake in Zenotech Laboratories via a share purchase agreement with Japan’s Daiichi Sankyo Company.

- Sun Pharmaceutical Industries Ltd. will pay USD 485 million to settle antitrust litigation for allegedly delaying generic versions of three drugs in the US.

- Laurus Labs has received US FDA nod to market generic of HIV drug-Kaletra tablet.

- Zomato announced the launch of ‘Zomato Instant’ – a 10-minute food delivery feature.

- Reliance Retail Ventures has acquired an 89% equity stake in Purple Panda Fashions for ₹950 crores.

- National Peroxide has resumed operations at its Kalyan plant on 20 March 2022.

- Wockhardt and Serum Institute of India tie-up to manufacture vaccines in the UK.

- Lupin Ltd. gets US FDA nod for marketing of Sildenafil for oral suspension.

- MDH, the company known for its range of spices, has refuted the reports of a possible sale of its business to HUL.

- Bajaj Electricals to use the Morphy Richards trademark for a further fifteen years.

- Chloride Metals, a wholly-owned subsidiary of Exide starts production at its new plant in West Bengal of capacity 108,000 MT per annum.

- Essential medicines to get expensive by over 10% next month.

- Reliance-ACRE wins bid to acquire Sintex.

- Future Enterprises has defaulted on payment of ₹93.99 crores to Punjab National Bank and Canara Bank under the one-time restructuring plan. Future’s offshore bondholders get recovery assurance that a Reliance linked entity will fully absorb their senior secured bonds.

🚀IPO Corner

- IPO bound Ola signs agreement to acquire neo bank Avail Finance.

- Mukka Proteins has filed draft papers with SEBI to raise funds through an IPO.

- Sresta Natural Bioproducts, Maini Precision Products, and Campus Activewear have received approval from SEBI to launch their initial public offerings.

- Corrtech International has filed draft papers with SEBI to raise funds through IPO.

- Ruchi Soya has priced its ₹4,300 crore FPO at ₹615-650 a share. FPO is open from March 24 to 28.

- The government has filed updated draft papers for LIC’s IPO, including the Q3 financial results of the company. The company reported a net profit of ₹235 crores in the October-December quarter.

- Vikram Solar has filed its draft papers with SEBI for an IPO.

- Veranda Learning’s IPO will open for subscription on March 29. The company has set a price band of ₹ 130-137 per share.

- Uma Exports Limited IPO will be open from 28th Mar to 30th Mar in the price band of ₹65-68.

- Motherson wiring India ltd will be listed on 28th March.

🔌Sustainability Corner

- Ola S1 pro electric scooter catches fire in Pune.

- L&T Technology Services is planning to achieve carbon neutrality by 2030.

- Ola Electric Mobility, Hyundai, Reliance New Energy Solar, and Rajesh Exports have won bids under India’s ₹18,100 crore Production Linked Incentive (PLI) scheme to build Giga factories that make battery cells in India.

- Torrent Power has acquired a 50 MW solar power plant from Lightsource bp and UKCI for an enterprise value of ₹300 crores.

- Japan’s Suzuki Motor Corp (SMC), the parent company of Maruti Suzuki India Ltd, announced fresh investments of ₹10,440 crore to manufacture electric vehicles (EVs) and batteries in India.

- NTPC commissioned 42.5 MW of 100 MW Ramagundam Floating Solar PV Project in Telangana, taking the company’s total commercial capacity to 54,494.68 MW.

- Battre joins Bounce Infinity’s network for swappable batteries.

- CETL partners with Indian start-up, Tsuyo to develop EV powertrains.

- Exicom has crossed the milestone of installing over 5,000 EV chargers including AC and DC chargers across 200 cities in India.

- Pinnacle Industries forays into EV component business.

- Delhi eyes 1 lakh ‘green’ jobs in 5 years through ‘Smart Urban Farming’, new solar policy, 25K e-autos.

- 8.2% of new vehicles registered in Delhi are electric vehicles.

- 491 charging stations installed as of Mar 1 under FAME.

- Third-party motor vehicle insurance to not increase from April 1.

- Okaya Electric Vehicles crosses 350 dealerships-mark within 8 months of launch.

- Crayon envy electric scooter launched at ₹64000 no driving license required.

- Nitin Gadkari predicts the cost of EVs to be at par with petrol-run vehicles in 2 years.

- Infy tops the list of firms with the strongest ESG scores, followed by M&M, Tech Mahindra.

- M&M Financial’s Quicklyz to lease 500 EVs to Blusmart.

- Tata Tigor EV‘s price hiked by ₹25000.

That’s all for now folks! See you next week!