Post Budget Review 2021

Strong Impetus for economic recovery with big

This is a special budget delivered by FM which is pro growth and pro capex. Sometimes no news is good news and this budget proves this thesis as this budget doesn’t have anything which the market has feared for as there was no cess, no tinkering of corporate taxes as it suggests continuity in government stance plus no changes in capital gains taxes. This is a great budget as it lacks everything the market feared for and it has a lot what the market was looking for in the budget.

This budget is growth driven and has a higher outlay for capital expenditure as Capital expenditure is estimated to increase from 1.6% of GDP in FY20 to 2.3% of GDP in FY21 (RE) and to 2.5% of GDP in FY22 BE. The benefits of higher capex would lead to focus on creating employment in sectors which have a multiplier impact like infrastructure which pushes other sectors also. The best thing about this budget is now focusing on infrastructure rather than direct consumption supported by finmin earlier which is pro growth. However fiscal deficit numbers were much higher due to higher spending by the government and shifting of off balance sheet items like food and farm subsidies to balance sheet in gradual manner, the higher capex outlay is the best thing the economy has asked for long term growth in the current environment.

A large number for Disinvestment : Disinvestment plan has been planned for FY22 with receipts from disinvestment budgeted to increase to INR1.75 lakh crores from INR32,000 crores in FY21. Apart from earlier announcements of PSUs like LIC, BPCL, Concor etc, 2 PSU banks and one General insurance company to be added in this list.

Budget Highlights:

Income Tax

- Exemption from filing income tax returns for senior citizens (75 years and above) who only have pension and interest

- Constitution of a Dispute Resolution Committee for small tax

- Income Tax Appellate Tribunal to be made

- Increase in limit for tax audit (to 10 crore) for persons who carry out 95% of their transactions digitally.

- Dividend payment to REIT/InvIT to be exempted from

- Additional deduction of ₹1.5 lakh shall be available for loans taken up till 31 March 2022 for purchase of affordable

- Relief to Trusts – Charitable trusts running Hospitals and Educational Institutions relief increased from Rs.1 crore to Rs.5

- Pre filling of returns will also cover capital gains from listed securities, dividend income,

Other Key Highlights

|

• Support for over 17,000 rural, 11,000 urban health centers, launch health scheme worth Rs 641.80 bln rupees over 6 yrs. • To strengthen National Centre for Diseases Control Expansion of integrated health database to all states • To launch urban Jal Jeevan Mission, Five-year outlay for Jal Jeevan Mission is Rs 2.87 trln rupees • To launch 7 mega investment textile parks over 3 yrs • To have big thrust on monetisation of assets • To enhance share of central, state capex in infra projects • Roads worth Rs 50K Cr being transferred to NHAI InVit, To award 8,500 km of highways by Mar 2022, 11,000 km of national highway corridor to be completed (including 3 new freight corridors). • National Rail Plan for India – 2030, 100% electrification of broad rail routes by Dec 2023. • A total of 702 km of conventional metro is operational and another, 1,016 km of metro and RRTS is under construction in 27 cities with Two new technologies i.e., ‘MetroLite’ and ‘MetroNeo’. • Government plans to add 139 Giga Watts of installed capacity, connected an additional 2.8 crores households and added 1.41 lakh circuit of transmission lines. Also did additional capital infusion of Rs 1,000 crores to Solar Energy Corporation of India. |

• To provide 200 bln rupees for development-finance institution • 20 thousand Cr rupees for recapitalisation of PSU banks in FY22 • Decriminalise Limited Liability Partnership Act, 2008 • NCLT framework to be strengthened, to implement ‘e-courts‘ • Propose to divest 2 PSU bks, 1 general insurance co FY22 • BPCL, Air India divestment to be completed in FY22 • NITI Ayog prepare list of PSUs to be disinvestment • BEML, Shipping Corp, CONCOR disinvestment to be completed FY22 • FY22 disinvestment seen 1.75 trln rupees • Govt committed to welfare of farmers • FY21 paddy MSP scheme spend seen 1.72 trln rupees • FY22 disinvestment seen 1.75 trln rupees • Govt committed to welfare of farmers, credit target Rs 16.5 trln rupees • To add 1,000 more mandis to e-NAM • To develop 5 major fishing hubs • FY21 fiscal deficit pegged at 9.5% of GDP • FY22 fiscal deficit pegged at 6.8% of GDP • FY21 spending seen 34.5 lakh rupees |

Due to Covid 19 lockdown, various infra sectors have posted huge losses in current FY due to loss in business which includes road transport & highways, Indian railways, aviation, ports and others etc. This Budget augurs well for long term infrastructure growth of country with higher allocation, easy of infra financing and PPP model.

| Infrastructure | Budget Announcement | Key Beneficiaries |

|

Road |

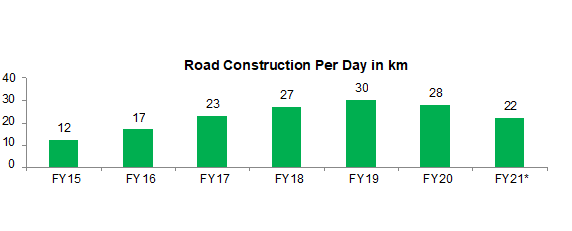

The road construction activity was strong despite COVID issues and per day road construction at 22 km per day. We believe higher allocation for highways would lead to accelerate growth across roadways and allied sectors. (allocation Rs 1181trln) |

Ashoka Buildcon, KNR Construction, PNC infratech, NCC etc. |

|

Railways |

Under National Rail plan, focus is on developing rail infrastructure by 2030 to cater the need for projected traffic requirements of 2050.

The objective of increasing railways share in freight from 27 pc to 45 pc. (Already gained some share post COVID). (allocation Rs 1101 trln) It also aims for privatization of DFC assets. 100 pc electrification of Broad Guage routes by 2023 |

LnT, KEC International, RVNL, RITEs, Concor, Sail, Jspl |

|

Ports |

Focus is on ports, shipping and waterways with PPP model, ease of finance, subsidy support and recycling of ships act 2019 enacted with doubling recycling capacity by 2024. (allocation Rs 2000 crore) |

GPPL, Adani Ports, Shreyas Shipping, G E Shipping |

|

Other Developments |

Some of the schemes to promote urban development like Public bus transport, metro, Swachh Bharat should also augur well for developing infrastructure of the country. (Swachh Bharata – llocation Rs 123 trln) |

Vatech wabag, Lnt, BEML |

With higher budgetary allocation across the infra segments, we believe infra offer very good opportunity across all the sectors post this budget which focus on infrastructure as an opportunity for country growth.

Indirectly it will also benefit government objective of higher job creation, support Cement, Capital goods & Auto sector (especially CV segment).

Source: Arihant Research, Government Filings

Source: Arihant Research, Government Filings

| Sector | Budget Announcement | Key Beneficiaries |

|

Banking |

Followings are the key announcement for the banking sector:

A. Recapitalisation of PSU banks: Government has announced further capital infusion of Rs 20,000 cr in 2021-22 to support the public sector banks. B. Setting up of ARC and AMC for stressed asset resolution: Given the high quantum of stress and high level of provisioning of PSU banks, Government of India (GoI) has announced setting up of an ARC and an AMC to consolidate and take over the existing stressed debt and then manage and dispose of the assets to Alternate Investment Funds and other potential investors for eventual value realization. As expected set up of ARC and AMC is in right direction, the details on which is awaited and implementation of these announcement need to be watch. This move will help to i) solve stressed asset recovery, ii) will increase the transparency and iii) balance sheet improvement with higher visibility on asset quality of PSU banks thus helping them to raise capital externally. C. Privatisation of 2 public sector banks: Government has proposed to privatise 2 PSU banks (Other than IDBI Bank) in FY22. While the details on this has not announced, we believe the UCO Bank, Central Bank of India and Indian Overseas Bank will be most likely candidate for privatisation as these banks were not the part of consolidation that happened in Apr’20. D. GoI has announced a set up of new institutional framework which would purchase investment grade debt securities both in stressed and normal times. This step will enhance the secondary market liquidity in corporate bond market and instil the confidence amongst the investors during times of stress. |

Positive for Public Sector Banks (SBI is our preferred pick in this space) |

|

Insurance |

The government in its big step has announced increase in FDI limit in insurance sector from 49% to 74%.

This step will help the private insurers to get access to more foreign capital, which is expected to accelerate their growth and improve the insurance penetration in India. |

Positive for HDFC Life, SBI Life, ICICI Pru and ICICIGI |

| Indirect Taxation | Budget Announcement | Key Beneficiaries |

|

GST |

Several measures to further simplify GST . Some of the measures include:

I. Nil return through SMS, II. Quarterly return and monthly payment for small taxpayers, III. Electronic invoice system, IV. Validated input tax statement, V. Pre-filled editable GST return, and VI. Staggering of returns filing. |

Indian Economy |

|

Custom duty |

Government Proposes to review more than 400 old exemptions to customs duty, and from October 1 and plans to put in place a revised customs duty structure free of any distortion. Govt plans on reducing customs duty uniformly to 7.5% on products of non-alloy, alloy and stainless steel, exempting duty on steel scrap till March 2022. The FM added that to provide relief to copper recyclers, the government will be reducing duty on copper scrap from 5% to 2.5%.

For greater domestic value addition, Government plans to withdraw a few exemptions on parts of chargers and sub- parts of mobiles. Further, some parts of mobiles will move from ‘nil’ rate to a moderate 2.5%. In order to rationalize duties on raw material inputs to manmade textiles. Government plans nylon chain on par with polyester and other man-made fibers. Government is uniformly reducing the BCD rates on caprolactam, nylon chips and nylon fiber & yarn to 5%. This will help the textile industry, MSMEs, and exports, too. Gold and silver presently attract a basic customs duty of 12.5%. Since the duty was raised from 10% in July 2019, prices of precious metals have risen sharply. To bring it closer to previous level Government plans rationalizingcustom duty on gold and silver. |

Indian Economy |

| Sector | Budget Announcement | Key Beneficiaries |

|

Healthcare (Vaccines) |

The Pneumococcal Vaccine, a Made in India product, is presently limited to only 5 states will be rolled out across the country. This will avert more than 50,000 child deaths annually.

Government has allocated Rs35,000 crores for Covid-19 vaccine in BE 2021-22. Government is committed to provide further funds if required. The Budget outlay for Health and Wellbeing is Rs 2,23,846 crores in BE 2021-22 as against this year’s BE of Rs 94,452 crores an increase of 137 percentage. |

Cadila Healthcare, Serum Institute, Wockhardth, Panacea biotech, Strides pharma |

|

Healthcare (Other Pointers ) |

A new centrally sponsored scheme,

PM AtmaNirbharSwasth Bharat Yojana, will be launched with an outlay of about Rs64,180 crores over 6years. This will develop capacities of primary, secondary, and tertiary care. Health Systems, strengthen existing national institutions, and create new institutions, to cater to detection and cure of new and emerging diseases. To strengthen nutritional content, delivery, outreach, and outcome, government plans to merge the Supplementary Nutrition Programme and the PoshanAbhiyan and launch the Mission Poshan 2.0. It plans to adopt an intensified strategy to improve nutritional outcomes across 112 Aspirational Districts To tackle the burgeoning problem of air pollution, Government propose to provide an amount of Rs2,217 crores for 42 urban centres with a million-plus population in this budget. The JalJeevan Mission (Urban), will be launched. It aims at universal water supply in all 4,378 Urban Local Bodies with 2.86 crores household tap connections, as well as liquid waste management in 500 AMRUT cities. It will be implemented over 5 years, with an outlay of ofRs2,87,000 crores The Urban Swachh Bharat Mission 2.0 will be implemented with a total financial allocation of Rs1,41,678 crores over a period of 5 years from 2021- 2026. |

Apollo Hospital, Fortis Healthcare, Shalby, Aster DM |

| Sector | Budget Announcement | Key Beneficiaries |

|

AtmaNirbhar Bharat – (PLI Scheme) |

To help the manufacturing sector grow in double digits, PLI schemes to create manufacturing global champions for an AtmaNirbhar Bharat have been announced for 13 sectors. For this, the government has committed nearly Rs1.97 lakh crores, over 5 years starting FY 2021-22. This initiative will help bring scale and size in key sectors, create and nurture global champions and provide jobs to our youth. |

Galaxy Surfacants, Alkyl Amines |

|

Power |

Government plans to add 139 Giga Watts of installed capacity, connected an additional 2.8 crores households and added 1.41 lakh circuit of transmission lines.

Provide choice to consumers by promoting competition. A framework will be put in place to give consumers alternatives to choose from among more than one Distribution Company. Power distribution sector scheme will be launched with an outlay of Rs 3,05,984crores over 5 years. The scheme will provide assistance to DISCOMS for Infrastructure creation including pre-paid smart metering and feeder separation, up gradation of systems, etc., tied to financial Improvements. To give a further boost to the non-conventional energy sector, government proposed to provide additional capital infusion of Rs 1,000 crores to Solar Energy Corporation of India. |

Kalpataru Power, Tata Power, Techno Electric, NTPC, L&T Sterling and Wilson Solar Limited |

|

Agriculture |

The government has enhanced the agricultural credit target to Rs 16.5 lakh crores in FY22. It will focus on ensuring increased credit flows to animal husbandry, dairy, and fisheries.

Enhancing the allocation to the Rural Infrastructure Development Fund from Rs30,000 croresto 40,000 crore. Agricultural credit targetset toRs16.5 lakh crores in FY22. Government will focus on ensuring increased credit flows to animal husbandry, dairy, and fisheries. The Micro Irrigation Fund, with a corpus of Rs5,000 crores has been created under NABARD, Government propose to double it by augmenting it by another `5,000 crores. Government proposes substantial investments in the development of modern fishing harbors and fish landing centers. To start with, 5 major fishing harbor’s – Kochi, Chennai, Visakhapatnam, Paradip, and Petuaghat – will be developed as hubs of economic activity. Government also plans to develop inland fishing harbor’s and fish- landing centers along the banks of rivers and waterways. |

DhanukaAgritech, Kaveri Seeds, Rallis,Deepak Nitrate, |