Impact Of Coronavirus On Stock Markets

Impact of COVID-19 on Stock Market in India & Global Economy

Amid the corona virus pandemic, the global slowdown and an unprecedented drop in domestic economic activity, owing to a 54-day nationwide lockdown, has affected India’s growth outlook. Macro indicators like monthly merchandise trade, auto sales, fuel sales and power generation have already been hit and the GDP of Q1FY20 is going to see a huge contraction.

The stock markets have plunged to 5-year lows with Nifty and Sensex witnessing a brutal monthly fall of ~23% in the month of April. With more than 35 lakh people infected worldwide and 2.44 lakh dead (as of May 3rd 2020), the COVID-19 pandemic shows no signs of abating. As vaccine is yet to be found, lockdown and social distancing remain the only way to slow its spread. However, the lockdowns are also pushing major economies to the brink. Here’s look at the impact of COVID-19 pandemic on Stock markets, sectors and discuss the current situation to help us plan our investment strategy. Let’s start with how the stock markets are reacting to the pandemic.

Market reaction:

The economic indicators like trade and GDP would take longer to reflect the real impact of COVID-19, financial markets globally (equity, bond, and currencies) started giving indications of its severity from February 2020. Equity markets worldwide declined sharply post the onset of COVID-19 outbreak: Pre-empting a massive COVID-19-induced global economic shock, equity markets worldwide fell sharply post mid-February until March 23rd, accompanied with heightened volatility, only to rise post that amid emerging signs of a flattening of COVID-19 curve globally and surge in fiscal/monetary intervention. However, the market is expected to fall again as Trump decided to increase the tariff on China along with EU and Australia, backs US for investigation into China’s role in Corona Virus.

In March, Domestic market benchmarks (~ 22%-33%) ended the worst hit in history. Amid the Covid-19 pandemic, The Nifty just took 15 trading days to fall into bear market territory (i.e. the first 31.6% decline), while volatility reached record levels. Across Large, Mid and Small-cap categories dropped by ~28-33% in a volatile month ended 31stMarch 2020.The Indian benchmark indices closed negative with S&P BSE Sensex down by 22.7% and the Nifty 50 was down by 22.8%.

Stimulus package to boost economy:

The 40-day lockdown has caused severe problems for the common man which might lead to shutting down of small businesses, which are the backbone of the economy. This is without a doubt going to be followed by job cuts, which have already begun. To relieve some of the burden from common man the government has announced several stimulus packages. The Reserve Bank of India (RBI) decided to open a special liquidity facility of Rs 50,000 crore for mutual funds to ease liquidity pressure on mutual funds. The government, in late March 2020, had announced an Rs 1.7 lakh crore stimulus package comprising free food grains and cooking gas to poor and cash doles to poor women and elderly. However, a second economic package is expected soon.

Slump in crude oil:

While all energy prices have dropped sharply because of novel corona virus, crude oil was perhaps the worst hit after its bloodbath in the month of April. NYMEX Crude traded in the negative territory for the first time due to the low demand of crude oil. Price of crude oil fell because of fall in consumption due to Covid-19 outbreak and price war between Saudi Arabia & Russia, that forced other producers to slash prices.

India is the world’s third biggest consumer of oil and imports more than 80% of its crude, which is typically the biggest expense on its trade bill. Indian oil tanks were 95% full as refiners hastily dumped fuel into the spot market and slashed processing rates across the country. Prime Minister Narendra Modi has extended India’s lockdown until May 17, which could cause another slump in crude oil prices.

Manufacturing Sector Activity (PMI):

India’s manufacturing sector activity witnessed unprecedented contraction in April amid the novel corona virus and national lockdown restriction. The PMI i.e. Purchasing Managers’ Index fell to 27.4 in April from 51.8 against the previous month.

Sector Impact:

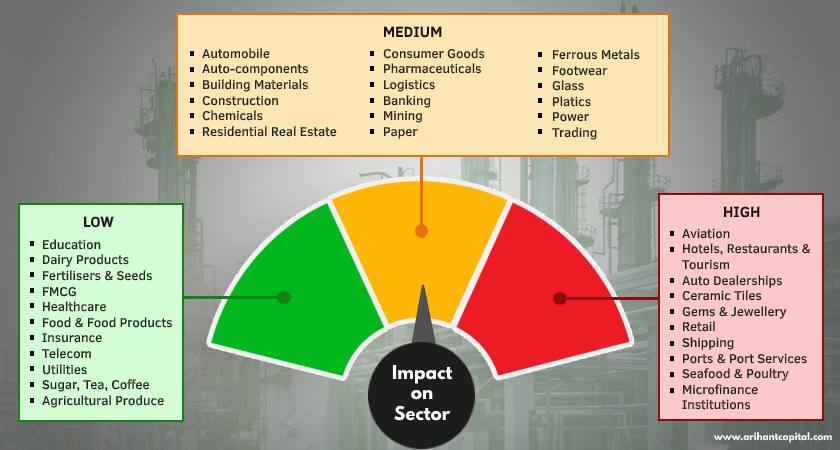

Nearly two third of the Indian economy is impacted by corona virus. While majorly all sectors are impacted by the paramedic some sector saw some relief too. Indian economy is broadly divided into three key sectors: Agriculture, Industry and Manufacturing, and they are further classified into various sub-sectors. The table below shows how severely various sectors have been impacted by the pandemic.

GST collections

After remaining north of Rs 1 trillion over the previous four months, GST collections fell by 8.4% YoY/7.4% MoM in March to Rs 976bn. The drop reflects the impact of a slowdown in economic activity and shutdown of nonessential segments towards March-end. The decline in GST collections is expected to worsen over the coming months amid a) a nation-wide lockdown, b) deterioration in domestic demand and c) waiver of interest, late fees or penalties for SMEs for delays in GST filings.

Zero auto sales:

India stands as fourth biggest market in the world providing employment over 35 million people. The lockdown initiated in March, which will continue till May 17th, led to zero sales of all vehicles, severely affecting the already suffering auto industry. More than 100 factories producing a variety of automobiles all over India were ordered to shut for more than a month. For the first time in the history of automotive companies in India, major automobile companies have reported zero sales in domestic market in a month.

On the global front:

In March, global equities (-13.4% m/m) ended the worst first quarter in history. Amid the Covid-19 pandemic, the US market just took 16 trading days to fall into the bear market territory (i.e. the first 20% decline), while volatility reached record levels. The epicentre is now in the US, with the federal government extending its social distancing guidelines until April 30. In commodity markets, WTI crude dropped -54.2% amid negative Covid-19 related demand shock and positive supply shock (as OPEC+ failed to meet production agreement), while gold went slightly lower by -0.57% The USD/INR gained of 4.7% in the month of March 2020. Jobless claims for the week ended April 25 came in at the lowest level since March 21 but bring the rolling six-week total to 30.3 million as part of the worst employment crisis in U.S. history. Claims hit a record 6.87 million for the week of March 28 and have declined each week since then.

Current situation:

Interestingly, the month of April saw upside in in stock market in India with the Benchmark Nifty 50 closing with a gain of 14.68% to settle at 9859.90 while Sensex settled the month end at 33717.62, up 14.41%. The situation looks to be stabilizing with FMCG and pharma sectors taking the initiative to lead the market.

With the corona taking a toll not only on the economy but also our personal lives, lifestyle choices and behaviour patterns of humankind is expected to change monumentally in the near future. Social distancing would be the new normal in the coming times until a full proof vaccination is released. Until then we will see aviation, travel and tourism, hospitality and entertainment taking a hit while pharma, healthcare and telecom looks promising.

Make sure no matter which sector you are choosing to invest in, pick companies with string fundamentals, good management and very low to no debt.