Aeroflex Industries Limited IPO is live. Should you Invest?

Aeroflex Industries Limited IPO is Open for Investing.

In this article

- IPO details

- Issue details

- Offer Breakup

- IPO Strengths

- Key Risks

- Aeroflex Industries Limited Financials

📃About Aeroflex Industries Limited

Incorporated in 1993, Aeroflex Industries Limited, known as Suyog Intermediates Private Limited, manufactures and supplies environment-friendly metallic flexible flow solution products.

The Company’s product list includes braided hoses, unbraided hoses, solar hoses, gas hoses, vacuum hoses, braiding, interlock hoses, hose assemblies, lancing hose assemblies, jacketed hose assemblies, exhaust connectors, exhaust gas recirculation (EGR) tubes, expansion bellows, compensators, and related end fittings. On March 31, 2023, the Company recorded over 1,700 Product SKUs (Stock Keeping Units) in its product portfolio.

Aeroflex Industries’ manufacturing facility is located at Taloja, Navi Mumbai, Maharashtra, and is spread across 3,59,528 square feet of area. The facility is certified with Annex III, Module H of Directive 97/23/EC on Pressure Equipment, Management System as per ISO 9001:2015, Environmental Management System-ISO 14001:2015, ISO 45001:2015 (Occupational Health & Safety), Testing Certificate-Gas Hoses-1/2″ NB Hose Assembly, NABL ISO /IEC 17025:2017, Statement of 153 Conformity for design, manufacturing, and testing of SS corrugated flexible Hose Assembly, Statement of Conformity for Quality Procedures applied standard EN ISO 10380:2012 and BS 6501-1 (E:2004), Certificate of Design Assessment required for quality management systems, environmental management systems, health and safety management systems.

The Company’s clientele includes distributors, fabricators, Maintenance Repair and Operations Companies (MROs), Original Equipment Manufacturers (OEMs), and various industries.

Aeroflex recorded Rs. 2694.78 Lakhs in total revenue in Fiscal 2023 and Rs. 2409.92 Million in Fiscal 2022.

💰Issue Details of Aeroflex Industries Limited

- IPO open from 22nd Aug 2023 – 24th Aug 2023

- Face value: ₹2 per equity share

- Price band: ₹102 to ₹108 per share

- Market lot: 130 shares

- Minimum Investment: ₹14,040

- Listing on: BSE and NSE

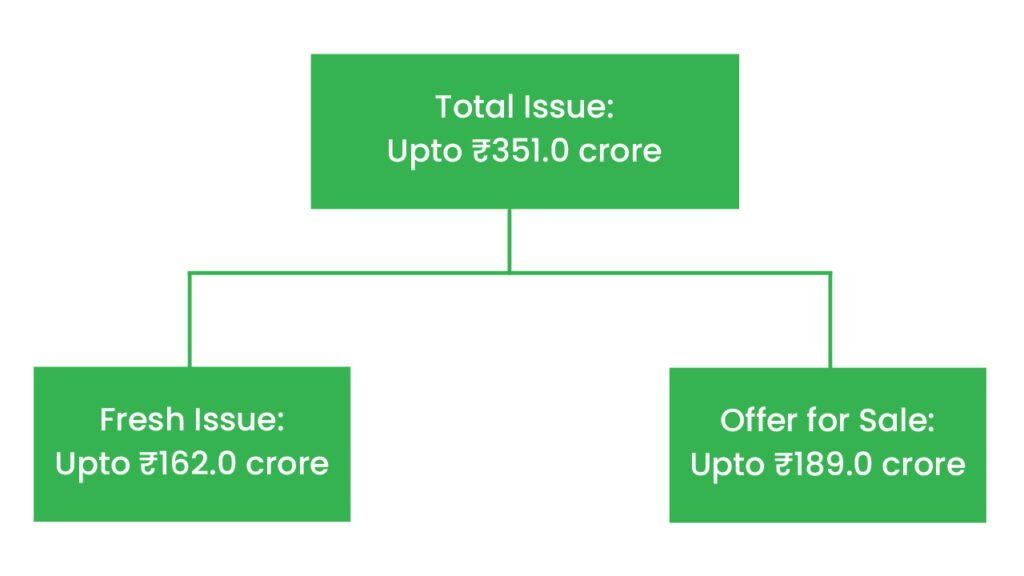

- Offer for sale: Approx ₹351 Cr (Fresh Issue: ₹162 Cr + OFS ₹189 Cr)

- Registrar: Link Intime India Private Ltd

🪙Total Issue Price

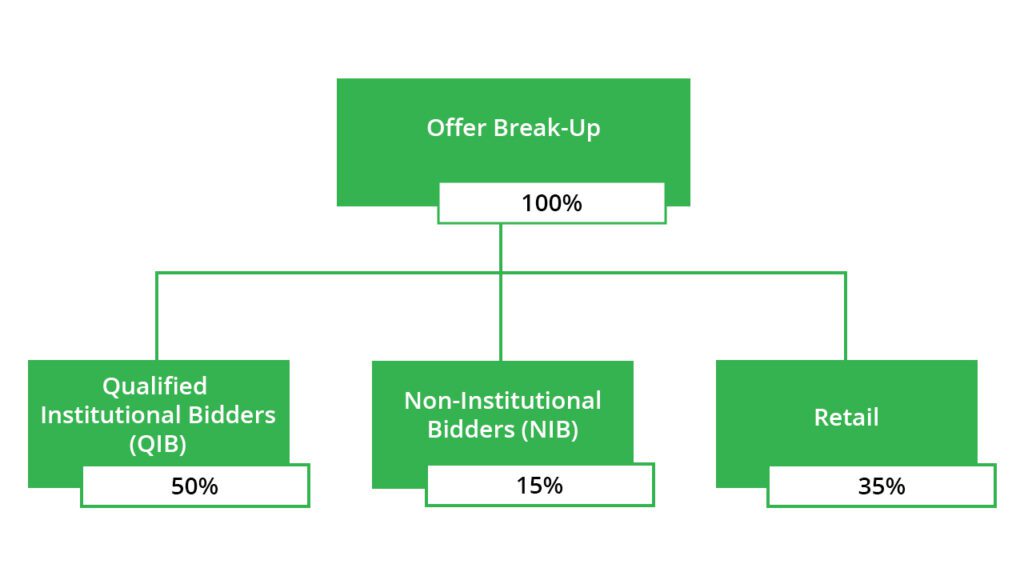

🪚Offer Breakup

🔭IPO Object

The company intends to utilise the net proceeds from the issue towards the funding of the following objects:

- Full or part repayment and/or prepayment of certain outstanding secured borrowings (including foreclosure charges, if any) availed by the Company,

- Funding working capital requirements of the Company, and

- General corporate purposes and Unidentified Inorganic Acquisitions.

⛓️IPO Strength

Some of the qualitative factors and strengths which form the basis for computing the Offer Price are:

- Global flexible flow solutions provider operating in a huge addressable market, catering to diverse industry segments and poised to benefit from mega industrial trends.

- Export-oriented business model.

- The experienced and dedicated senior team with the strategic corporate promoter across essential functions.

- The primary manufacturer of flexible flow solutions (Made in India with no listed peers with an advanced manufacturing facility and R&D infrastructure).

- Robust financial performance, High entry and exit barriers.

🧨IPO Risk

- They export their products to various countries, and the export operations of their Company contribute more than 80% of Revenue from Operations. Because of those above, they may be subject to significant import duties or restrictions of the relevant jurisdictions. Further, adverse fluctuation in foreign exchange rates, unavailability of any fiscal benefits or inability to comply with related requirements may harm their business and results of operations.

- Their business depends on and will continue to rely on their single manufacturing facility. They are subject to certain risks on that behalf. Any slowdown or shutdown in manufacturing operations could hurt their business, financial condition and results of operations.

- They depend on third parties for the supply of raw materials and delivery of products. A disruption in the collection of raw materials or failure of their suppliers to meet their obligations could impact their production and increase their costs.

- They depend on their management team, several Key Managerial Personnel, and persons with technical expertise. The loss of or inability to attract or retain such persons could adversely affect their business, operations, and financial condition.

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-21 | ₹161.64 | ₹144.84 | ₹6.01 |

| 31-Mar-22 | ₹183.44 | ₹240.99 | ₹27.51 |

| 31-Mar-23 | ₹213.98 | ₹269.48 | ₹30.15 |

📬Also Read: Sustainable Investing in India: ESG Investments