Are Hospitals on the Verge of a Growth Spree? | Indian Stock Market Weekly Update Aug 19✨

Indian Stock Market Update | Are Hospitals on the Verge of a Growth Spree?

Hello Readers!

We hope you had a great week!

The Indian hospital industry seems to be in good shape, according to ICRA, a rating agency. They’re predicting revenue growth of 8-10% for the sector in the fiscal year 2024. This is particularly positive news for big players like Apollo Hospitals, Fortis Healthcare, Shalby, Narayana Hrudayalaya, and KIMS, all of the hospital chains.

These hospital stocks have already been doing well this year, with their values increasing by around 11% to 30% in 2023. Let’s dig into what could drive this growth in the coming year.

One big reason is that hospitals could be improving in some fundamental ways. In the next fiscal year, they might see a 5-7% increase in average revenue per occupied bed (ARPOB). This is even considering that last year had a high base. This growth is expected because hospitals offer a more comprehensive range of specialities these days and adjust prices annually to manage rising costs.

Another thing to consider is how many beds hospitals are filling. They’re expecting strong occupancy rates, around 60-65% this year, building on the 65.1% occupancy seen in the previous fiscal year. This is mainly because more people are going to organized hospitals, and there’s also a growing demand for healthcare services.

Hospitals are also getting more significant. They plan to add about 8,400 beds over the next four years to make more money. Plus, bigger hospital chains are looking into teaming up with smaller ones through mergers and acquisitions, which could increase revenue.

More to the story is that more people are hospitalised due to lifestyle-related diseases. Medical tourism is booming in India, too, as the country offers excellent medical care at lower costs. And since the Covid pandemic, more people are aware of healthcare needs, and health insurance is becoming more popular.

All in all, things are looking good for the Indian hospital industry. But, of course, there are some challenges, like rules that limit how much hospitals can charge for drugs and treatment. So, while things look rosy, there are a few thorns to watch out for.

🧾In this Article

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

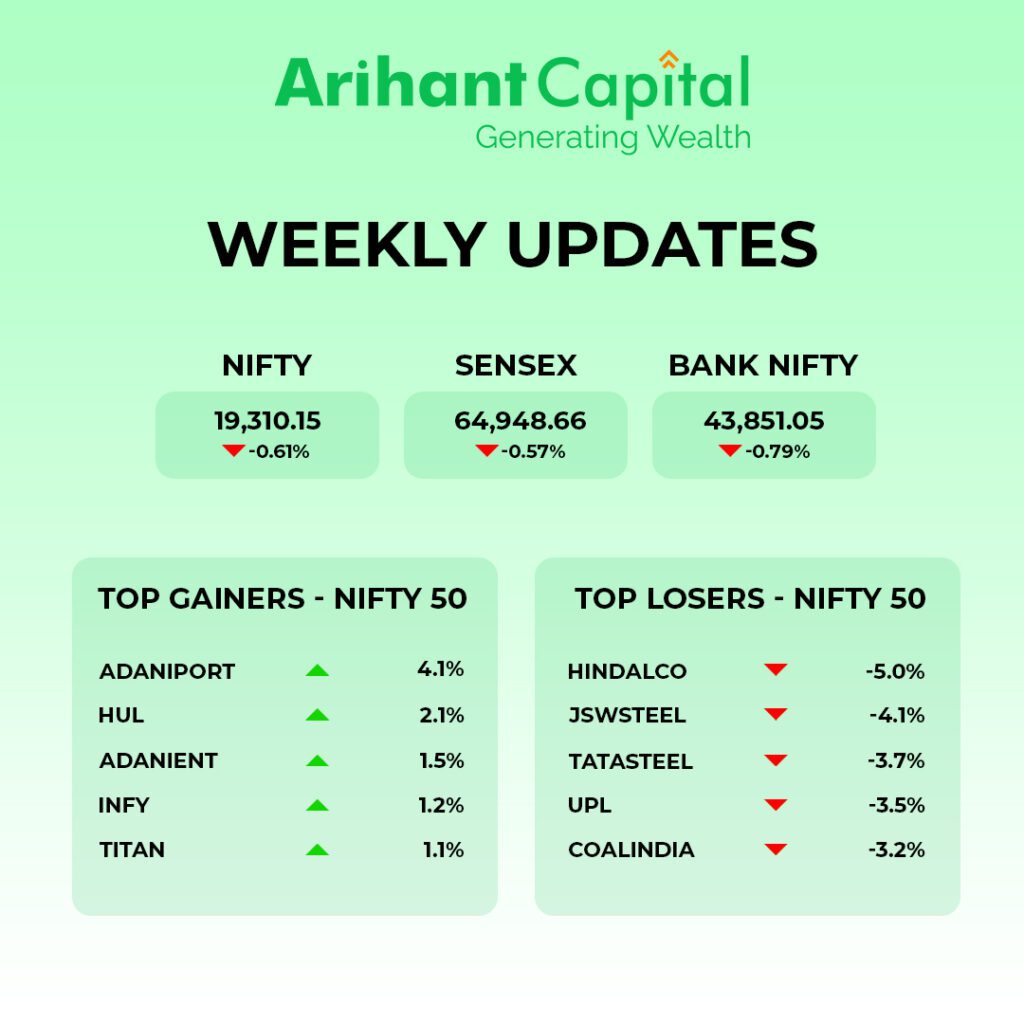

Nifty

If we look at the daily chart of Nifty, we observe prices close below 50 Day SMA. On the weekly chart, we observe a Breakdown of the “Lower Trend line” If we analyse both chart patterns, it indicates some pressure will continue from higher levels, and we can see some consolidation also. If Nifty starts trading above the 19,380 level, then it can touch the 19,500-19,650 level, while on the downside, support is 19,250, and if it starts to trade below, it can test the level 19,100 and 19,000 levels.

Bank Nifty

Let’s look at the daily chart of Bank-Nifty. We observe the prices close below 50 Day moving averages, and the series of “Narrow range body formation” on the weekly chart has also given a breakdown of the “Lower trend line”, which suggests that pressure from a higher level may continue. Bank-nifty, if it starts trading above 44,200, then it can touch 44,500 and 44,800 classes. However, downside support comes at 43,800; below that, we can see 43,500 and 43,100 levels.

🔎Stocks in News

📅 Upcoming Listings

🚀 Reliance: Jio Financial Services to be listed on NSE and BSE on 21 Aug.

🔄 Acquisitions & Partnerships

💼 Lupin: Acquires ‘Ondero’ and ‘Ondero Met’ brands from Boehringer Ingelheim for ₹235 cr.

🏦 South Indian Bank: Appoints PR Seshadri as new CEO and MD.

📉 GMM Pfaudler: Pfaudler Inc sells 13.6% stake in GMM Pfaudler.

☀️ NLC India: Secures a 25-year contract to supply 300 MW solar power to Rajasthan Urja Vikas Nigam.

🚗 IRB Infra: July toll revenue rises 14% YoY to ₹365 cr.

✈️ SpiceJet: Reports net profit of ₹197.64 cr for April-June quarter.

🌞 SJVN: Subsidiary SJVN Green Energy to supply 1,200 MW solar power to Punjab State Power Corp.

🏟️ L&T: Bags order for construction of a cricket stadium in Varanasi.

🚚 Ashok Leyland: To acquire OHM Global Mobility Pvt Ltd.

📉📞 Vodafone-Idea (Vi): Reports a loss of ₹7,840 cr; Promoter group commits up to ₹2,000 cr support.

🏦 SBI: Plans to open 300 branches across India this year.

✈️ IndiGo: Promoter Gangwal family to sell shares worth ₹3,730 cr through a block deal.

💼 Business Developments

💻 TCS: Secures an order from Lexmark for digital services.

💳 SBI Card: Abhijit Chakravorty appointed MD and CEO.

📶 Tejas Networks: Bags a ₹7,500 cr order from TCS for 4G/5G equipment.

🏧 Punjab & Sind Bank: Plans to double the ATM network to about 1,600 in the next 2 years.

📊 Adani Group: To acquire the remaining 51% stake in Quintillion Business Media Pvt. Ltd.

⛏️ Coal India: Capital expenditure rises 8.5% YoY to ₹4,700 cr in Apr-Jul.

📉 Reliance: Jio Financial Services to be removed from the FTSE All-World index and other global indices from 22 Aug.

💰 Financial Insights

📊 Tata Group: Tata Play reports a net loss of ₹105.25 cr for the financial year that ended in March 2023.

💰 GMDC: Increases its dividend to ₹11.45 per share from ₹9.10 per share earlier.

💸 Airtel: Airtel Payments Bank’s revenue rises 41% YoY to ₹400 cr.

🏦 Muthoot Finance: Plans to open 114 new branches across India in the next 2-3 months.

💹 Inox Wind: Promoters will invest ₹500 cr for debt repayment.

🔌 Adani Power: Sells an 8.1% stake to the US-based investment firm GQG.

📰 Quick Bites

📜 Regulatory Updates: RBI launches UDGAM (Unclaimed Deposits – Gateway to Access Information) Centralised Web Portal for investors to search for unclaimed deposits.

🚀 Space Exploration: Chandrayaan-3’s lander successfully separated from the rest of the spacecraft today.

⚡ Automotive Innovations: Mercedes-Benz India aims for EVs to constitute 25% of its total car sales in the next 3 years.

🎬 Cinematic Milestone: Indian cinema records highest-ever weekend box office collection of ₹390 cr. Blockbusters like Jailer, Gadar 2, and OMG 2 are captivating audiences.

💼 IPO Buzz: SBFC Finance IPO debuts with a premium of 43.8% on NSE.

🌐 Digital India Initiative: India approves a new Digital India project worth ₹14,903 cr to up-skill 5.25 lakh IT professionals and trains 2.65 lakh individuals.

✈️ Aerospace Development: Boeing begins production of the Indian Army’s Apache helicopters, with delivery of 6 AH-64E Apaches planned.

🚌 Sustainable Transportation: India’s cabinet approves ₹57,613 cr expenditure for 10,000 new e-buses.

🛤️ Railway Expansion: India approves 7 multi-tracking (railways) projects worth ₹32,500 cr, expanding the Indian Railways network by 2,339 km.

🏦 Financial Trends: Banks’ lending to NBFCs surges 35% to ₹14.2 lakh cr in June 2023.

🏭 Industry Moves: Auto components maker, Happy Forgings files for an IPO.

⛽ Fuel Fluctuations: Petrol and diesel sales decline due to decreased consumption, impacting two consecutive months.

🛢️ Energy Transactions: India makes its first INR payment for crude oil; Indian Oil pays Abu Dhabi National Oil.

💼 Corporate Actions: Cello World submits draft papers with SEBI for a ₹1,750 cr IPO.

⛽ Taxation Adjustments: Windfall tax on petroleum crude increased to ₹7,100 per tonne; on diesel increased to ₹5.50 per litre; aviation fuel levy raised to ₹2 per litre.

📜 DBT Impact: Government saves ₹2.73 lakh cr in 9 years through Direct Benefit Transfer (DBT) to beneficiaries: FM Nirmala Sitharaman.

📊 Inflation Trends: India’s retail inflation rises to 7.44% in July (highest since May 2022) vs 4.81% in June.

✈️ Air Travel Insights: India’s domestic air passenger traffic rises by 25% YoY to 1.21 cr passengers in July.

🍲 Commodity Analysis: India’s vegetable oil imports surge by 46% to 17.71 lakh tonnes in July: SEA.

📈 IPO Momentum: TVS Supply Chain Solutions IPO oversubscribed 2.78 times; Retail investors subscribe 7.61 times.

📉 Wholesale Inflation Update: Wholesale inflation (WPI) stands at -1.36% in July 2023 vs -4.12% in June 2023. 📉

💼 Market Offering: Aeroflex Industries IPO (₹351 cr) opens between 22 to 24 Aug. Price band: ₹102 to ₹108 per share.

📈 Corporate Steps: RK Swamy Limited files draft papers with SEBI for an IPO.

⚡ Energy Insights: India’s electricity output rises 1.3% in the April-June quarter vs 17.1% last year.

📦 Export Trends: Exports of electronic goods rise by 37.6% in April–July compared to the previous year: Ministry of Commerce and Industry.

📱 Manufacturing Milestone: India ranks 2nd in terms of number of mobiles manufactured: Counterpoint.

🌱 Sustainability Corner:

🌿 Investing in Clean Energy: India to invest $1 trillion in clean energy by 2030. The government’s commitment will drive renewable energy projects, energy efficiency measures, and other clean energy initiatives.

☀️ Solar Power Milestone: India’s solar power capacity crosses 100 GW, ranking as the world’s third-largest solar market. The nation aims to add another 100 GW of solar power capacity by 2025.

🏞️ Floating Solar Innovation: India’s first floating solar plant was inaugurated in Kerala, boasting a 500 kW capacity on a reservoir in Alappuzha district.

🚗 Electric Vehicle Thrust: Maharashtra government launches an electric vehicle policy, offering incentives like subsidies and tax breaks to promote electric vehicle usage in the state.

💧 Green Hydrogen Ambition: Tata Power sets eyes on 10 GW of green hydrogen capacity by 2030, with a $10 billion investment in the project.

🌳 Railways’ Green Initiative: Indian Railways plans to plant 75 lakh trees along tracks over the next five years to combat air pollution and enhance the environment.

🚌 Electrifying Public Transit: Delhi government announces a plan to launch a fleet of 1,000 electric buses by 2025, contributing to air pollution reduction in the city.

♻️ Waste-to-Energy Commitment: Kerala plans to establish 10 waste-to-energy plants to convert waste into electricity, reducing reliance on fossil fuels.

☀️ Rooftop Solar Promotion: Gujarat government introduces incentives to encourage rooftop solar panels’ installation, advancing solar energy utilization. ☀️🏠

🌞 Solar Superpower Aspirations: Tamil Nadu targets developing 100 GW of solar power by 2030, propelling the state towards its carbon-neutral goal by 2050. 🌞🏭

💡Knowledge Candy🍬: Will Telecom Experience Gradual Growth in FY24 with 5G on the Horizon?

The Indian telecom industry will experience restrained growth in the fiscal year 2024.

According to ICRA, a rating agency, the industry’s combined revenue could increase by 7-9%, reaching ₹2.9 to ₹3 lakh crore. This subdued growth is primarily attributed to a gradual rise in Average Revenue Per User (ARPU), a critical performance measure in the telecom sector. Let’s explore the reasons behind this incremental ARPU growth.

ARPU, or average revenue per user, signifies the average income a telecom operator generates from each active subscriber over a specified period. ARPU is calculated monthly by dividing the monthly recurring revenue (MRR) by the total number of active users. For instance, in Q1FY24, Reliance Jio’s ARPU was ₹180.5 per subscriber per month, while Airtel’s stood at ₹200.

The ICRA report suggests that the industry’s overall ARPU growth could be slower in FY24, moderating to ₹182-₹185 from ₹175 a year ago. This is mainly due to the absence of significant tariff hikes by telecom providers. Instead, they aim to increase revenue from low-paying customers, as evident when Airtel raised its base recharge plan price from ₹99 to ₹155.

Moreover, the transition to 5G monetization has been gradual, lacking 5G-specific plans, as the adoption and rollout of 5G technology remain in their early stages. Consequently, there has yet to be a substantial boost to ARPU. The report anticipates that telecom companies will witness a more robust growth phase as more subscribers transition to 5G services and telecoms monetize this shift through dedicated 5G plans. Additionally, increased revenue from non-core segments like digital, cloud services, and fixed broadband could open doors to future expansion.

Regarding industry debt, ICRA predicts that the sector’s debt will remain elevated at ₹6.1-6.2 lakh crore as telecom players will increase their capital expenditure to expand 5G coverage across the country, primarily financed through borrowings.

While telecom companies could observe moderate revenue growth in FY24, the proliferation of 5G subscribers or diversification into non-core domains might steer future growth.

Happy reading!

Also Read: Pyramid Technoplast Limited IPO is live. Should you Invest?