Pyramid Technoplast Limited IPO is live. Should you Invest?

Pyramid Technoplast Limited IPO is Open For Investing.

In this article

- IPO details

- Issue details

- Offer Breakup

- IPO Strengths

- Key Risks

- Pyramid Technoplast Limited Financials

📃About Pyramid Technoplast Limited

Incorporated in 1997, Pyramid Technoplast Limited manufactures polymer-based moulded products (Polymer Drums) mainly used by chemical, agrochemical, speciality chemical, and pharmaceutical companies for their packaging requirements.

The Company manufactures polymer-based bulk packaging drums and Intermediate Bulk Containers (IBC), as well as MS Drums for packaging used in the packaging and transport of chemicals, agrochemicals, and speciality chemicals.

Pyramid Technoplast started its commercial production in 1998 and now has over 6 manufacturing units, out of which four are situated in Bharuch, GIDC, Gujarat, and two are located at Silvassa, UT of Dadra and Nagar Haveli. The total installed capacity of their Polymer Drum manufacturing units is 20,612 MTPA, the entire installed capacity of the IBC manufacturing unit is 12,820 MTPA, and the total installed capacity of the MS Drums unit is 6,200 MTPA. The Company is constructing its seventh manufacturing unit, which will also be situated in Bharuch, GIDC, Gujarat.

The Company has obtained UN certification outlined by United Nations Recommendation for IBC and MS Drums to meet safety levels. The manufacturing units are ISO 9001:2015/ ISO 14001:2015/ISO 45001:2018 certified by quality, environment, health, and safety management systems for the manufacture of Polymer Drums, carboys, jerry cans, IBC & MS Drums and accessories, and their MS Drums meet the quality standards as per IS 1783:2014 (Part 1 and 2) laid down by Bureau of Indian Standards.

💰Issue Details of Pyramid Technoplast Limited IPO

- IPO open from 18th Aug 2023 – 22nd Aug 2023

- Face value: ₹10 per equity share

- Price band: ₹151 to ₹166 per share

- Market lot: 90 shares

- Minimum Investment: ₹14,940

- Listing on: BSE and NSE

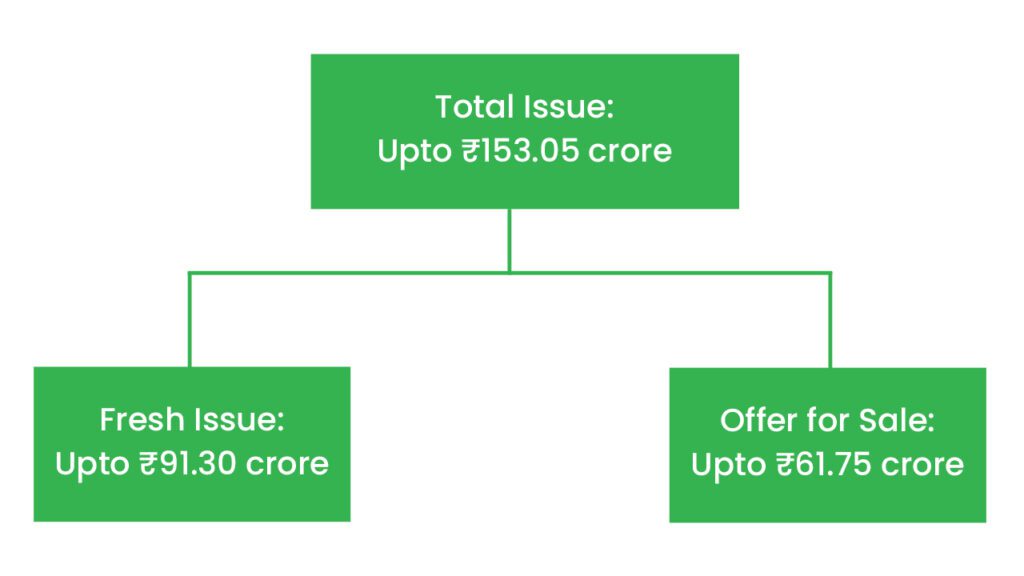

- Offer for sale: Approx ₹153.05 Cr (Fresh Issue: ₹91.30 Cr + OFS ₹61.75 Cr)

- Registrar: Bigshare Services Pvt Ltd

🪙Total Issue Price

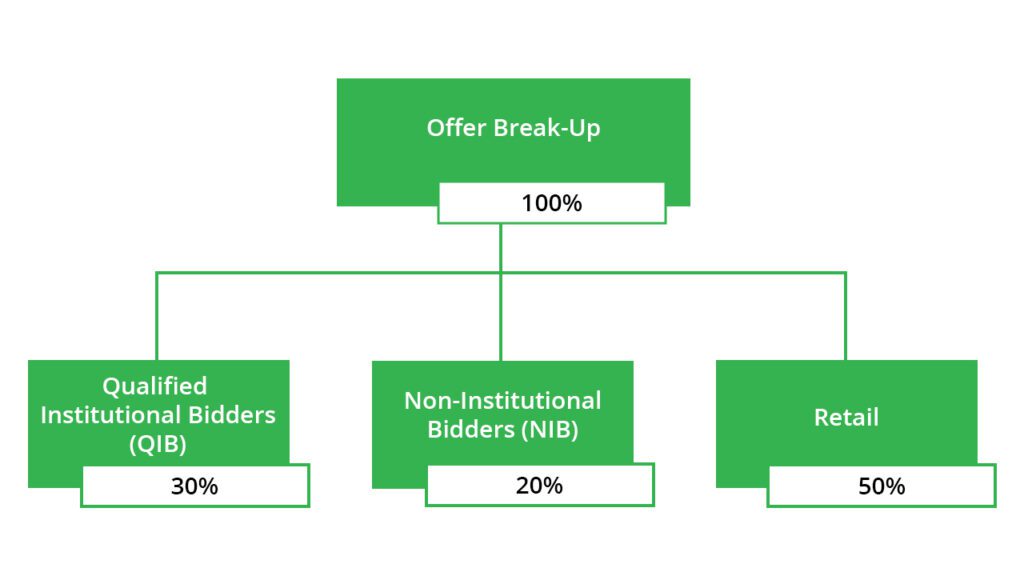

🪚Offer Breakup

🔭IPO Object

The company intends to utilise the net proceeds from the issue towards the funding of the following objects:

- The Company intends to utilize the net proceeds from the issue towards the funding of the following objects:

- Repayment and/or pre-payment, in whole or part, of certain outstanding borrowings availed by the Company,

- Funding working capital requirements of the Company, and

- General corporate purposes.

⛓️IPO Strength

Some of the qualitative factors and strengths which form the basis for computing the Offer Price are:

- Diverse customer base

- Comprehensive product portfolio

- Experienced Promoters and senior management team

- The strategic location of their manufacturing units.

- Quality Standard Certifications & Quality Tests

🧨IPO Risk

- Any change in government policies or quality norms by their customers for moulded industrial packaging, which they may need help to adhere to, may affect their business growth, operations and financials.

- Polymer, including polypropylene and polyethene, is their primary raw material for polymer-based moulded products, including IBC & Polymer Drums. It constitutes a significant percentage of the Company’s total expenses. Polymer is a derivative of crude oil, and any substantial increase in the price or decrease in the polymer supply could materially adversely affect the Company’s business.

- The Company has not entered into any long-term agreements with its customers for purchasing their products. They are subject to uncertainties in demand, and there is no assurance that their customers will continue to buy their products. This could impact the business and financial performance of the Company.

- Any ban on polymer-based packaging by the Government of India may affect their business.

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-21 | ₹153.46 | ₹316.18 | ₹16.99 |

| 31-Mar-22 | ₹183.76 | ₹402.64 | ₹26.15 |

| 31-Mar-23 | ₹225.78 | ₹482.03 | ₹31.76 |

PEER COMPANIES

- Time Technoplast Limited

- TPL Plastech Limited

- Mold-Tek Packaging Limited

📬Also Read: Sustainable Investing in India: ESG Investments