Cyient DLM Limited IPO is live. Should you Invest?

Cyient DLM Limited IPO is live. Should you Invest? Find out here.

In this article

📃About Cyient DLM Limited IPO

Incorporated in 1993, Cyient DLM Limited provides Electronic Manufacturing Services (EMS) and solutions.

The company provides Electronic Manufacturing Services such as Build to Print (“B2P“) and Build to Specification (“B2S“) services. B2P solutions involve clients providing the design for the product for which the company provides agile and flexible manufacturing services. And, B2S services involve designing the relevant product based on the specifications provided by the client and manufacturing the product.

Cyient DLM’s solutions primarily comprise:

Printed circuit board (“PCB“) assembly (“PCBA“),

Cable harnesses and Box builds are used in safety-critical systems such as cockpits, inflight systems, landing systems, and medical diagnostic equipment.

The company’s client list includes Honeywell International Inc. (“Honeywell“), Thales Global Services S.A.S (“Thales“), ABB Inc, Bharat Electronics Limited, Molbio 152 Diagnostics Private Limited, and so on.

💰Issue Details of Cyient DLM IPO

- IPO open from 27th June 2023 – 30th June 2023

- Face value: ₹10 per equity share

- Price band: ₹250 to ₹265 per share

- Market lot: 56 shares

- Minimum Investment: ₹14,840

- Listing on: BSE and NSE

- Offer for sale: ₹592 Cr (Fresh Issue: ₹592Cr)

- Registrar: Kfin Technologies Limited

🪙Total Issue Price

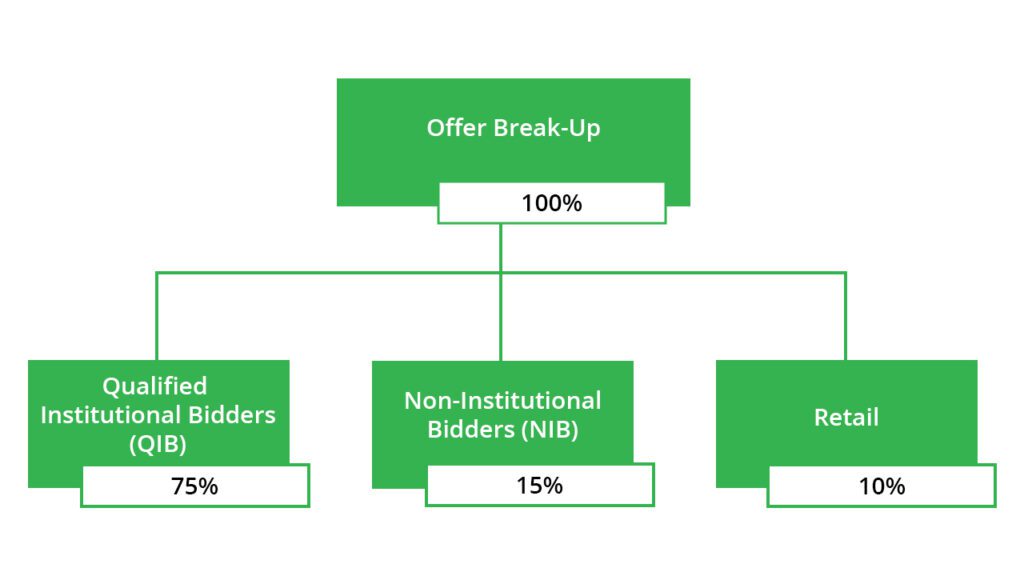

🪚Offer Breakup

🔭IPO Object

The Company proposes to utilize the Net Proceeds towards funding the following objects:

- Funding incremental working capital requirements of the company,

- Funding capital expenditure of the company,

- Repayment/prepayment, in part or full, of certain of the borrowings,

- Achieving inorganic growth through acquisitions, and

- General corporate purposes.

⛓️IPO Strength

Some of the qualitative factors and strengths which form the basis for computing the offer price are:

- Robust and industry-leading order book with marquee customers, with whom we enjoy sustained and long-standing relationships as their preferred partners.

- Ability to provide integrated engineering solutions with strong capabilities across the product value chain.

- World-class manufacturing infrastructure, stringent quality, diverse in-house capabilities and robust supply chain, enable them to provide high-quality end-to-end integrated solutions to their customers.

- High entry barriers for our competitors due to our technical expertise, capabilities in safety-critical electronics in highly regulated industries and customer engagement.

🧨IPO Risk

- Their business is dependent on the sale of their products to certain key customers. The loss of any of the key customers or loss of revenue from sales to their customers could have a material adverse effect on business, results of operations, financial condition and cash flows.

- They are dependent on third-party suppliers for raw materials and components, which are on a purchase order basis any delay, shortage, interruption, reduction in the supply of or volatility in the prices of raw materials on which they rely may have a material adverse effect on their business

- Highly Dependent on their Promoter, management and key personnel and the loss of any key team member may adversely affect our business performance

- The global nature of their operations exposes them to numerous risks that could materially adversely affect their business, results of operations, financial condition and cash flows.

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-21 | ₹645.03 | ₹636.91 | ₹11.81 |

| 31-Mar-22 | ₹776.91 | ₹728.48 | ₹39.80 |

| 31-Mar-23 | ₹1104.72 | ₹838.34 | ₹31.73 |

📬Also Read: Sustainable Investing in India: ESG Investments