📊🚀 Market Milestones: Nifty50 Surges Above 19,000, Sensex Roars Past 64,000 | Market Weekly Update July 1

Nifty and Sensex Scale New Heights |Stock Market Weekly Update July 1

Welcome, dear readers!

Party time! Well, you already know why are we celebrating…

Indian markets hit all-time highs this week! The Nifty50 index crossed 19,000 and the Sensex went past 64,000 before settling just below these milestones. It’s been quite a journey since December 2022 when the Nifty last reached its previous high of 18,887. So, what’s driving this rally? Let’s dig into the key factors behind it.

Here are some interesting facts about this rally:

In 2023, the Nifty50 has already gained 4.7%, and sectors like FMCG, Auto, and Realty have seen strong growth with impressive gains. Top performers among Nifty50 stocks include Tata Motors and ITC, while Bajaj Auto, Dr Reddy’s, and Larsen & Toubro have also made their mark.

So, what’s been fueling this market momentum?

Well, favourable macroeconomic trends play a significant role, such as easing inflation and impressive GDP growth in the March quarter. The confidence of global rating agencies like Fitch Ratings, which upgraded India’s growth forecast, adds to the positive sentiment. Additionally, the influx of foreign capital into Indian equities has been strong, with foreign portfolio investors pouring in around ₹86,000 crores since April 2023.

Other factors that have supported this rally include the RBI’s decision to pause rate hikes, robust corporate earnings in Q4, and timely monsoon rains. With all these factors working in our favour, it’s no wonder that markets closed at record highs today.

Exciting times are ahead for investors!

🧾In this Article

🔍Analyst Corner

– Mrs Anita Gandhi, Whole Time Director at Arihant Capital

What should investors do?

It is prudent for investors to stay invested in companies with strong fundamentals, sound management, and reasonable valuations. However, they should consider taking profits when valuations exceed the underlying fundamentals. Monitoring indicators like auto sales data for June will provide additional insight into the country’s economic momentum.

– Mr Abhishek Jain, Head of Research at Arihant Capital

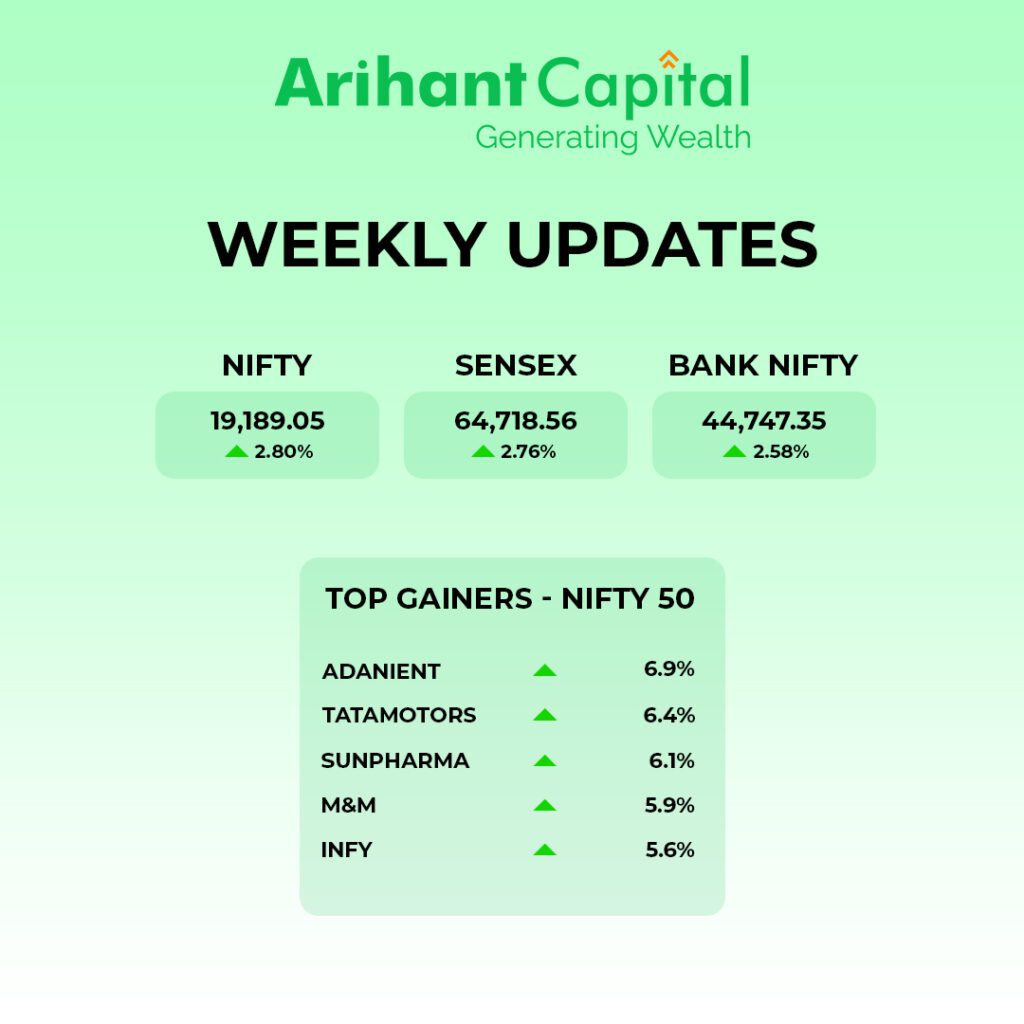

India’s benchmark stock indices reached new all-time highs, capping off a truncated trading week with a record-breaking close on Friday. The Information Technology (I.T.), PSU bank, and auto sectors led the market’s upward momentum, while the metals sector faced pressure. Prominent companies like Infosys Ltd., TCS Ltd., and M&M Ltd. spearheaded the rally, contributing to the market’s surge, whereas ICICI Bank Ltd. and RIL Ltd. weighed it down. The Nifty index closed with an impressive 1.14% increase, touching a level of 19,189.

Globally, S&P 500 contracts showed a slight uptick, reflecting the main index’s third consecutive quarterly gain, while Nasdaq 100 futures rose by 0.5%, suggesting continued growth for the index, which has already surged by an impressive 37% since the year’s start. Meanwhile, India’s Sensex rose 1.26% to stand at 64,719, and Nifty Bank gained 0.95%, reaching 44,747. As the second quarter came to a close, U.S. equity futures also experienced gains.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

Nifty

When analyzing the daily chart of Nifty, we observe an “Upward gap” area, indicating a positive trend. Additionally, the weekly chart shows a strong bull candlestick formation, suggesting that the positive momentum will likely continue, with stock-specific movements being key. If Nifty starts trading above the 19,225 level, it has the potential to reach the 19,350-19,500 level. On the downside, support is expected at 19,150, and if Nifty starts trading below this level, it may test the 19,050 and 18,950 levels. These observations provide insights into the potential movement and key levels to watch for in Nifty’s trading activity

Bank Nifty

Upon analyzing the daily chart of Bank-Nifty, we observe a similar pattern to Nifty, with an “Upward” gap area indicating a positive trend. The weekly chart also shows a strong bull candlestick formation, suggesting that the positive momentum may continue in the banking indices. In the upcoming week, if Bank-Nifty trades above the 44,950 level, there is a potential for it to reach the 45,100 and 45,300 levels. On the downside, support is expected at 44,750, and below that, we may see 44,600 and 44,450 levels. These observations provide insights into the potential movement and key support/resistance levels to monitor in Bank-Nifty.

📈 Stocks in News

🚀 HDFC: Chairman Deepak Parekh announced his retirement.

🏆 M&M: Received eligibility certificate under PLI scheme for automobiles.

💰 Coromandel International: Company’s subsidiary has invested ₹204.24 cr in Dhaksha Unmanned Systems Pvt Ltd.

⛽ Reliance Industries: Announced the start of regular production from MJ oil and gas field in the KG-D6 block.

🔄 Easy Trip Planners: Promoter Rikant Patti sold a 5.75% stake in the company.

🏭 JK Tyre: Completed the first phase of capacity expansion of its radial tyre manufacturing facility in Madhya Pradesh.

🎉 Shree Cement: Completed ₹550 cr cement plant in Purulia, West Bengal. 📜 MCX: Extended its contract with 63 Moons Technologies.

💼 Bharat Electronics: Received new defence and non-defence orders worth ₹2,191 cr.

👥 Zydus Wellness: Norway’s Norges Bank sold a 0.79% stake in Zydus Wellness.

💰 BPCL: Will raise up to $2.19 billion through a rights issue.

💼 Tata Group: Tata Communications will acquire US-based company Kaleyra for around $100 million.

🔒 Granules India: Informed that the company faced a cybersecurity attack late last month.

🏦 ICICI Bank: ICICI Securities will become a wholly-owned subsidiary of ICICI Bank after delisting.

🍟 Quick Bites

📊 SEBI has reduced the time period for listing shares in IPOs from six (T+6) days to three (T+3) days.

💰 PKH Ventures’ ₹379 cr IPO will open for subscription on 30 June. The price band is ₹140 – Rs 148.

💼 Senco Gold’s ₹405 cr IPO will open on July 4. The price band is Rs 301-317 per share.

🔗 The last date to link your PAN and Aadhaar number is 30 June.

🌾 The Indian government has approved several agricultural schemes with a combined outlay of ₹3.7 lakh cr.

💰 The World Bank has approved $700 million in budgetary and welfare support for Sri Lanka.

📉 Net non-performing assets ratio fell to a 10-year low of 3.9% in March 2023: RBI.

🚀 ISRO’s moon mission, Chandrayaan-3, will be launched on July 13 at 2:30 pm.

💼 Cyient DLM IPO has been subscribed 7.60 times so far. Retail investors have subscribed to the issue 24.02 times.

💼 IdeaForge IPO has been subscribed 50.30 times so far. Retail investors have subscribed to the issue 64.48 times. The subscription date for this IPO has been extended to 30 June.

🏭 The Coal Ministry mentioned that it has received 35 bids under the 7th round of auctions of commercial coal mines.

📅 NSE has withdrawn its plan to shift the expiry of Nifty Bank derivative contracts to Friday from Thursday.

💼 India’s current account deficit fell to $1.3 billion (0.2% of GDP) in Q4 of 2022-23 from $16.8 billion (2.0% of GDP) in Q3 and $13.4 billion (1.6% of GDP) a year ago.

🕌 Trading holiday for Eid al-Adha has been postponed from June 28, 2023 (Wednesday) to June 29, 2023 (Thursday).

💼 IdeaForge IPO has been subscribed 13.27 times so far. Retail investors have subscribed to the issue 36.36 times.

💼 Cyient DLM IPO has been subscribed 2.65 times so far. Retail investors have subscribed to the issue 9.82 times.

💼 SEBI has approved the IPO of Tata Technologies.

🥃 Sales of Indian-made foreign liquor rose by 14% in FY 2022-23 while premium products priced over ₹ 1,000 per 750ml bottle grew by 48%: CIABC.

🏠 Demand for residential properties across 13 Indian cities rose 7.8% YoY and 10.4% QoQ in April-June 2023: Magicbricks.

🦄 India added 3 unicorns in 2023, compared to 24 in the year-ago period: Hurun India.

🛣️ India’s road network grew 59% in the last 9 years and is now the 2nd largest in the world: Union Minister Nitin Gadkari.

🚆 The Indian government has launched 5 new Vande Bharat trains, including one on the Patna-Ranchi (Hatia) route.

🌱Sustainability Corner

🔴 With the recent slashing of the FAME subsidy, electric two-wheeler retail sales will see a 60% month-on-month decline in June 2023, with only 35,464 units sold as of June 27.

🚫 Amid slowdown fears, dealers face INR 1,500 crore of unpaid premiums. IRDAI’s 30% cap on expenses will further squeeze dealer margins.

🔌 Stellantis expands its global partnerships to ensure a stable supply of key materials for its electrified future and invests in Norway’s Kuniko for supply (35% of Kuniko’s future annual output) of low-carbon, battery-grade nickel and cobalt sulphate.

⚡️ Tata Power and the Ayodhya Development Authority to set up EV charging points in public parking lots across the city.

🚗 Taiwan’s Gogoro and the Maharashtra government partner on an 8-year Ultra Mega Project involving an investment of $1.5 billion for the manufacture of EVs, smart battery packs, battery swap stations, and deploying a battery swapping infrastructure in the State beginning in late 2023.

📝 Tamil Nadu amends policy to enable registration of EVs (e-rickshaws, e-taxis, and electric buses).

🏍 Yamaha Motor will merge with subsidiary Yamaha Motor Electronics, which develops, manufactures, and sells electrical components for motorcycles, outboard motors, and electrically powered bicycles.

🚀 Tesla, with record sales, was Europe’s biggest market share winner in May; Model Y was the best-seller in January–May; BEV demand was up by 65%, led by Volkswagen Group; while the overall European market grew by 18%, it remains short of pre-pandemic levels, says JATO Dynamics.

🔧 JLR upskills hundreds of employees with a new data programme and lifts production of Range Rover and Range Rover Sport by more than 600 units a week, generating over £50 million (INR 510 crore) in additional weekly revenues and ensuring faster delivery of vehicles.

🚙 Kia Cars raced past 100,000-unit sales in India in 16 months since launch; the spacious and versatile three-row MPV has turned out to be a growth driver for Kia in a competitive marketplace teeming with compact and midsize SUVs.

💼 Improved semiconductor supplies and weak demand in the non-SUV segment are pushing passenger vehicle inventory to a near-alarming level of 45–50 days, say financiers HDFC Bank, Mahindra Finance, and Yes Bank.

🚗 ZF develops a lightweight, ultra-compact e-drive for passenger cars with a high torque density of 70 Nm/kg. Full details and first pictures of the optimized e-driveline showcased on a Porsche Taycan-based concept EV.

🛵 TVS Motor Co. partners with food ordering and delivery platform Zomato and supplies 50 iQube e-scooters as part of Zomato’s strategic plan to deploy over 10,000 TVS electric scooters for last-mile delivery operations.

📈 Car and SUV sales in India are set to clock 325,000–330,000 units in June, albeit growth will be in the low single digits due to the high year-ago base of 320,985 units; July–September sales are likely to be tepid before picking up in the festive season.

💰 Apollo Tyres targets 10% revenue growth in FY2024 and lines up Rs 1,100 crore in capex.

🚘 Mahindra Scorpio “N” turns a year old; the refined and premium SUV, which also doubles up as a tough workhorse, gives Brand Scorpio, which has clocked 900,000 sales, a new charge in India’s competitive SUV market.

🔋 Tata Nexon EV hits 50,000 sales in India. 41 months after the market launch, demand grows in tandem with the consumer shift to electric mobility.

🌐 Tata Elxsi is currently in talks with mining companies, ports, and airports about adopting its intelligence operator assistance system, which it earlier developed for global PV and CV makers.

Also Read: Understanding ESG Investing & Its Emergence in India