ideaForge Technology Limited IPO is live. Should you Invest?

ideaForge Technology Limited IPO is live. Should you Invest? Find out here.

In this article

- IPO details

- Issue details

- Offer Breakup

- IPO Strengths

- Key Risks

- ideaForge Technology Ltd. Financials

📃About ideaForge Technology Limited IPO

Incorporated in 2007, ideaForge Technology Limited is engaged in the business of manufacturing Unmanned Aircraft Systems (UAS).

The company manufactures Unmanned Aircraft Vehicles for Mapping, Security & Surveillance. These drones are capable of a wide range of mining area planning, and mapping applications. ideaForge UAVs help construction and real estate boost their operations. They also assist defense forces in conducting Intelligence, Surveillance, and Reconnaissance (ISR) operations along borders.

ideaForge has two main software, namely:

- BlueFire Live!: It enables secure and live streaming of the UAV video feed and also allows payload control from a remote command location.

- BlueFire Touch: BlueFire Touch is a Ground Control Software (GCS). It is built to plan and command both mapping and surveillance missions with the ability to pre-plan missions based on operational area and target locations via waypoint-based navigation.

The company is a market leader in the Indian Unmanned Aircraft Systems (“UAS”) market with a market share of approximately 50% in fiscal 2022. It has the largest operational deployment of indigenous UAVs across India, with an ideaForge-manufactured drone taking off every five minutes for surveillance and mapping on average.

The company has been ranked 7th globally in the dual-use category (civil and defense) drone manufacturers as per the report published by Drone Industry Insights in December 2022

💰Issue Details of ideaForge Technology IPO

- IPO open from 26th June 2023 – 29th June 2023

- Face value: ₹10 per equity share

- Price band: ₹638 to ₹672 per share

- Market lot: 22 shares

- Minimum Investment: ₹14,784

- Listing on: BSE and NSE

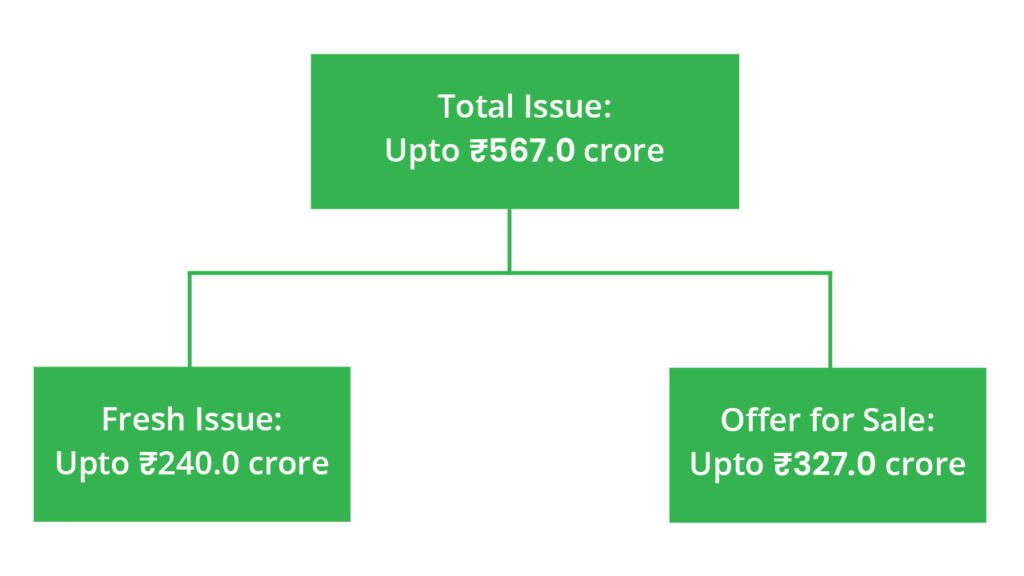

- Offer for sale: ₹567 Cr (Fresh Issue: ₹240Cr + OFS ₹327 Cr)

- Registrar: Link Intime India Private Ltd

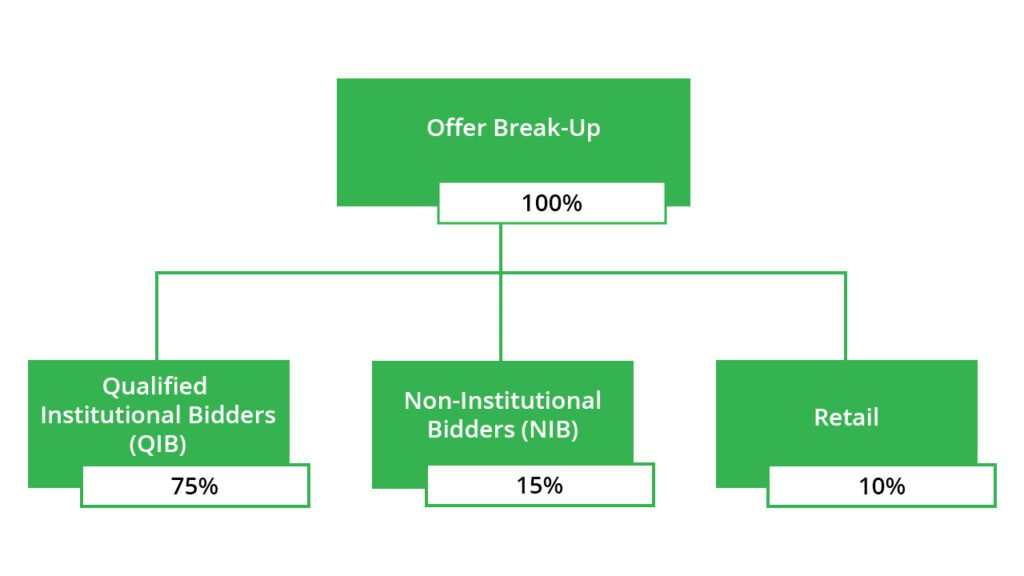

🪚Offer Breakup

🔭IPO Object

The Company proposes to utilize the Net Proceeds towards funding the following objects:

- Repayment/prepayment of certain indebtedness availed by the company;

- Funding working capital requirements,

- Investment in product development; and

- General corporate purposes.

⛓️IPO Strength

Some of the qualitative factors and strengths which form the basis for computing the offer price are:

- Strong management capabilities with a demonstrated track record of delivering robust financial performance.

- Pioneer and the pre-eminent market leader in the Indian UAS industry, with first-mover advantage

- Strong relationships with a diverse customer base

- Expanding their product portfolio and catering to new end-use applications and industries with Expansion into international markets

🧨IPO Risk

- They are heavily reliant on sales to the Indian government including to the central and state government agencies. A decline in orders, termination of existing contracts, can adversely impact on their business.

- They operate in an industry which is highly regulated and is subject to change.

- They are highly dependent on global vendors for the supply of components and may not be able to reduce their dependency on such imports.

- Hacking of their software and solution or any other kind of cyber-attack could have a material adverse effect on their business, results of operation or financial condition.

- Their business is dependent on their single manufacturing facility, and we are subject to certain risks in our manufacturing process. Any slowdown or shutdown in manufacturing operations could have an adverse effect on business, financial condition and results of operations.

⚖️Peer Companies

- MTR Technologies Limited

- Data Patterns India Limited

- Astra Microwave Products

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-21 | ₹123.74 | ₹36.34 | ₹-14.63 |

| 31-Mar-22 | ₹222.33 | ₹161.45 | ₹44.01 |

| 31-Mar-23 | ₹487.93 | ₹196.40 | ₹31.99 |

📬Also Read: Sustainable Investing in India: ESG Investments