🚀Sweeter than Ever: Sugar Stocks Soar to New Heights! 🍭| Stock Market Weekly Update June 24

Welcome explorers! 😊

A Treat for Your Mind! Explore this week’s reading and delight in the sweet 🍭 flavours of knowledge. Enjoy the journey!

Sugar producers took centre stage on June 22(Thursday) as shares of Shree Renuka Sugars, Balrampur Chini, and Dalmia Sugar experienced a remarkable surge of 2 to 6% in an otherwise lacklustre market. What could have ignited this impressive rise?🤔

Here you go! 💡

One significant factor driving this rally is the surge in international sugar prices, which have reached multi-week highs. Global sugar prices have soared due to reports of delayed monsoons in key sugar-producing countries like India and Brazil, caused by the El Nino effect. As a result, international sugar prices have climbed above $0.26 per pound, edging closer to the impressive 11-year high of $0.27 per pound witnessed in April 2023. This spike in international prices benefits domestic sugar producers as they fetch higher prices for their exports. Remarkably, despite the global surge, domestic sugar prices have remained stable due to government-imposed price caps.

Adding to the sugar rush is the anticipation of low domestic ⚖️ sugar production in India. Early estimates suggest a decline of 11% year-on-year, with projected production standing at 32.8 million tonnes. Meanwhile, consumption is steadily increasing and is estimated to reach 27.5 million tonnes. This balance between production 🌾and consumption is expected to maintain domestic prices at current levels, presenting a favourable situation for the industry.

An additional driving force behind the sugar stock surge is the promising ethanol business. Many sugar producers have ventured into ethanol production, and it is proving to be a highly lucrative endeavour. The government’s plan to increase ethanol blending with automotive fuel to 20% by 2025 further bolsters the sugar industry’s prospects, providing an exciting avenue for growth and profitability.

With multiple favourable factors aligning, sugar stocks are experiencing a sweet momentum. However, as always, the weather ☀️🌧️ outlook will hold the key to future movements in these stocks.

Keep an eye on the skies as sugar producers continue to captivate the market with their sugar-coated success.

🧾In this Article

– Mr. Abhishek Jain, Head of Research at Arihant Capital

India’s benchmark stock indices declined through Friday to close the week and the day on a lower note. While metals and consumer durables declined the most, the majority of the sectoral indices were trading lower, except pharma and private banks, which were marginally higher. Adani Enterprises Ltd. dragged the indices, whereas HDFC Twins and Bharti Airtel Ltd. led the positive change.

The headline indices snapped four weeks of advances to decline this week. Global stocks are headed for their biggest weekly decline in more than three months. In Europe, equities extended their longest losing streak since December, paced by a record 36% drop in Siemens Energy AG’s shares after a profit warning. The Nifty ended its decline by 0.56% at the 18,665.5 level. Sensex was down 0.41% and stood at 62,979, and Nifty Bank was down 0.23% at 43,622.9.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

Nifty

Upon examining the daily chart of Nifty, we can observe that prices have broken below the lower trend line support level. However, on the weekly chart, we notice a supportive bounce near the short-term moving averages. Taking both charts into account, the overall trend remains positive, albeit with some pressure at higher levels. If Nifty manages to trade above the 18,750 level, it has the potential to reach the range of 18,850-18,950. Conversely, if it falls below the support level of 18,650, it could test the levels of 18,500 and 18,350. Traders should monitor these levels for potential market movements.

Bank Nifty

Upon analysing the daily chart of Bank-Nifty, we can observe a breakdown of the channel, while on the weekly chart, it has started trading below the short-term moving average. This suggests a potential pause in Bank-Nifty’s momentum and a likelihood of profit booking. In the upcoming week, if Bank-Nifty manages to trade above the 43,800 level, it could potentially reach levels of 43,950 and 44,100. On the downside, key support is expected at 43,550, followed by 43,350 and 43,100 levels. Traders should keep a close watch on these levels for potential market dynamics.

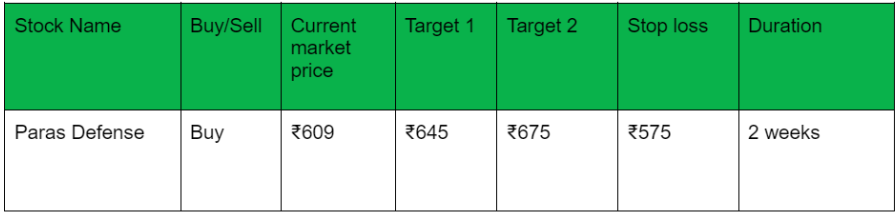

💰Stock Picks

– Ms. Kavita Jain, Sr Research Analyst, and Learning Head, Arihant Capital.

📈 Stocks in News

📣 BPCL: The board of BPCL will consider fundraising on June 28.

📣 Federal Bank: Harsh Dugar’s role as executive director of Federal Bank has been approved by the RBI.

📣 Delhivery: Carlyle has sold its entire stake in Delhivery for ₹709 crore.

📣 Aurobindo: Aurobindo’s subsidiary, Eugia Pharma Specialities, has entered into an agreement to develop and market an anti-cancer drug.

📣 Lupin: Lupin has launched a drug in the US for the treatment of seizures among paediatric patients.

📣 PNB Housing Finance: The board of PNB Housing Finance has approved raising ₹5,000 crore.

📣 Dr. Reddy’s: Dr. Reddy’s has entered the trade generics business in India with the launch of ‘RGenX’.

📣 UPL: UPL will transfer its speciality chemicals business to its wholly-owned subsidiary, UPL Speciality Chemicals, for ₹3,572 crores.

📣 Hindustan Aeronautics Ltd: GE Aerospace has signed an agreement with Hindustan Aeronautics (HAL) to produce fighter jet engines for the Indian Air Force (IAF).

📣 NMDC: LIC has reduced its stake in NMDC to 9.62% by selling 6.06 crore shares.

📣 L&T: L&T has signed a contract with DRDO to provide 2 Air Independent Propulsion (AIP) System Modules for the Indian Navy’s Kalvari Class submarines.

📣 ZEE: Zee Entertainment Enterprises (ZEE) has settled a securities law violation-related case with SEBI by paying ₹7 lakhs as settlement charges.

📣 Shriram Finance: Piramal Enterprises has sold its entire stake in Shriram Finance for around ₹4,823 crores through block deals.

📣 Tata Group: Tata AIA Life Insurance has declared a dividend payout of ₹1,183 crore to policyholders, marking a 37% rise year-on-year.

🍟Quick Bites

🚀 India and the US have signed Artemis Accords. NASA and ISRO will now launch a joint mission to the International Space Station in 2024.

💰 Cyient DLM’s ₹592 crore IPO will be open between June 27 and June 30. The price band is ₹250-265 per share.

📈 HMA Agro Industries IPO subscribed 0.98 times. Retail investors subscribed 0.54 times.

💡 American company Micron plans to invest $825 million in Gujarat to set up a new semiconductor assembly and test facility.

⛽ Domestic crude oil production fell 3.8% YoY in May 2023.

🏭 India’s crude steel production rose 4.1% to 11.2 MT in May 2023: World Steel Association.

⚡ The government has introduced a time-of-day tariff – electricity prices will vary based on the time of the day. Applicable from 1st April 2024 for commercial/industrial consumers and from 1st April 2025 for all other consumers (except agriculture).

🔒 SEBI has banned 7 entities from the stock market for 3 years for not following insider trading regulations while dealing in shares of Sharon Bio-Medicine.

📈 HMA Agro Industries IPO subscribed 1.62 times. Retail investors subscribed 0.96 times.

💼 Funds deposited by Indian people and companies in Swiss banks fell by 11% in 2022 to around ₹30,000 crores: Switzerland’s central bank.

🏭 Ola has started construction of its EV factory in Tamil Nadu.

🔌Sustainability Corner

🚀 Electric motorcycle maker Tork Motors targets demand in Gujarat by opening two new showrooms in Rajkot and Ahmedabad. CEO Kapil Shelke announces a plan to set up 100 outlets across India by the end of March 2024.

🔧 The Automotive Skills Development Council (ASDC) hosts Partners Forum 2023, which sees key stakeholders, industry experts, and policymakers deliberate on crucial aspects of skilling and shaping the future workforce at India Auto Inc.

🔋 VE Commercial Vehicles improves uptime for its connected trucks and buses by up to 98%, resulting in 7–10% savings for fleet operators.

💡 Volkswagen’s battery division, PowerCo, develops pathbreaking tech for cell production: dry coating of battery cells is claimed to save about 30% of energy, 15% of the floor space required, and millions of euros in production costs.

♻️ There’s a new and safer way to recycle EV battery packs: Bosch Rexroth’s kit fully automates battery discharge and recycles eight lithium-ion batteries from electric cars in less than 15 minutes.

🔌 Panasonic Energy and Mazda are in talks for the supply of automotive cylindrical lithium-ion batteries for fitment in EVs planned for launch in the second half of this decade.

⚡ Fifteen EV makers from Europe, Asia, and the US tested StoreDot’s extremely fast-charging battery cells and reported game-changing performance of energy density greater than 300 Wh/kg at a charging rate higher than 4C and over 1000 consecutive XFC charging cycles.

🌱 Valeo plans to invest ₹1,500 crore in India to accelerate its business in the country. Of this amount, 35% is allocated for the electrification space.

🏭 Ola Electric commences Gigafactory construction; operations are to begin by early next year with an initial capacity of 5 GWh, which will be further expanded in phases to 100 GWh at full capacity.

🎠 Vespa collaborates with Disney on a limited-edition Mickey Mouse Edition scooter. The Vespa Primavera is coloured black, red, white, and yellow—the same hues that have characterised Walt Disney’s most famous mouse for decades. The first official photos were revealed.

💻 Continental develops a cost-optimised smart cockpit high-performance computer system and claims a speedy time to market of just 18 months from order to start of production.

🔋 Volvo rolls out medium-duty electric trucks with up to 450 km of range; new and more powerful batteries claim to deliver 42% extra energy capacity.

💡🍬 Knowledge Candy: Profitability Takes Center Stage for Emerging Companies 🚀

📈 Tech companies that emerged in recent years have regained investor confidence after experiencing a significant drop in their stock prices. Companies like Paytm, Zomato, PB Fintech, and Delhivery have seen their stocks rise between 12% and 58% in 2023.

One key factor behind this turnaround is their shift in focus from solely pursuing growth to prioritising profitability. 💰 Paytm, for example, reported a 61% year-on-year increase in revenue and reduced its losses.

These companies are also concentrating on strengthening their core operations, reducing costs, and being cautious with new acquisitions and expansions. With funding expected to become scarce for new ventures, these established companies are now considered attractive investments.