IKIO Lighting Limited IPO is live. Should you Invest?

IKIO Lighting Limited IPO is live. Should you Invest? Find out here.

In this article

📃About IKIO Lighting Limited IPO

Incorporated in 2016, IKIO Lighting Limited is an Indian manufacturer of light-emitting diode (LED) lighting solutions. In its journey of over seven years, the entity focused on providing sustainability and low-energy LED products to help India meet its sustainability goals.

The product portfolio of IKIO can be categorized as LED lighting, Refrigeration lights, ABS (acrylonitrile butadiene styrene) piping and other products.

The company is primarily an Original Design Manufacturer (ODM). They design, develop, manufacture and supply products to customers. Thereon, the customers further distribute the products under their own brands. Alongside, they also work with the customers to develop, manufacture and supply products as designed by the customers.

The company’s LED lighting offerings focus on the premium segment and include lighting, fittings, fixtures, accessories, and components. The products are designed and created to cater to the distinct requirements and expectations of the customers.

The total revenue of IKIO Lighting Limited in the preceding financial years 2022, 2021, and 2020 was 3,339.95 million, .72 million, and 2,218.28 million, respectively.

💰Issue Details of IKIO Lighting IPO

- IPO open from 06th June 2023 – 08th June 2023

- Face value: ₹10 per equity share

- Price band: ₹270 to ₹285 per share

- Market lot: 52 shares

- Minimum Investment: ₹14,820

- Listing on: BSE and NSE

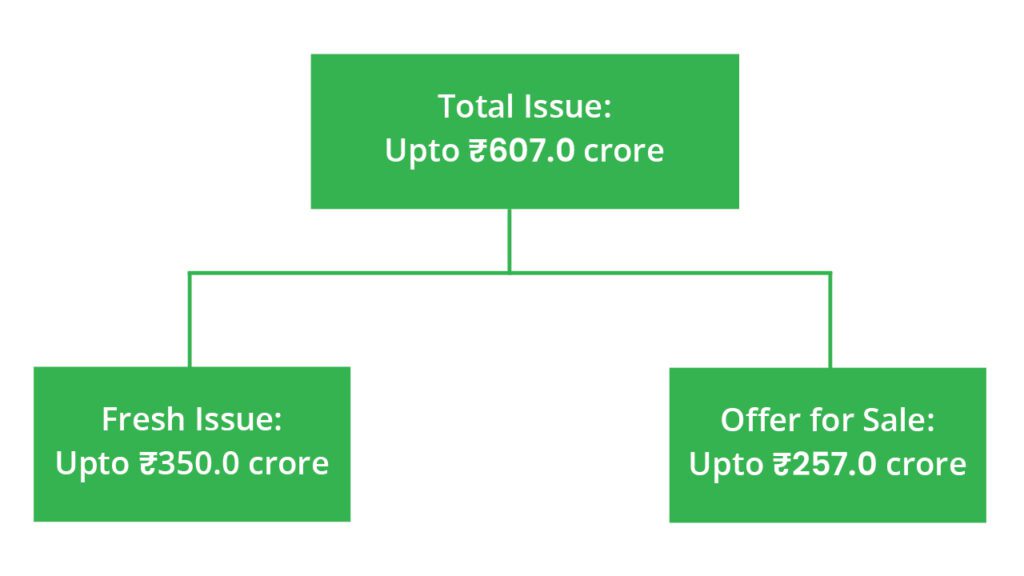

- Offer for sale: ₹607 Cr (Fresh Issue: ₹350Cr + OFS ₹257 Cr)

- Registrar: KFin Technologies Limited

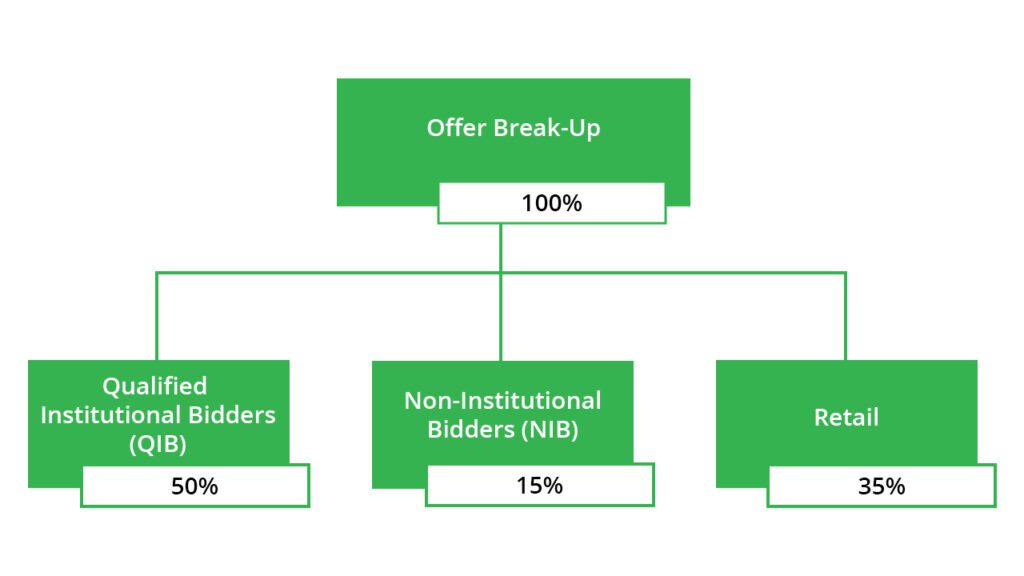

🪚Offer Breakup

🔭IPO Object

The Company proposes to utilize the Net Proceeds towards funding the following objects:

- Repayment/ prepayment, in full or part, of certain borrowings availed by the Company and its Subsidiaries on a consolidated basis

- Investment in the wholly owned Subsidiary, IKIO Solutions Private Limited, for setting up a new facility at Noida, Uttar Pradesh

- General corporate purposes

⛓️IPO Strength

Some of the qualitative factors and strengths which form the basis for computing the offer price are:

- They have a diverse product basket with a focus on high-margin areas.

- The Company has shown Strong and consistent financial performance.

- They have long-term relationships with leading industry customers.

- Experienced Promoters and Management Team

🧨IPO Risk

- The company is dependent on and derives a substantial portion of its revenue from, a single customer and over 85% of its revenue is derived from the top twenty customers. Cancellation by the top customers or delay or reduction in their orders could have a material adverse effect on the business, results of operations and financial condition.

- They are dependent on their R&D activities for future success. If they do not successfully develop new products in a timely and cost-effective manner, their business, results of operations and financial condition may be adversely affected.

- The company rely on a number of third-party suppliers for their key components, materials and stock-in-trade as well as customer support services including product repairs and returns. Any shortfall in the supply of components and raw materials or an increase in component or raw material costs, or other input costs, may adversely affect their business.

- The business may expose to potential warranty claims, product recalls and returns, which could adversely affect their results operations, goodwill and the marketability of products

⚖️Peer Companies

- Dixon Technologies India Limited

- Amber Enterprises India Limited

- Syrma SGS Technology Limited

- Elin Electronic Limited

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-20 | ₹144.83 | ₹221.83 | ₹21.41 |

| 31-Mar-21 | ₹174.45 | ₹214.57 | ₹28.81 |

| 31-Mar-22 | ₹264.87 | ₹334.00 | ₹50.52 |

📬Also Read: Sustainable Investing in India: ESG Investments