Language, Creativity, Software: India’s e-Conomy’s Triumvirate! 🗣️🎨💻| Indian Stock Market Weekly Update 10 June

India’s e-Conomy’s Triumvirate! | Indian Stock Market Updates

Hello Readers!

This weekly reading diet offers a scrumptious feast of insights that will leave you craving for more! Get ready to explore the exciting opportunities in India’s e-Conomy as it gears up for a remarkable journey of growth.

India’s e-Conomy is set for a meteoric rise! 🚀 With Tier 2+ cities gaining momentum, businesses have an incredible chance to tap into their vast potential. Projections show that rural India’s income growth will surpass urban areas, driving a surge in consumption patterns. And hold on tight! A whopping 500 million non-English literate internet users are waiting to be engaged! 🌍

Leading the charge are companies like KukuFM, Meesho, and Apna, breaking barriers by offering services in multiple languages. Small-town consumers are eager for new brands and products, creating opportunities for emerging players to challenge industry giants. Interestingly, local influencers reign supreme in Tier 2+ cities, wielding influence without the need for A-list endorsements!

With countless YouTube channels and an ever-growing fan base, influencers are revolutionizing marketing. The influencer market is projected to reach a mind-boggling $3 billion by 2030, with ordinary heroes stealing the spotlight. Already, the creator economy has contributed billions to India’s GDP and generated hundreds of thousands of jobs! 💸

Hold your breath, because we’re not done yet! India’s SaaS sector is taking the global stage by storm! With over 1,500 funded companies, Indian SaaS aims to capture 10-12% of global revenues by 2030💰. As remote work becomes the norm, these tech wizards are delivering innovative software solutions that the world craves 🌍. Get ready for a unicorn frenzy as investors flock to bet big on SaaS’s skyrocketing success!

India’s e-Conomy is an enthralling tale of growth, innovation, and limitless potential. The rise of Tier 2+ cities, the captivating creator economy, and the global dominance of the SaaS sector are shaping an exciting and transformative future! Buckle up for an exhilarating ride into the heart of India’s digital revolution!💥

🧾In this Article

– Mr. Abhishek Jain, Head of Research at Arihant Capital

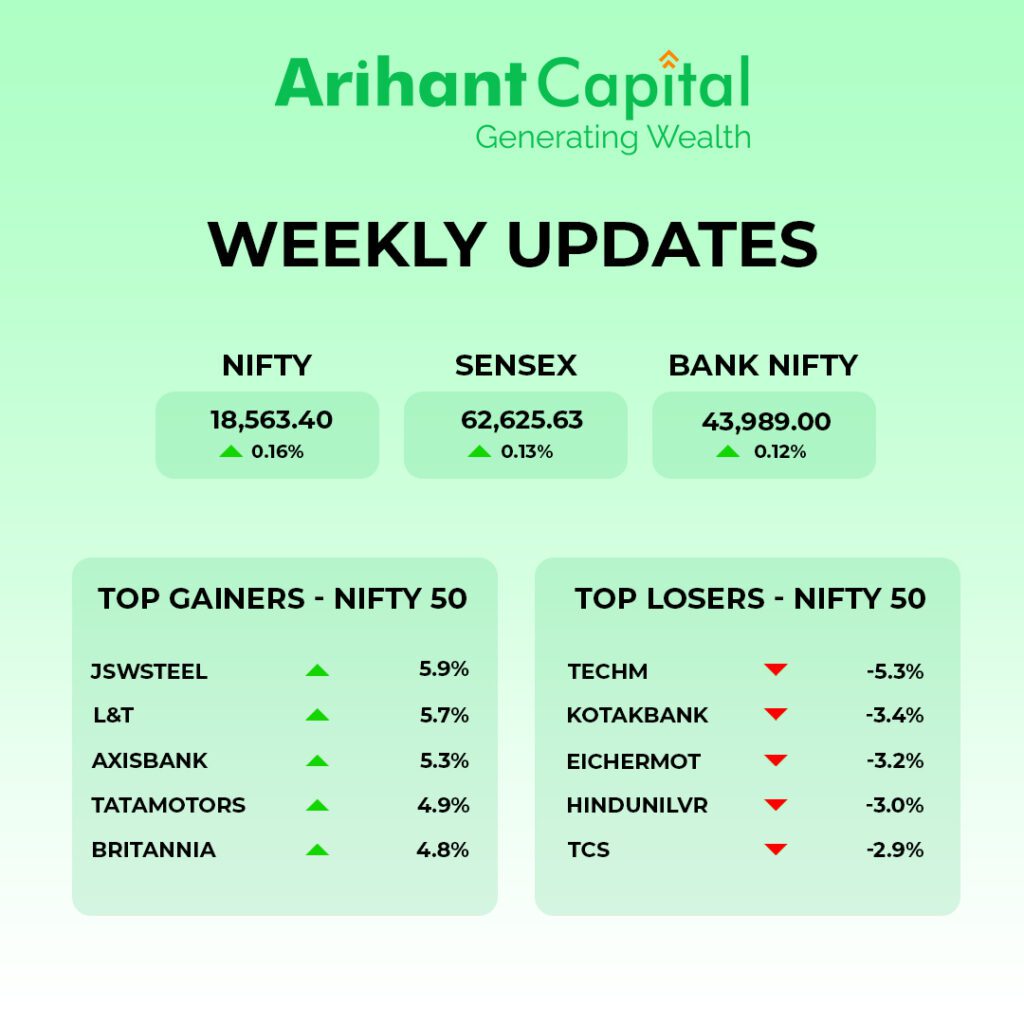

India’s main stock market indicators fell for the second consecutive day towards the end of the week and closed the week with minor gains after fluctuating between gains and losses throughout the week. While sectors such as PSU banks, fast-moving consumer goods, and I.T. experienced declines, real estate and private banking shares showed resilience. Companies like Infosys Ltd., HUL Ltd., and SBI were responsible for the downturn, whereas Axis Bank Ltd. and L&T Ltd. led the positive movement in the indices. Moreover, the headline indices recorded a third consecutive week of growth.

European stocks and U.S. futures declined after a significant surge in Asian markets. The chemical sector experienced the most significant losses in Europe due to a disappointing earnings announcement by Croda International Plc. The Turkish lira also weakened as President Recep Tayyip Erdogan nominated a new central bank governor. Conversely, Asian stocks were on track for a second consecutive week of gains, with Japan’s Nikkei 225 poised to complete a nine-week streak of growth, which would be its longest in recent times.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

Nifty

If we look at the daily chart of Nifty, we are observing a breakdown of “Trendline” On the weekly chart, we are observing “Doji” candlestick pattern formation. If we analyze both charts, it indicates that now the market can take some pause and we may see some profit booking from higher levels. If Nifty starts trading above the 18,650 level, then it can touch the 18,750–18,880 level, while on the downside, support is at 18,400, and if it starts to trade below, then it can test the levels of 18,320 and 18,200.

Bank Nifty

If we look at the daily chart of the Bank Nifty, we are observing the “Trendline” breakdown and, on the weekly chart, the “Doji” candlestick formation. It indicates that Banknifty can also take a pause here, and some profit booking may be seen. In the coming week, if it trades above 44,350, it can touch 44,500 and 44,750 levels. However, downside support comes at 43,850, and below that, we can see 43,600 and 43,450 levels.

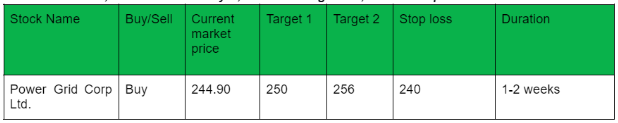

💰Stock Picks

– Ms. Kavita Jain, Sr Research Analyst, and Learning Head, Arihant Capital.

🔎Quick Bites

- Equity mutual funds witnessed a net investment of Rs 2,906 crore in May 2023, compared to Rs 5,275 crore in April, according to AMFI.

- Property prices in 43 cities showed an increase during the Jan-March quarter of 2022-23. The highest price hike was observed in Kolkata (11%), Ahmedabad (10.8%), and Bengaluru (9.4%), as reported by the National Housing Bank (NHB).

- The RBI has maintained the repo rate at 6.5%.

- The IPO of IKIO Lighting was subscribed 66.29 times, with retail investors subscribing 13.86 times.

- HMA Agro Industries IPO is scheduled to be open from 20-23 June, with a price band of Rs 555-585 per share.

- The Indian government has approved a revival package of Rs 89,047 crore for BSNL, including the allotment of 4G/5G spectrum.

- The government has approved an increase in the Minimum Support Price (MSP) of paddy, moong dal, and some other commodities.

- NSE has moved the Nifty Bank F&O expiry to Friday.

- The service industry growth (PMI) stood at 61.2 in May, compared to 62 in April.

- Saudi Arabia will reduce oil supply by 1 million barrels per day starting from July.

- The government has approved a proposal worth Rs 5,452 crore to extend the metro connectivity project from HUDA City Centre to Cyber City in Gurugram.

- India’s auto sales recorded a 10% year-on-year jump in May, according to FADA.

- The Indian government has banned 14 fixed dose drug combinations (FDCs).

🏗️Corporate Actions 12th June – 17th June 2023

| Split | ||

| Company | Ratio | Ex-Date |

| ION EXCHANGE INDIA LTD | 1:10 | 12-June-2023 |

| VARUN BEVERAGES LTD | 5:10 | 15-June-2023 |

| Right | ||

| Company | Ratio | Ex-Date |

| UDAIPUR CEMENT WORKS LTD | 4:5 | 14-June-2023 |

| Buyback | |||

| Company | Start Date | End Date | Offer Price |

| WIPRO LTD | – | – | 445.00 |

| Dividend for 22nd – 27th 2023 | |||

| Company | Type of dividend | Dividend | Ex-Date |

| APCOTEX INDUSTRIES LTD. | Final Dividend | 3.5 | 12-Jun-23 |

| RELIANCE IND. INFRA LTD | Dividend | 3.5 | 12-Jun-23 |

| CANARA BANK | Dividend | 12 | 14-Jun-23 |

| TATA CHEMICALS LTD | Final Dividend | 17.5 | 14-Jun-23 |

| HDFC Life Insurance Company Ltd | Final Dividend | 1.9 | 16-Jun-23 |

| POWER FINANCE CORP. LTD. | Final Dividend | 4.5 | 16-Jun-23 |

| TORRENT POWER LTD | Final Dividend | 4 | 16-Jun-23 |

| Welspun Corp Limited | Final Dividend | 5 | 16-Jun-23 |

🔌Sustainability Corner

- Tata Technologies signs MoU with the Tamil Nadu government to transform 71 ITIs into technology centers and upskill youth in Industry 4.0, manufacturing process control, automation, CAD/CAM, CNC machining, industrial robotics, EV maintenance, and advanced manufacturing.

- BorgWarner unveils its new logo for the electric era as the company aims to rebrand itself as a future-focused entity. It targets EV-driven revenues of over $10 billion by 2027.

- Maruti Suzuki expands its service network in India and inaugurates its 4,500th service touchpoint at Nexa Service, Rampally in Hyderabad. In FY2023, Maruti Suzuki established 310 new service touchpoints and serviced over 22.3 million vehicles.

- Ramanathan Srinivasan, MD of Automotive Test Systems (ATS), highlights the need to tune ADAS technology for Indian conditions and adapt to the country’s unique road infrastructure challenges.

- The Society of Manufacturers of Electric Vehicles in India urges the Finance Minister to levy a “Green Tax” on IC engine 2-wheelers to reduce pollution and create a level-playing field for electric 2-wheelers, following a reduction in FAME subsidy for electric 2-wheelers.

- Greaves Cotton subsidiary Greaves Finance launches the financial platform “EVfin” to facilitate EV buying in India through customized and cost-efficient financing solutions.

- Maruti Suzuki India announces the commissioning of two new solar power plants, 1.85 MWp at the R&D Centre in Rohtak and 20 MWp at Manesar, to harness renewable energy. The plants are expected to be operational in FY2024 and FY2025.

- Tata Motors plans sustained investment in green technology and aims to slash carbon emissions by 30% using hydrogen, with a goal of achieving net carbon zero by 2045. The company will be one of the first OEMs globally to utilize Cummins’ hydrogen IC engine.

- Kawasaki, Suzuki, Honda, and Yamaha collaborate to research and develop hydrogen-powered engines.

- Tata Motors, a leader in the EV market in India, focuses on the growing demand for CNG cars and targets sales of 150,000 CNG cars and SUVs per year with models like Tiago, Tigor, Altroz, and the upcoming Punch CNG.

- Electric vehicle sales in India exceeded 2.5 million units in 10 years, with nearly 2 million units sold in the past 29 months, indicating the accelerating pace of the shift towards e-mobility.

- EV sales in India surpassed 150,000 units for the first time in May 2023 and maintained a streak of over 100,000 units for the 8th consecutive month. Tata leads in electric passenger vehicles, buses, and goods vehicles, while Mahindra & Mahindra holds a 9% share in electric 3-wheelers.

- Minus Zero, a Bengaluru-based autonomous driving start-up, unveils the zPod, claimed to be India’s first autonomous vehicle. The company aims to provide its self-driving technology to other manufacturers to enhance their ADAS suite.

- General Motors CEO Mary Barra acknowledges that EVs priced below $40,000 may not be profitable at the moment.

- General Motors announces that starting in 2025, its future EVs will feature the North American Charging Standard (NACS), also known as the Tesla charge port.

📚Knowledge Candy 🍬

The National Stock Exchange (NSE) has made a significant change that will benefit traders. They have decided to shift the expiry day for Bank Nifty Futures and Options (F&O) contracts from Thursday to Friday. This change applies to weekly, monthly, and quarterly contracts and will take effect from 7th July 2023.

Following this announcement, the Bombay Stock Exchange (BSE) witnessed a decline of nearly 2% in its shares on Tuesday. You might be wondering why this happened and how traders will benefit from the new expiry day. Let’s break it down for you.

The change in expiry day is expected to have an impact on BSE’s F&O business. BSE recently reintroduced weekly options contracts for Sensex and Bankex, which saw a significant increase in market participation. Traders found BSE contracts appealing due to the difference in expiry day, lower charges, and smaller lot size compared to NSE contracts. In response, NSE decided to modify its expiry day to maintain its dominance.

This change is likely to benefit traders in several ways. It is expected to reduce volatility in Nifty’s weekly contracts since the components of the Bank Nifty index will be more active on Friday’s expiry instead of Thursday. With this modification, NSE will now have an F&O expiry on every day of the week except Monday. Traders can now explore different themes across various expiries on NSE. Additionally, NSE has decided to adjust the lot size of Nifty Bank from 25 to 15, starting from July 2023. This change will release some margins for traders, allowing them to utilize it for other trades.

📬Also Read: Sustainable Investing in India: ESG Investments