Fuelling the Future: India’s Oil Rise Sparks Global Attention | Indian Stock Market Weekly Update 17 June

India’s Oil Rise Sparks Global Attention | Indian Stock Market Updates

Welcome, dear readers!

Hold onto your hats as India adds yet another feather to its cap! 🎩 Get ready to celebrate an incredible milestone.

According to a new report by the International Energy Agency (IEA) based in Paris, India is going to rock the oil game! 🚀 We are set to surpass China and become the world’s second-largest oil consumer, right after the United States. How awesome is that?

So, why is India on this oil-consuming spree? 🤔 Well, it’s mainly because of our booming industrial and economic scene. India’s economy is growing faster like a cheetah on roller skates, and that means more demand for oil. In the last fiscal year alone, we gobbled up a whopping 222 million tonnes 😮 of petroleum products, which was a 10.2% increase compared to the previous year.

But wait, there’s more! The rising urbanization and the expanding middle class in India are playing a big role too. As more people move to cities and climb up the social ladder, their need for oil keeps growing. In fact, diesel, a popular fuel in the country, is going to see a bigger slice of the oil pie, increasing its share from 32% to 35% over the next five years. That’s quite a jump!

Meanwhile, things are a bit different in China. Their economy has hit a bit of a speed bump, and their domestic consumption is slowing down. Plus, they’re all about electrifying their cars and buses, which means they won’t need as much oil in the future. So while China takes a breather, India is grabbing the oil spotlight. 🔌

But hold up, there’s a twist in the global oil story. The IEA report says that the world’s overall oil demand is hitting its peak. More and more people are hopping on the electric vehicle bandwagon, and the oil industry is getting smarter with technology and logistics. As a result, global oil demand growth will be less than 1 million barrels per day from 2024 onwards. By 2028, it might even shrink to just 0.4 million barrels per day. Whoa! 😱

In fact, the report predicts that by 2026, the demand for oil in road transport worldwide will go downhill, and from 2027 onwards, oil won’t be the top fuel choice for vehicles anymore. 🚙💨

Amid the oil drama, India is shining as a major player in the oil game. Keep an eye on India, folks! It speaks volumes about the future of oil companies in the country. Exciting times are ahead! 🔥

🧾In this Article

– Mr. Abhishek Jain, Head of Research at Arihant Capital

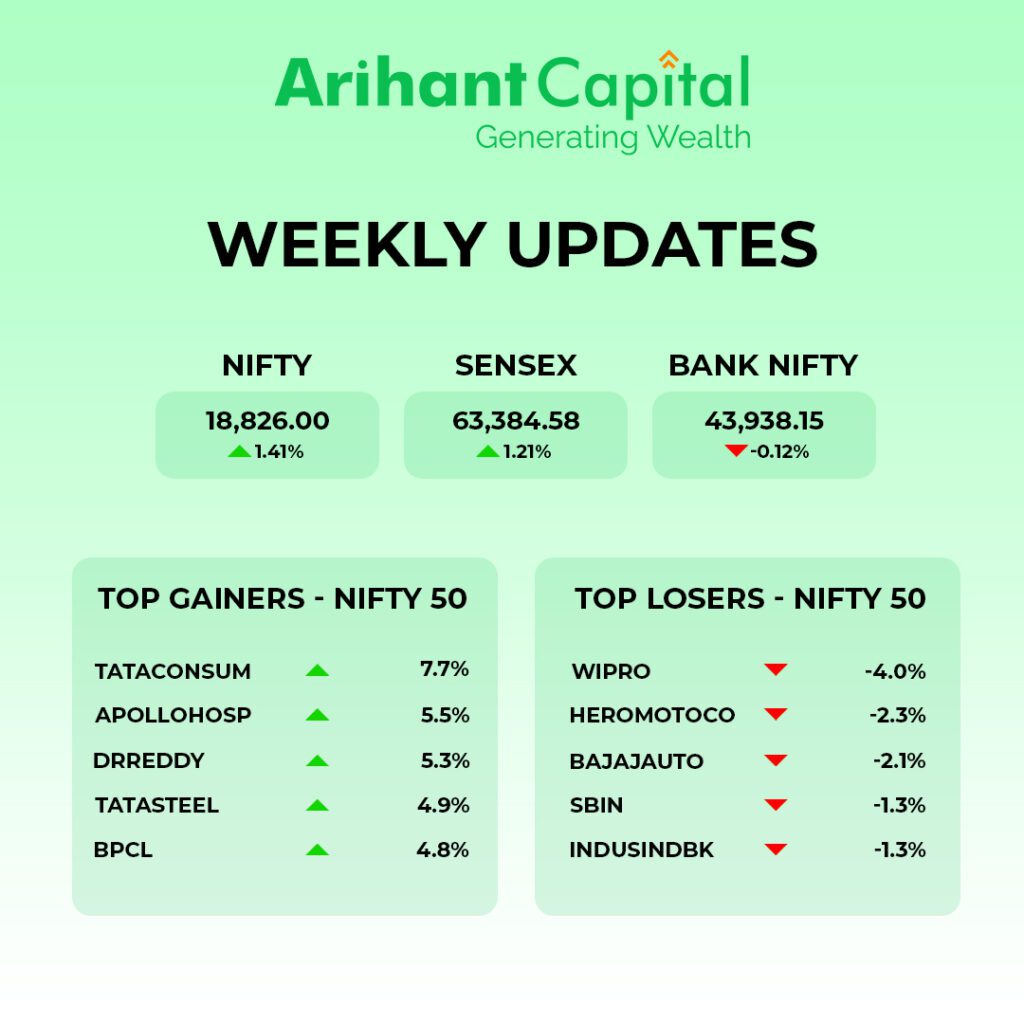

India’s stock market indexes reached an all-time high, marking a fourth straight week of gains. Banks and non-banking financial companies drove the surge. Global stocks were on track for their best week in over two months, boosted by optimism over Chinese stimulus measures and excitement surrounding artificial intelligence companies.

The Nifty index closed up 0.74% at 18,826, while the Sensex rose 0.74% to 63,385. The Nifty Bank index saw a notable increase of 1.14% to 43,938. These remarkable gains showcase the resilience and strength of the Indian market, instilling confidence among investors worldwide.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

Nifty

If we look at the daily chart of the Nifty, we observe prices taking support at the lower trend line and, on the weekly chart, taking support at short-term moving averages. If we analyse both charts, it indicates that the overall trend is still positive and stock-specific moves will continue, but at a higher level, use some caution.

If Nifty starts trading above the 18,950 level, then it can touch the 19050–19,200 level, while on the downside, support is 18,750, and if it starts to trade below, then it can test the levels of 18,650 and 18,500.

Bank Nifty

If we look at the daily chart of Bank Nifty, we are observing the breakdown of the channel and the weekly chart series of “narrow” range body formation. It indicates that Banknifty can take a pause here, and some profit booking may be seen.

In the coming week, if it trades above 44,150, then it can touch 44,350 and 44,500 levels. However, downside support comes at 43,850, and below that, we can see 43,600 and 43,450 levels.

📈 Stocks in News

- TVS Motor: Sold stake in Emerald Haven Realty for ₹166.83 cr.

- Paras Defense: Received ₹53 cr order from Ministry of Defence.

- NLC India: Launched subsidiary NLC India Renewables for green energy projects.

- Axis Bank: Bain Capital sold a 0.7% stake for ₹2,178 cr.

- BHEL: To manufacture 80 Vande Bharat sleeper trains with Titagarh Rail.

- CDSL: BSE sold 4.53% stake via a bulk deal.

- SJVN: Partnered with Mahagenco for 5,000 MW green energy projects in Maharashtra.

- Cochin Shipyard: Subsidiary received ₹580 cr order for cargo vessels.

- Maruti Suzuki: Planning to launch ‘Invicto’ – its costliest car yet.

- SBI: IRDAI approved SBI Mutual Fund to acquire up to 10% stake in ICICI Lombard General Insurance.

- HFCL: Bagged ₹81 cr order from Delhi Metro.

- KEC International: Secured ₹1,373 cr order across various businesses.

- Indian Oil: Targets ₹30,395 cr capital expenditure for FY 2024 – 13.7% lower than last year.

- Vedanta: Hindustan Zinc paid 1.7% royalty of annual revenue to Vedanta.

- Brightcom Group: SEBI imposed ₹40 lakh penalty for insider trading regulation violation.

- Indian Oil: Plans to set up 80,000 tonnes sustainable aviation fuel plant in Haryana.

- TVS Motors: Subsidiary acquired 25% stake in Swiss E-Mobility (Holding) AG.

- Cochin Shipyard: Bagged ₹300 cr order.

- Bank of India: Planning to raise up to ₹3,000 cr through bonds.

🍟Quick Bites

- India’s retail inflation stood at 4.25% in May, down from 4.70% in April.

- Loans given out through fintech companies rose 2.5 times year-on-year to ₹92,848 crore in FY 2022-23.

- Industrial production in India increased by 4.2% in April 2023.

- New business premium income of India’s life insurance companies fell by 4.1% in May 2023.

- China recorded its lowest number of marriages ever in 2022.

- Uber and Rapido bikes are no longer allowed in Delhi.

- The Ministry of Power extended the deadline for coal import by plants to Sept 30.

- UBS has completed its takeover of Credit Suisse.

- India and the UAE aim to increase non-oil trade from $48 billion to $100 billion by 2030.

- Toyota plans to launch high-performance solid-state batteries for electric vehicles.

- Chandrayaan-3 is scheduled for launch between July 12 and 19.

- India’s GDP has reached $3.75 trillion, as per the Finance Ministry.

- The last date to link Aadhar card with PAN card is June 30.

🏗️Corporate Actions 19th June – 24th June 2023

| Split | ||

| Company | Ratio | Ex-Date |

| AKI INDIA LTD | 1:5 | 22-Jun-2023 |

| Right | ||

| Company | Ratio | Ex-Date |

| VINTAGE COFFEE AND BEVERAGES LTD | 1:2 | 19-Jun-2023 |

| Bonus | ||

| Company | Ratio | Ex-Date |

| ASHIRWAD CAPITAL LTD | 1:2 | 19-Jun-2023 |

| BLUE STAR LTD | 1:1 | 20-Jun-2023 |

| GULSHAN POLYOLS LTD | 1:5 | 21-Jun-2023 |

| INDIAMART INTERMESH LTD | 1:1 | 21-Jun-2023 |

| Dividend | |||

| Company | Type of dividend | Dividend | Ex-Date |

| HINDUSTAN UNILEVER LTD. | Final Dividend | 22 | 19-Jun-23 |

| BANK OF INDIA | Dividend | 2 | 20-Jun-23 |

| CEAT LTD. | Final Dividend | 12 | 20-Jun-23 |

| TATA ELXSI LTD. | Dividend | 60.6 | 22-Jun-23 |

| TATA STEEL LTD | Final Dividend | 3.6 | 22-Jun-23 |

| PUNJAB NATIONAL BANK | Dividend | 0.65 | 23-Jun-23 |

| RAYMOND LTD | Final Dividend | 3 | 23-Jun-23 |

| TORRENT PHARMACEUTICALS LTD. | Final Dividend | 8 | 23-Jun-2 |

🔌Sustainability Corner

- Clean tech company Quantron & India’s Goldstone Technologies set up a JV called ‘ROQIT’ to build an innovative transaction platform with digital solutions to meet the needs of zero-emission fleets.

- Society of Manufacturers of Electric Vehicles petitions NITI Aayog to review FAME Policy; says subsidy blockade, claw-back notices & embargo on future sales are sabotaging the FAME 2 policy & claims mass-market e-scooters are losing out to premium e-bikes.

- ZF and Tevva develop four times more efficient regenerative braking system – ZF’s EBS integrated with Tevva trucks 7.5t electric truck’s regenerative braking system helps recuperate up to 4x more energy than a traditional air brake system & optimises range.

- Toyota accelerates the development of solid-state batteries following a “technological breakthrough”; plans to roll out solid-state EV in 2027 with a near-1,200km range

- British firm Nyobolt unveils breakthrough battery technology – an advanced new EV battery that charges in a scant six minutes and delivers a 250km range

- JLR leverages Tata Group synergies – Agratas Energy Storage Solutions to supply battery packs of up to 120kWh capacity that will give future Jaguar & Land Rover EVs a range of up to 720km; also enable rapid charging to add an extra 320km of range in 15 minutes.

- Exide Industries receives orders of INR 600 crore to INR 700 cr for its lithium-ion modules and packs to be executed in the next 12 to 15 months.

- Mahindra Last Mile Mobility, which has clocked cumulative sales of over 100,000 e-three-wheelers, expands its e3W market share to 14.6% in FY2023 with sales of 36,816 EVs. The Zor Grand, for last-mile cargo delivery operations, gives sales a new charge.

- Ford opens Cologne EV Centre, its first carbon-neutral assembly plant; first set up in 1930, the facility now has a brand-new production line, battery assembly & state-of-the-art tooling and automation, enabling annual production of over 250,000 EVs.

- EV maker BYD launches its fifth sub-brand Fangchengbao whose vehicle line-up ranges from off-road vehicles to sports cars; an early model, codenamed SF Hardcore SUV, will be released later this year.

- Volvo’s new EX30 is its smallest SUV with the lowest C02 footprint & with 0-100kph in 3.6sec, also its fastest accelerating – enters the fast-growing segment of small electric SUVs; priced at 36,000 euros, the EX30 aims to attract new & younger customers

- EV sales in India surpassed 150,000 units for the first time in May.

- Electric 2W retails hit a record 104,750 units in May before slashed FAME 1.97 million EVs sold in the past 29 months.

- Toyota is to expand EV development capability with a new battery lab in the US – to open in 2025, the lab will evaluate & support the development of EV batteries, from the cell through the pack; the facility to support Toyota manufacturing at plants in North Carolina & Kentucky.

- Musashi enters India to invest INR 70 cr in phase 1. The Japanese auto parts manufacturer intends to manufacture a new electric vehicle unit comprising a motor, power control unit, and gearbox.

- The Ministry of Heavy Industries’ latest decision to cut down FAME II subsidies is likely to disrupt India’s growth in the EV sector and consequently have a detrimental impact on the environmental and health indices of the country.

📚🍬Knowledge Candy: MRF’s Rise to the Six-Figure Mar 🚀

MRF’s shares hit the magical six-figure mark, making it the first Indian company to achieve this feat 🎉. While we won’t debate if the stock is expensive or cheap, let’s explore why MRF stands out. Unlike many companies, MRF hasn’t indulged in stock splits, where shares are divided to make them appear cheaper.

Maybe it’s sentiment? Warren Buffett never split the stock of Berkshire Hathaway, as its price held sentimental value tied to his life milestones. Similarly, MRF, founded in 1946 and is now run by the third generation, including MD Rahul Mammen, could have a sentimental attachment to the stock 📈.

Or is it vanity? Sanjay Bakshi compared MRF’s high stock price to a peacock’s tail, signalling high quality to investors who believe pushing an already “high-priced” stock higher takes effort and time. This may attract discerning investors while deterring others.

We don’t know the real reason, but it’s intriguing to think about why MRF didn’t split its shares. Either way, it’s quite an achievement! 🎊

📬Also Read: Sustainable Investing in India: ESG Investments