Mindtree Q1FY23 Results show strong roots

Mindtree Q1 FY 23 results are out! Check out the detailed analysis here.

Mindtree [NSE: MINDTREE], an Indian multinational IT services and consulting company announced its. Mindtree is a part of the engineering, technology & construction giant L&T. The Bengaluru-headquartered company posted a strong set of numbers above Arihant’s estimates.

The Mindtree Q1 FY 23 result highlights

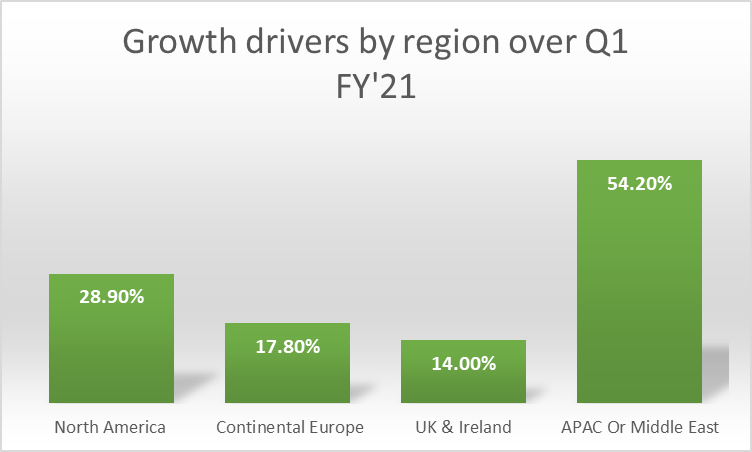

Mindtree reported revenue of $399.3 million, a 5.5% increase over the previous quarter in constant currency terms and a +4.0% increase in USD terms. The revenue grew 28.6% over the same quarter in the previous year.

Hits

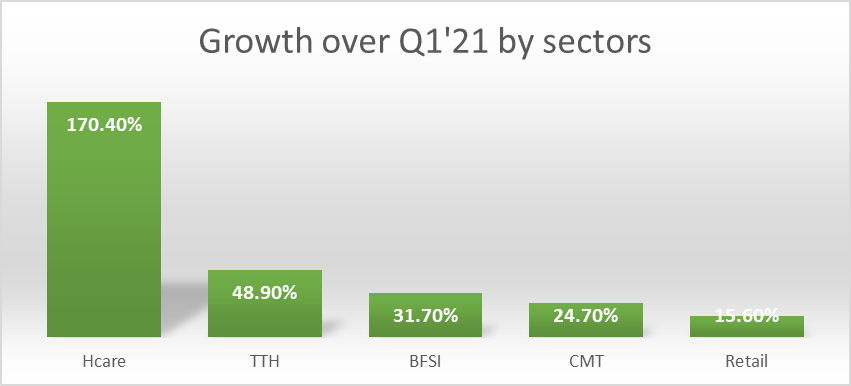

😊Reported revenue stood at ₹3,121 crores up 8% over the previous quarter and 36% over Q1 FY 21.

😊The growth was broad-based led by strong performance in Healthcare and TTH, while the retail sector declined from the previous quarter due to ramping down of clients owing to the rebalancing of projects in Russia and China which was impacted.

😊MindTree beat our estimate on the Margin front: EBITDA margin was up 9bps QoQ/82 bps YoY at 21.1% against our estimates of 20.0%. The reported EBITDA was impacted by visa norms (to the tune of 50 bps) and merger-related expenses (to the tune of 60 bps). On the plus side, the company worked on improving operational efficiency (50 bps) and got forex benefits (70 bps) due to the fall in Rupee.

😐 PAT is in-line with the estimates The company’s consolidated PAT stood at ₹471.6 crores, flat sequentially and up 37% YoY against our estimate of ₹472.3 crores.

😊The company continued work on its offshore and nearshore delivery footprint. It is working on setting up full-fledged offices in Coimbatore, Noida and satellite offices in Bangalore.

😊 The company is showcasing a strong deal win momentum with an order book of $570mn vs $504 mn in Q1FY22. This is a growth of 13.1% YoY due to strong demand, aggressive customer mining, and end-to-end digital transformation capabilities. This reflects the relevance of the company’s value proposition in delivering business-critical transformation at scale. The overall demand environment remains strong with certain pockets of softness related to few clients.

Misses

🙁 The company saw its headcount breach 37K with gross addition of 4,700 in Q1FY23) due to high trailing-12-months attrition of 24.5% vs 23.8% in Q4FY22. The attrition may take some more quarters to stabilize.

Valuation and Outlook

Mindtree has reported strong performance during Q1FY23 mainly driven by the company’s better service line and better execution. We believe that it will maintain growth momentum going forward due to a robust pipeline and a strong demand environment. It has booked the highest ever TCV of $570mn in the quarter( up 13.1% YoY). The company remains confident of delivering an EBITDA margin of >20% despite the ongoing supply-side challenges. This is due to better margins in new deals. After the steep correction in the IT sector, valuations are attractive. We value Mindtree at a PE of 25x to its FY24E EPS of ₹138.4. This yields a revised target price of ₹3,461 per share (our previous target price was ₹4,153). We upgrade our rating to Accumulate from Neutral earlier.