Protean eGov Technologies IPO is live. Should you Invest?

In this article

- IPO details

- Issue details

- Offer Breakup

- IPO Strengths

- Key Risks

- Protean eGov Technologies Financials

📃About Protean eGov Technologies

Incorporated in December 1995, Protean eGov Technologies Limited was previously known as NSDL e-Governance Infrastructure Limited. The company is engaged in the business of developing citizen-centric and population-scale e-governance solutions for more than 2 decades.

Protean eGov Technologies has played a vital role in developing national infrastructure for capital market development in India. The company has developed & implemented some of the most crucial technological infrastructure in India.

Since December 2022, the company has implemented and managed 19 projects spread across several ministries.

The company’s vital role in developing digital infrastructural solutions has led to the achievement of multiple milestones. Key amongst them are

- Mordernizing direct tax infrastructure through the introduction of projects like PAN issuance.

- The company has enabled the universal social security system for all Indians, in particular for workers in the unorganized sector, by creating technology infrastructure as a CRA for the Atal Pension Yojana.

- The company has also been instrumental in improving accessibility to education and skill financing through the development of efficient digital marketplaces. This has led to the discovery of financial resources through platforms such as Vidya Lakshmi and Vidyasaarathi.

- The company has contributed to and supported open digital building blocks such as Open Network for Digital Commerce (ONDC) for use cases across sectors like e-commerce, mobility, healthcare, agriculture, and education. It is worth mentioning that Protean eGov Technologies Limited is one of the key and early contributors to the open-source community and protocols that power ONDC.

💰Issue Details of Protean eGov Technologies

- IPO open from 06th Nov 2023 – 08th Nov 2023

- Face value: ₹10 per equity share

- Price band: ₹752 to ₹792 per share

- Market lot: 18 shares

- Minimum Investment: ₹14,256

- Listing on: BSE and NSE

- Offer for sale: Approx ₹490.33 Cr (OFS aggregating up to: ₹490.33 Cr)

- Registrar: Link Intime India Private Ltd

🪙Total Issue Price

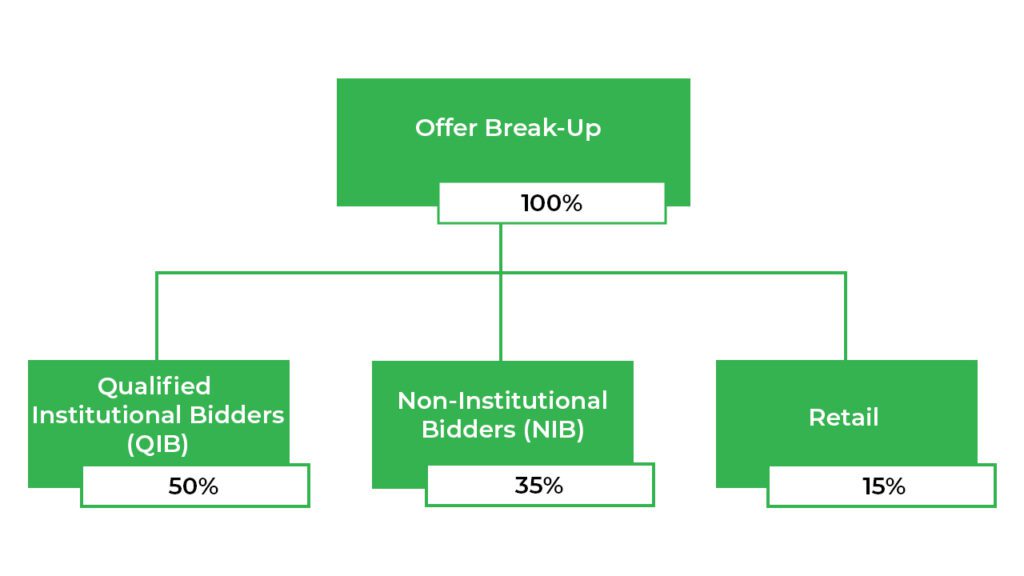

🪚Offer Breakup

🔭IPO Object

The company will not receive any proceeds from the Offer and all the Offer Proceeds will be received by the Selling Shareholders, in proportion to the Offered Shares sold by the respective Selling Shareholders as part of the Offer.

⛓️IPO Strength

Some of the qualitative factors and strengths that form the basis for computing the Offer Price are:

- Pioneer and market leader in universal, citizen-centric and population-scale e-governance solutions.

- Secure, scalable and advanced technology infrastructure.

- Large physical infrastructure with pan-India network and scale resulting in inclusion

- Diversified, granular and annuity-based service offerings

- Track record of healthy financial performance

🧨IPO Risk

- They are dependent on and derive a substantial portion of their revenue from government entities and agencies and their relationship with GoI entities exposes them to risks inherent in doing business with them, which may adversely affect their business, results of operations and financial condition.

- Their reputation could be at risk and they may be liable to their clients or to regulators for damages caused by inadvertent disclosure of confidential information and sensitive data.

- They rely on telecommunications and information technology systems, networks and third-party infrastructure to operate their business and any interruption or breakdown in such systems, networks or infrastructure of the third parties they rely could adversely affect their business.

- If their pricing structures do not accurately anticipate the cost, complexity and duration of their work, then their contracts could be unprofitable.

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-21 | ₹862.39 | ₹652.03 | ₹92.19 |

| 31-Mar-22 | ₹988.14 | ₹770.18 | ₹143.94 |

| 31-Mar-23 | ₹1104.10 | ₹783.87 | ₹107.04 |

PEER COMPANIES

- N.A.

📬Also Read: A Simple Guide: Opening a Demat Account for Minors in Bharat