Sai Silks (Kalamandir) Limited IPO is live. Should you Invest?

In this article

- IPO details

- Issue details

- Offer Breakup

- IPO Strengths

- Key Risks

- Sai Silks (Kalamandir) Limited Financials

📃About Sai Silks (Kalamandir) Limited

Incorporated in 2005, Sai Silks (Kalamandir) Limited provides ethnic apparel and value-fashion products.

Inspired by India’s vibrant culture, traditions, and heritage, the company offers a diverse range of products, which includes various types of ultra-premium and premium sarees suitable for weddings, party wear, occasional and daily wear, lehengas, men’s ethnic wear, children’s ethnic wear and value fashion products comprising fusion wear and western wear for women, men and children.

Sai Silks has four different format stores:

- Kalamandir: Here, it offers contemporary ethnic fashion for the middle income; this includes varieties of sarees, such as Tusser, Silk, Kota, Kora, Khadi, Georgette, Cotton, and Matka.

- VaraMahalakshmi Silks: Here, it offers premium ethnic silk sarees and handlooms targeting wedding and occasional wear, such as Banarasi, Patola, Kota, Kanchipuram, Paithani, and Organza, Kuppadam, with a focus on handlooms such as Kacheepuram silk sarees.

- Mandir: Here, it offers ultra-premium designer sarees targeting high net worth individuals, such as designer sarees such as Banarasi, Patola, Ikat, Kanchipuram, Paithani, Organza, and Kuppadam.

- KLM Fashion Mall: Here, it offers value fashion at affordable prices, such as fusion wear, sarees for daily wear, and western wear for women, men, and children.

The company also offers its products through e-commerce channels, which comprises its website sskl.co.in and other online e-commerce marketplaces.

As of July 31, 2023, the company has over 54 stores in four south Indian states, namely Andhra Pradesh, Telangana, Karnataka, and Tamil Nadu, with an aggregate area of approximately 603,414 square feet. The company recorded Rs. 13,514.69 million, Rs. 11,293.23 million, and Rs. 6,772.48 million in revenue from operations in the fiscal 2023, 2022, and 2021, respectively.

💰Issue Details of Sai Silks (Kalamandir) Limited

- IPO open from 20th Sep 2023 – 22nd Sep 2023

- Face value: ₹2 per equity share

- Price band: ₹210 to ₹222 per share

- Market lot: 67 shares

- Minimum Investment: ₹14,874

- Listing on: BSE and NSE

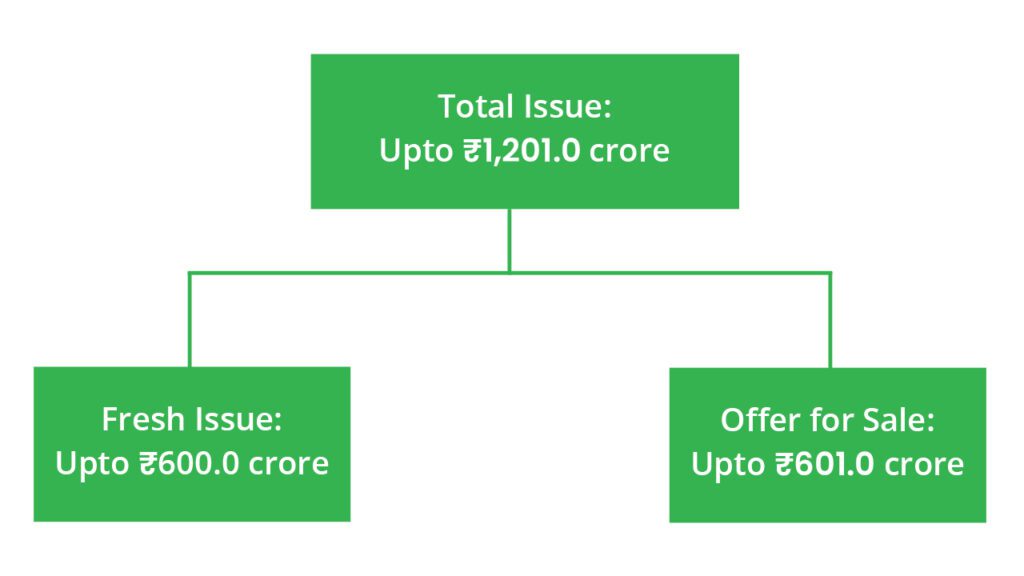

- Offer for sale: Approx ₹1201 Cr (Fresh Issue: ₹600 Cr + OFS ₹601 Cr)

- Registrar: Bigshare Services Pvt Ltd

🪙Total Issue Price

🪚Offer Breakup

🔭IPO Object

The company intends to utilise the net proceeds from the issue towards the funding of the following objects:

- Funding capital expenditure towards setting up 25 new stores.

- Funding capital expenditure towards setting up of two warehouses.

- Funding the working capital requirements of the company.

- Repayment or pre-payment, in whole or part, of certain borrowings availed by the company.

- General corporate purposes.

⛓️IPO Strength

Some of the qualitative factors and strengths that form the basis for computing the Offer Price are:

- Among the leading ethnic and value-fashion retail companies in south India, having a portfolio of established formats with a focused sales and marketing strategy.

- Leading ethnic wear retail brand in India with a scalable model, which is well positioned to leverage growth in the ethnic and value-fashion apparel industry in India.

- Strong presence in offline and online marketplace with an omni-channel network.

- Track record of growth, profitability and unit economics with an efficient operating model.

- Experienced Promoter, management and in-house teams with proven execution capabilities.

🧨IPO Risk

- Their business is highly concentrated on the sale of women’s sarees. It is vulnerable to variations in demand, and changes in consumer preference could hurt their business, operations, and financial condition.

- An inability to effectively market their products, or any deterioration in public perception of their brands, could affect customer footfall and consequently adversely impact their business, financial condition, cash flows and results of operations.

- The current locations of their stores may become unattractive, and suitable new sites may not be available for a reasonable price or acceptable terms. In addition, they are exposed to risks associated with leasing real estate, and any adverse developments could materially affect their business, results of operations and financial condition.

- They generate substantially all of their sales from stores in Southern India, and any adverse developments affecting their operations in these regions could hurt their revenue and results.

- If they cannot maintain an optimal inventory level, their business, results of operations and financial condition may be adversely affected.

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-21 | ₹665.42 | ₹679.10 | ₹5.13 |

| 31-Mar-22 | ₹842.49 | ₹1133.02 | ₹57.69 |

| 31-Mar-23 | ₹1220.45 | ₹1358.92 | ₹97.59 |

PEER COMPANIES

- Vedant Fashions Limited

- TCNS Clothing Co. Limited

- Go Fashion (India) Limited

- Aditya Birla Fashion and Retail Limited

- Shoppers Stop Limited

- Trent Limited

📬Also Read: A Simple Guide: Opening a Demat Account for Minors in Bharat