Investors’ Delight: PSU Banks on the Rise | Stock Market Weekly Update Sep 16

Hello Readers!

Throughout September, the Nifty Bank index has showcased an impressive growth of over 10%, surpassing the performance of the benchmark NIFTY50 index, which saw a 4.2% increase during the same period. Let’s explore the primary factors contributing to this resurgence.

PSU bank stocks are gaining substantial momentum due to a surge in credit growth across various sectors. Recent data from the RBI reveals a remarkable 14.8% growth in bank credit in July 2023. Concurrently, retail loans witnessed an impressive growth of 18.4%, fueled mainly by higher demands for housing and vehicle loans. This growth has persevered despite rising interest rates amidst a tightening monetary policy.

Industry experts are optimistic about the continued elevation of credit growth in the ongoing fiscal year, bolstered by optimistic forecasts for the nation’s economic expansion. Last week, the global rating agency Moody’s revised India’s economic growth forecast for 2023 to 6.7%.

Adding to this positive outlook, the State Bank of India (SBI), the largest public sector bank in the country, has set an ambitious target of 15% credit growth for FY24. The bank reported a credit growth of 13.9% in the April-June period. Concurrently, credit offtake increased by over 16% across public sector banks.

Moreover, the combined net profit of 12 PSU banks surged significantly by over 68% YoY to ₹73,393 crore during the first quarter of FY24. This surge was accompanied by a substantial reduction of 23.8% YoY in gross NPAs, totaling ₹4.05 lakh crore. These robust operational metrics are compelling reasons for investors to focus on PSU bank stocks.

🧾In this Article

– Mr Abhishek Jain, Head of Research, Arihant Capital

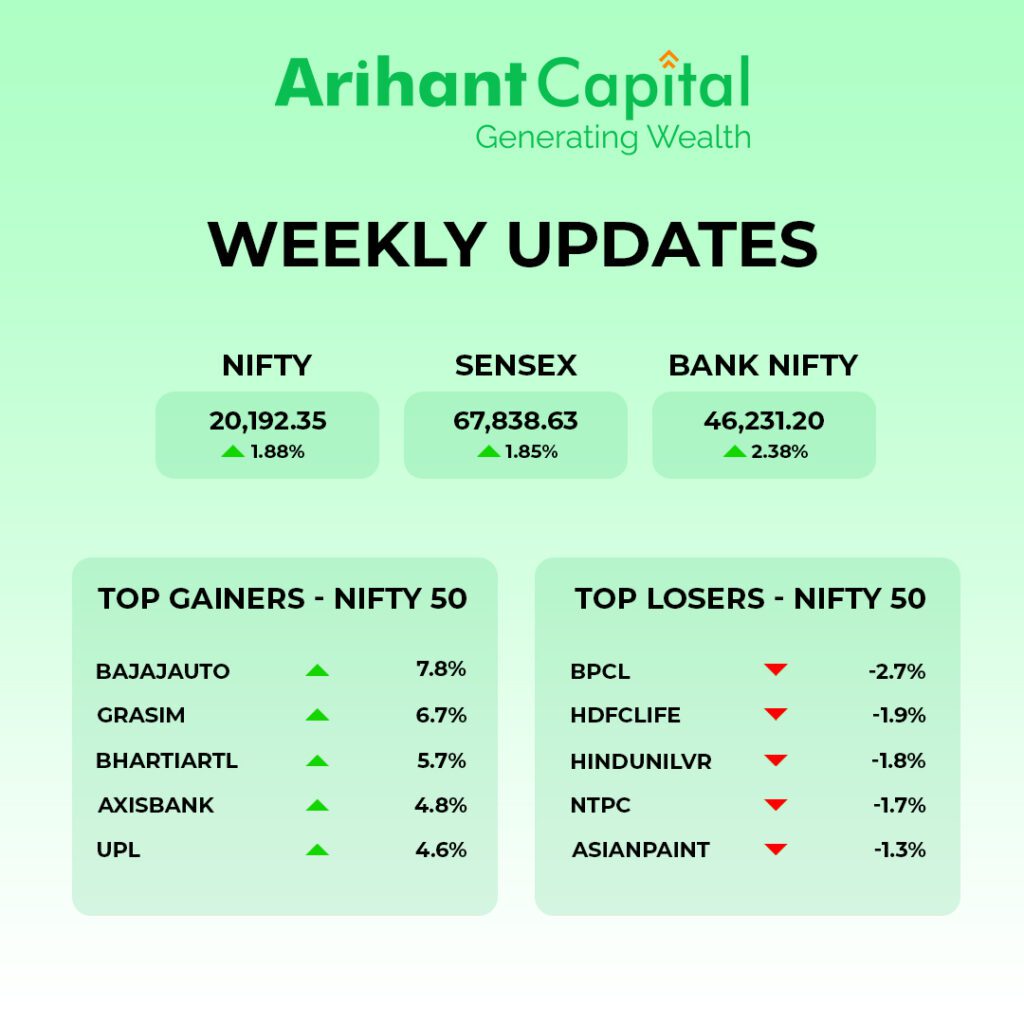

India’s benchmark stock indices reached new all-time highs, closing at unprecedented levels. The Nifty index continued its upward trend for the third consecutive session, while the Sensex index recorded its 11th straight day of gains, marking its longest winning streak since October 2007. Nifty ended up by 0.44% at 20,192 level. Sensex was up 0.47% at 67,839, and Nifty Bank was up 0.50% at 46,231.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

Nifty

If we look at the daily chart of Nifty, we observe a “Higher high” formation, and on the weekly chart, we observe prices taking support at the lower trend line. Analysing both chart patterns indicates that, once again, we can adopt the “Buy on Dips” approach. If Nifty starts trading above the 20,250 level, then it can touch the 20,450-20,650 level, while on the downside, support is 20,050, and if it starts to trade below, then it can test the levels 19,850 and 19,700.

Bank Nifty

If we look at the daily chart of Bank-Nifty, it also makes a “Higher High” formation on the weekly chart prices, taking support at short-term moving averages. Bank-nifty starts trades above 46,350, then can touch 46,650 and 46,800 levels. However, downside support comes at 45,900; below that, we can see 45,750 and 45,600 levels.

🔎Stocks in News

🏦 Bajaj Holdings: Approved an interim dividend of Rs 110 per share.

🏨 Lemon Tree Hotels: Signed a license agreement for 2 properties in Gujarat and Nepal.

💊 Zydus Lifesciences: Received final approval from US authorities to market a generic medication to prevent pregnancy.

🍔 Restaurants Brands Asia: QSR Asia Pte sold a 25.4% stake in the company through a block deal.

🚌 Ashok Leyland: Will invest Rs 200 cr to set up a greenfield bus plant in UP.

🏗️ Tata Steel: Signed an agreement with the UK government to invest in Electric Arc Furnace steelmaking at the Port Talbot site.

🌐 Tata Group: The combined market capitalisation of Tata Group companies crossed Rs 25 lakh crore.

🏢 NBCC India: Will assist in monetising non-core assets of Rashtriya Ispat Nigam at Visakhapatnam.

🏞️ Bombay Dyeing: Will sell 22 acres of land to Goisu Realty Pvt for Rs 5,200 cr.

💉 Bajaj Healthcare: Received an Establishment Inspection Report from US authorities for its plant in Savli, Gujarat.

🚄 Rail Vikas Nigam: Was the lowest bidder for a Rs 245 cr order from Western Railways.

⚡ GMR Power: Subsidiary GMR Smart Electricity Distribution Pvt won a project worth nearly Rs 2,470 cr in UP.

🏗️ KEC International: Got new orders worth Rs 1,012 cr.

💡 Tata Power: Tata Power Solar Systems signed an MoU with SIDBI to offer financing options for MSMEs.

💊 Suven Pharma: The Government has approved foreign investment of up to Rs 9,589 cr in the company by Cyprus-based Berhyanda Ltd.

📰 Quick Bites

🛫 Domestic Air Passenger Traffic: Rose 23% to 1.24 cr in August, as reported by ICRA.

🏦 RBI Directive: Orders banks to return all property papers within 30 days of loan repayment, with a penalty of ₹5000/day for non-compliance.

⚖️ eCourts Project Phase III: The Indian government approves an allocation of ₹7,210 cr, aiming to develop online and paperless court systems.

📊 Retail Inflation: Stood at 6.83% in August, down from 7.4% in July.

🏭 Industrial Output: Grew by 5.7% in July, up from 3.7% in June.

🛢️ Anti-Dumping Duty: The Finance Ministry imposes on certain Chinese steel imports for 5 years.

📉 Wholesale Inflation: Registered at -0.52% (prices fell) in August, remaining negative for the 5th consecutive month.

✈️ Air Traffic Report: India’s air traffic rose by 22.8% month-on-month to 1.24 cr passengers in August, with market shares as follows – IndiGo: 63.3%, Air India: 9.8%, Vistara: 9.8%, SpiceJet: 4.4%, Akasa: 4.2%, Air Asia: 7.1%.

🌏 India-Middle East-Europe Economic Corridor: Launched at the ongoing G20 summit.

💼 EMS IPO: Subscribed by over 15.03 times, retail investors subscribing 16.59 times. The IPO remains open till 12 Sept.

Ratnaveer IPO: Listed on the markets today and closed at 134.4 on NSE, over 37% above the IPO price.

📈 Rishabh Instruments IPO: Also listed today, closing at ₹443.15 on NSE, which is only 0.5% above the IPO price.

💱 Digital Rupee: RBI looks to introduce the wholesale version in interbank borrowing within a month.

💰 Mutual Fund Investments: Equity mutual funds saw a total of ₹20,245 cr being invested in them in August. Debt mutual funds saw a withdrawal of ₹25,873 cr.

📉 Alibaba’s Shares: Over 3% down as the CEO leaves the company.

🌱 Sustainability Corner:

🚗 Mahindra & Mahindra: Adopts Volkswagen’s APP550 electric motor (210kW / 286hp & 550Nm of torque) to power M&M’s range of BE EVs and Thar.e. Volkswagen may explore localizing the e-motor in India with good combined volumes.

🔋 Stellantis Technology: Shrinking and reducing the cost of electric car batteries through the Intelligent Battery Integrated System (IBIS) project, using package-friendly microinverters to reverse current and eliminate the need for an onboard charger.

🚌 Ashok Leyland: Setting up a bus manufacturing plant in Uttar Pradesh, focusing on electric bus production and assembly of vehicles powered by current fuels & emerging alternative fuels.

🛵 Greaves Electric Mobility: Launches new Eltra cargo three-wheeler with a 100km range, targeting last-mile delivery service providers.

🔧 NBC Bearings: Develops low-noise bearings for EV applications, including motors and wheel hubs. Begins supplies to leading e2W- & 3W OEMs in India and is preparing e-axle & e-axle bearings for electric car-SUV & CV manufacturers.

🚚 Volvo Trucks: Expands its electric truck manufacturing footprint with a fourth plant in Ghent, Belgium, to build 3 models – FH, FM & FMX Electric. Receives orders, including letters of intent to buy, for around 6,000 electric trucks in 42 countries.

🚘 Tata Motors: Aiming for 20% of revenues to come from EVs in FY2024. The recently launched Nexon. EV, along with Punch, Harrier & Curvv EVs, will help the company expand its addressable customer base.

🏍️ FADA India: The President requests the government to reduce GST to 18% from the current 28% for entry-level two-wheelers, constituting about 75% of total volume sales in the country.

🛠️ Tesla: To source US$1.7 to 1.9 billion worth of automotive components from India in 2023, says Piyush Goyal, Union Minister for Commerce & Industry, at ACMA Convention. Anticipates a rise in demand for EVs driving growth in component manufacturing & exports.

Happy reading!

Also Read: How to Trade Above Freeze Quantity in Options on Arihant Plus?