Yatra Online Limited IPO is live. Should you Invest?

In this article

📃About Yatra Online Limited

Incorporated in 2005, Yatra Online Limited provides information, pricing, availability, and booking facilities for domestic and international customers.

The company provides domestic and international air ticketing on Indian and international airlines, as well as bus ticketing, rail ticketing, cab bookings, and ancillary services within India, hotels, homestays, and other accommodations bookings, with about 105,600 hotels in 1,490 cities and towns in India, as on Fiscal 2023 and more than two million hotels globally through its website yatra.com, mobile applications, corporate SaaS platform, and other associated platforms.

Yatra Online has over 94,000 hotels and homestays contracted in approximately 1,400 cities across India and more than 2 million hotels worldwide. The company is India’s largest platform for domestic hotels. Yatra Online recently launched a freight forwarding business called Yatra Freight to further expand its corporate service offerings.

The company’s clientele includes both B2B and B2C customers, this enables the company to target India’s most frequent and high-spending travellers, namely, educated urban consumers. As of fiscal 2023, the company has over 813 corporate customers and over 49,800 registered SME customers and is the third largest consumer online travel company (OTC) in the country in terms of gross booking revenue as well as has the largest number of hotel and accommodation tie-ups amongst key domestic OTA players of over 2,105,600 tie-ups.

💰Issue Details of Yatra Online Limited

- IPO open from 15th Sep 2023 – 20th Sep 2023

- Face value: ₹1 per equity share

- Price band: ₹135 to ₹142 per share

- Market lot: 105 shares

- Minimum Investment: ₹14,910

- Listing on: BSE and NSE

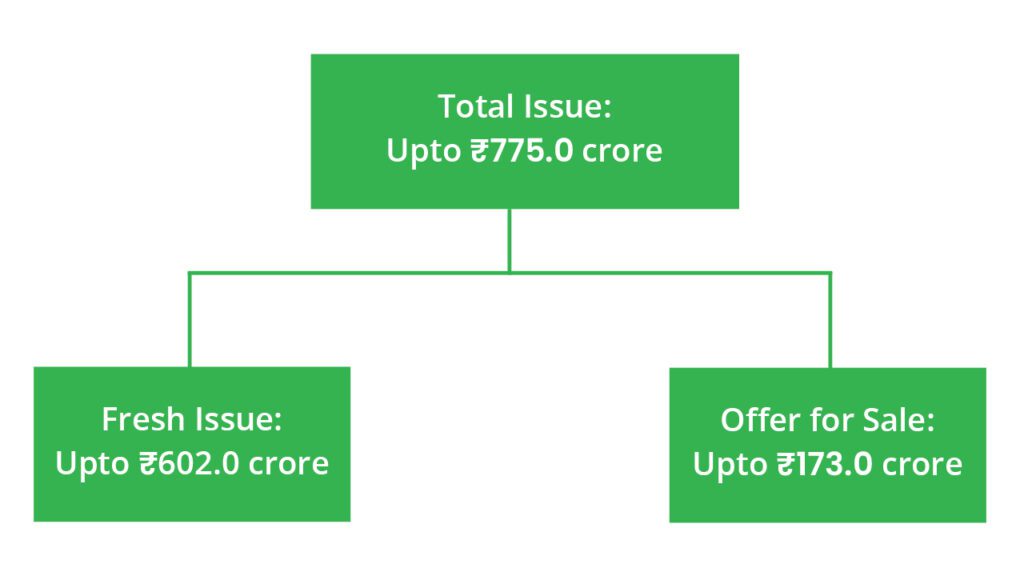

- Offer for sale: Approx ₹775 Cr (Fresh Issue: ₹602 Cr + OFS ₹173 Cr)

- Registrar: Link Intime India Private Ltd

🪙Total Issue Price

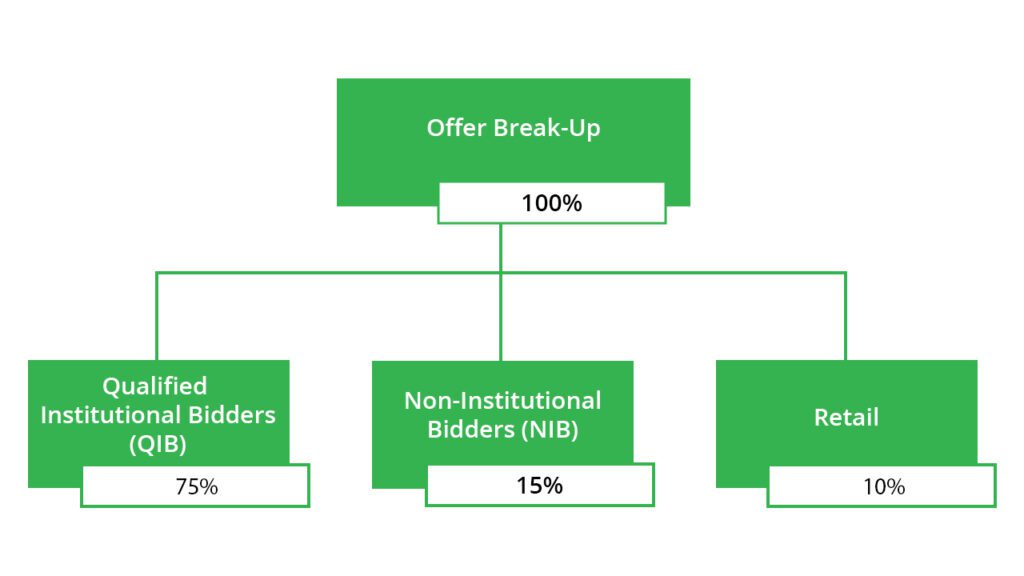

🪚Offer Breakup

🔭IPO Object

The company intends to utilise the net proceeds from the issue towards the funding of the following objects:

- Strategic investments, acquisitions, and inorganic growth,

- Investment in customer acquisition and retention, technology, and other organic growth initiatives, and

- General corporate purposes.

⛓️IPO Strength

Some of the qualitative factors and strengths that form the basis for computing the Offer Price are:

- Trusted brand with a proven track record and targeted marketing strategy.

- Synergistic Multi-Channel Platform for Business and Leisure Travelers.

- Comprehensive Selection of Service and Product Offerings.

- Large and Loyal Customer Base and Largest inventory of Domestic Hotels

- Integrated Technology Platform.

- Experienced management team with an established track record.

🧨IPO Risk

- Their business depends on their relationships with a broad range of travel suppliers, and any adverse changes in these relationships, or their inability to enter into new relationships, could negatively affect their business, cash flows, and results of operations.

- The COVID-19 pandemic has had and is expected to continue to have, a material adverse impact on the travel industry and its business, financial performance and liquidity position.

- They depend on their airline ticketing business, which generates a significant percentage of their revenues and is derived from a small number of airline suppliers in India.

- They rely on third-party systems and service providers, and any disruption or adverse change in their business may have a material adverse effect on their business.

- They are exposed to risks associated with Indian businesses, particularly those in the Indian travel industry, including bankruptcies, restructurings, consolidations and alliances of its partners, the creditworthiness of these partners, and the possible obligation to make payments to their partners.

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-21 | ₹562.91 | ₹143.62 | –₹118.86 |

| 31-Mar-22 | ₹547.78 | ₹218.81 | -₹30.79 |

| 31-Mar-23 | ₹681.25 | ₹397.47 | ₹7.63 |

PEER COMPANIES

- Easy Trip Planners Limited

📬Also Read: A Simple Guide: Opening a Demat Account for Minors in Bharat