Should you Invest in Tamilnad Mercantile Bank Limited IPO?

Tamilnad Mercantile Bank Limited IPO is live now. Should you apply? Find out here.

In this article

About Tamilnad Mercantile Bank

Incorporated in 1921, Tamilnad Mercantile Bank (TMB) is one of the oldest and leading private sector banks in India. It offers an array of banking and financial services to retail customers, micro, small, and medium enterprises (MSMEs), and more. TMB has a strong portfolio of advances and deposits from a diversified customer base including retail customers, agricultural customers, and MSMEs.

As of March 31, 2022, the bank has a strong branch network of 509 branches and a total customer base of 5.08 million. TMB has a significant market presence in the state of Tamil Nadu with 369 branches which constitutes ~75% of its total business.

The bank has presence across 16 states and 4 UTs. As of Mar’22, it has served 5.08 million customers of which, ~79.8% of customers have been associated with the bank for a period of >5 years. Bank has well diversified portfolio with focused into RAM (Retail, Agri and MSME) segment which constitutes ~87% of the total advances. It has Advances book of ₹33,748 cr, with deposits base of ₹44,933 cr as on FY22.

The bank has a network of 509 branches and 1,141 ATMs. Out of these 509

branches, 76 branches are in metro, 80 branches are in urban, 247 branches

are in semi-urban and 106 are in rural areas

To comply with RBI norms, bank is coming out with an IPO of ₹832 crores (all via

fresh issue of equity shares), as RBI has restricted the bank from opening

new branches.

💰Issue Details of Tamilnad Mercantile Bank IPO

- IPO open from Sep 05th – Sep 07th 2022

- Face value: ₹10

- Price band: ₹500-₹525

- Market lot: 28 shares

- Minimum investment: ₹14,700

- Listing on: BSE and NSE

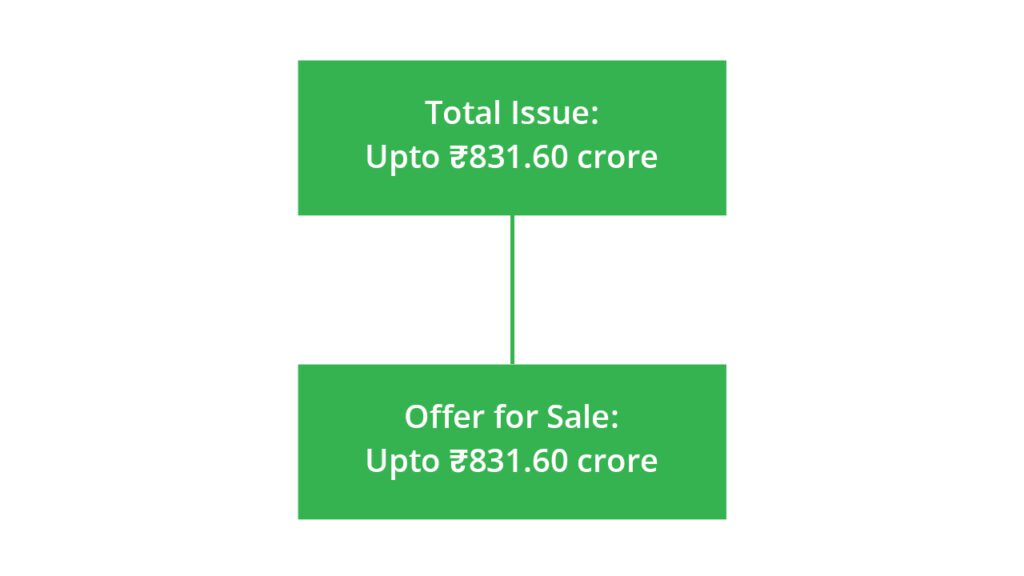

- Offer for sale: up to ₹831.60 crores

- Registrar: Link Intime India Private Ltd

What is an IPO and should you invest in them?

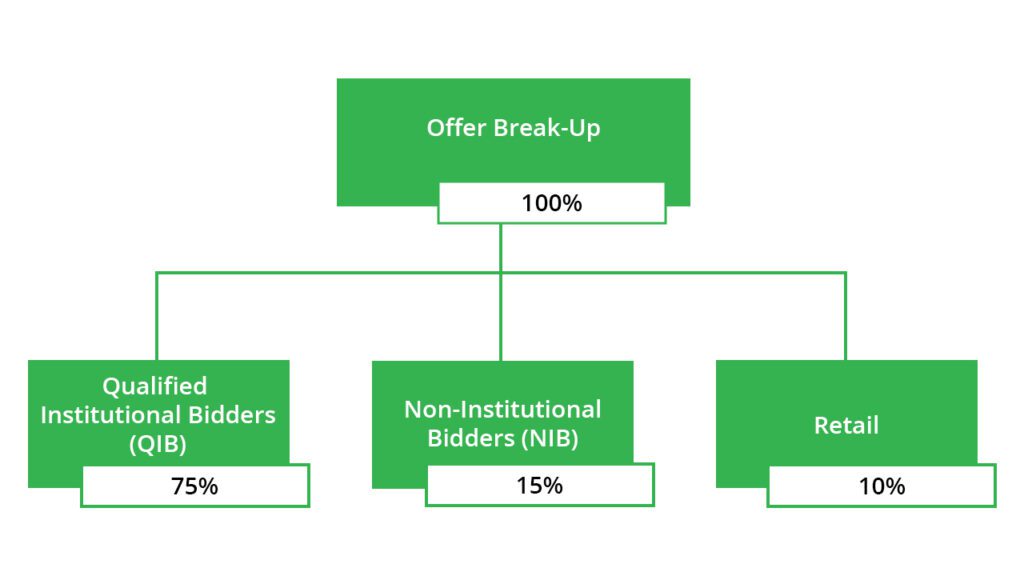

✂️Offer Breakup

The offer is broken up into the following investor classes:

🏷️IPO Object

The net proceeds from the issue will be utilized for the following purposes;

- To augment tier- I capital base to meet future capital requirements.

- Meet offer issue expenses.

- To receive the benefits of listing the shares on the stock exchanges.

📊IPO Timeline

| IPO open date | Sep 05th 22 | Initiation of refunds | Sep 13th 22 |

| IPO close date | Sep 07th 22 | The credit of shares to the Demat account | Sep 14th 22 |

| Basis of allotment date | Sep 12th 22 | IPO listing date | Sep 15th 22 |

🔭IPO Strengths

- Long-term track record with almost 100 years of history.

- Strong presence in Tamil Nadu and consistent focus to expand presence in strategic regions.

- Diversified and loyal customer base i.e., retail, MSMEs, and agricultural.

- Consistently growing customer deposit base with a focus on low-cost retail CASA.

- Proven financial performance track record: NII of the bank increased by 18% YoY to ₹1,815 crores during FY22, driven by 8% growth in net advances and 33bps expansion in NIM at 4.1%. NIM expansion was largely due to 59bps decline in cost of deposits at 4.9%. Yield on advances during FY22 declined by 20bps YoY at 9.5%. Cost to income ratio of the bank reduced from 46.1% in FY20 to 42.1% in FY22. PAT of the bank increased by 42% CAGR from ₹408 crores in FY20 to ₹822 crores in FY22.

- Asset quality improved; credit cost stood lower: GNPA/NNPA ratio of the bank declined from 3.4%/2% in FY21 to 1.7%/1% in FY22. Credit cost declined from 1.5% in FY20 to 0.6% in FY22 and it is expected to remain <1% in FY23

- A focused RAM segment player: TMB’s portfolio primarily consists of RAM segment which together constitutes ~87% of the advances, with Retail at ~20%, Agri at ~30% and MSME at ~37%. The share of RAM segment has increased from 76% in FY19 to 87% as on FY22 and going ahead bank will continue to focus into this segment. RAM portfolio has increased at a CAGR of 13% over FY19-22 at ₹29,521 crores as on FY22. ~99.2% of the portfolio is secured in nature. Total advances of the bank increased by 8% CAGR over FY19-22 at ₹33,748 crores and ~77% of the portfolio qualifies for the PSLC. Average ticket size remained in the range of 0.31-0.34 millionn during the last 3 years.

- Margins improved due to lower deposits cost: NIM increased from 3.65% in FY19 to 4.1% in FY22, largely led by strong improvement witnessed in cost of deposits. Overall yield of the bank declined from 10.1% in FY19 to 9.5% in FY22. Bank’s higher focus into RAM segment and steady increase into CD ratio will support the margins ahead. Entire book of the bank is on floating basis with Repo linked book at ~65%, 8% – T-bills and rest is MCLR linked.

PEER COMPANIES

- City Union Bank

- Catholic Syrian bank

- DCB Federal Bank

- Karur Vysya Bank

- Karnataka Bank

- RBL Bank

- South India Bank

🔎IPO Risks

- TMB bank is unable to convene AGMs without obtaining prior approval of the High Court of Madras, which limits its ability to obtain shareholder approvals in a timely manner or at all. which may adversely affect the bank’s reputation, business, results of operations and financial conditions.

- 37.61% of the bank’s paid-up equity share capital or 53.59 million equity shares are subject to outstanding legal proceedings which are pending at various forums and various regulatory proceedings have been initiated involving the bank which has caused penalties against the bank in the past.

- TMB will be unable to open new branches unless it is a listed company and is also required to obtain prior permission from the RBI to open new branches.

- TMB is currently significantly dependent on Retail, MSME and Agri-financing, customers and any adverse developments in these segments could adversely affect our business, operations, financial condition and cash flows.

- An increase in our portfolio of NPAs may materially and adversely affect its business and the results of operations.

- TMB has a regional concentration in southern India, especially Tamil Nadu. Any adverse change in the economic, political, or geographical conditions of Tamil Nadu and other states in which it operates can impact its results of operations.

🚀Financial Data

| Particulars | For the year (₹ in Cr) | ||

| 2022 | 2021 | 2020 | |

| Total Revenue | 4,656.44 | 4,253.4 | 3,992.53 |

| Total Assets | 52,858.49 | 47,527.17 | 42,758.8 |

| Profit After Tax | 901.9 | 654.04 | 464.89 |

Valuation and View

At the upper price band of ₹525, the issue has been offered at 1.3x FY22 P/BV (post-issue), which we believe is reasonable, considering its consistent financial performance with strong return ratio. TMB has long credit history in banking sector and loan book of the bank growing steadily with improving liability franchise. Bank has reported meaningful improvement in asset quality with moderating credit cost due to its long customer relationship, focus on secured lending and strong underwriting practices. Considering all these factors, we recommend investors to

‘Subscribe’ for this issue. However, outstanding legal proceedings regarding

37.7% of the bank’s equity share capital will be an overhang for the IPO.