India is the 5th largest world economy | Weekly Market Wrap-up 04 Sep

No time to catch up with news of the weekly market? We’ve got you. Order a “Chai Tea” at your nearest Starbucks ‘coz Arihant Capital is here with the last week’s market wrap-up and outlook for the week ahead.

In this article

Why Starbucks you ask? The American coffee giant Starbucks appointed the Indian-origin Laxman Narasimhan as its next CEO leading to a meme-fest from the Twitterati.

Talking about Twitter, now no need to be embarrassed by the typo in your trending tweet. The microblogging platform will finally allow you to edit, but it’s gonna cost you. Hats off to the geniuses who thought editing should be a premium feature.

Coming to our feature story: India grows at 13.5% this quarter, leaving behind the UK to land at the 5th spot in the world’s largest economy. Before you start celebrating the fastest growth in 4 quarters, notice that the 13.5% growth is on a low base and more so, it is below RBI’s expectations of 16.2%. This coupled with gloomy global economic cues has made many agencies downgrade India’s outlook.

It’s not all bad though, fundamentally, the last month saw some great numbers including FPI inflows touching a 20-month high, check out this article to see what Mr Arpit Jain of Arihant Capital had to say about this.

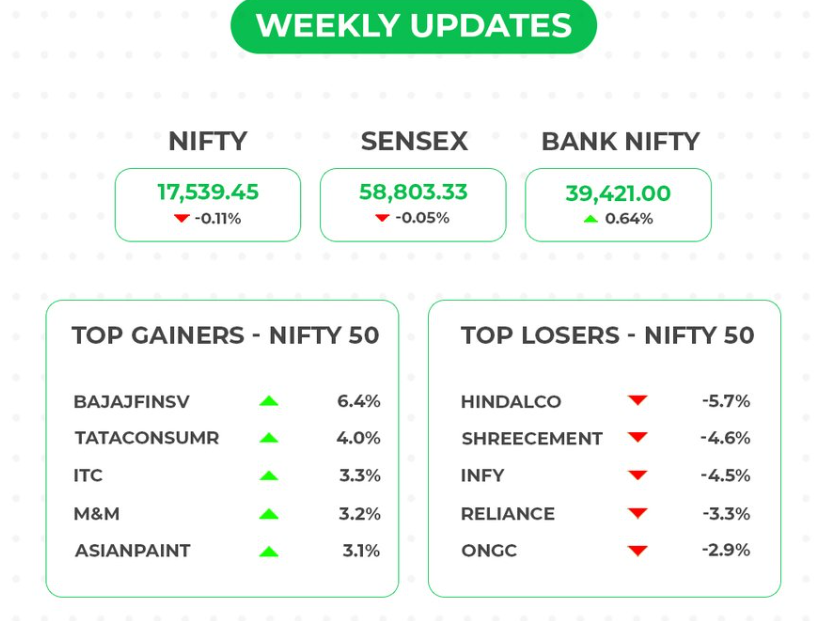

Let us jump into what the markets were up to last week. Jerome Powell’s announcement last week sent tremors on most indices globally, especially on the IT-heavy indices. By Wednesday, we saw Nasdaq and even the D-Street recovering. Nifty ended the week mostly flat at 17,539 (down 0.11%) and Sensex ended 0.05% down at 58,803. Bank Nifty and Nifty Midcap 100 were up slightly at 0.64% and 0.54%.

📈What to expect from the markets

–Mr. Abhishek Jain, Head Research, Arihant Capital

India’s stock market closed a volatile session led by gains in capital goods, and industrial stocks. The gains were offset by losses in energy, oil and gas, and metal stocks, ahead of the crucial U.S. jobs report scheduled later in the day. On the sectoral front, Nifty Auto, Nifty FMCG, and Nifty Realty indices surged most, while, Nifty I.T, Nifty Pharma and Nifty metal closed on negative sentiment.

We would like to keep an eye on global events like Russia stopping the supply of Gas from the Nord Stream pipeline on Friday which has led sell-off in US markets. We believe US markets are close to bottom and expected to see a bounce back from current levels.

On the domestic front, most auto companies have posted decent numbers. We continue to remain positive in the auto-auto ancillaries sector.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital

Nifty

The daily chart of Nifty shows a narrow range candlestick pattern formation. Nifty is trading above its 30 WMA on the weekly chart. On analysis, it seems that the market may remain in consolidation mode but the momentum in midcap stocks will continue. Nifty can face resistance around 17,650 levels, if it starts to trade above then it can touch 17,880-18,050 levels. While on the downside support is 17,450 if it starts to trade below then it can test the levels of 17,300 and 17,150.

Bank Nifty

On the daily chart of Bank Nifty, we see a Doji candlestick pattern. The weekly chart shows prices trading above all the short-term moving averages. It seems that Bank Nifty may also consolidate here. In the coming trading session if it trades above 39,650 then it can touch 39,850 and 40,100 levels. However, the downside support comes at 39,300 below that we can see 38,800-38,500 levels.

💰Stock Picks

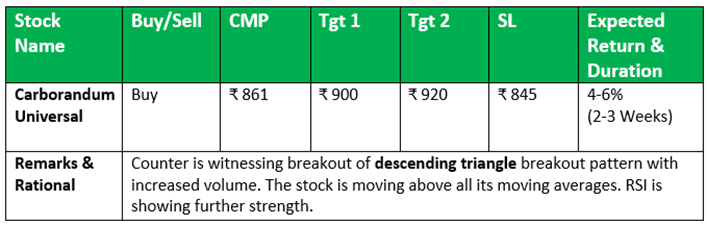

From the Technical Desk

-Ms Kavita Jain, Sr Research Analyst and Learning Head, Arihant Capital

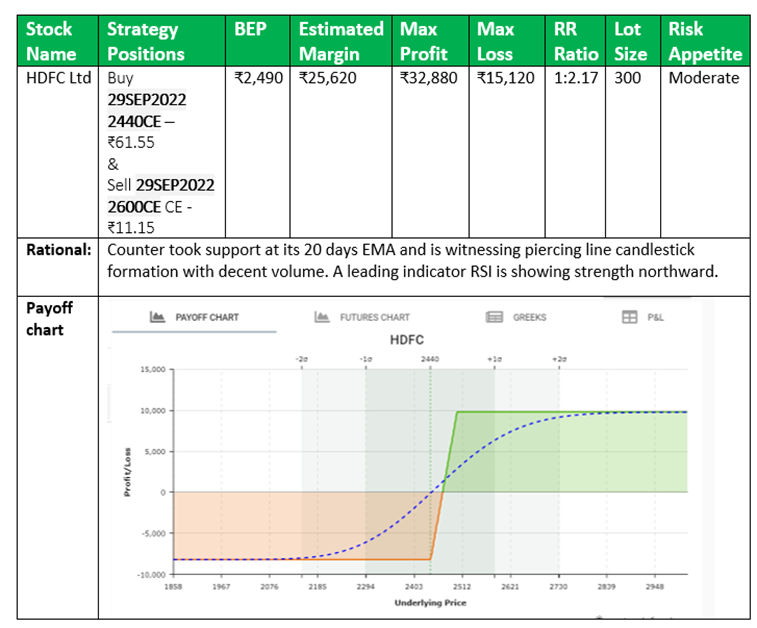

💰Option Hub

Ms Kavita Jain, Sr Research Analyst and Learning Head, Arihant Capital

🔎Quick Bites

Global

- India pips the UK to become the fifth biggest economy.

- Starbucks gets a taste of India: Narasimhan to succeed Schultz.

- US hiring slows in August in the face of rising interest rates, high inflation and sluggish consumer spending. The unemployment rate rose to 3.7%, from a 50-year low of 3.5% in July.

- China shuts down the world’s largest electronic market Shenzhen has gone into lockdown.

- IMF agrees to a $2.9-b bailout for Sri Lanka.

- Inflation hits 9.1% in Euro countries.

- US Treasury two-year yields rise highest since 2007.

Economy

- The monthly GST collections rose by 28% YoY in August to ₹1.44 lakh crore, while the manufacturing PMI stood stable at 56.2, indicating strength in the economy as interest rates inched up and inflation remained elevated.

- Credit growth or loans given out to industry touched an 8-year high increasing by 10.5% YoY to ₹31.8 lakh crore in July, signalling positive signs for the economy. Core growth slows to 4.5%, and the FMCG market grows 6% over July.

- RBI Governor expects inflation to ease to 5% by April-June next year.

- Goldman Sachs has cut the full-year 2022 GDP growth forecast to 7%. Moody predicts India’s GDP to slow to 7.7% in 2022.

- Centre hikes windfall profit tax on export of diesel and ATF.

Automobile

- Full throttle: Tata Motors and Maruti Suzuki clocked a 41% and 30% rise in domestic passenger vehicle sales for August. M&M auto sales record 93% YoY growth. Hero MotoCorp reported a 1.92% increase in total sales in Aug 2022. TVS Motors’ total two-wheelers sales grew by 15% YoY Bajaj Auto sales grew by 5% Eicher Motors, reported a 53% YoY increase in Royal Enfield sales.

- Tata Motors acquires its Brazilian partner Marcopolo’s stake in their bus body manufacturing joint venture Tata Marcopolo Motors Ltd.

- Maruti is expecting strong festive demand; has a lot of pending bookings.

- Ashok Leyland has secured orders for 1,400 school buses in the UAE.

Banking and Finance

- Axis Bank is likely to raise its stake in Max Life Insurance to about 20% over the next 6-9 months.

- RBI has issued guidelines to all lenders including banks to protect the data of borrowers using digital lending apps. The regulated entities cannot store borrowers’ data except for some basic minimal information. Privacy FTW! All digital loans have to comply with new norms by Nov 30.

- IRDAI may ease investing in AT-1 bonds.

- HDFC eyes up to ₹10,000 crores from bonds sale.

Energy and Infrastructure

- Coal India’s supplies to the power sector surpass the annual action plan target.

- Sunteck’s Realty arm acquires Russel Multiventures.

- State-owned hydro power giant NHPC has inked a pact with the Himachal Pradesh government for the implementation of the 500 MW Dugar Hydroelectric Project in Chamba district.

- ONGC-Indian Oil, GAIL and MCPI submit bids for bankrupt JBF Petro. GAIL makes the highest bid for JBF Petro at ₹1,800 crores,

- Indian Oil raises ₹2,500 crores via NCDs.

- GMR Infra to divest 33.3% stake in Philippines airport to Aboitiz InfraCapital Inc (AIC) for ₹1,334 crores. GMR to sell 30% in Indonesia Mine Co for over $420 million.

- Government to Fastrack divestment of BEML and SCI.

IT and Telecom

- Infosys has completed the acquisition of Europe-based life sciences consulting and technology firm BASE life science.

- Infosys sells its entire stake in Trifacta Inc for $12 million.

- Voda-Idea prepays ₹2,700 crore loan to SBI. Vodafone Idea boosts gaming content ahead of 5G launch.

- NPCI is all set to pick up a 9-10% stake in ONDC for ₹10 crores.

- LTTs bags 5-year contract from BMW Group.

- Vi to launch 5G only after finalizing loans and gear deals. Jio and Airtel line up around 16 billion for the 5G rollout.

- Slurrp: If you are craving a Rosogulla or a Hyderabadi Biryani? Zomato will bring the authentic taste to your doorstep. Be sure to order one day ahead to take advantage of Zomato’s intercity delivery. It also expects the B2B line to be as big as its core offerings.

Other

- Aurobindo Pharma’s arm to invest around ₹300 crores for capacity expansion

- Ramco Systems Defense to provide Aviation M&E suite to GA-ASI

- Zydus gets USFDA nod to market Venlafaxine and Pregabalin extended-release tablets.

- Cipla, Kemwell India to incorporate joint venture company in the US. Cipla (EU) has agreed to acquire an additional 13.10% stake in Cipla in China.

- Zee Entertainment Enterprises gets TV rights for ICC men’s events from Disney Star.

- UltraTech commissions 1.3Mta dalla expansion

- Berger Paints to commission a ₹1,000-crore manufacturing plant in Lucknow in November

- USFDA approves Alembic Pharmaceuticals’ Chlorthalidone

- SpiceJet is likely to get around ₹225 crores next week under the central government’s Emergency Credit Line Guarantee Scheme (ECLGS) to clear its dues.

- IndiGo-Virgin signed a codeshare agreement. Jet is likely to order 50 Airbus aircrafts.

🔌Sustainability Corner

- Mahindra Electric Mobility launches its new cargo electric three-wheeler Zor Grand

- Roads ministry rolls out stricter safety requirements for EVs.

- Rajasthan govt comes up with e-vehicle policy; sanctions ₹40 crores for e-vehicle purchase grant.

- Hero Electric moves HC against DRI show-cause notice.

- EV site Droom sees EV demand growing 4X in 3 years.

- CPBIB and 12 others bid for a minority stake in NTPC Green.

- KKR-backed Virescent is in final discussion to acquire 100MW solar assets from Jackson Group

- Solar equipment maker Arctech opens joint venture manufacturing facility in Gujarat

- JSW Energy’s bid lowest in the battery storage auction with a winning bid of ₹10.84 lakh per MW.

- KP Energy to develop wind energy projects worth ₹222 crores for Aditya Birla Group.

- Lambretta to re-enter the Indian market in 2023, to launch electric scooter in 2024.

- Olectra gets orders for 100 electric buses worth ₹151 crores from Assam.

- Peel Works to replace the entire delivery vehicle fleet with electric.

- Triton EV approaches Supreme Court to be able to bid for the AMW subsidiary.

- Electric vehicles on Indian roads are to touch 5cr by 2030, according to KPMG.

- SAR Group to invest up to₹ 1,500 crores in e-bike foray.

- Ashok Leyland to roll out their electric LCVs within six months: Dheeraj Hinduja.