Sona Comstar IPO – Should you invest?

The promising future growth of the electric vehicles and hybrids sector, in light of sustainable and clean mobility development, stands in favour of the company. The IPO is also priced reasonably compared to its peers, and hence we think an investment in Sona Comstar for the long-term at its IPO stage can be a good decision for patient investors.

In this article:

- IPO Details

- How will the company utilise funds raised through IPO?

- About Sona Comstar & Its Business

- Company Strengths

- Key Concerns

- Should you invest in Sona Comstar IPO?

Sona Comstar is coming up with a ₹5,550 crore initial public offering (IPO), as India’s leading automotive technology company aims to repay its debt. The two days stake sale will be open from Monday, 14-16th June 2021 with a price band of ₹285-291. If successful, the Sona Comstar IPO will be the largest IPO by an auto component maker in India’s corporate history.

The Gurugram-based company supplies components to original equipment manufacturers (OEM) of global auto giants like Volvo, Ford Motors, Daimler, and back home, to Mahindra Electric, Mahindra and Mahindra, Tata Motors, and Ashok Leyland, among others. In 2020, Sona Comstar was among the top 10 global players in the differential bevel gear segment and among the largest exporters of starter motors in India. Sono Comstar ended the 2020-21 fiscal with a net profit of ₹215 cr on revenue of ₹1,566.30 cr.

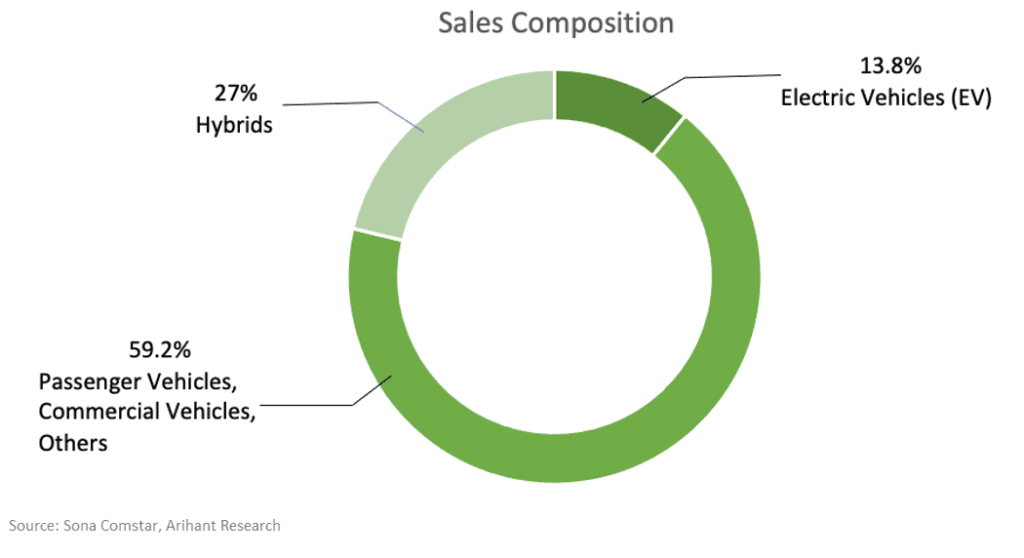

The company is betting big on electric and hybrid vehicles, which already generate 13.8% and 27% of its revenues respectively. According to the senior officials of Sona Comstar, only one-fourth of the company’s revenue came from internal combustion engine (ICE) vehicle supplies in FY21. “From 35% in FY19 our dependence on ICE segment has come down to 25%,” said Rohit Nanda, Group CFO, Soma Comstar.

IPO Details

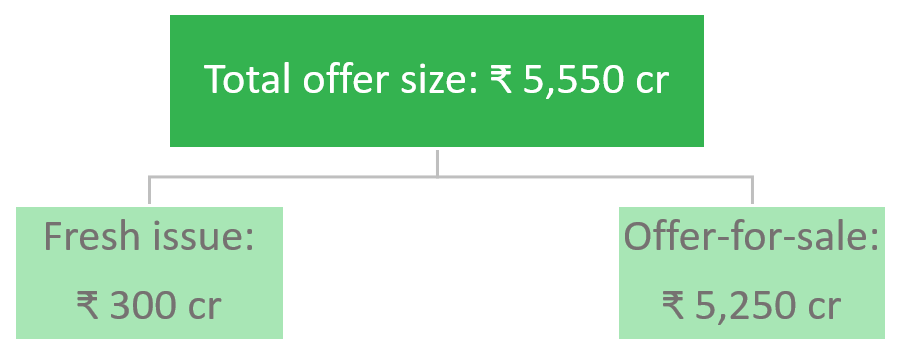

Promoted by Sunjay Kapur, Sona Autocomp Holding Private Limited, and Singapore VI Topco III Pte. Ltd (a Blackstone entity), the company plans on offering ₹ 5,550 crores worth of equity shares, constituting a fresh issue and a stake sale (offer-for-sale) by its promoters.

- IPO open from June 14th –16th 2021

- Face value: ₹10

- Price Band: ₹ 285-291

- Listing on: BSE and NSE

- Fresh Equity Issue: ₹300cr

- Offer for sale: ₹ 5,250 cr

- Total issue: ₹ 5,550 cr

- No. of Shares being issued: 194,736,000 -190,721,000

- Promoters: Sunjay Kapur, Sona Autocomp Holding Private Limited and Singapore VI Topco III Pte. Ltd

- Book running lead managers: Kotak Mahindra Capital Company Ltd, Credit Suisse Securities (India) Pvt Ltd, JM Financial Ltd, J.P. Morgan India Pvt Ltd, Nomura Financial Advisory and Securities (India) Pvt Ltd

- Registrar: KFin Technologies Pvt Ltd.

After the successful completion of the IPO, the promoters’ holding will reduce from 100% to 67% and the rest will be held by the public.

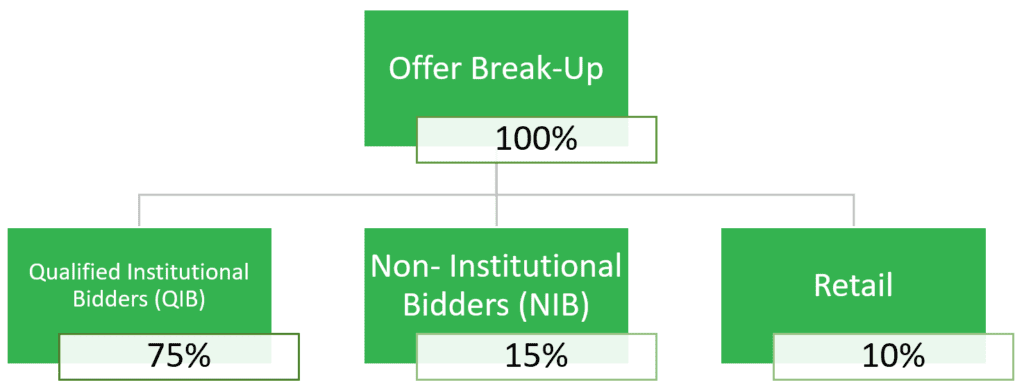

Offer break-up

The offer is broken up into the following investor classes:

How will the company use the funds?

According to the RHP, of the ₹300 cr fresh issue equity, the company plans on utilizing ₹241.1 cr to repay company debt which will help it to reduce its cost of finance. The remaining amount would be used for general corporate activities, including capital expenditure, marketing and business development expenses.

Sona Comstar also disclosed that it will not receive any proceeds from the ₹5,200 cr offer for sale.

Understanding Sona Comstar’s Business

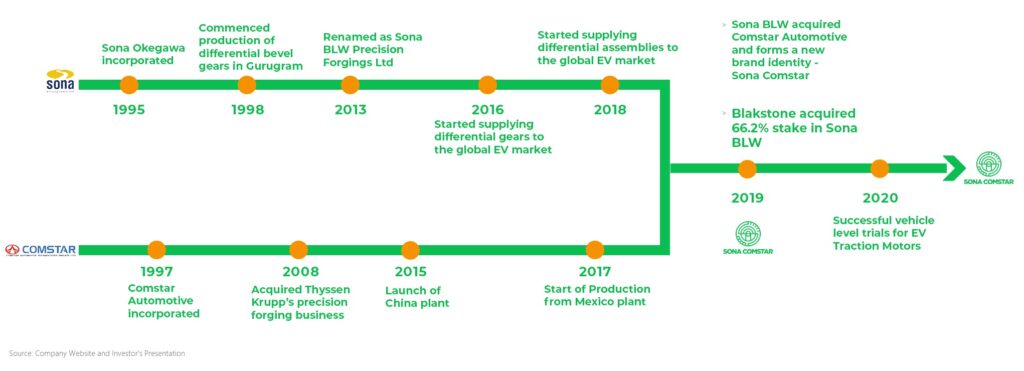

Incorporated in 1995, the company is now a leading global car components manufacturer, primarily catering to the automobile sector across the US, Europe, India, and China. Back in 2019, Sona Group, led by Sunjay Kapur, merged with Chennai-based parts maker Comstar Automotive Technology backed by leading global private equity firm Blackstone. They named this new entity Sona Comstar, which was set up to create an India-centric, electric vehicle (EV) focused automotive technology platform.

At present, Sona Comstar serves across all vehicle categories, such as conventional passenger vehicles, commercial vehicles, off-highway vehicles, electric cars, electric light commercial vehicles, and electric two & three-wheelers, according to the company’s website. Currently, they have 9 manufacturing units of which 6 are located in India, and the rest in China, Mexico and the USA.

Products offered by the company range from differential assemblies, to differential gears, starter and traction motors, and more. With a wide range of conventional and electrified powertrains, the company is well-set to gain from high-growth industry trends that will accelerate the growth of India’s automobile sector.

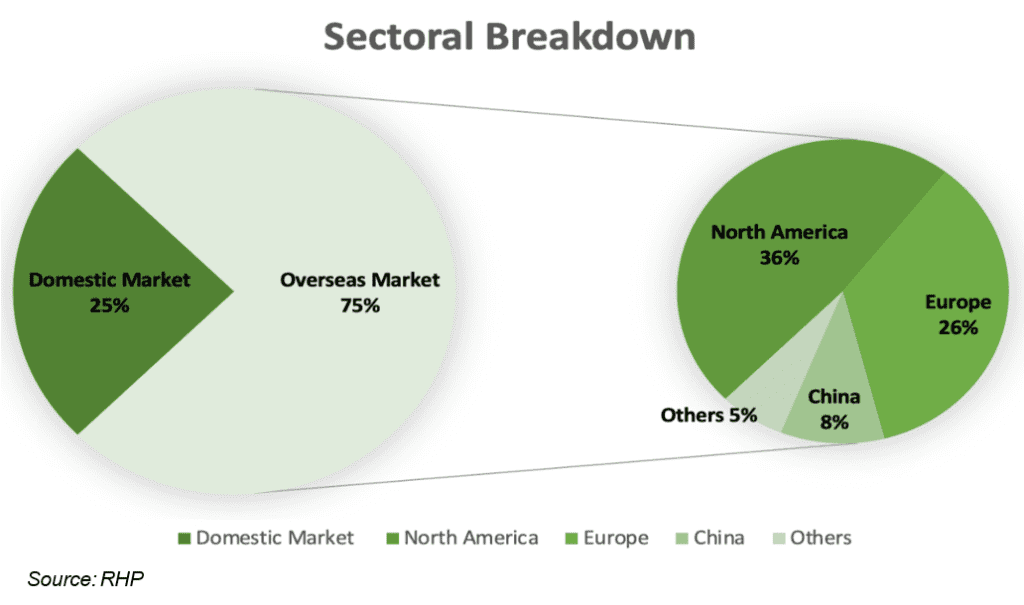

The company derives 75% of their revenue from the overseas export markets, and the remaining from domestic Indian markets, as follows:

Global Market Share

The company has been gaining a global presence across products, capturing a global market share of approximately 5% for differential bevel gears, 3% for starter motors and 8.7% for Battery EV (BEV) differential assemblies, in 2020.

Company Strengths

– Leading manufacturer & supplier to the Global EV market:

The promising future of the EV sector is a result of the growing drive for sustainability, a positive social footprint and the recognition of clean mobility. Amongst the many propulsion technologies globally, Battery EV (BEV) has been the fastest-growing segment with a CAGR of 45% between 2015 and 2020, with a projected growth of 36% CAGR between 2020 and 2025.

The global market share of this company in BEV differential assemblies is 8.7%, and they are identified as one of the limited capable players that can design high-power density EV systems with a lightweight design, catering to the needs of their EV customer base (according to Ricardo Report).

– Strong R&D & technological capacity:

The company believes in spending big on R&D to ensure its continued growth. They have their own in-house R&D capabilities, that focus on delivering evolutionary green technologies that shape future mobility. In FY21 Sona Comstar’s R&D spend was 5.8% of its revenues at ₹91.5 cr, compared with 1.7% and 3.3% in FY19 and FY20, respectively. Between 2018-2020, the company spent an aggregate expenditure of ₹157 cr on R&D.

– Consistent financial performance with industry-leading metrics:

According to the RHP, among the top 10 auto-component manufacturers in India by market cap, the company ranks on top in the:

- Earnings before interest, taxes, depreciation and amortization (EBITDA margin).

- Profit after tax (PAT margin).

- Return on Capital Employed (ROCE).

- Return on equity (ROE).

The operating income of the company has grown at a 10.9% CAGR between 2016-2020, compared to the average 8.1% CAGR of market peers during the same time. The company also exhibits strong financial statements, including balance sheets, and cash flow statements.

Despite the pandemic, the company demonstrated consistent EBITDA margins, and a year–on–year 64.6% growth in revenue between 2019 and 2020 and 26.1% from 2020 to 2021, in contrast to the overall slowdown of the global automotive sector.

– Strong client relationships

As on March 31, 2021, they have been awarded 58 programs from 27 customers across their product portfolio, from customers in India and overseas. Long-term client relations are a key strength of the company, with over 15 years of relations with 13 of its top 20 clients.

Key Concerns

- Dependence on global automobile sector performance – Since the company derives three-quarters of its revenues from overseas markets, the performance of the company is highly sensitive to fluctuations in the automobile sector performance in its key markets, including the US, Europe, China and India.

- The majority of sales are concentrated over the company’s top 10 customers – over 2018-2020, around 80% of sales were derived from the company’s top 10 customers, while the top 3 customers constitute around 45% of sales. This means any loss of such customers or reduction in their purchases can adversely affect business operations, cash flows and financial health.

- Failure of R&D/production techniques/systems/improved products – the expensive, lengthy and uncertain nature of the development of systems/products/components puts the company at risk of adverse effects on financial condition and operations in case of failure.

Impact of Covid-19 on the company

Worldwide preventive and protective measures, including country-wide lockdowns, stagnated business operations. The eventual easing of preventive measures was reversed in India due to the emergence of a variant of the virus. However, the company did not suffer any significant delays or interruptions in their production process and undertook timely deliveries in line with its customers’ interests.

Owing to the easing of lockdown and movement restrictions, the company’s production level at all manufacturing units has returned to pre-covid levels.

Should you invest in Sona Comstar IPO?

Mainstream automakers are making big commitments of shifting to EVs quickly and this could help suppliers like Soma Comstar. Moreover, governments worldwide are making a push towards EVs as part of their emission targets. Given that the future of mobility is electric and the company is betting big on this space and already garners a good amount of revenues from this segment, we believe it has a bright future ahead.

Valuation-wise, at the upper price band of ₹291, the issue is offered at a price-to-earnings ratio (PE) of 41, considering FY20 earnings per share (EPS) of ₹7.1. This is a reasonable valuation compared to industry peers.

The company also spends well on R&D and is building production capacity to facilitate future growth. This forward-looking outlook brings confidence about its future.

Moreover, with Covid-19 vaccines being rolled out, investors are hoping for a quick economic rebound. This could fare well for the company as one could see money moving into real-economy sectors including auto components, among others.

Considering the company’s forward-looking business model, growth trajectory and financial performance, we recommend a subscription for long-term investing.

Plus, if you are keen on investing in the EV space, then putting your money in an EV component supplier company could be a good way to play the growing electric vehicle market, instead of betting on individual brands.