Valiant Laboratories Limited IPO is live. Should you Invest?

In this article

- IPO details

- Issue details

- Offer Breakup

- IPO Strengths

- Key Risks

- Valiant Laboratories Limited Financials

📃About Valiant Laboratories Limited

Incorporated in 1980, Valiant Laboratories Limited is a pharmaceutical ingredient manufacturing company in India having focuses on manufacturing Paracetamol.

The company’s manufacturing unit is located in Palghar, Maharashtra, and is spread across 2,000 sq. mts. of land with an aggregate annual total installed capacity of 9,000 MT per annum. Valiant Laboratories also has an R&D Facility, equipped with an analytical laboratory and infrastructure for developmental activities in existing products.

For the Fiscal 2023, Fiscal 2022 and Fiscal 2021, Valiant Laboratories revenue from operations was Rs. 3,339.10 million, Rs. 2,915.23 million and Rs. 1,823.69 million, respectively.

Valiant Laboratories Limited imports Para Amino Phenol, the raw material for the manufacture of Paracetamol from China and Cambodia.

As of April 30, 2023, Valiant Laboratories has 86 employees.

💰Issue Details of Valiant Laboratories Limited

- IPO open from 27th Sep 2023 – 03rd Oct 2023

- Face value: ₹10 per equity share

- Price band: ₹133 to ₹140 per share

- Market lot: 105 shares

- Minimum Investment: ₹14,700

- Listing on: BSE and NSE

- Offer for sale: Approx ₹152.46 Cr (Fresh Issue: ₹152.46 Cr)

- Registrar: Link Intime India Private Ltd.

🪙Total Issue Price

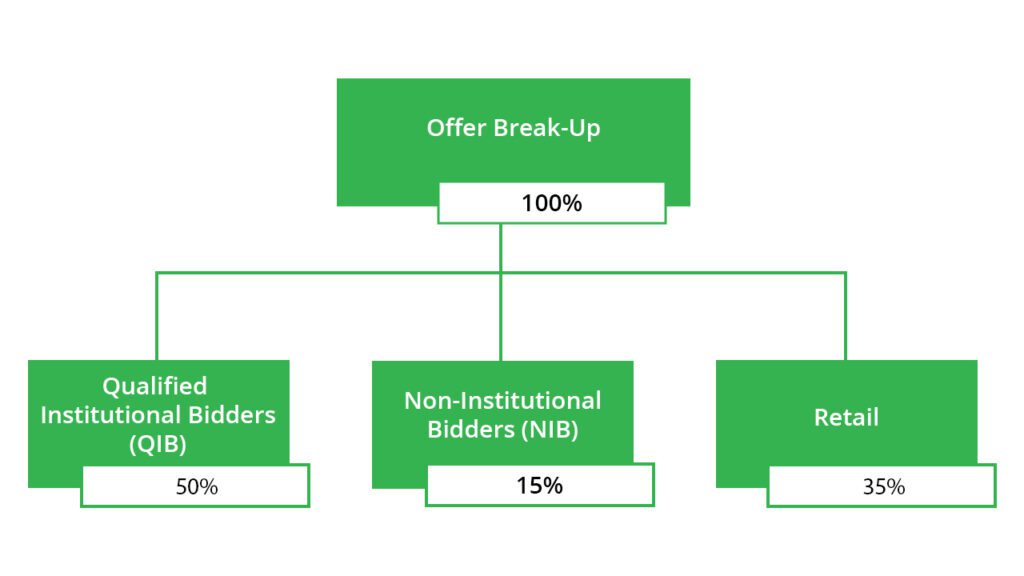

🪚Offer Breakup

🔭IPO Object

The company intends to utilise the net proceeds from the issue towards the funding of the following objects:

- Investment in its wholly-owned subsidiary, Valiant Advanced Sciences Private Limited (VASPL) for part-financing its capital expenditure requirements in relation to the setting up of a manufacturing facility for speciality chemicals at Saykha Industrial Area, Bharuch, Bharuch, Gujarat (Proposed Facility).

- Investment in VASPL for funding its working capital requirements.

- General corporate purposes.

⛓️IPO Strength

Some of the qualitative factors and strengths that form the basis for computing the Offer Price are:

- Experienced promoters and strong management team

- Strong customer base.

- Leading player in the pharmaceutical ingredient manufacturing industry in India.

- Strong financial performance

- Strategically located Manufacturing Facility

🧨IPO Risk

- They are subject to strict quality requirements, regular inspections and audits by their customers and any failure to comply with quality standards may lead to the cancellation of existing and future orders and could negatively impact their business, financial condition, and results of operations.

- They do not have long-term agreements with their suppliers for raw materials and an inability to procure the desired quality, and quantity of their raw materials in a timely manner and at reasonable costs, or at all, may have a negative impact on their business.

- They are a single-product manufacturing company and any changes to the paracetamol API industry or their product demand will adversely affect their revenues, financials and profitability.

- They are dependent on a few customers for a major part of their revenues. Further, they do not enter into long-term arrangements with their customers and any failure to continue their existing arrangements could adversely affect their business and results of operations.

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-21 | ₹106.31 | ₹183.78 | ₹30.59 |

| 31-Mar-22 | ₹181.81 | ₹293.47 | ₹27.50 |

| 31-Mar-23 | ₹212.76 | ₹338.77 | ₹29.00 |

PEER COMPANIES

- Granules India Ltd.

- Jagsonpal Pharmaceuticals Limited

📬Also Read: A Simple Guide: Opening a Demat Account for Minors in Bharat