How IPOs Shaped the Market this Week? 🎭 | Stock Market Weekly Update Sep 23

Hello Readers!

We hope you had a great week!

This week in the stock market was bustling with IPOs, like invitations for people to join a company’s journey by buying a part.

At the beginning of the week, a major real estate player, Signatureglobal India, extended an invitation, saying, “We’re having a gathering. Would you care to join?” They aimed to gather ₹730 crores, and to their surprise, within just two days, more people were eager to attend than they had anticipated!

Simultaneously, another company, Sai Silks (Kalamandir), had its own gathering with an invitation to raise ₹1,201 crores. People found it appealing, and by the end of Day 2, about 33% of the spots were taken!

The previous week had its own success story! EMS Ltd, assisting with sewer solutions, had their gathering too. As the event kicked off, excitement was so high that the spots (shares) sold for 33% more than expected!

Now, everyone is eagerly awaiting the upcoming gatherings! JSW Infrastructure Limited, Updater Services Limited, and Valiant Laboratories Limited will host their events from 25th September to 27th September. People are looking forward to these gatherings, hoping to have a good time and find something special during these occasions.

In essence, this week was a series of exciting gatherings. More are coming, and everyone is ready to have a great time and seize something valuable at these events!

🧾In this Article

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

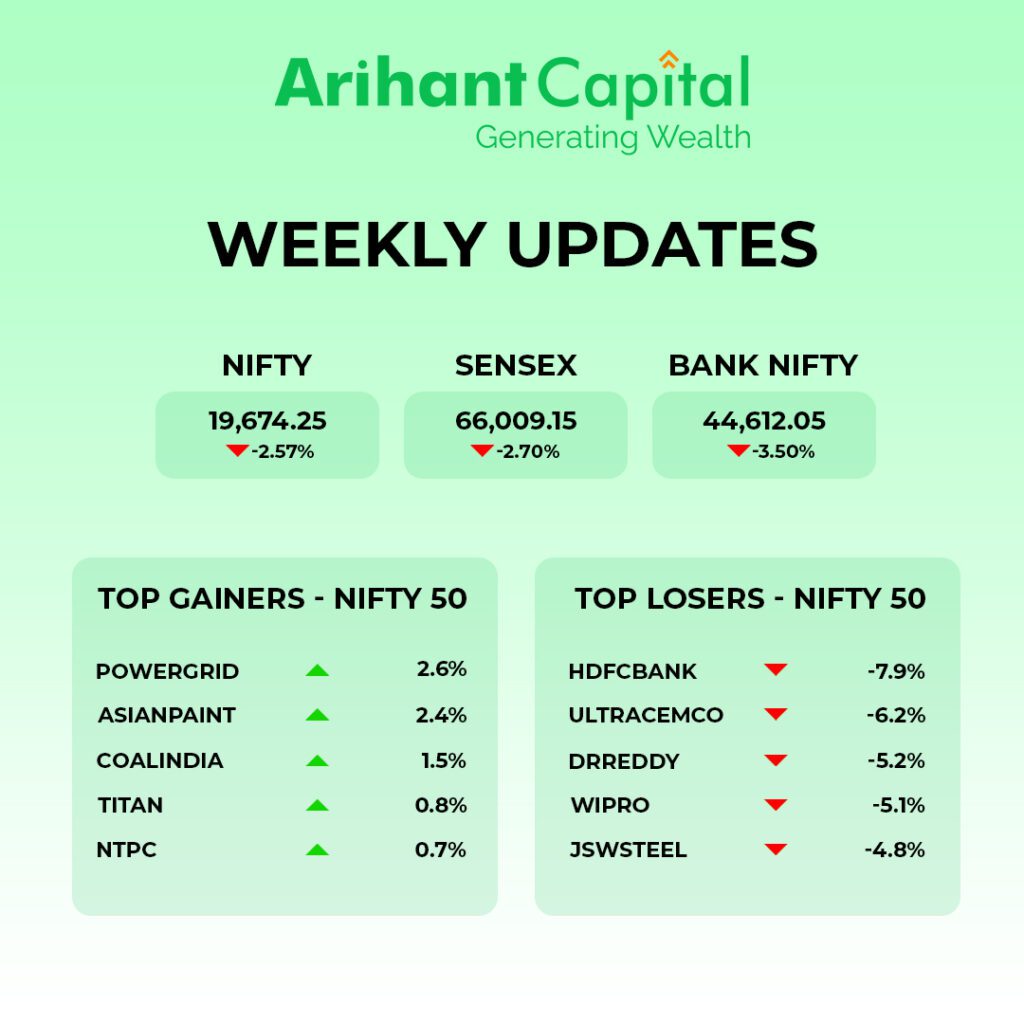

Nifty

Looking at the daily chart of Nifty, we observe prices holding 50 DMA support levels. On the weekly chart, we observe a “Bearish “ candlestick formation. Analyzing both chart patterns indicates that we can witness selling pressure at a higher level. If Nifty starts trading above the 19,800 level, then it can touch the 19,950-20,050 level, while on the downside, support is 19,600, and if it starts to trade below, then it can test the levels 19,450 and 19,300.

Bank Nifty

If we look at the daily chart of Bank Nifty, we observe prices have closed below 50 DMA, and the weekly chart also shows a “Bearish” candlestick formation. If we analyze both chart patterns, it indicates that bank-nifty can show more pressure compared to Nifty. Bank-nifty starts trades above 44,800, then can touch 45,100 and 45,300 levels. However, downside support comes at 44,500; below that, we can see 44,300 and 44,100 levels.

🔎Stocks in News

🏭 Glenmark Pharma: Agreed with Nirma to divest a 75% stake in Glenmark Life Sciences for ₹5,651.5 cr, at a price of ₹615 per share.

⛏️ Vedanta: Board approved raising ₹2,500 cr through non-convertible debentures on a private placement basis.

🎨 Berger Paints: Board of directors has declared bonus shares in a 1:5 ratio.

💼 Wipro: CFO Jatin Dalal resigns, and Aparna Iyer will take over.

💊 IPCA Labs: Acquired an additional 19.29% stake in Unichem Labs for ₹598 cr.

💡 Schneider Electric: CEO Deepak Sharma has planned capital expenditure of ₹3,200 cr by 2026.

⚡ SJVN: The Government launches Offer for Sale (OFS) to sell a 2.46% stake at ₹69 per share.

💊 Zydus Life: The US FDA approved a skin-care gel.

🌿 Adani Green: Will form a joint venture with TotalEnergies with an investment of $300 mn.

🚗 M&M: Market cap of the company crossed ₹2 lakh cr.

🏗️ Shree Cement: Planning to issue debentures worth ₹700 cr on a private placement basis.

💊 Venus Remedies: Received approval to market cancer drugs in Serbia.

🏗️ Ashok Buildcon: Bagged a ₹646 cr order from Maharashtra Electricity Board.

🏗️ JK Lakshmi: Will acquire a 21% stake in Amplus Helios for ₹22 cr.

🚛 Tata Motors: To hike commercial vehicle prices by up to 3%.

🏦 HDFC Bank: RBI has approved the reappointment of Sashidhar Jagdishan as MD and CEO.

📶 Reliance: Launched Jio AirFiber.

💡 Bharat Electronics: Received new orders worth ₹3,000 cr.

📺 ZEE: Will be delisted from the FTSE Russell index following its merger with Sony Entertainment India.

⛽ Hindustan Petroleum: Petromin Corporation KSA and Hindustan Petroleum will invest $700 million in petrol pumps, multi-brand vehicle service workshops, and EV charging stations.

📱 Vodafone-Idea (Vi): Paid ₹1,701 cr to the Department of Telecommunications towards the annual instalment for the spectrum acquired in the 2022 auction.

📰 Quick Bites

💸 The Indian government has increased windfall tax on domestically produced crude oil from ₹6,700 per tonne earlier to ₹10,000 per tonne now.

⛽ Export duty on diesel has been decreased to ₹5.50 per litre from ₹6 per litre earlier. Aviation fuel duty is now ₹3.50 per litre vs. ₹4 before.

🏛️ Santiniketan in West Bengal has been added to the UNESCO World Heritage List.

🥛 The Food Safety and Standards Authority of India (FSSAI) has started nationwide surveillance on milk and milk products. Results will be out by Dec.

The US Fed has paused interest rate hikes. They have increased rates 11 times since March 2022.

🏦 Bank of England kept rates unchanged at 5.25% after 14 hikes since Dec 2021.

🏛️ ‘Sacred Ensembles of the Hoysalas’ in Karnataka has been added to the UNESCO World Heritage List.

🗓️ Sept 30 is the last date to submit ₹2,000 notes.

💰 Global debt stood at $307 trillion in the second quarter of the year: Institute of International Finance.

🏛️ SEBI has imposed a fine of ₹35 lakh on MI Research (investment adviser) for not following regulations.

🌱 Sustainability Corner:

Hero Electric partners with Gogoro for Swappable Battery Scooters in India

⚡🛵 Hero Electric, India’s largest electric two-wheeler manufacturer, has joined forces with Gogoro, a Taiwanese battery swapping company, to introduce swappable battery scooters in India. This collaboration aims to enhance the convenience and accessibility of EVs for Indian consumers.

Ola Electric Raises $500 Million in Funding

💰🔌 Ola Electric, a leading electric scooter manufacturer in India, has secured a significant investment of $500 million in a recent funding round. The funds will fuel the expansion of Ola Electric’s manufacturing capacity and the development of new EV products, including electric cars.

Mahindra & Mahindra Launches Affordable Electric SUV, XUV400

🚙⚡ Mahindra & Mahindra, India’s largest automaker, has unveiled its budget-friendly electric SUV, the XUV400. Offering affordability and sustainability, the XUV400 is anticipated to drive electric vehicle adoption across the country.

Tata Motors Introduces Enhanced Electric SUV, Nexon EV Max

🚗⚡ Tata Motors, India’s second-largest automaker, has rolled out an upgraded version of its electric SUV, the Nexon EV Max. Boasting an extended range and enhanced features, the Nexon EV Max is set to become a popular choice among electric SUV enthusiasts.

Union Bank of India Launches New EV Loan Scheme for Affordable Financing

💳⚡ Union Bank of India has initiated a specialized EV loan scheme, offering attractive interest rates and favorable repayment terms. This scheme is designed to make financing for electric vehicles more accessible and affordable for Indian consumers.

💡🍬 Knowledge Candy: 🤔 What are smart beta ETFs, and are they becoming popular in India?

Smart beta ETFs 💡 are a type of investment fund that blends elements of passive (tracking a specific index) and active (strategic stock selection) investing.

Unlike traditional ETFs that follow a market index, smart beta ETFs use predefined rules or strategies to select and weigh stocks. These rules can be based on company size, growth potential, dividends, or other financial metrics.

In India, smart beta ETFs are gaining attention as investors seek ways to enhance their returns potentially.

FOR INSTANCE, the NSE’s Nifty 200 Alpha 30 index is an innovative beta index that has shown returns comparable to well-established indices like Nifty Smallcap 50 and Nifty Midcap 50. However, one challenge is the need for a dedicated ETF or index fund tied to this promising index.

Investors are keen on accessible and user-friendly investment options, and the lack of a direct vehicle to invest in the Nifty 200 Alpha 30 index could limit its widespread adoption.

One good option for small investors is to consider larger, more established companies for investment due to lower risk. While smart beta ETFs have gained traction in developed markets like the US and India, they are relatively new. They may require focused efforts in educating investors about their potential benefits and ease of use to become widely popular. Making these investment options more accessible and straightforward is essential to encourage their uptake in the Indian investment landscape.

Happy reading!

Also Read: How to Trade Above Freeze Quantity in Options on Arihant Plus?