Bikaji Foods International Limited IPO is live now. Should you invest?

Bikaji Foods International Limited IPO is live now. Should you apply? Find out here.

In this article

- IPO details

- Issue details

- Offer Breakup

- IPO Strengths

- Key Risks

- Bikaji Foods International Financials

About Bikaji Foods International Limited IPO

Bikaji Foods International Limited is one of India’s largest fast-moving consumer goods (“FMCG”) brands. The company’s product range includes six principal categories: Bhujia, Namkeen, packaged sweets, papad, western snacks as well as other snacks which primarily include gift packs (assortment), frozen food, mathri range and cookies. In the six months that ended June 30, 2022, the company sold more than 300 products under the Bikaji brand.

The company was the largest manufacturer of Bikaneri bhujia with an annual production of 29,380 tonnes, and it was the second largest manufacturer of handmade papad with an annual production capacity of 9,000 tonnes in Fiscal 2022. The company has an international footprint, selling Indian snacks and sweets, and is among the fastest-growing companies in the Indian organised snacks market.

The company has over the years established market leadership in the core states of Rajasthan, Assam and Bihar with an extensive reach. It has gradually expanded its footprint across India, with operations across 23 states and three union territories as of June 30, 2022.

In the six months that ended June 30, 2022, The company has exported the products to 21 international countries, including North America, Europe, the Middle East, Africa, and Asia Pacific, representing 3.20% of its sales of food products in such period.

Bikaji Foods International Limited has six operational manufacturing facilities, with four facilities located in Bikaner (Rajasthan), one in Guwahati (Assam), one facility in Tumakuru (Tumkur) (Karnataka) held through the subsidiary Petunt Food Processors Private Limited to cater to the southern markets in India.

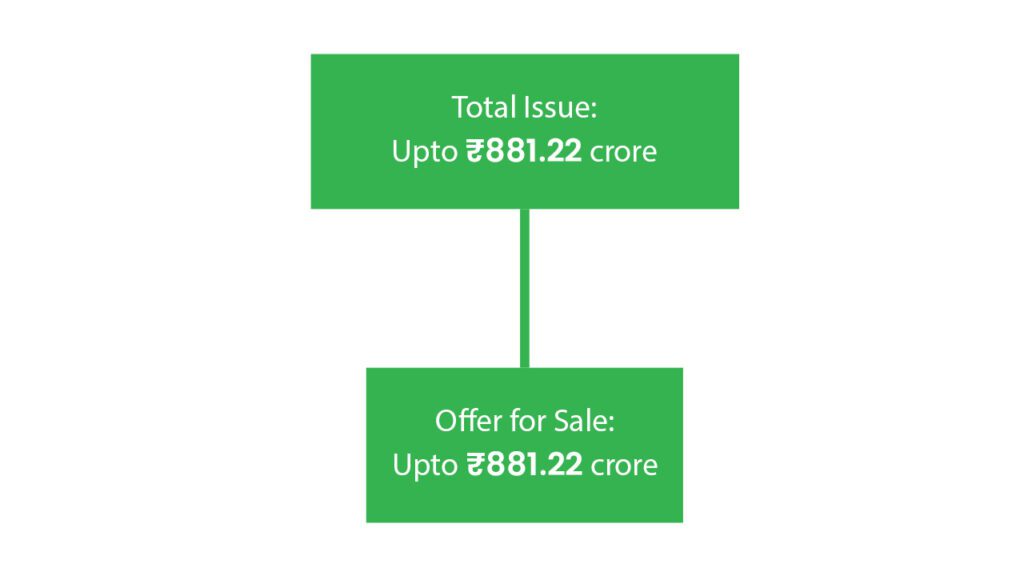

Issue Details of Bikaji Foods International Ltd IPO

- IPO open from 03 Nov – 07 Nov 2022

- Face value: ₹1

- Price band: ₹285 to ₹300

- Market lot: 50 shares

- Minimum investment: ₹15,000

- Listing on: BSE and NSE

- Offer for sale: ₹881.22 Cr

- Registrar: Link Intime India Private Ltd

- Promoters: Shiv Ratan Agarwal, Deepak Agarwal

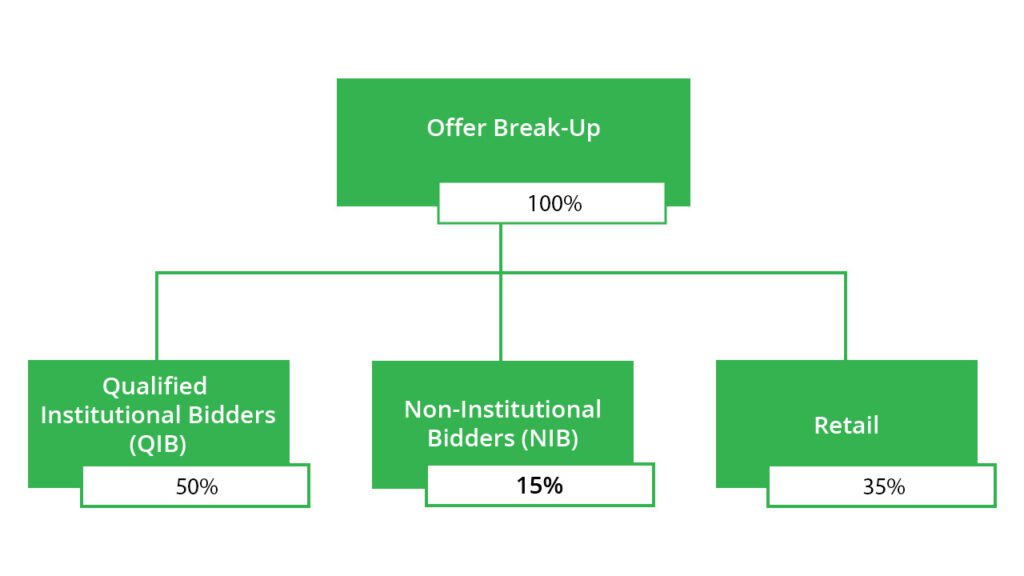

Offer Breakup

IPO Object

The company proposes to utilise the net proceeds of the fresh issue towards funding the following objects:

- Achieve the benefits of listing the Equity Shares on the Stock Exchanges. And

- To enhance company visibility and brand image.

IPO Strength

- A well-established brand with pan-India recognition

- Diversified product portfolio focused on various consumer segments and markets

- Extensive distribution network in India as well as Strategic arrangements with retail chains in India and international markets

- Strategically located, large scale sophisticated manufacturing facilities with stringent quality standards

- Consistent financial performance

IPO Risk

- The success of the firm is dependent on the reputation and consumer goodwill Connected with its brand.

- The company is significantly dependent on the sale of its bhujia products.

- Any slowdown or interruption to manufacturing operations or under-utilization of existing or future manufacturing facilities may have an adverse impact on the business and its financial performance.

- Any contamination or deterioration of the product could result in legal liability, damage reputation and adversely affect financial performance.

- The company has unsecured loans that may be recalled by the lenders at any time and the Company may not have adequate funds to make timely payments at all.

Peer Companies

- DIAMONDYD (Prataap Snacks Limited)

- BRITANNIA (Britannia Industries Limited)

Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-20 | ₹676.64 | ₹1082.9 | ₹56.37 |

| 31-Mar-21 | ₹817.15 | ₹1322.21 | ₹90.34 |

| 31-Mar-22 | ₹1102.13 | ₹1621.45 | ₹76.03 |

Also Read: Sustainable Investing in India: ESG Investments