Global Health Limited IPO is live now. Should you invest?

Global Health Limited IPO is live now. Should you apply? Find out here.

In this article

About Global Health Limited IPO

Global Health Limited is one of the largest private multi-speciality tertiary care providers operating in the North and East regions of India. The company has key specialities in cardiology and cardiac science, neurosciences, oncology, digestive and hepatobiliary sciences, orthopaedics, liver transplant, and kidney and urology.

Global Health Limited has a network of four hospitals currently in operation (Gurugram, Indore, Ranchi and Lucknow) under the “Medanta” brand. The company established “The Medanta Institutional Tissue Repository” in 2017 to promote biomarker and other tissue-based research.

In Fiscals 2020, 2021 and 2022 and the three months ended June 30, 2021 and 2022, the company generated income from healthcare services of ₹1,480.57 crores, ₹1,417.8 crores, ₹2,100.4 crores, ₹473.2 crores and ₹596.1 crores, respectively, and had EBITDA of ₹230.4 crores, ₹222.8 crores, ₹489.7 crores, ₹105.7 crores and ₹141.64 crores, respectively.

As of June 30, 2022, the company provide healthcare services in over 30 medical specialities and engage over 1,300 doctors led by experienced department heads, spanning an area of 4.7 million sq. ft., the operational hospitals have 2,467 installed beds.

Global Health Limited’s hospital at Gurugram was ranked as the best private hospital in India for three consecutive years in 2020, 2021 and 2022, and was the only Indian private hospital to be featured in the list of top 200 global hospitals in 2021 and was featured in the list of top 250 global hospitals in 2022 by Newsweek.

Issue Details of Global Health Limited IPO

- IPO open from 03 Nov – 07 Nov 2022

- Face value: ₹2

- Price band: ₹319 to ₹336

- Market lot: 44 shares

- Minimum investment: ₹14,784

- Listing on: BSE and NSE

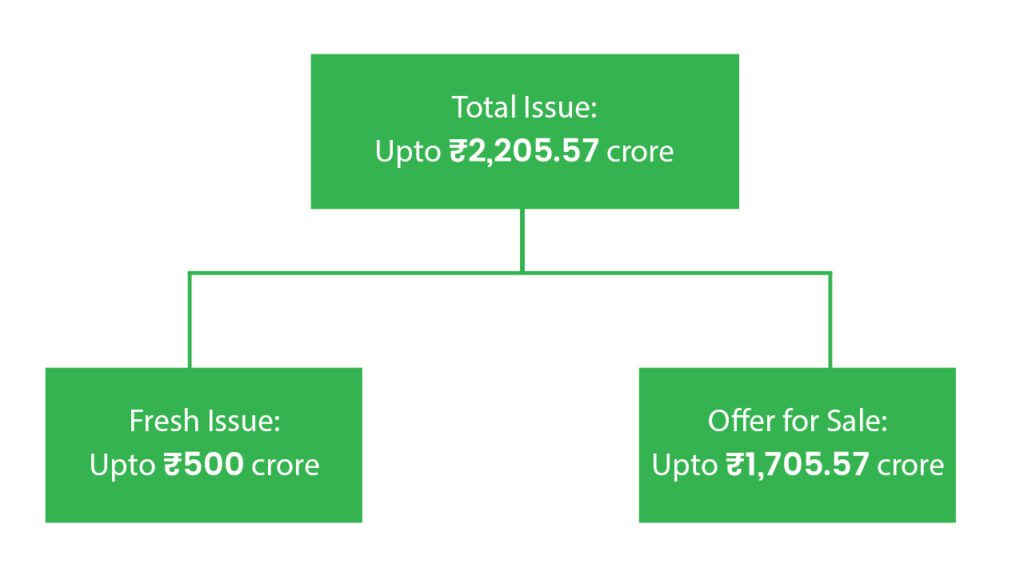

- Offer for sale: ₹2,205.57 Cr (Fresh Issue ₹500 Cr + OFS up to ₹1,705.57 Cr )

- Registrar: KFin Technologies Limited

- Promoters: Dr. Naresh Trehan

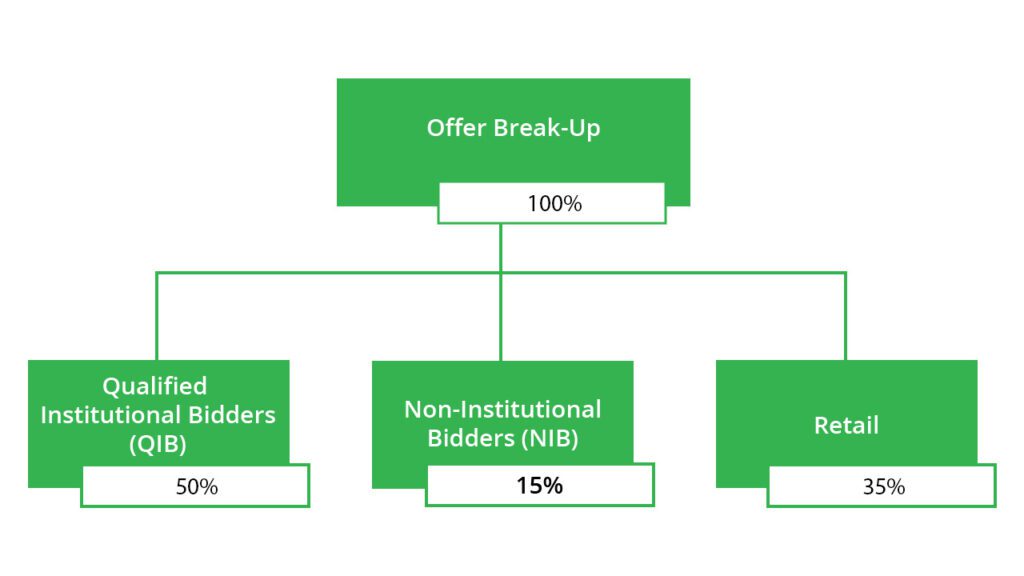

Offer Breakup

IPO Object

The company proposes to utilise the net proceeds of the fresh issue towards funding the following objects:

- Repayment/prepayment of borrowings, in full or part, of the Subsidiaries, GHPPL and MHPL.

- General corporate purposes.

IPO Strength

- Leading tertiary and quaternary care provider in India, well recognized for clinical expertise in particular in dealing with complicated cases.

- Focus on clinical research and academics.

- Large-scale hospitals with world-class infrastructure, high-end medical equipment, and technology.

- Track record of strong operational and financial performance.

- Focus on under-served areas with dense population and presence in top or capital cities of large states (NCR, Lucknow and Patna).

- Growth opportunities in existing facilities and diversification into new services, including digital health.

- Experienced senior management team with strong institutional shareholder support.

IPO Risk

- Stringent restrictions to slow down the spread of Covid-19, including limitations on international and local travel, had and could continue to have a negative impact on business.

- Highly dependent on doctors, nurses and other healthcare professionals thus, failure to retain or attract staff may hurt business.

- Failure to pass on high costs such as manpower cost, infrastructure maintenance and repair cost, high medical equipment cost to the patients.

- Developing or to be developed facilities may experience delays in construction, in reaching full operational capacity.

- Certain land parcels on which the hospital buildings and clinics operate are neither owned by the company nor leased to the company on a perpetual basis.

Peer Companies

- APOLLOHOSP (Apollo Hospitals Enterprise Limited)

- FORTIS (Fortis Healthcare Limited)

- MAXHEALTH (Max Healthcare Institute Limited)

- NH (Narayana Hrudayalaya Limited)

Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-20 | ₹2666.29 | ₹1544.27 | ₹36.33 |

| 31-Mar-21 | ₹2694.1 | ₹1478.16 | ₹28.8 |

| 31-Mar-22 | ₹3145.52 | ₹2205.82 | ₹196.2 |

Also Read: Sustainable Investing in India: ESG Investments

FPIs Invest in India | Weekly stock market newsletter 06 Nov