FPIs Invest in India | Weekly stock market newsletter 06 Nov

Get the latest stock market updates. Catch up on all that’s trending in the last week and get ready for the Monday markets with insights and stock recommendations from our expert research team.

In this article

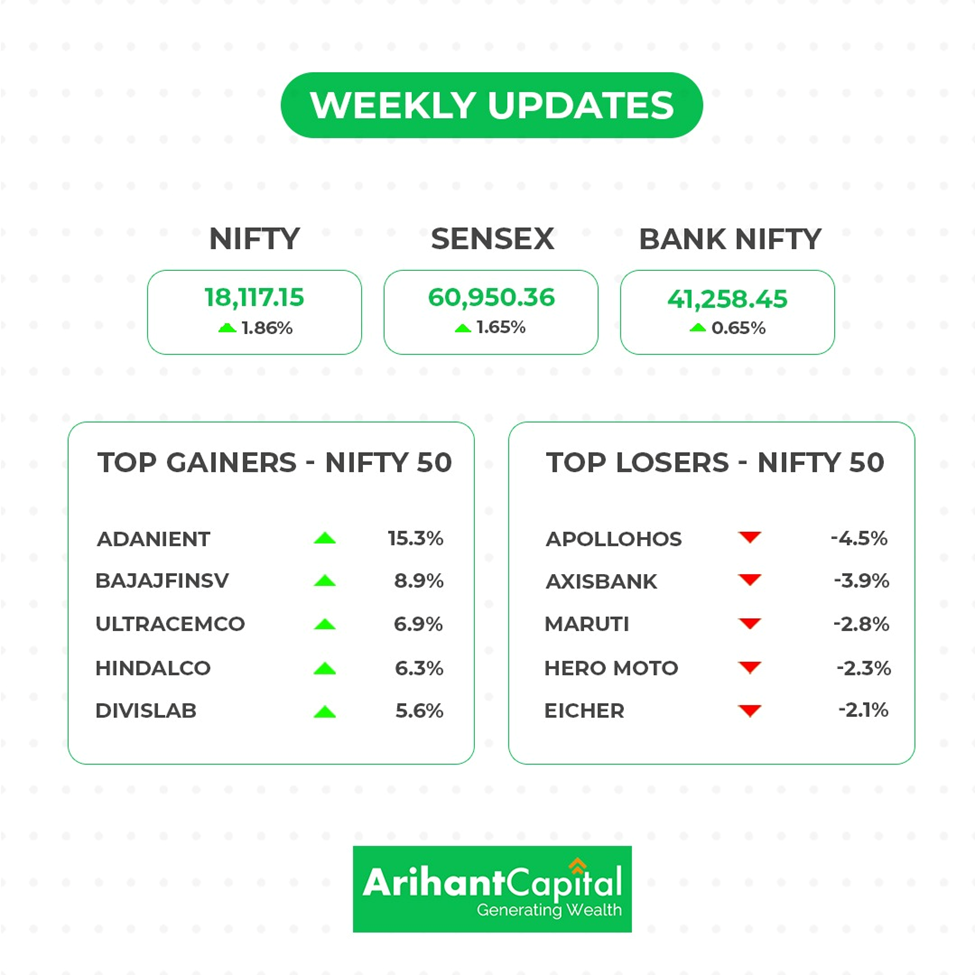

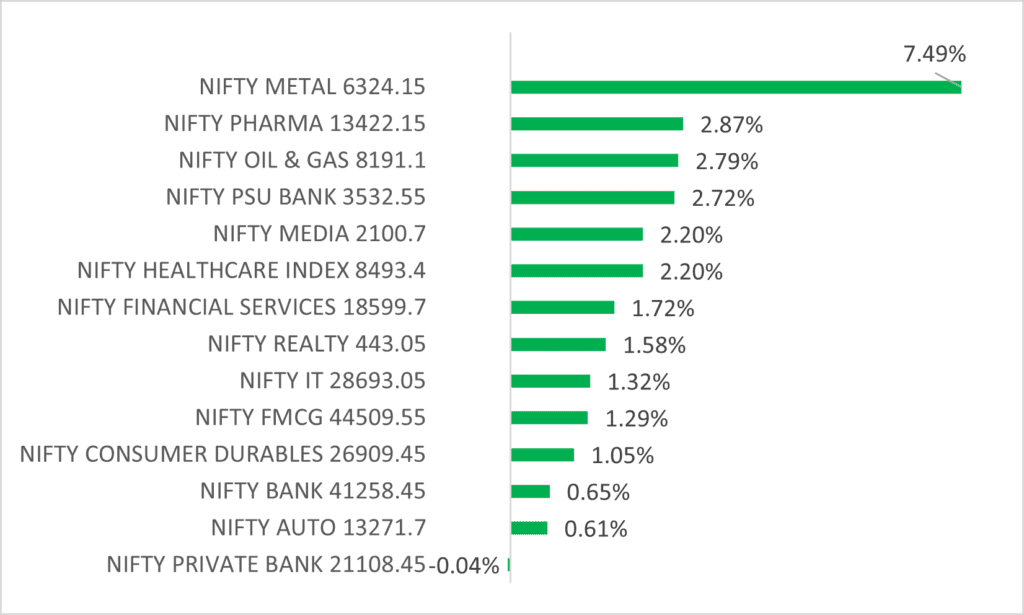

Let’s start with some good news- Nifty scaled Mt. 18K this week ending at 18,117(up by 1.86%), shortly after Sensex crossed 60K last week. Diwali gave a further push to consumption, which seems to be the driving force for India’s resilience story. Ever since we analysed the IMF’s global economic outlook (in our newsletter) to conclude that India shows a silver lining among gloomy global outlook, it was evident that investors will soon flock to India.

So this week, we saw FPIs making a strong comeback with a massive sum of Rs 15,280 crores. After being sellers for two months in continuation, why did foreign investors come back so strongly in November? Find out what Mrs Anita Gandhi (Head of Institutional Business at Arihant Capital) has to say on FPI inflows in this article. Surprisingly, even though FPI inflows in the equity market were high, FPI bond ownership hit record lows because of the narrowing gap between the US-India bond yields.

The Ever-Growing Rates:

Foreign portfolio buying has partly helped Indian markets withstand the continued hawkish stance of the Fed. While announcing another 75 bps hike this week, the Fed gave clear indications that it will take in the cumulative effect of all its tightening efforts before its December announcements. The Fed isn’t the only central bank raising its rates. The Bank of England surprised everyone by raising its benchmark rate by 75 bps, its biggest hike in 33 years. With the leadership change in the UK last week, (read last week’s newsletter ICYMI), economists had anticipated a less hawkish tone from UK’s central bank.

Coming back to the Indian stock markets, IPOs are back with three issues open in the past week, and more coming in the next week. (Read along for IPO News). The benchmark index Sensex also closed the week, higher by 1.65% at 60,950, whereas Bank Nifty, closed at 41,258 on Friday, up 0.65% from last week.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital

Nifty

On the technical daily chart of Nifty, we observe the price has filled its previous upward gap area. On the weekly chart, the Nifty broke and sustained above its upward trendline resistance level. It seems that stock-specific action will continue, and we will maintain buy on dips strategy. Nifty can face resistance around the 18,250 level if it starts to trade above then it can touch 18,400-18,550 levels, while on the downside support is 18,050 if it starts to trade below then it can test 17,800 and 17,650 levels.

Bank Nifty

On the daily and weekly chart of Bank Nifty, we observe a Doji candlestick pattern formation. It appears that Bank Nifty may remain in consolidation mode. In the coming trading session if it trades above 41,600 then it can touch 41,850 and 42,100 levels, however, the downside support comes at 40,900 below which it can touch 40,500-40,200 levels.

🚀IPO corner

- DCX Systems IPO subscribed close to 70X.

- Muted response: Fusion Microfinance IPO gets subscribed 2.95X on the last day. Medanta IPO was subscribed 0.449 times on day 2. Bikaji IPO gets 1.48 times subscription till day 2.

- Chennai-based NBFC- Five Star Business Finance IPO to open from Nov 9. The company has a fixed price band at ₹450 – ₹474 per share.

- Byju is finalising its IPO valuing tutoring unit, Aakash at up to $4 billion

- Kaynes Technology India Limited IPO opens on 10 Nov 2022.

- Archean Chemicals Industries Limited IPO to start on Nov 9 2022.

🔎Quick Bites

Global

- Global food prices hold at a 9-month low, easing the strain on households.

- The annual UN Climate change conference begins on Sunday.

- Euro zone’s October business activity contracted at the fastest pace since late 2020. ECB chief Christine Lagarde hinted at the possibility of a mild recession.

- Former Pakistan PM Imran Khan and several others were injured after gunmen opened fire at his anti-government march in Gujranwala.

Economy

- GST collections touch ₹1.52 lakh crores in Oct, the second-highest collection ever.

- RBI may send an inflation target report to the government by next Friday.

- Forex kitty swells by 6.56 billion to reach $531 billion in Oct end.

- CEA pegs medium-term India growth at 6.5-7%.

- JP Morgan expects India’s market capitalisation to touch $10 trillion in 2031.

Energy and Infrastructure

- Shapoorji Pallonji Group firm builds floating rig for ONGC’s KG Basin wells.

- Kalpataru Power bagged orders worth ₹1,290 crores.

- Adani Power will acquire DB power for ₹7,017 crore by Nov 30.

IT and Telecom

- Airtel crosses 10 lakh 5 G users.

- Infosys is likely to reclaim the No. 2 spot from Cognizant soon in terms of revenue.

- Centre puts Vi’s call about its ₹16,130-cr equity conversion plan on hold.

Automobile

- Car makers roll out discounts to get sales in high – gear.

- Tata Motors’ passenger vehicles to cost more from Nov 7

- Maruti Suzuki lines up ₹7,000 crore capex for the current financial year. Maruti Suzuki crosses crore production mark in Oct.

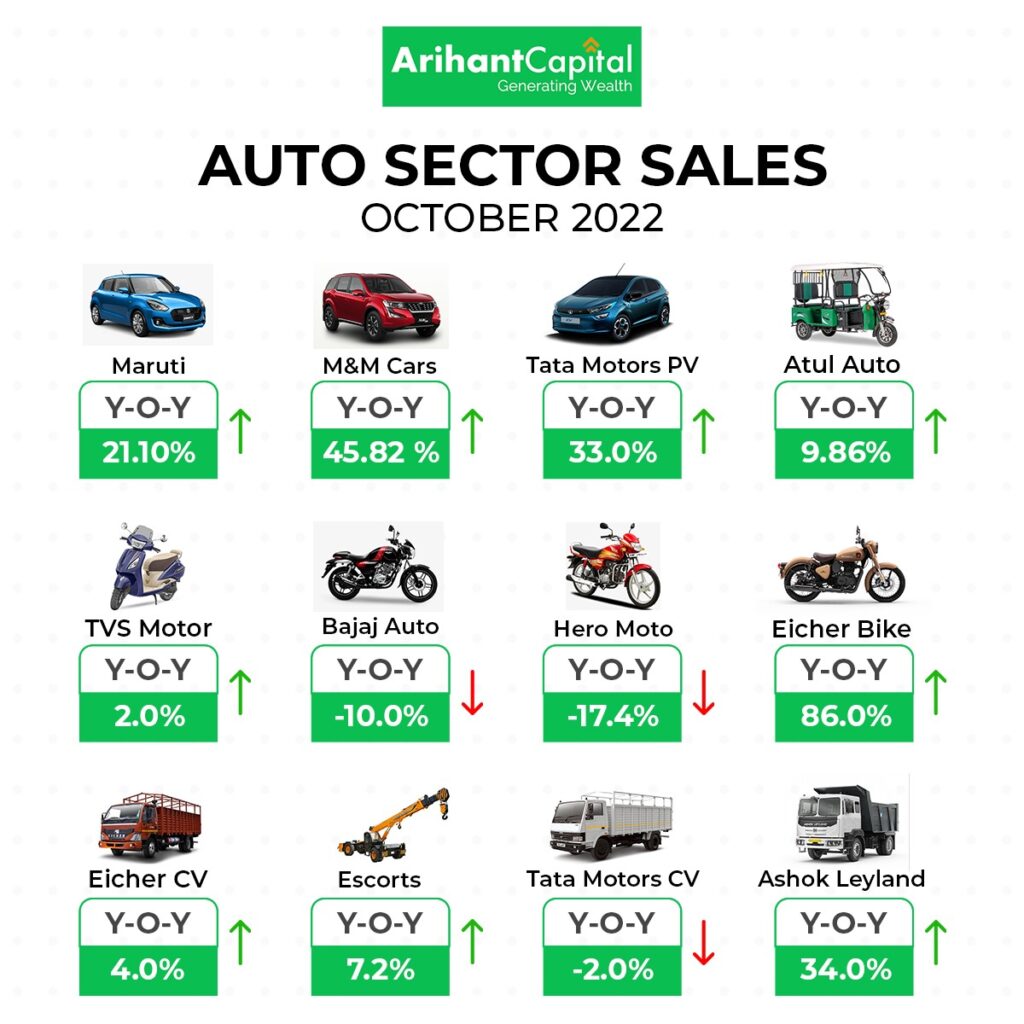

- 4-wheeler sales rise in Oct, and some 2-wheeler companies like Hero Moto and Bajaj Auto see a fall in sales. See a complete breakdown below.

Other

- Gati to buy out Japanese partner KWE’s stake in JV

- NCC Ltd gets orders worth ₹1,056 crores in Oct

- Reliance plans to enter the salon business and may buy 49% of Chennai-based Naturals Salons and Spa.

- Aditya Birla Group plans branded jewellery foray.

- Tata Consumer makes a juicy expansion with its NourishCo arm to take on rivals.

- Tata Group brings AirAsia India under Air India’s wings post acquiring a 16.67% stake for ₹155.65 crore.

- GE Aerospace and Tata Advanced Systems have extended their long-term contract (worth USD 1 bn).

📝Key Results

- SBI profit surges 74% to a record ₹13,265 crores on strong deposit growth and corporate loan demand.

- Indigo’s Q2 loss widens to ₹1,585 crores on pricier fuel and weak rupee.

- Titan reported a 34% YOY increase in net profit at ₹857 crores.

- Bank of Baroda profit rises 58% YOY for ₹3,312 crores

- TVS net profit rises 47% in Q2 to ₹408 crores.

- Jindal Stainless Hisar’s Q2 net falls 49% to ₹253 crores.

- Tata Steel’s net profit fell 87% YoY to ₹1,514 crores.

- Airtel’s consolidated profit rose 89% Year on Year to ₹2,145 crores

- Adani Enterprises Posts Over Two-Fold Increase in Q2 PAT at ₹461 crores

- GAIL’s profit fell 46% to ₹1,537 crores.

- Adani Ports’ profit jumped 68.5% YoY to ₹1,677 crores.

🔌Sustainability Corner

- India’s net-zero goal will need 50 million green jobs.

- ONGC is planning to set up 1 GW solar plant in Rajasthan.

- Adani New Energy installs India’s largest wind turbine in Gujarat.

- Ola Electric rolls out its 100,000th scooter within 11 months of production rollout of its first S1 Pro model from the Krishnagiri plant near Bengaluru.

- BYD India revs up network expansion after Atto 3 e-SUV unveil.

- Shared electric 2-wheeler Mobility-as-a-Service& Battery-as-a-Service provider Yulu to invest ₹1,200 crore in Karnataka, deploy 100,000 EVs & operationalise extensive EV battery charging and swapping infrastructure in the State over the next five years.

- Epsilon Advanced Materials inks MoU with government of Karnataka to invest ₹9,000 crore to set up EV battery material manufacturing plants in the state. Taiwan-based global tech player in battery swapping Gogoro enters the fleet segment in India with Zypp Electric.

- Bajaj Auto to invest ₹750 crore in FY2023 to expand manufacturing capacity for EVs as well as premium motorcycles.

- Ather Energy records its best-ever monthly sales in October: 8,213 units; smart electric-scooter maker sees sustained month-on-month growth; strong demand in Kerala, Maharashtra & Karnataka; cumulative sales of 35,439 units in first 7 months of FY2023.

- Indian government increases ethanol procurement prices, effective December 1; aims to accelerate the domestic E20 programme and reduce dependence on costly crude oil imports.

Also Read: Sustainable Investing in India: ESG Investments