Archean Chemical Industries Limited IPO is live now. Should you invest?

Archean Chemical Industries Limited IPO is live now. Should you apply? Find out here.

In this article

- IPO details

- Issue details

- Offer Breakup

- IPO Strengths

- Key Risks

- Archean Chemical Industries Limited Financials

📃About Archean Chemical Industries IPO

Archean Chemical Industries Limited is India’s largest exporter of bromine and industrial salt in Fiscal 2021. The company is the leading speciality marine chemical manufacturer in India and is focused on producing and exporting bromine, industrial salt, and sulphate of potash to customers around the world.

Archean Chemical Industries markets the products to 18 global customers in 13 countries and 24 domestic customers. The company was the largest exporter of industrial salt in India with exports of 2.7 million MT in Fiscal 2021.

Archean Chemical Industries Limited is the largest exporter of bromine from India. The company is the only manufacturer of sulphate potash in India. The company’s marine chemicals business is predominately conducted on a business-to-business basis both in India and internationally.

The company has an integrated production facility for the bromine, industrial salt, and sulphate of potash operations, located at Hajipir, Gujarat, located on the northern edge of the Rann of Kutch brine fields.

💰Issue Details of Archean Chemical Industries IPO

- IPO open from 09 Nov – 11 Nov 2022

- Face value: ₹2 per equity share

- Price band: ₹386 to ₹407

- Market lot: 36 shares

- Minimum investment: ₹14,652

- Listing on: BSE and NSE

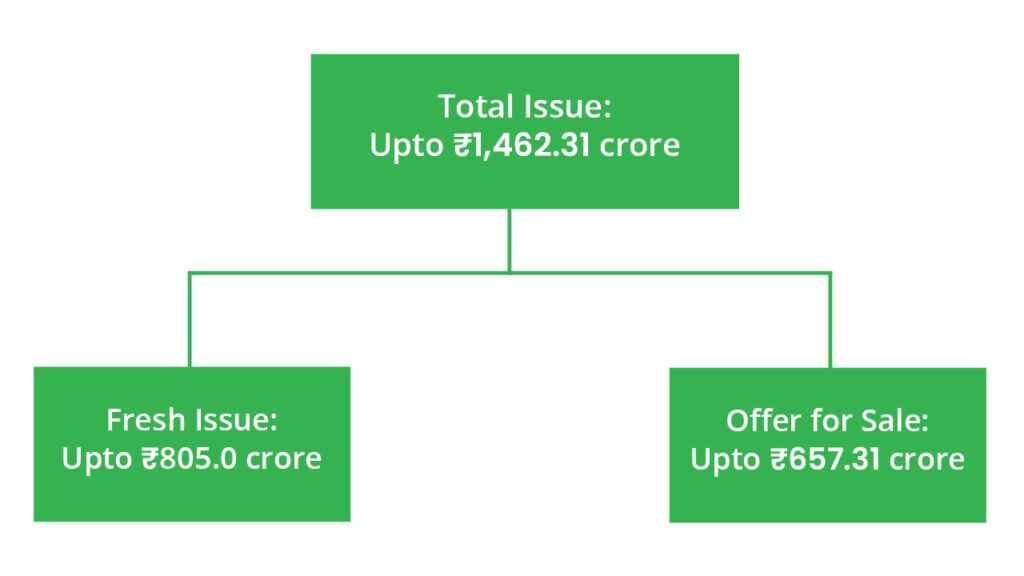

- Offer for sale: ₹1,462.31 Cr (Fresh Issue ₹805 Cr + OFS up to ₹657.31 Cr )

- Registrar: Link Intime India Private Ltd

- Promoters:

- Chemikas Speciality LLP

- Ravi Pendurthi and

- Ranjit Pendurthi

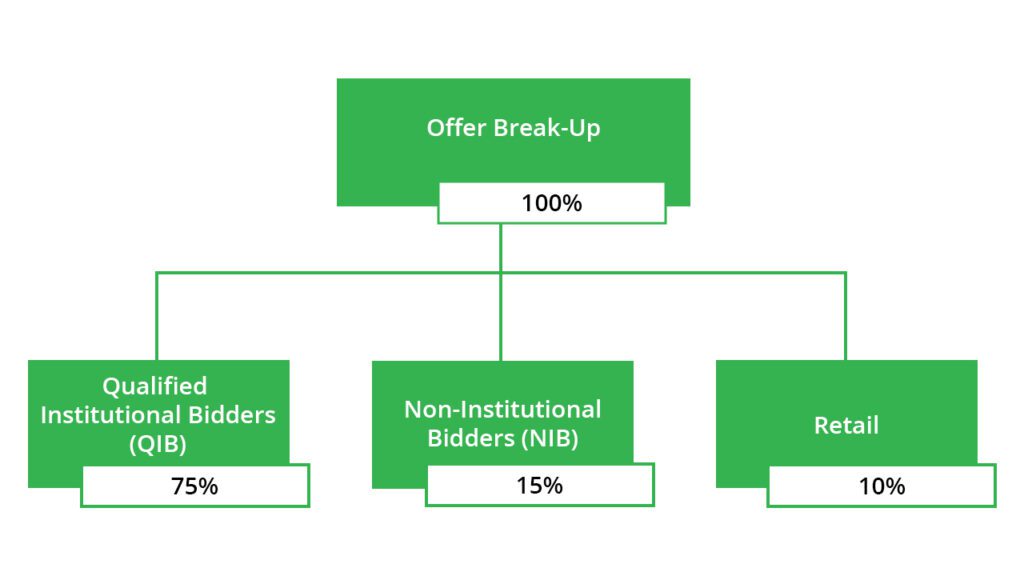

🪚Offer Breakup

🔭IPO Object

The company proposes to utilise the net proceeds of the fresh issue towards funding the following objects:

- Redemption or earlier redemption, in part or full of NCDs issued by the company.

- General corporate purposes

⛓️IPO Strength

Some of the qualitative factors and our strengths which form the basis for computing the offer price are:

- Leading market position, expansion and growth in bromine and industrial salt.

- High entry barriers in the speciality marine chemicals industry.

- Established infrastructure and integrated production with cost efficiencies.

- Focus on the environment and safety.

- Largest Indian exporter of bromine and industrial salt with a global customer base.

- Strong and consistent financial performance.

- Experienced management team, promoters and financial investors and stakeholders.

🧨IPO Risk

- The company is dependent on its manufacturing facility. Any slowdown or shutdown in its manufacturing operations or strikes, work stoppages or increased wage demands by its employees that could interfere with its operations could have an adverse effect on its business.

- Unsuccessful development of new bromine derivative products or continuation of product portfolio expansion in a timely and cost-effective.

- Debt was restructured as of March 18, 2017, with overdue principal and interest aggregating to₹17.74 crores with certain banks as on March 18, 2017.

- The company relies on a combination of trade secrets, copyright law and contractual restrictions to protect intellectual property. The company does not own any patents and its logo is not registered as a trademark.

- The company has received notices from regulatory authorities in the past; in particular from the environmental authorities, which may result in litigation, penalties, fines or cancellation or suspension of operating licenses.

⚖️Peer Companies

- Tata Chemicals Limited

- Deepak Nitrite Limited

- Aarti Industries Limited

- Neogen Chemicals Limited

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-20 | ₹1260.5 | ₹572.9 | ₹39.97 |

| 31-Mar-21 | ₹1428.6 | ₹617.0 | –₹39.24 |

| 31-Mar-22 | ₹1529.6 | ₹1142.8 | ₹188.58 |

📬Also Read: Sustainable Investing in India: ESG Investments

FPIs Invest in India | Weekly stock market newsletter 06 Nov