Kaynes Technology India Ltd IPO is live now. Should you invest?

Kaynes Technology India Ltd IPO is live now. Should you apply? Find out here.

In this article

- IPO details

- Issue details

- Offer Breakup

- IPO Strengths

- Key Risks

- Kaynes Technology India Ltd Financials

📃About Kaynes Technology India IPO

Kaynes Technology is a leading end-to-end and IoT solutions-enabled integrated electronics manufacturing company. The company provides conceptual design, process engineering, integrated manufacturing and life-cycle support for major players in the automotive, industrial, aerospace and defence, outer-space, nuclear, medical, railways, Internet of Things (“IoT”), Information Technology (“IT”) and other segments.

The company is among the first companies in India to offer design-led electronics manufacturing to original equipment manufacturers (“OEMs”). Kaynes Technology operates eight manufacturing facilities across India in the states of Karnataka, Haryana, Himachal Pradesh, Tamil Nadu, and Uttarakhand.

The company’s operations are classified under the following business verticals:

- OEM – Turnkey Solutions – Box Build (“OEM – Box Build”).

- OEM – Turnkey Solutions – Printed Circuit Board Assemblies (“PCBAs”) (“OEM – Turnkey Solutions”).

- ODM: The company offers ODM services in smart metering technology, smart street lighting, and brushless DC (“BLDC”) technology.

- Product Engineering and IoT Solutions: The company offer conceptual design and product engineering services in industrial and consumer segments.

Kaynes Technology operates eight manufacturing facilities across India in the states of Karnataka, Haryana, Himachal Pradesh, Tamil Nadu, and Uttarakhand.

As of June 30, 2022, the company’s research and development team comprised 19 employees, including engineers, designers and other workers.

In nine months ended June 30, 2022, the company served 229 customers in 21 countries globally and multiple industry verticals such as automotive, aerospace and defence, industrial, railways, medical and IT / ITES. The company works with over 871 vendors and sources materials from various regions including North America, Europe, and Singapore as well as locally within India, as of June 30, 2022.

💰Issue Details of Kaynes Technology India IPO

- IPO open from 10 Nov – 14 Nov 2022

- Face value: ₹10 per equity share

- Price band: ₹559 to ₹587

- Market lot: 25 shares

- Minimum investment: ₹14,675

- Listing on: BSE and NSE

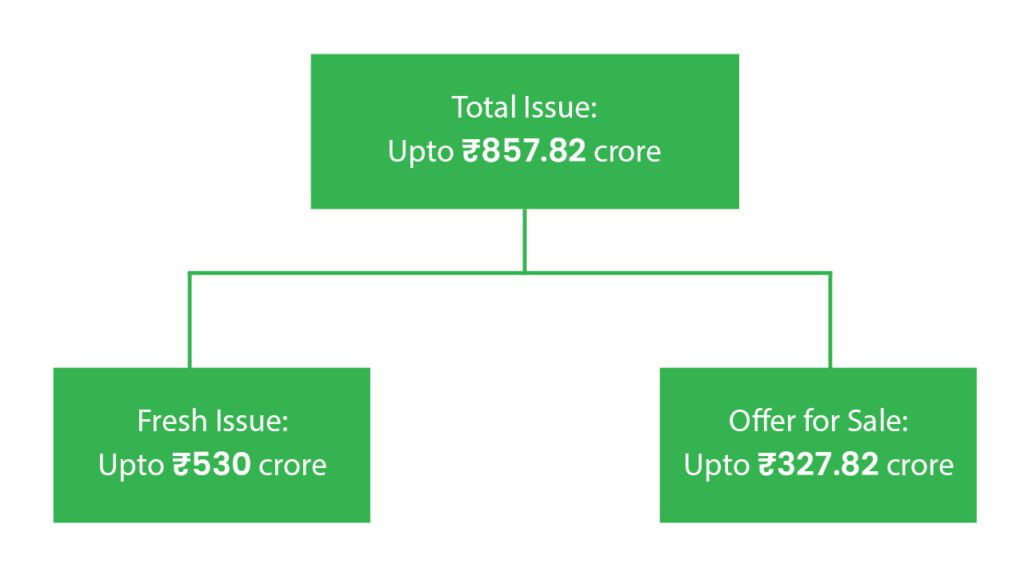

- Offer for sale: ₹857.82cr (Fresh issue of ₹530cr +OFS of ₹327.82cr)

- Registrar: Link Intime India Private Ltd

- Promoters:

- Ramesh Kunhikannan

- Savitha Ramesh

- RK Family Trust

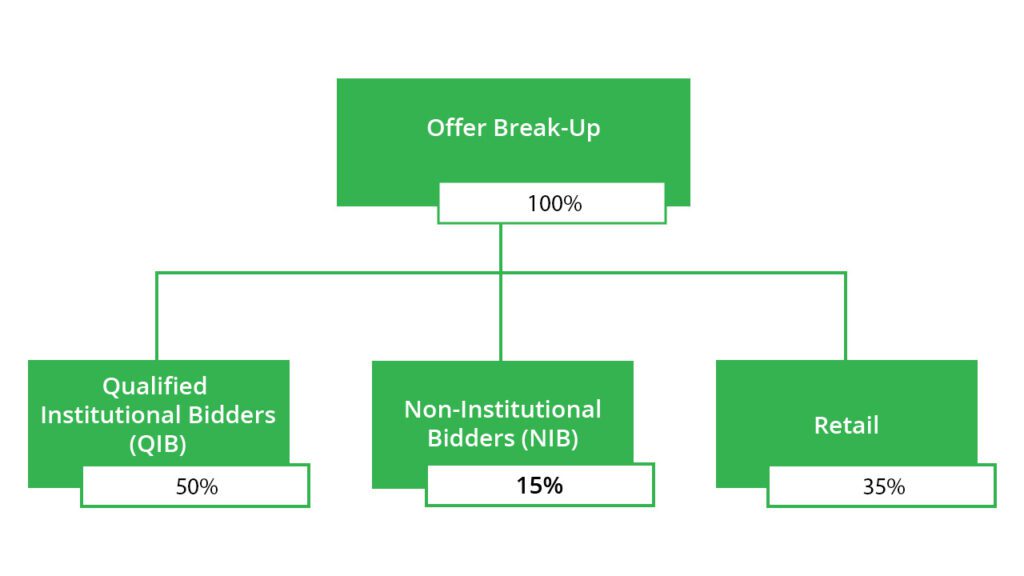

🪚Offer Breakup

🔭IPO Object

The company proposes to utilise the net proceeds towards funding the following objects:

- Repayment/ prepayment, in full or part, of certain borrowings availed by the company.

- Funding capital expenditure towards the expansion of the existing manufacturing facility at Mysore, Karnataka, and near the existing manufacturing facility at Manesar, Haryana.

- Investment in the wholly owned subsidiary, Kaynes Electronics Manufacturing Private Limited, for setting up a new facility at Chamarajanagar, Karnataka.

- Funding the working capital requirements of the company.

- General corporate purposes.

⛓️IPO Strength

Some of the qualitative factors and our strengths which form the basis for computing the offer price are:

- Internet of Things (“IoT”) solutions enabled integrated electronics manufacturing players with end-to-end capabilities across the Electronics System Design and Manufacturing spectrum.

- The diversified business model with a portfolio has applications across industry verticals.

- Global certifications for each industry vertical catered to and multiple facilities across India with advanced infrastructure.

- Strong supply chain and sourcing network.

🧨IPO Risk

- Increasing competition in the electronics system design and manufacturing industry may create pressures on pricing and market share.

- Any slowdown, shutdown or disruption in its manufacturing facilities may be caused by natural and other disasters causing unforeseen damage.

- The loss of one or more customers or a reduction in demand for the products.

- Inability to formalize and operationalised effective business and growth strategy.

⚖️Peer Companies

- Dixon Technologies Limited

- Amber Enterprises India Limited

- Syrma SGS Technology Limited

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-20 | ₹378.12 | ₹370.17 | ₹9.36 |

| 31-Mar-21 | ₹419.37 | ₹424.66 | ₹9.73 |

| 31-Mar-22 | ₹622.42 | ₹710.35 | ₹41.68 |

📬Also Read: Sustainable Investing in India: ESG Investments