Five Star Business Finance Ltd IPO is live now. Should you invest?

Five Star Business Finance Ltd IPO is live now. Should you apply? Find out here.

In this article

- IPO details

- Issue details

- Offer Breakup

- IPO Strengths

- Key Risks

- Five Star Business Finance Ltd Financials

📃About Five Star Business Finance IPO

Incorporated in 1984, Five Star Business Finance Limited is an NBFC-ND-SI (Non-Banking Finance Company) providing secured business loans to micro-entrepreneurs and self-employed individuals. The company has an extensive network of 311 branches, as of June 30, 2022, spread across eight states and one union territory and approximately 150 districts across India, with Tamil Nadu, Andhra Pradesh, Telangana and Karnataka being the key states.

Five Star Business Finance Limited has created a business model based on identifying an appropriate risk framework and the ideal instalment-to-income ratio to make sure that customers have the resources to repay the loan after meeting their regular obligations and other event-based capital requirements.

The company is headquartered in Chennai, Tamil Nadu with a strong presence in south India. As of September 30, 2021, we had a total of 4,306 employees.

The company has provided loans to more than 185,000 customers in total. They had an active loan base of 230,175 and 217,745 as of June 30, 2022, and March 31, 2022, respectively.

With more than 30,000 million in AUM, the company has the fasted AUM growth among the compared peers. As of June 30, 2022, and March 31, 2022, the Total Borrowings were Rs 25,203.19 million and Rs 25,588.31 million, respectively.

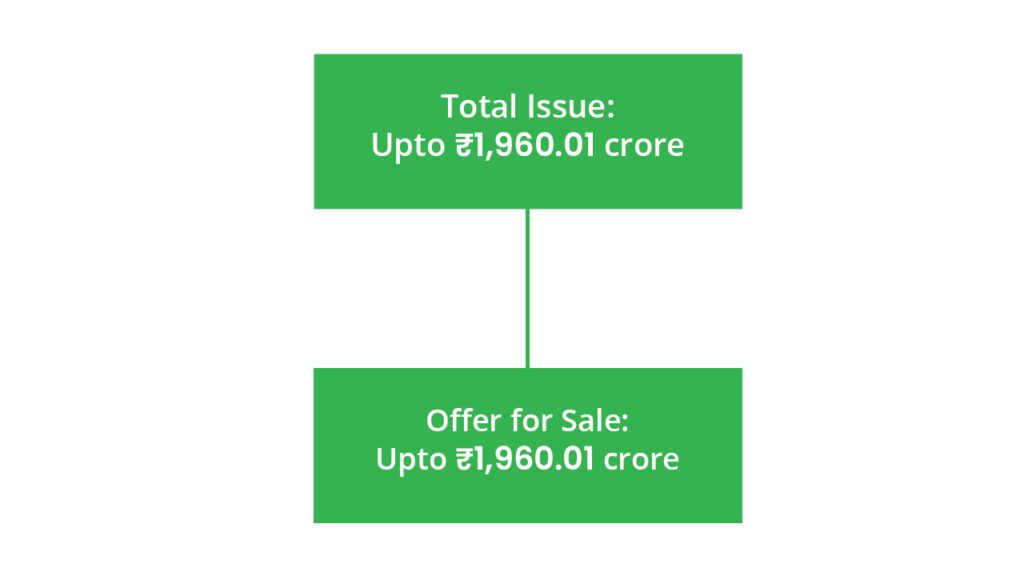

💰Issue Details of Five Star Business Finance IPO

- IPO open from 09 Nov – 11 Nov 2022

- Face value: ₹1 per equity share

- Price band: ₹450 to ₹474 Per Share

- Market lot: 31 shares

- Minimum investment: ₹14,694

- Listing on: BSE and NSE

- Offer for sale: ₹1,960.01cr

- Registrar: KFin Technologies Limited

- Promoters:

- Lakshmipathy Deenadayalan;

- Hema Lakshmipathy;

- Shritha Lakshmipathy;

- Matrix Partners India Investment Holdings II, LLC; and

- SCI Investments V.

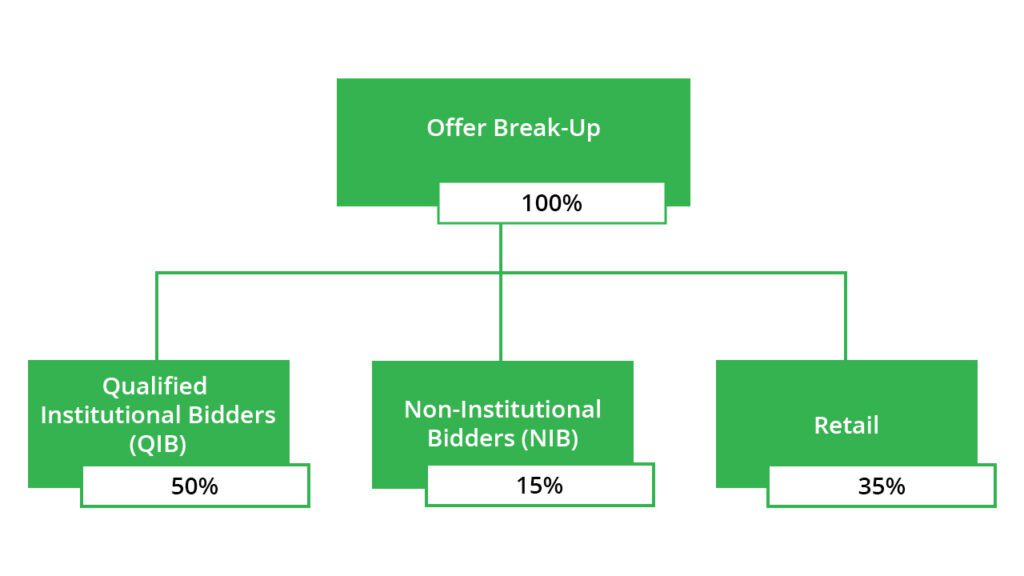

🪚Offer Breakup

🔭IPO Object

The company proposes to utilise the net proceeds towards funding the following objects:

- Carry out the Offer for Sale.

- Achieve the benefits of listing the Equity Shares on the Stock Exchanges.

- The Company will not receive any proceeds from the Offer and all such proceeds will go to the Selling Shareholders.

⛓️IPO Strength

Some of the qualitative factors and our strengths which form the basis for computing the offer price are:

- Fastest AUM growth among our compared peers with more than Rs. 30,000 million in AUM, with strong return and growth metrics and a significant potential addressable market (CRISIL Report).

- Among the select institutions to develop an underwriting model that evaluates the cash flows of small business owners and self-employed individuals in the absence of traditional documentary proofs of income.

- Strong on-ground collections infrastructure leading to our ability to maintain robust asset quality.

- Ability to successfully expand to new underpenetrated geographies through a calibrated expansion strategy.

- 100% in-house sourcing, comprehensive credit assessment and robust risk management and collections framework leading to good asset quality.

🧨IPO Risk

- The risk of non-payment or default by our borrowers may adversely affect our business, results of operations and financial condition.

- Financials are affected by volatility in interest rates for both our lending and treasury operations

- The inability to maintain a capital adequacy ratio could adversely affect business.

- The company had negative net cash flows in the past and may continue to have negative cash flows in the future

- Unable to identify, monitor and manage risks or effectively implement our risk management policies.

- Non-compliance with the RBI’s observations made pursuant to its periodic inspections and violations of regulations prescribed by the RBI could expose them to certain penalties and restrictions.

⚖️Peer Companies

- Aavas Financiers LTD

- Aptus Value Housing Finance India Ltd

- Au Small Finance Bank LTD

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-20 | ₹4353.15 | ₹787.35 | ₹261.95 |

| 31-Mar-21 | ₹5,794 | ₹1051.26 | ₹358.99 |

| 31-Mar-22 | ₹6,343 | ₹1256.17 | ₹453.54 |

📬Also Read: Sustainable Investing in India: ESG Investments