Inox Green Energy Services Limited IPO is live now. Should you invest?

Inox Green Energy Services Limited IPO is live now. Should you apply? Find out here.

In this article

- IPO details

- Issue details

- Offer Breakup

- IPO Strengths

- Key Risks

- Inox Green Energy Services Financials

📃About Inox Green Energy Services IPO

Incorporated in 2012, Inox Green Energy Services Limited is one of the major wind power operation and maintenance (O&M) service providers within India. The company is a subsidiary of Inox Wind Limited (IWL), a company which is listed on the National Stock Exchange of India Limited and BSE Limited, and part of the Inox GFL group of companies.

The company is engaged in the business of providing long-term O&M services for wind farm projects, specifically the provision of O&M services for wind turbine generators (WTGs).

Inox Green Energy services Limited provides exclusive O&M services for all wind turbine generators (WTGs) sold by IWL through the entry of long-term O&M contracts between the WTG purchaser and Inox for terms which typically range between five to 20 years.

As of March 31, 2022, the company has a team of 393 employees including managers with extensive experience in the O&M of WTGs and the wind industry generally.

The company has a presence in Gujarat, Rajasthan, Maharashtra, Madhya Pradesh, Karnataka, Andhra Pradesh, Kerela and Tamil Nadu. The company’s total revenue (from the continuing operations i.e. the O&M business) was ₹172.2 crores, ₹172.3 crores and₹ 165.3 crores for fiscals 2022, 2021 and 2020, respectively.

💰Issue Details of Inox Green Energy Services IPO

- IPO open from 11 Nov – 15 Nov 2022

- Face value: ₹10 per equity share

- Price band: ₹61 to ₹65 Per Share

- Market lot: 230 shares

- Minimum investment: ₹14,950

- Listing on: BSE and NSE

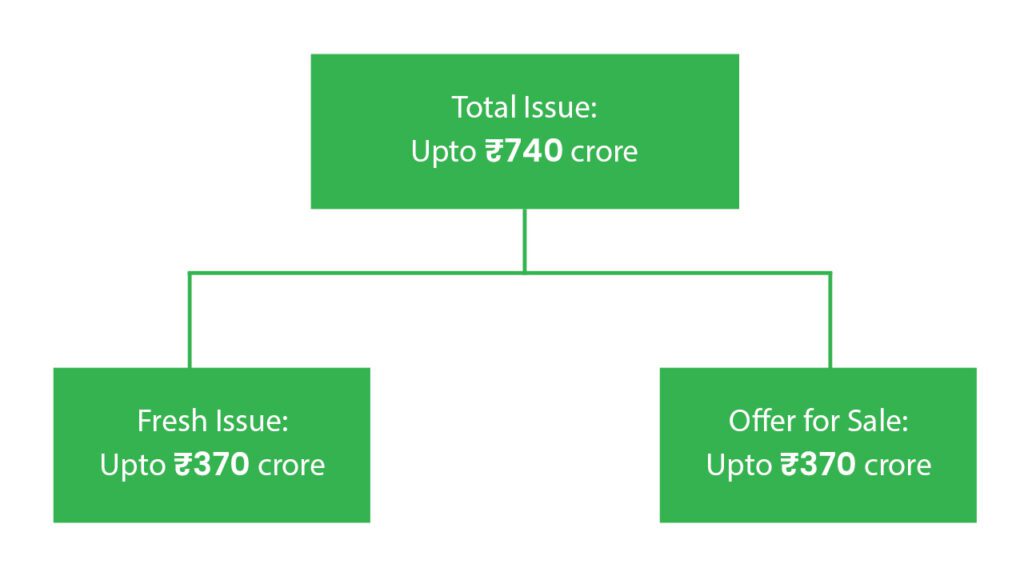

- Offer for sale: ₹740 Cr (Fresh Issue of ₹370 Cr + OFS of ₹370 Cr)

- Registrar: Link Intime India Private Ltd

- Promoters: Inox Wind Limited

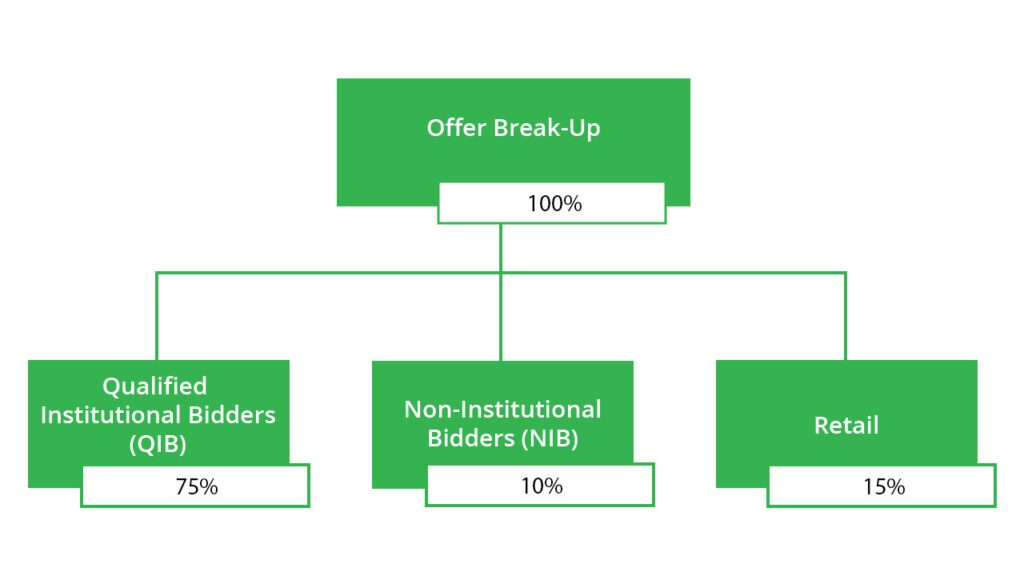

🪚Offer Breakup

🔭IPO Object

The offer comprises the fresh issue and the offer for sale by Inox Wind Limited, the selling shareholder.

The net proceeds of the fresh issue, are proposed to be utilized in the following manner:

- Repayment and/ or pre-payment, in full or part, of certain borrowings availed by the company including redemption of non-convertible debentures in full

- General corporate purposes.

⛓️IPO Strength

Some of the qualitative factors and our strengths which form the basis for computing the offer price are:

- Strong and diverse existing portfolio base

- Established track record, favourable national policy support and visibility for future growth

- Reliable cash flow supported by long-term O&M contracts with high credit quality counterparties.

- Supported and promoted by its parent company, IWL.

- Established supply chain in place.

- Strong and experienced management team.

🧨IPO Risk

- The company is entirely dependent on Inox Wind Limited.

- The sale of services and renewal rate of service contracts may decrease in the future.

- There are outstanding legal proceedings involving the company, its subsidiaries, directors, promoters, and group companies

- The demand for services is primarily dependent on electricity demand

- The company is dependent on external suppliers for spares and components.

- Unable to effectively manage its future growth and expansion

⚖️Peer Companies

- There are no listed companies in India that are comparable in all aspects of business and services that Inox Green provides.

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-20 | ₹2339.86 | ₹172.16 | ₹1.68 |

| 31-Mar-21 | ₹2692.8 | ₹186.29 | ₹-27.73 |

| 31-Mar-22 | ₹2120.65 | ₹190.23 | ₹-4.95 |

📬Also Read: Sustainable Investing in India: ESG Investments