Keystone Realtors Limited IPO is being live. Should you invest?

Keystone Realtors Limited IPO is Being live. Should you apply? Find out here.

In this article

- IPO details

- Issue details

- Offer Breakup

- IPO Strengths

- Key Risks

- Keystone Realtors Limited Financials

📃About Keystone Realtors Limited IPO

Incorporated in 1995, Keystone Realtors Limited is one of the prominent real estate developers. The company is engaged primarily in the business of real estate construction, development, and other related activities in India.

As of June 30, 2022, the company had 32 Completed Projects, 12 Ongoing Projects, and 21 Forthcoming Projects across the Mumbai Metropolitan Region (“MMR”) that includes a comprehensive range of projects under the affordable, mid and mass, aspirational, premium and super premium categories, all under the Rustomjee brand.

June 30, 2022, Keystone Realtors have developed 20.22 million square feet of high-value and affordable residential buildings, premium gated estates, townships, corporate parks, retail spaces, schools, iconic landmarks, and various other real estate projects.

As part of the business model, the company is entering into joint development agreements, redevelopment agreements with landowners or developers, or societies, and slum rehabilitation projects, which requires lower upfront capital investment compared to the direct acquisition of land parcel.

The company has adopted an integrated real estate development model for every stage of the property development life cycle, commencing from business development, which involves the identification of land parcels and the conceptualization of the development, to execution, comprising planning, designing, and overseeing the construction activities, marketing, and sales.

As of June 30, 2022, the company has developed over 280 buildings and homes for over 14,000 families.

💰Issue Details of Keystone Realtors Limited IPO

- IPO open from 14 Nov – 16 Nov 2022

- Face value: ₹10 per equity share

- Price band: ₹514 to ₹541 Per Share

- Market lot: 27 shares

- Minimum investment: ₹14,607

- Listing on: BSE and NSE

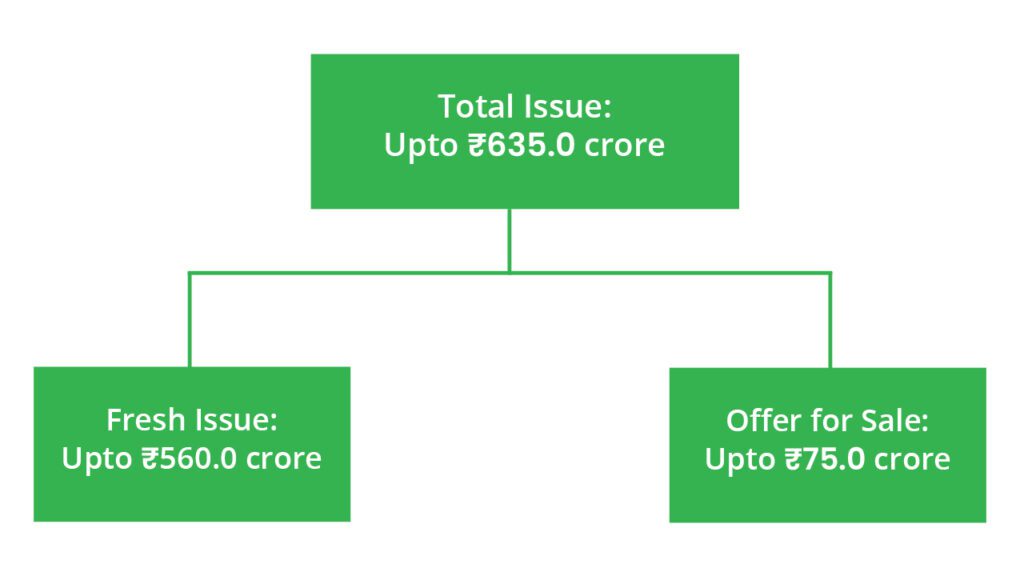

- Offer for sale: ₹635 Cr (Fresh Issue of ₹560 Cr + OFS of ₹75 Cr)

- Registrar: Link Intime India Private Ltd

- Promoters:

- Boman Rustom Irani

- Percy Sorabji Chowdhry

- Chandresh Dinesh Mehta

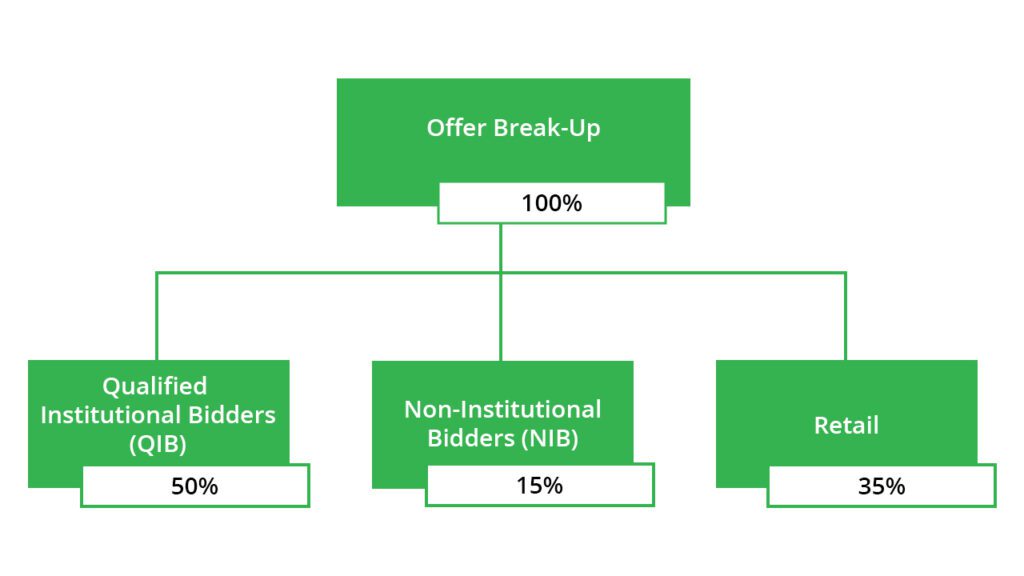

🪚Offer Breakup

🔭IPO Object

The offer comprises the fresh issue and the offer for sale by Inox Wind Limited, the selling shareholder.

The net proceeds of the fresh issue, are proposed to be utilized in the following manner:

- Repayment/ prepayment, in full or part, of certain borrowings availed by the company and/or certain of the company subsidiaries

- Funding acquisition of future real estate projects

- General corporate purposes.

⛓️IPO Strength

Some of the qualitative factors and our strengths that form the basis for computing the offer price are:

- Well-established customer-centric brand in the Mumbai Metropolitan Region.

- Amongst the leading residential real estate development companies in MMR with a well-diversified portfolio and strong pipeline.

- Technology-focused operations resulting in operational efficiency and enhancing customer experiences

- Strong focus on sustainable development

- Experienced promoters, qualified senior management, good corporate governance, and a committed employee base

🧨IPO Risk

- The company’s business is significantly dependent on the performance of the real estate market generally in India and particularly in the Mumbai Metropolitan Region (“MMR”). Varying market conditions in the MMR may adversely affect its financial condition.

- Shortage of land for development in the MMR or a significant increase in the cost of such land or transferable development rights available for development in the MMR may adversely impact business prospects.

- An inability to complete ongoing projects and forthcoming projects by their respective expected completion dates.

- Certain unsecured loans have been availed by the company which may be recalled by lenders.

- The growth plan could be adversely affected by the incidence and change in the rate of property taxes and stamp duties.

⚖️Peer Companies

- Macrotech Developers Limited

- Godrej Properties Limited

- Oberoi Realty Limited

- Sunteck Realty Limited

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-20 | ₹4415.31 | ₹1,269 | ₹14 |

| 31-Mar-21 | ₹3654.1 | ₹1,177 | ₹232 |

| 31-Mar-22 | ₹3876.84 | ₹1,303 | ₹136 |

📬Also Read: Sustainable Investing in India: ESG Investments

Climbing up | Stock Market Weekly Update Newsletter 13 Nov