Blue Jet Healthcare Limited’s IPO is live. Should you Invest?

In this article

- IPO details

- Issue details

- Offer Breakup

- IPO Strengths

- Key Risks

- Blue Jet Healthcare Limited Financials

📃About Blue Jet Healthcare Limited

Incorporated in 1968, Blue Jet Healthcare is a pharmaceutical and healthcare ingredient and an intermediate company. Blue Jet Healthcare was India’s first manufacturer of saccharin and its salts (artificial sweeteners). They later expanded into contrast media intermediates used in CT scans and MRIs. The company mainly deals in three product categories: (i) contrast media intermediates, (ii) high-intensity sweeteners, and (iii) pharma intermediates and active pharmaceutical ingredients.

Blue Jet Healthcare is a global, science-led pharmaceutical company. They are the provider of:

- Process development and production capabilities

- Global regulatory support

- Collaborate, develop, and manufacture advanced pharmaceutical intermediates and APIs.

The company has three manufacturing facilities, which are situated in Shahad (Unit I), Ambernath (Unit II) and Mahad (Unit III) in the state of Maharashtra, India, with an annual installed capacity of 200.60 KL, 607.30 KL and 213.00 KL, respectively, as of June 30, 2023.

The company’s core strength lies in the following

- Huge manufacturing capacity of contrast media intermediates in India.

- The company operates in a niche market that has high entry barriers.

- Long-term relationships and long-term contracts with multi-national customers.

💰Issue Details of Blue Jet Healthcare Limited

- IPO open from 25th Oct 2023 – 27th Oct 2023

- Face value: ₹2 per equity share

- Price band: ₹329 to ₹346 per share

- Market lot: 43 shares

- Minimum Investment: ₹14,878

- Listing on: BSE and NSE

- Offer for sale: Approx ₹840.27 Cr (Fresh Issue: ₹840.27 Cr)

- Registrar: Link Intime India Private Ltd

🪙Total Issue Price

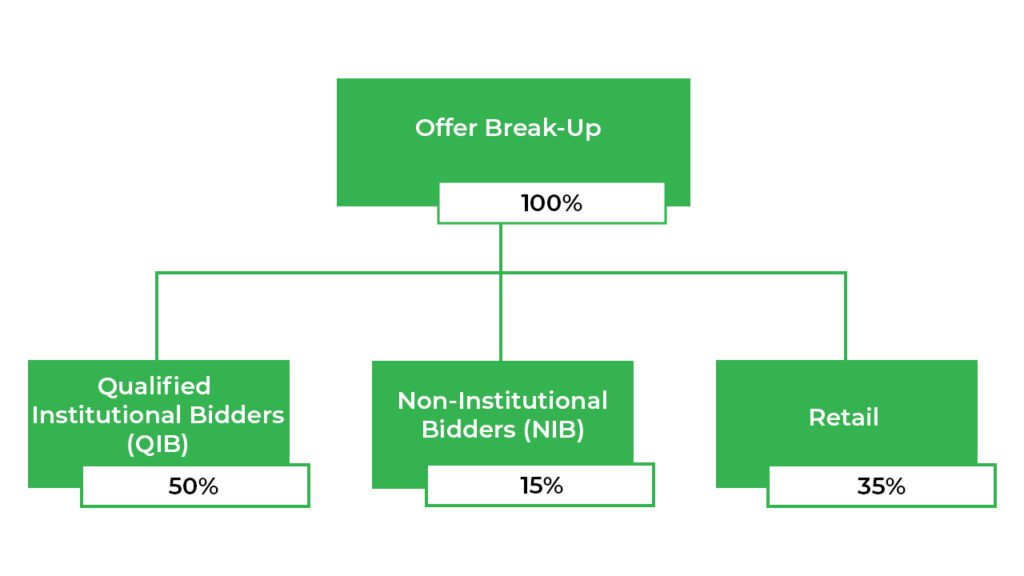

🪚Offer Breakup

🔭IPO Object

The company will not receive any proceeds from the Offer, and all the Offer Proceeds will be received by the Selling Shareholders in proportion to the Offered Shares sold by the respective Selling Shareholders as part of the Offer.

⛓️IPO Strength

Some of the qualitative factors and strengths that form the basis for computing the Offer Price are:

- Large manufacturer of contrast media intermediates in India

- Presence in niche categories with high barriers to entry

- Long-standing relationships and multi-year contracts with multi-national customers

- Strong product development and process optimization capabilities with a focus on sustainability

🧨IPO Risk

- Their business depends on selling their products to a few key customers, including those in Europe and the United States. The loss of one or more such customers may adversely affect their business.

- If they cannot commercialize new products promptly, their business, financial condition and prospects will be adversely affected.

- Any delay, interruption or reduction in the supply or transportation of raw materials or an increase in the costs of such raw materials to manufacture their products may adversely affect their business, results of operations, financial condition and cash flows

- Their manufacturing facilities and procurement operations are concentrated in one state, and any adverse developments affecting this region could harm their business, results of operations and financial condition.

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-21 | ₹536.27 | ₹507.81 | ₹135.79 |

| 31-Mar-22 | ₹713.38 | ₹702.88 | ₹181.59 |

| 31-Mar-23 | ₹862.07 | ₹744.94 | ₹160.03 |

PEER COMPANIES

- N.A.

📬Also Read: A Simple Guide: Opening a Demat Account for Minors in Bharat