Why is SEBI Cracking Down on Finfluencers? Weekly Stock Market Update Oct 28

Hello Readers!

We hope you had a great week!

You won’t believe what happened on May 25, August 25, and October 25 this year. It’s not just the date 25, but something more interesting.

In those days, the Securities and Exchange Board of India (SEBI) took action against people known as “finfluencers.” Finfluencers advise on stock market trading and mutual funds, especially on social media.

Here is a quick rundown of what went down on those dates:

- May 25: SEBI banned a YouTuber and trader named PR Sundar for a year because he broke some rules for investment advisers. They also told him to pay a hefty fine.

- August 25: SEBI started discussing ways to control these finfluencers and the problems they cause.

- October 25: SEBI banned a person who goes by ‘Baap of Chart’ on social media and a company called Shivaay Investments. They said these folks need to pay back a bunch of money.

So, why is SEBI cracking down on finfluencers? 🤔

Well, these people are advising on investments without proper authorisation. They have a lot of followers on Instagram, Facebook, YouTube, and other social platforms.

The trouble is, they often don’t tell you if they’re getting paid to say what they’re saying, and sometimes, their advice could be better.

SEBI is worried because these finfluencers might lead regular folks into risky investments. You know, like convincing someone to buy something shady. That’s not good.

The exciting part is that the timing of SEBI’s actions is essential. After 2020, when many people started investing more because of COVID-19, the number of finfluencers exploded 😬.

That’s cool when things are going well, but if the stock market suddenly drops, it could be a mess.

SEBI wants to ensure everything runs smoothly, so they’re taking action. The fact that they did it three times shows they’re pretty serious about keeping these influencers in check. 😊

🧾In this Article

📈Market Outlook

– Mr Abhishek Jain, Head of Research, Arihant Capital

Indian stock market indices saw a 1% rise on Friday, rebounding from a six-day decline driven by geopolitical concerns related to the Israel-Hamas conflict, increased crude oil prices, and expectations of prolonged high U.S. interest rates.

The market recovered due to reduced FII selling, along with stabilisation in currency and global bond yields. Q2 earnings results have been decent, aligning with optimistic estimates.

Still, the market’s enthusiasm is tempered by the anticipation of potential earnings downgrades, stemming from concerns about a global economic slowdown due to higher interest rates and geopolitical risks.

The robust domestic inflow in India has provided significant support to the overall stock indices, preventing the erosion of gains and contributing to a reduction in overall market volatility.

In the Nifty 50 Index, ITC Ltd., Dr Reddy’s Laboratories Ltd., Asian Paints Ltd., UPL Ltd., and SBI Life Insurance Company Ltd. were exerting an antagonistic movement. At the same time, Reliance Industries Ltd., Axis Bank Ltd., Infosys Ltd., State Bank of India Ltd., and Larsen & Toubro Ltd. made positive contributions.

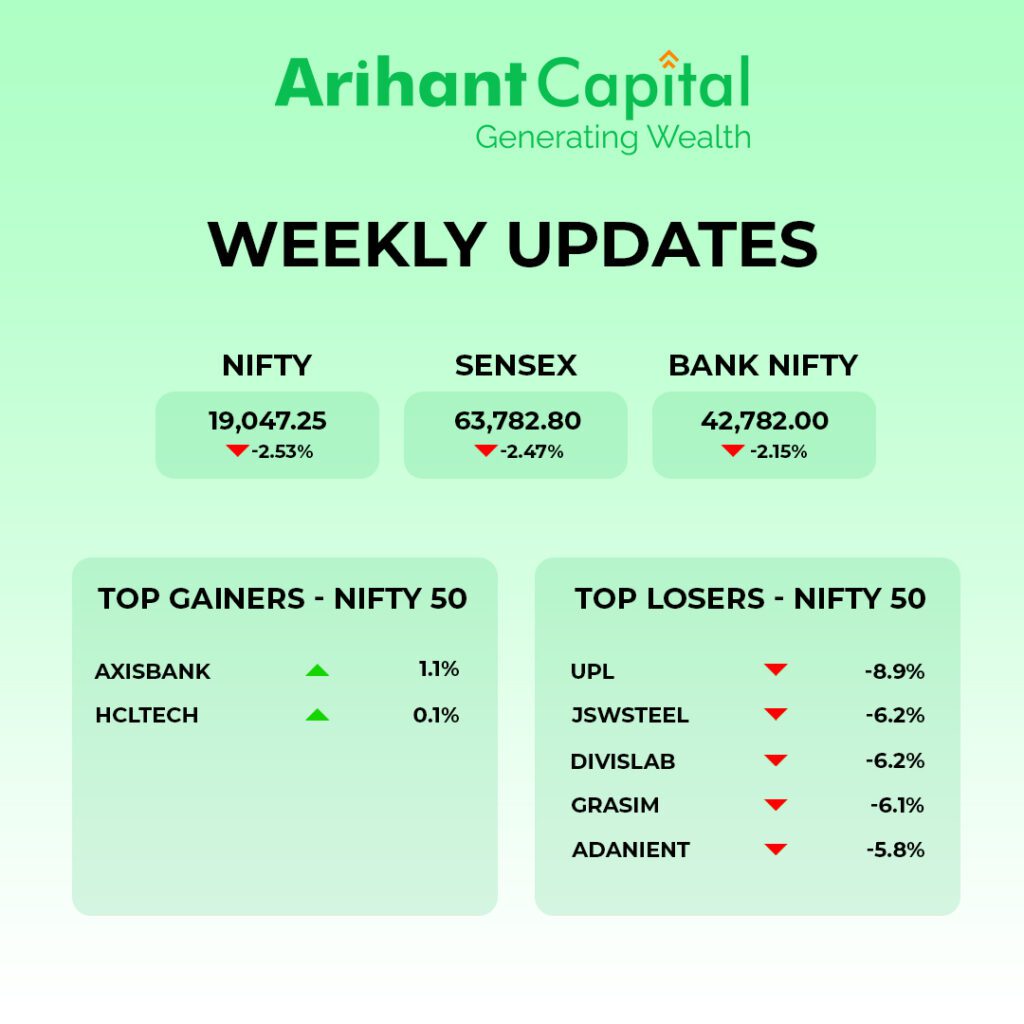

Nifty ended up by 1.01% at the 19,047 level. Sensex was up 1.1% and stood at 63,783, and Nifty Bank was up 1.19% at 42,782.

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

Nifty

If we look at the daily chart of Nifty, we observe a breakdown of the “Head & Shoulder” pattern, but taking support at 200 DMA & the weekly chart takes support at 50 DMA. If we analyse both charts’ patterns, we can see pressure from a higher level. If Nifty starts trading above the 19,150 level, then it can touch the 19,350-19,500 level, while on the downside, support is 18950, and if it starts to trade below, then it can test the level 18,800 and 18,650 levels.

Bank Nifty

If we look at the daily chart of Bank-Nifty, we are observing prices trading below 200 DMA & on the weekly chart, trading below 50 DMA. If we analyse both chart patterns, it indicates that bank-nifty can continuously underperform compared to Nifty. Bank-nifty starts trading above 43,100, then can touch 43,500 and 43,850 levels. However, downside support comes at 42,650, and below that, we can see 42,450 and 42,300 levels.

🔎Stocks in News

💼 Karnataka Bank: Approved raising ₹800 cr from 5 institutional investors by allotting preferential shares.

🏡 Macrotech Developers: Plans to build luxury housing projects with a potential revenue of ₹12,000 cr.

🌬️ Suzlon: Won an order for a 50.4 MW wind power project from Juniper Green Energy.

📉 Vodafone-Idea (Vi): Reported a net loss of ₹8,737 cr, revenue stood at ₹10,716 cr.

🏦 Indian Bank: Plans to raise ₹8,000 cr through a Qualified Institutional Placement (QIP).

🛢️ ONGC: Will acquire PTC India’s wind power unit for ₹925 cr.

🏦 Kotak Mahindra: Ashok Vaswani will be the new MD and CEO.

💊 Lupin: Received approval from US authorities to market its generic Fluconazole tablets.

🛢️ IOC, BPCL: The New Central Pollution Control Board (CPCB) has fined the 2 companies for not installing pollution control devices at their petrol pumps.

👗 Aditya Birla Fashion: Subsidiary Aditya Birla Digital Fashion Ventures will buy a 51% stake in Styleverse Lifestyle for ₹155 cr.

🏛️ Delta Corp: The Court has directed GST officers not to pass a final order on the company’s ₹16,195 cr tax notice without prior permission from the court.

📱 Tech Mahindra: Tech Mahindra (Americas) will sell its 30% holding in Avion Networks Inc. for $50,000.

🏗️ JSW Steel: Has not changed its plans for a potential stake buy in a Canadian company, the company’s CEO mentioned. The company is planning to buy a stake in the coal unit of Canada’s Teck Resources.

💼 Vedanta: Sonal Shrivastava has resigned as the company’s CFO due to personal reasons. The company will reappoint Ajay Goel.

📰 Quick Bites

📊 Facebook India recorded a 13% growth in gross ad revenue to ₹18,308 cr for the financial year that ended on 31 March 2023.

♻️ Coal ministry generated revenue of ₹28.79 cr by disposing of scrap as part of a special campaign.

🛂 Sri Lanka will now offer free visas to travellers from 7 countries, including India, China, Russia, Malaysia, and Japan.

💹 BSE has increased transaction charges in the equity derivatives segment from Nov 1.

🌎 The US became India’s largest trading partner in April-Sept this financial year, followed by China.

🛒 Flipkart reported a total revenue of ₹56,013 cr in the 2023 financial year. Net loss stood at ₹4,834 cr: Tofler.

💰 The Indian government has approved a ₹22,303 cr subsidy on P&K fertilisers for the current Rabi season.

🎵 Spotify posted an operating profit of €32 million for the July-September quarter.

📈 US GDP growth in the July-Sept quarter stood at 4.9% vs 2.1% in the last quarter.

🛢️ India has started producing ‘reference’ petrol and diesel. It is used for testing automobiles.

🏦 The European Central Bank has left interest rates unchanged for the first time since July 2022.

🚗 Ola Electric has raised ₹3,200 cr from Temasek-led investors and SBI.

🌱 Sustainability Corner

🔍 GKN Automotive develops a new modular eDrive concept, aiming to meet the growing demand for high-quality and cost-effective eDrives from niche and low-volume OEMs and conversion companies.

🏭 JLR’s plant in Nitra, Slovakia, will produce EVs in the future as part of the £15 billion investment earmarked for JLR’s transformation to electric.

💰 Ola Electric raises ₹3,200 crore from Temasek, SBI. The funds raised would be utilised for the expansion of its EV business and setting up India’s first lithium-ion cell manufacturing facility in Krishnagiri, Tamil Nadu.

🚗 Stellantis to invest 1.5 billion euros & acquire a 20% stake in Chinese EV OEM Leapmotor; Stellantis-led JV to have exclusive rights for the export and sale, as well as manufacturing, of Leapmotor products outside Greater China.

🔄 Stellantis and Orano plan JV for recycling EV batteries and scrap from gigafactories; reclaimed cobalt, nickel & lithium support Stellantis’ circular economy approach will help meet the EU 2031 battery directive to use recycled materials in new batteries.

🌍 Global EV sales to grow 10-fold by 2030, says the latest World Energy Outlook study. As per the projections, it is estimated that around 60% of the two- and three-wheelers sold in 2030 will be electric, with renewables’ share of the global electricity mix nearing 50%.

💼 PMI Electro Mobility secures ₹250 crore investment from Piramal Alternatives.

🚗 Suzuki Motor Corp invests in Canada-based Inmotive Inc to accelerate joint development of two-speed EV transmission; Inmotive, which has invented the ultra-efficient multi-speed powertrain tech, claims a 7-13% improvement in an EV’s range using ‘Ingear’.

💡🍬 Knowledge Candy: Is the return received in a mutual fund called ‘interest’?

No, mutual fund returns are not called ‘interest.’

The term ‘interest’ is specifically used when money is borrowed or lent.

For instance, if you borrow Rs 1 lakh from a bank at a 10% interest rate for 1 year, you must repay Rs 1 lakh plus 10% interest after that year.

Similarly, when you put your money in a fixed deposit (FD), you essentially lend your money to the bank, which is why the bank pays you interest.

In the case of mutual funds, it’s different. When you invest in a mutual fund, you entrust your money to a group of experts, including a fund manager and their team, who then invest your money on your behalf.

This means you are purchasing assets, not lending your money. It’s akin to buying a house – while investing in it can yield returns, it doesn’t generate interest.

Happy reading!

Also Read: How to Trade Above Freeze Quantity in Options on Arihant Plus?