Feast, Finance, and Festivity: India’s Food and FMCG Bonanza | Weekly Stock Market Update Oct 21

Hello Readers!

We hope you had a great week!

India’s food production is booming, all thanks to the ‘green revolution’ and modern farming techniques. Recently, the government shared some fantastic news: we’ve had a record-breaking year for foodgrain and horticulture production, reaching 329.68 million tonnes in 2022-23. This is a significant 4% increase from the previous year. 🍚

The best part is that this is a short-term success story. Over the past ten years, we’ve seen consistent growth, going from 257.1 million tonnes in 2012-13 to 315.6 million tonnes in 2021-22. So, this year’s achievement is nearly 31 million tonnes more than the previous five-year average.

This growth isn’t limited to just grains; it covers major food products, including rice, wheat, pulses, and oilseeds. Even fruits, vegetables, and honey are on the rise. 🍯

In parallel, the fast-moving consumer goods (FMCG) sector thrives. Big FMCG players like Hindustan

Unilever (HUL) and Nestle India reported impressive profits. HUL’s net profit for the July-September quarter increased by 3.86%, with a 3.53% boost in revenue. Nestle India’s net profit grew an astounding 37.3%, and its revenue jumped by 9.5%. 💪

Even though ITC’s results had some ups and downs, with profit growth exceeding expectations but cigarette and revenue growth slightly below par, it seems like the FMCG industry is on the right track.

FMCG companies will likely continue their winning streak as we approach the festive season, with celebrations like Dussehra and Diwali, wedding season, and the cricket World Cup. Food production is soaring, and FMCG businesses are making the most of increased consumer spending. 🎉

In simple terms, India’s food production is hitting new highs, and FMCG companies are reaping the benefits as people buy more products. This trend is set to continue, especially during the upcoming festive and wedding seasons. 🇮🇳🥘

🧾In this Article

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

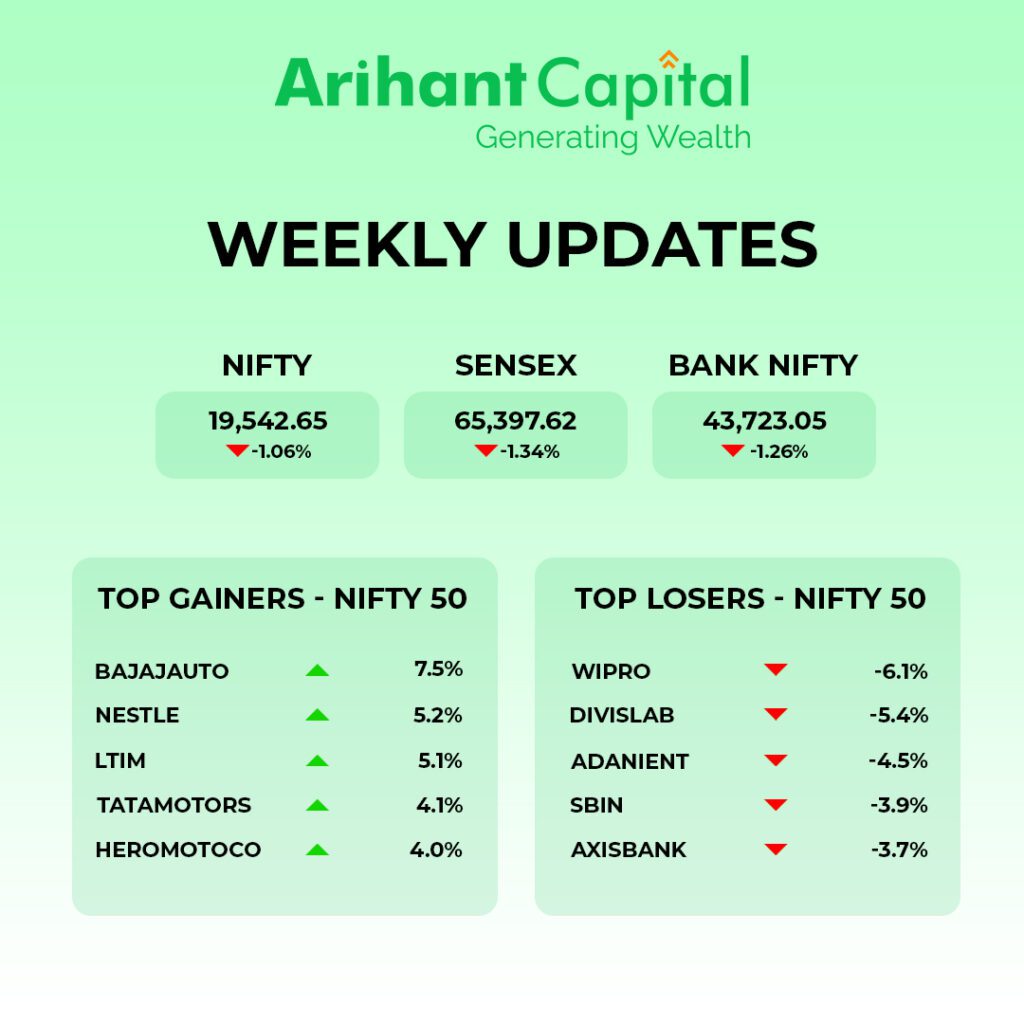

Nifty

Let’s look at the daily chart of Nifty. We are observing prices start trading below 50 days (SMA) & on the weekly chart series of “Narrow” range body formation. If we analyze both chart patterns, we can still see pressure from a higher level. If Nifty starts trading above the 19,650 level, then it can touch the 19,750-19,850 level, while on the downside, support is 19,500, and if it starts to trade below, then it can test the level 19,350 and 19,200 levels.

Bank Nifty

Let’s look at the daily chart of Bank-Nifty. We observe prices trading below all key “Short-term moving averages” and near the top 200 days (SMA). We observe prices near 50 days (SMA) on the weekly chart. Analysing both chart patterns indicates that bank-nifty continues to underperform compared to Nifty. Bank-nifty starts trades above 43,850, then can touch 44,100 and 44,350 levels. However, downside support comes at 43,600; below that, we can see 43,450 and 43,300 levels.

🔎Stocks in News

🚗 Tata Motors: will acquire a 27% stake in ‘Freight Tiger’ for ₹150 cr.

🚄 RVNL: received orders worth ₹420 cr from Vadodara Division of Western Railway.

🏦 HDFC Bank: distributed ₹42.40 cr to fractional shareholders of HDFC.

🏗️ Tata Steel will acquire a 26% stake in TP Vardhaman Surya.

🏦 Kotak Mahindra: RBI has approved Kotak Mahindra for its ₹537 cr acquisition of Sonata Finance.

⚕️ Biocon Biologics: appointed Kedar Upadhye as its new CFO.

⚙️ Power Mech: set a floor price of ₹4,085.44 for its ₹350 cr qualified institutional placement.

🔧 Welspun: contracted to supply 61,000 metric tonnes (MT) of LSAW pipes and bends in the Middle East.

💼 Tech Mahindra: the board will consider interim dividend on 25 Oct.

📊 Wipro: approved the merger of five of its wholly owned subsidiaries with itself.

💳 Piramal Enterprises: ₹1,000 cr Non-Convertible Debentures issue will start tomorrow (19 Oct).

🍔 Zomato: signed an agreement with IRCTC to launch a test to provide more food options to railway passengers.

🔌 REC: signed an agreement with Bank of India to co-finance projects worth ₹30,000 cr over the next 5 years.

🏘️ HUDCO: the government will sell up to 7% stake in the company through an Offer for Sale (OFS)—floor price: ₹79 per share.

📰 Quick Bites

💰 The Union Cabinet has approved a Productivity Linked Bonus (worth 78 days’ pay) for eligible Railway employees.

🛢️ The Finance Ministry reduced windfall tax on crude oil to ₹9,050/tonne. Duty on export diesel was reduced to ₹4/litre, and the tariff on jet fuel was lowered to ₹1/litre.

🌾 The government has permitted exports of 10.35 lakh tonnes of non-basmati white rice to 7 countries, including Nepal, Cameroon, and Malaysia.

🌾 Government has approved a 2 to 7% increase in the Minimum Support Prices for mandated Rabi crops.💼 Government has increased the dearness allowance for central government employees and the dearness relief to pensioners from 42% to 46%.

📱 43 million smartphones were shipped in India in the July-Aug-Sept quarter, 3% year-on-year decline. Samsung shipped the most smartphones, Xiaomi was second.

💸 GST evasion of ₹1.36 lakh cr detected in the current financial year: Finance Ministry.

📱 Google announced that it will contract to manufacture its Pixel smartphone in India. It is expected next year.

🚢 The Global Maritime India Summit attracted investment proposals worth ₹2.37 lakh cr on the 2nd day of the 3-day event.

🌐 Nokia will cut up to 14,000 jobs globally.

💻 The Indian government has allowed restriction-free imports of laptops and tablets.

🌱 Sustainability corner

🛵 TVS, Suzuki, Yamaha, Ather & Bajaj increased their scooter market share in the first half of FY2024, which saw 2.86 million units sold, up 4%. Market leader Honda sells 1.28 million units, down 4%; iQube’s share of TVS dispatches grows to 13%. Full details of 10 OEMs.

🚗 Maharashtra government asks GM to increase severance pay for striking workers Hyundai Motors to absorb workforce.

🚗 Tata Motors, Toyota Kirloskar Motor & Volkswagen India buck industry (-8% YoY) decline in the car, sedan sales in H1 FY2024 in India & grow market share. MG Motor India sells 1,914 Comet EVs. Full details of 10 carmakers’ April-September sales and market share.+-

💡🍬 Knowledge Candy: What is Interim Dividend?

When a company turns a profit, it faces a choice. It can plough all that money into the business to help it grow.

Alternatively, it can distribute some of those earnings to its shareholders. The amount each shareholder receives depends on how many shares they own. This distribution is known as a “dividend.”

Many companies strike a balance between the two options. They reinvest some profits into the business while sharing some with their shareholders.

In India, companies can give dividends every three months. This periodic dividend is referred to as an “interim dividend.” It keeps shareholders engaged and satisfied throughout the year.

At the end of the financial year, the final dividend is granted to wrap things up.

This approach ensures that the company and its shareholders benefit from the profits.

Hope you like it!

Happy reading!

Also Read: How to Trade Above Freeze Quantity in Options on Arihant Plus?