Concord Biotech Limited IPO is live. Should you Invest?

Concord Biotech Limited IPO is live.

In this article

📃About Concord Biotech Limited

Incorporated in 1984, Concord Biotech Limited is an India-based R&D-driven biopharma company. The company is ranked among the leading global developers and manufacturers of select fermentation-based APIs across immunosuppressants and oncology in terms of market share, based on volume in 2022. Concord Biotech has a Global presence. They are supplying their products to over 70 countries including the USA, India, Europe, and Japan.

The company manufactures Active Pharmaceutical Ingredients (API) through fermentation & semi-synthetic process and finished formulations. It started with a single product and has grown to become a wide-spectrum solution provider.

Concord manufactures fermentation and semi-synthetic-based products in therapeutic segments such as Immunosuppressant, Anti-bacterial, Oncology, Antifungal & others. This wide range of products has attracted customers across the globe. Concord also has a robust pipeline of products under development.

💰Issue Details of Concord Biotech Ltd IPO

- IPO open from 04th Aug 2023 – 08th Aug 2023

- Face value: ₹1 per equity share

- Price band: ₹705 to ₹741 per share

- Market lot: 20 shares

- Minimum Investment: ₹14,820

- Listing on: BSE and NSE

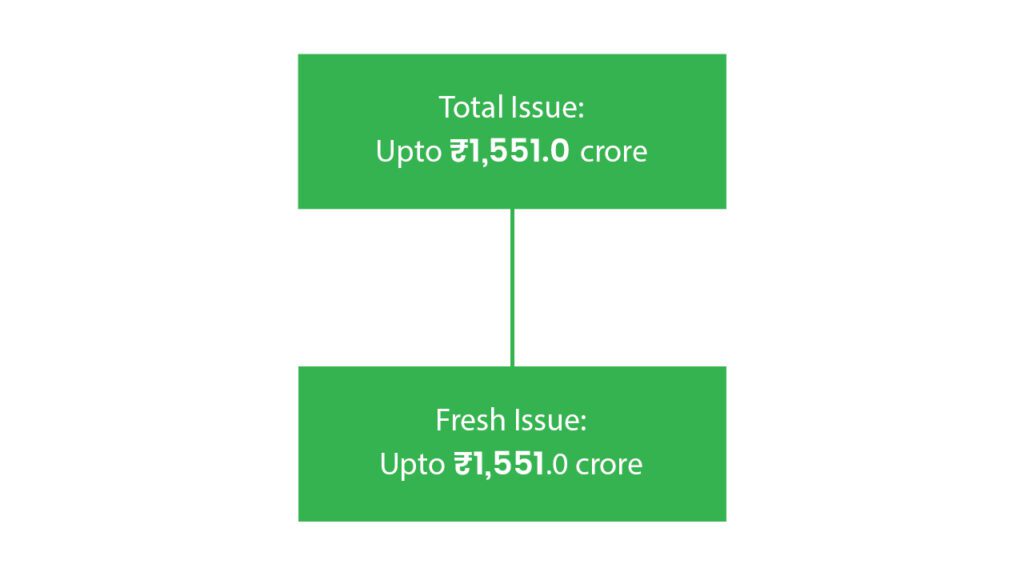

- Offer for sale: ₹1551 Cr

- Registrar: Link Intime India Private Ltd

🪙Total Issue Price

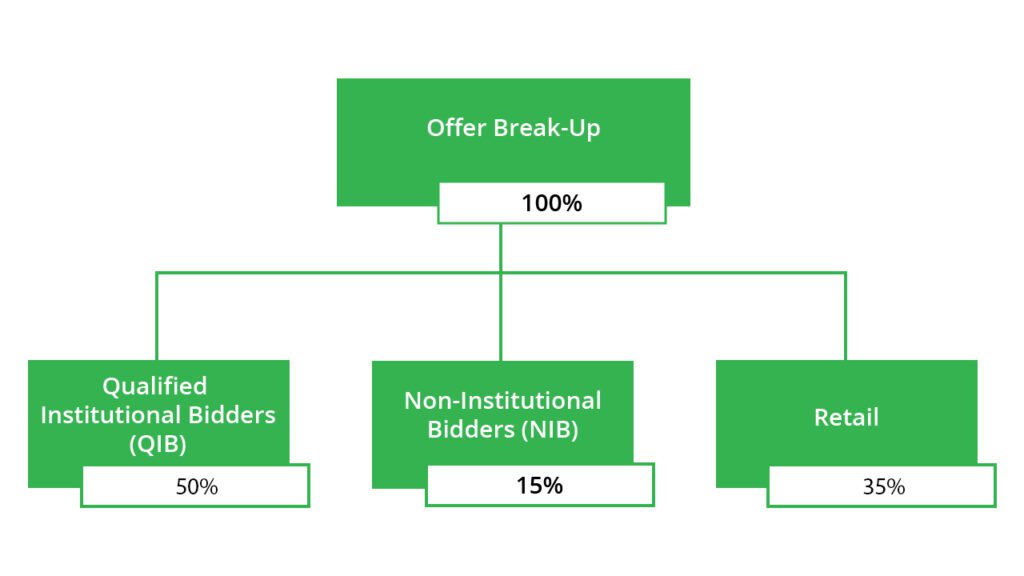

🪚Offer Breakup

🔭IPO Object

The objectives of the Offer are to:

- Achieve the benefits of listing the Equity Shares on the Stock Exchanges and

- Carry out the Offer for Sale of up to 20,925,652 Equity Shares by the Selling Shareholder.

⛓️IPO Strength

Some of the qualitative factors and strengths which form the basis for computing the Offer Price are:

- Established presence across the complex fermentation value chain

- Global leadership in immunosuppressant APIs along with a wide spectrum of complex fermentation-based APIs across multiple therapeutic areas

- Scaled manufacturing facilities with a consistent regulatory compliance track record and supported by strong R&D capabilities

- Diversified global customer base with long-standing relationships with key customers

- Experienced Promoters, management team supported by marquee investors

🧨IPO Risk

- Any delay, interruption or reduction in the supply of raw materials or the transportation of raw materials or products may adversely impact the pricing and supply of their products and have an adverse effect on their business.

- Any manufacturing or quality control issues may damage their reputation, be subject to regulatory action, and expose them to litigation or other liabilities, which could adversely affect their business, financial condition and results of operations.

- A slowdown or shutdown in their manufacturing or research and development operations,( all located in Gujarat, India), could adversely affect their business, financial condition and results of operations.

- They depend on a limited number of key customers for a substantial portion of their revenues. Any significant reduction in demand for their products from such customers may adversely affect their business and results of operations.

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-21 | ₹1182.55 | ₹630.75 | ₹234.89 |

| 31-Mar-22 | ₹1312.80 | ₹736.35 | ₹174.93 |

| 31-Mar-23 | ₹1513.98 | ₹888.48 | ₹240.08 |

PEER COMPANIES

- Divi’s Laboratories Limited

- Suven Pharmaceuticals Limited

- Laurus Labs Limited

- Shilpa Medicare Limited

📬Also Read: Sustainable Investing in India: ESG Investments