PVR-INOX📽️ Duo is on an Exhilarating Rollercoaster Ride 🚀 | Stock Market Weekly Update Aug 5

Stock Market Update | PVR-INOX Duo is On an Exhilarating Rollercoaster Ride

Hello Readers!

We hope you had a great week!

This reading has something great for movie lovers. We are going to hang around the cinematic delight!

Amidst the June quarter, PVR-INOX 🎬 showcased commendable performance, riding a wave of robust earnings growth. The multiplex giant witnessed a remarkable surge of over 32% in revenue, reaching ₹1,324 crore. This surge owed much to elevated box office collections driven by major international releases.

Recent Hollywood blockbusters – Mission Impossible 7, Barbie, and Oppenheimer – captivated domestic audiences, resulting in exceptional bookings. Oppenheimer secured bookings for more than two lakh tickets across PVR-INOX cinema chains. At the same time, box office revenues for Oppenheimer and Mission Impossible 7 already surpassed ₹100 crore, and Barbie stands strong at around ₹40 crore.

🚀 This robust trend in box office collections positions PVR-INOX optimally for a promising September quarter. Boasting a widespread presence of 361 cinemas, housing 1,707 screens across 114 cities, and commanding an impressive market share of nearly 40%, PVR-INOX is poised to seize this momentum. Moreover, an exciting lineup of anticipated Hindi movie releases – Gadar 2, DreamGirl 2, and Jawaan – is projected to rejuvenate Hindi cinema enthusiasts, further propelling theatre footfall.

⚖️ Yet, within this hopeful outlook, a pivotal question emerges: Can these new releases translate into profitability for PVR-INOX, particularly after reporting a net loss of ₹44 crore in the preceding quarter? The answer hinges on the collective impact of robust box office performances and astute operational management.

As PVR-INOX navigates this dynamic terrain, the September quarter promises an exhilarating cinematic journey, promising an immersive experience for the company and eager moviegoers.

🧾In this Article

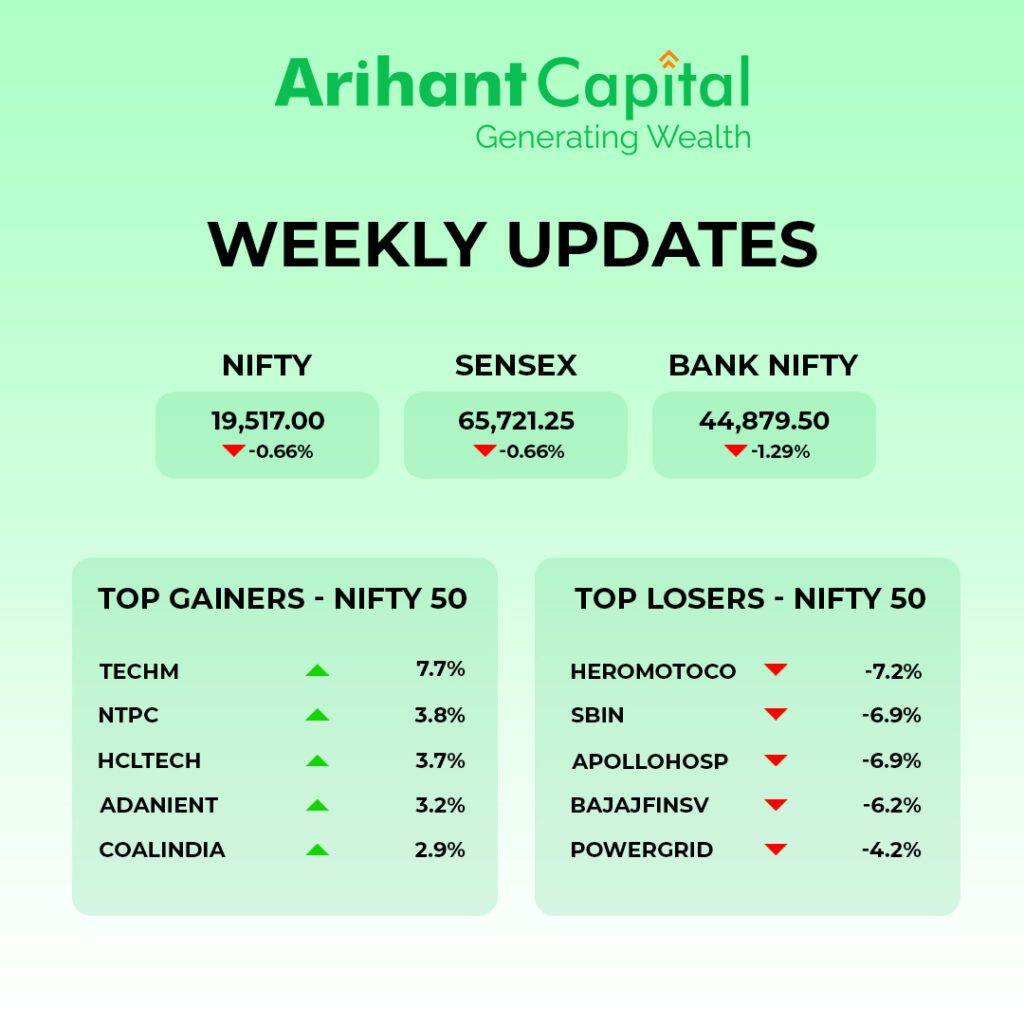

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

Nifty

If we look at the daily chart of Nifty, we observe a “Downward gap area”, and prices have tested short-term moving averages. On the weekly chart, we are observing prices has taken trend line support; if we analyse both chart patterns, it indicates some pressure will continue from higher levels, and we can see some consolidation. If Nifty starts trading above the 19,580 level, then it can touch the 19,680-19,750 level, while on the downside, support is 19,450, and if it starts to trade below, then it can test the level 19,300 and 19,200 levels.

Bank Nifty

Let’s look at the daily chart of Bank-Nifty. We are observing the prices close below the short-term moving averages but holding 50 Day moving averages on the weekly chart; it has tested a lower trend line support level which suggests that compared to Nifty, Bank-nifty underperformance will remain to continue. Bank-nifty, it starts trading above 44,850, then it can touch 45,200 and 45,500 levels. However, downside support comes at 44,500; below that, we can see 44,100 and 43,800 levels.

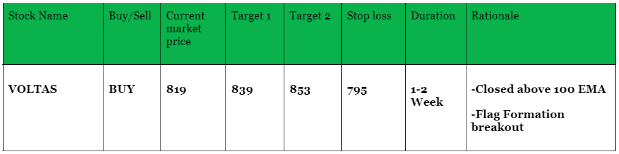

💰Stock Picks

– Ms. Kavita Jain, Sr Research Analyst and Learning Head, Arihant Capital.

🔎Stocks in News

🚢 Adani Ports: Cargo volumes increased 7% YoY in July.

🚌 Eicher Motors: Vijayanand Travels ordered 550 buses from VE Commercial Vehicles.

⛏️Vedanta: Twin Star Holding sold a 4.14% stake in Vedanta.

🚗 M&M: Temasek to invest ₹1,200 cr in M&M’s EV business.

🏗️ Ambuja Cements: Acquired Sanghi Industries for ₹5,000 cr.

🔌 JSW Steel: Announced a JV with JFE Steel for CRGO electrical steel.

🍔 Zomato: Recorded first-ever quarterly net profit of Rs 2 cr.

🚗 Maruti Suzuki: Alto crosses the 45 lakh sales mark.

⛽ Oil India: Upgraded to Maharatna status.

🏍️ Hero MotoCorp: Sold 3.91 lakh units in July 2023 vs 4.46 lakh units in July 2022.

🍇 Sula Vineyards: Received ₹116 cr excise duty notice.

⚗️ Tata Chemicals: Reduced domestic soda ash price by 5%.

✈️ SpiceJet: Seeks shareholder approval to issue a 5.91% stake to Carlyle Aviation Partners.

📱 Reliance: Reliance Retail launched the ‘JioBook’ laptop at ₹16,499.

🎨 Berger Paints: To consider bonus issue on 9 August.

⚒️ Coal India: In July, coal production rose 13.4% YoY to 53.6 million tonnes.

✈️ EaseMyTrip: To buy a 51% stake each in 3 travel companies.

🏢 DLF: Promoter group sold a 0.87% stake in the company.

⛽ Oil companies: Govt .-owned oil firms sold 3.8% more petrol in July and 4.3% less diesel.

💰 SBI: Raised Rs 10,000 crore at a coupon rate of 7.54% through infrastructure bonds.

🍟 Quick Bites

📈 India’s Core Sector Growth: Output of core sectors rose 8.2% in June – fastest in 5 months. Steel and coal production recorded significant growth.

🏭 Manufacturing Sector Growth: Growth in India’s manufacturing sector (PMI) stood at 57.7 in July, 57.8 in June and 58.7 in May.

💰 Windfall Tax Increase: The government increased the windfall tax on petroleum crude to Rs 4,250 per tonne from ₹1,600 on 1 Aug.

✈️ Jet Fuel Price Change: Jet fuel prices increased by 8.5%. The commercial cooking gas price was reduced by ₹99.75.

📱 Smartphone Exports: India exported smartphones worth $2.43 billion in April-May. The USA was the top destination.

💼 Government Loans to States: Central government approved ₹84,884 cr worth of interest-free loans to states, with ₹29,518 cr issued so far.

🚗 Ola’s Valuation Update: Vanguard Inc. reduced Ola’s valuation by 27% to around $3.5 billion.

💵 Returned Banknotes: Around ₹3.14 lakh cr worth of ₹2,000 banknotes (88% of total) returned to banks: RBI.

📦 GST Refund Change: Automated refund of Integrated GST on certain items restricted from 1 Oct: Finance Ministry.

⛽ Natural Gas Price Increase: The price of domestic natural gas increased to $7.85 per mmBtu vs $7.48 in the previous month.

💡 Power Consumption Growth: India’s power consumption grew 8.4% YoY to 139 billion units in July.

🛍️ Services Sector Growth: Growth of India’s services sector (Services PMI) at a 13-year high of 62.3 in July vs 58.5 in June.

💼 SBFC Finance IPO: SBFC Finance IPO subscribed 1.91 times. Retail investors subscribed 2.06 times.

🛒 Import Restrictions: Indian government restricted imports of laptops, tablets, computers, and servers. Import allowed with a valid licence.

✈️ Aeroflex Industries IPO: Aeroflex Industries gets SEBI approval for ₹350 cr IPO.

🚗 Tesla India Expansion: Tesla India reportedly leased office space in Pune.

💡Knowledge Candy🍬: Markets Rattled as US Credit Rating Takes a Hit

A credit rating is like a grade that shows how trustworthy someone or something is when borrowing money. It can be a letter or a number that tells us if a person, company, or government can repay the money they borrow. Credit rating agencies give these grades based on many things, like numbers and facts about the borrower.

Now, let’s talk about why this matters.

When a credit rating goes down, it’s like getting a lower grade in school – it means people might think you’re not as good at paying back money. So, when a country or a company’s credit rating goes down, it can worry people.

They might think lending them money is riskier, which can decrease the country’s stock market or affect other financial needs. That’s why changes in credit ratings can impact how healthy calls are doing.

Happy reading!

Also Read: Understanding ESG Investing & Its Emergence in India