SBFC Finance Limited IPO is live. Should you Invest?

In this article

📃About SBFC Finance Limited

Incorporated in 2008, SBFC Finance Limited is a systemically important, non-deposit-taking Non-Banking Finance Company (NBFC-ND-SI). The primary customer base of the company includes entrepreneurs, small business owners, self-employed individuals, and salaried and working-class individuals.

SBFC provides its services in the form of Secured MSME Loans and Loans against Gold.

SBFC Finance tends to extend its services to entrepreneurs and small business owners who are underserved or unserved by traditional financial institutions like banks. There are various factors taken into consideration while offering financial assistance in the form of loans. SBFC Finance offers its services so that entrepreneurs can fulfil their financial requirements and thrive.

The entity has a diversified pan-India presence through its extensive network. As of December 31, 2022, SBFC Finance had established its footprints in over 105 cities in 16 Indian states and two union territories. They currently have 137 branches.

💰Issue Details of SBFC Finance Ltd IPO

- IPO open from 03rd Aug 2023 – 07th Aug 2023

- Face value: ₹10 per equity share

- Price band: ₹54 to ₹57 per share

- Market lot: 260 shares

- Minimum Investment: ₹14,820

- Listing on: BSE and NSE

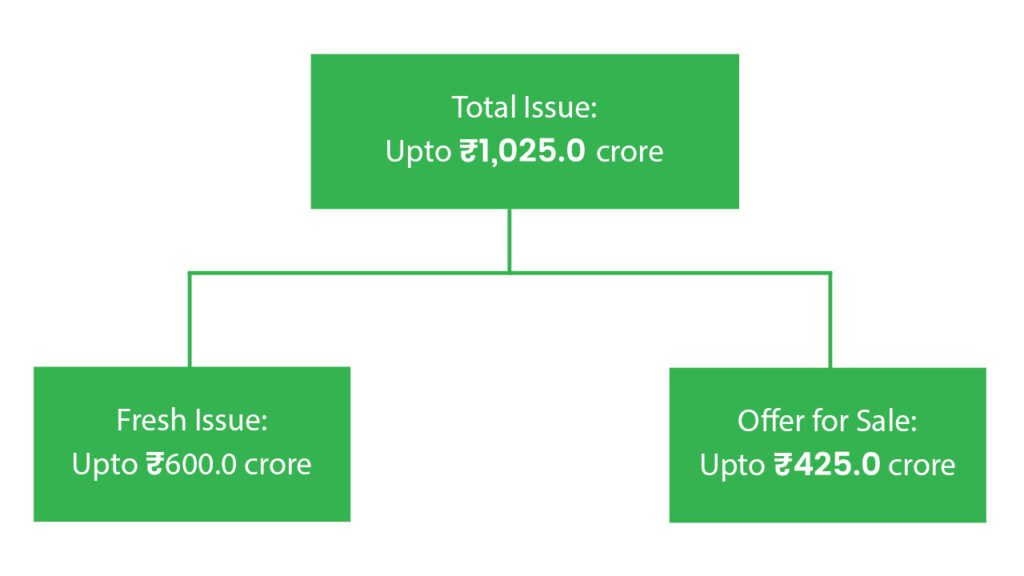

- Offer for sale: ₹1025 Cr(Fresh Issue of ₹600 Cr+OFS aggregating up to ₹425 Cr)

- Registrar: Kfin Technologies Limited

🪙Total Issue Price

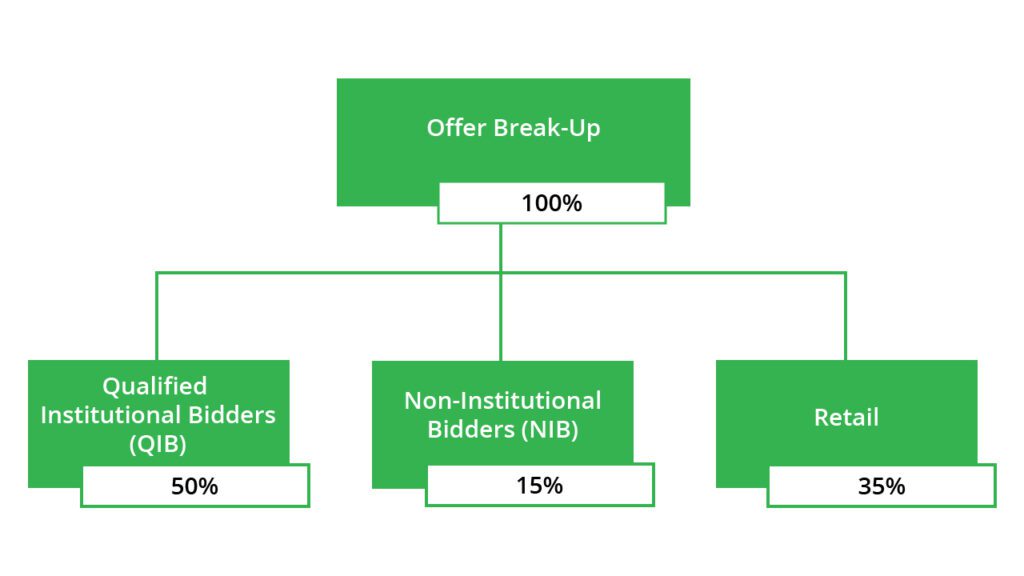

🪚Offer Breakup

🔭IPO Object

The Company proposes to utilize the Net Proceeds towards augmenting the Company’s capital base to meet their future capital requirements arising out of the growth of the business and assets.

⛓️IPO Strength

Some of the qualitative factors and strengths which form the basis for computing the Offer Price are:

- Diversified pan-India presence with an extensive network to cater to their target customer segment

- Experienced, cycle-tested and professional management team with good corporate governance backed by marquee investors

- Consistent financial performance backed by profitable growth

- Comprehensive credit assessment, underwriting and risk management framework

- Extensive on-ground collections infrastructure leading to maintenance of robust asset quality

🧨IPO Risk

- The risk of non-payment or default by their borrowers may adversely affect their business, results of operations and financial condition.

- The quality of their portfolio may be impacted due to higher levels of NPAs and their business may be adversely affected if they are unable to provide for such higher levels of NPAs.

- They require substantial capital for their business and any disruption in their sources of capital could have an adverse effect on their business, results of operations and financial condition.

- Their business is particularly vulnerable to interest rate risk and volatility in interest rates for both lending and treasury operations could have an adverse effect on their net interest income and net interest margin, thereby affecting their results of operations and cash flows.

- Their inability to assess and recover the full value of collateral, or amounts outstanding under defaulted loans in a timely manner, or at all, could adversely affect our business, results of operations and financial condition.

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-21 | ₹4231.19 | ₹511.53 | ₹85.01 |

| 31-Mar-22 | ₹4515.03 | ₹530.70 | ₹64.52 |

| 31-Mar-23 | ₹5746.44 | ₹740.36 | ₹149.74 |

PEER COMPANIES

- Aavas Financiers Ltd Aavas Financiers Ltd

- Home First Finance Company India Ltd

- Aptus Value Housing Finance India Ltd

- AU Small Finance Bank Ltd

- Five Star Business Finance Limited

📬Also Read: Sustainable Investing in India: ESG Investments