Tata Motors’ DVR Shares in Peril: What’s Next for Investors?🔍| Stock Market Weekly Update July 29

Tata Motors’ DVR Shares in Peril | Stock Market Weekly Update July 29

Hello Readers!

We hope you had a great week!

This reading diet has something enlightening about the complexities of equity shares and the significance of Differential Voting Rights (DVR) shares.

Companies that issue equity shares aim to raise funds for various purposes, such as acquisitions, day-to-day operations, or debt repayment. However, a downside to equity shares is that they dilute ownership. For instance, if you own 1 out of 10 company shares, your ownership is 10%. 😔 But if the company issues more shares, your ownership percentage decreases.

Founders and promoters often dislike diluting their stake as it can lead to losing control. Shareholders with voting rights can actively participate in management decisions that may not align with the founders’ visions.

Tata Motors 🚗, facing a similar dilemma in 2008 when it needed funds to repay a loan after acquiring luxury brands Jaguar and Land Rover, devised a brilliant solution. Instead of issuing regular shares, they introduced Differential Voting Rights (DVR) shares. DVR shares offered fewer voting rights (1 vote for every ten shares). Still, they came with additional dividends and were issued at a discount to regular shares. This move attracted investors who prioritised passive income over voting rights, allowing Tata Motors to raise funds without diluting promoter control.

While DVR shares are popular in the US, they gained little traction in India, despite being allowed since 2000. One reason could be that big investors preferred shares with voting rights, while retail investors needed to understand DVRs fully.

Over the years, Tata Motors’ DVRs consistently traded at a 40–50% discount to regular shares, indicating the lack of demand. Realising this and seeking to simplify its share structure, Tata Motors recently announced plans to cancel all DVR shares within a year. In a clever move, Tata Motors offered DVR shareholders a 20% premium on the share price by exchanging seven regular shares for every 10 DVR shares held.

This strategic move 💡 benefits both investors and Tata Motors. Investors who bought DVRs hoping to narrow the price differential are pleased with the premium offer. On the other hand, Tata Motors will no longer have to manage two classes of shares, and it will improve liquidity and enhance the earnings per share (EPS) metric.

By reducing the total number of shares after converting DVRs to regular shares, Tata Motors’ EPS improves, which is an attractive factor for investors. The increased EPS might encourage more people to invest in Tata Motors, driving demand and boosting the stock price.

Bottom line!

Tata Motors’ decision to cancel DVR shares and offer a premium to shareholders showcases its commitment to simplifying its share structure and rewarding investors. This move benefits the company and demonstrates how a well-planned strategy can optimize shareholder value and align with long-term growth goals. As the curtain falls on the era of DVR shares for Tata Motors, it leaves behind a valuable lesson in navigating the dynamic world of equity markets.

🧾In this Article

📊 Weekly Update

– Mr Abhishek Jain, Head of Research, Arihant Capital

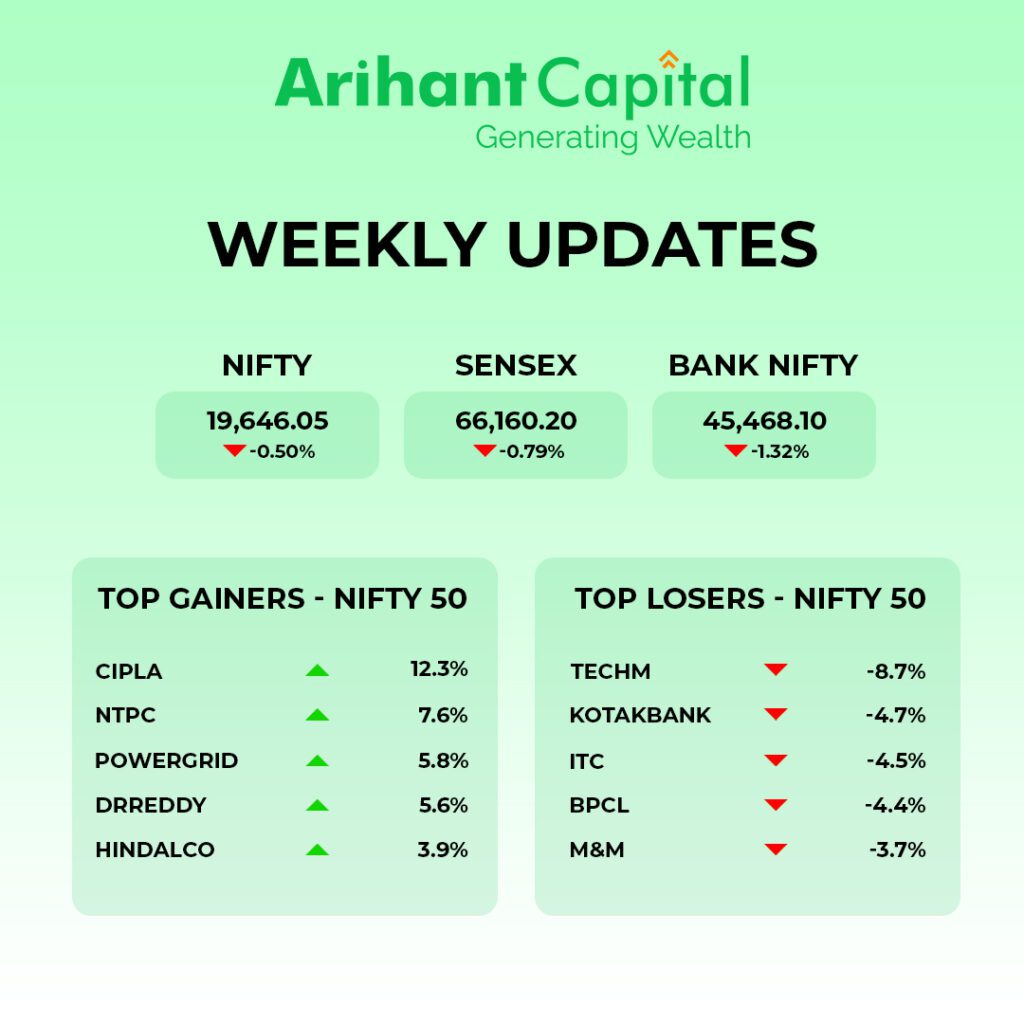

India’s benchmark indices, the S&P BSE Sensex and NSE Nifty 50, experienced a weekly decline after four weeks of record-setting gains. The Sensex fell 0.79%, and the Nifty 50 was lower by 0.50%. The previous week had witnessed a positive trend, with the Sensex rising 0.94% and Nifty 50 gaining 0.92%.

This week, the stock market opened higher on Friday but later faced a decline, primarily driven by the I.T. and private banking sectors. However, realty, metal, and media shares showed gains. The Nifty closed down 0.07% at 19,646, while Sensex stood at 66, and Nifty Bank fell 0.24% to 46,075.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

Nifty

If we look at the daily chart of Nifty, we observe a “Bearish candlestick” formation. On the weekly chart, we follow a “Doji” candlestick formation. Analysing both charts’ patterns indicates some pressure from the higher level, and we may see consolidation here. If Nifty starts trading above the 19,780 level, then it can touch the 19,850-19,950 level, while on the downside, support is 19,650, and if it starts to trade below, then it can test the level 19,550 and 19,450 levels.

Bank Nifty

If we look at the daily chart of Bank-Nifty. We are observing the “Engulfing Bear” candlestick formation on the weekly chart “Doji” candlestick formation. This suggests that compared to Nifty, Bank-nifty may underperform. If it trades above 45,850, it can touch 46,100 and 46,300 levels. However, downside support comes at 45,550; below that, we can see 45,300 and 45,100 levels.

🔎Stocks in News

🏗️ Rail Vikas Nigam: Bagged a ₹1,088 cr order from Haryana Rail Infrastructure Development Corporation.

💊 Lupin: Resolved warning letters issued by US authorities for its facilities in Goa and Madhya Pradesh.

💰 Cholamandalam Investment: To raise funds worth up to ₹1,500 cr through a public issue of bonds.

⚡ Adani Transmission: Renamed itself to Adani Energy Solutions.

🔬 IPCA Labs: Competition Commission of India approved the acquisition of up to a 59.3% stake in Unichem Laboratories.

🛫 IndiGo: DGCA imposed a fine of ₹30 lakh for 4 tail strike incidents in 6 months.

📈 Piramal Enterprises: Announced a share buyback scheme worth ₹1,750 cr at ₹1,250 per share.

🥤 Marico: To buy a 58% stake in Satiya Nutraceuticals ₹Rs 369 cr.

🏢 RVNL: Indian government launched an offer for sale (OFS) to sell up to 5.36% stake in the company.

💳 HDFC Bank: Became the first bank to process transactions worth ₹500 cr on RuPay credit card on UPI.

🧬 Bharat Biotech: Bought a 20% stake in Eastman Exports Global Clothing.

💰 PNB: Net profit for the April-June quarter rose 4x to ₹1,255 cr.

🌿 L&T: To invest ₹506 cr in its subsidiary L&T Energy Green Tech.

🤝 Adani Group: Signed agreement with Visa to launch co-branded cards.

🚗 Mahindra Group: Bought around 4.9% stake in RBL Bank through an open market route.

💼 Federal Bank: Raised ₹3,099 cr through qualified institutional placement.

🏍️ Eicher Motors: Royal Enfield’s Hunter 350 model crossed sales of 2 lakh units.

🔌 Torrent Power: Launched 4 EV charging stations in Ahmedabad.

⚡ Reliance Industries: Signed an agreement to invest with Brookfield Infrastructure and Digital Realty to develop data centres in India.

🚆 Titagarh Rail Systems: Commercial production of Vande Bharat sleeper trains to begin in June 2025.

🏨 ITC: Approved demerger of the hotel business to incorporate ITC Hotels Ltd.

💼 Adani Group: Bain Capital to buy a 90% stake in Adani Capital and Adani Housing.

🏭 Samvardhana Motherson: To acquire assets and shares of Dr Schneider Group entities.

☕ Coffee Day Enterprises: Cafe Coffee Day operator files for bankruptcy process.

🚄 RITES: Received a ₹500 cr order for locomotives and wagons from Mozambique.

🔩 Ramkrishna Forgings: Acquired Multitech Auto Private Ltd and its subsidiary Mal Metallics Private Limited for ₹205 cr.

☀️ SJVN: Won a ₹7,000-cr contract from Punjab State Power Corporation Ltd (PSPCL) for the development and procurement of 1,200 MW solar power.

🍕 Zomato: Started the process to liquidate its Portugal-based wholly-owned subsidiary (Zomato Media Portugal).

🍟 Quick Bites

💰 The Employees’ Provident Fund Organisation (EPFO) declared an 8.15% interest rate for Employees’ Provident Fund (EPF) accounts in the financial year 2022-23.

📈 Number of people filing income tax returns rose by 6.18% in the financial year 2023, compared to the previous year, as per FM Nirmala Sitharaman.

🚗 Jaguar Land Rover (JLR) India reported its best-ever quarterly sales performance with a growth of 102% – retailing 1,048 units in the April-June quarter.

🔍 The government has asked for a penalty of ₹469 cr from 7 electric 2-wheeler makers for claiming incentives while not complying with FAME II scheme norms, as per media reports.

📦 Leasing in India’s industrial and warehousing sector fell 12% year-on-year in the April-June quarter of 2023 to 40 lakh square feet across 5 major cities, as reported by Colliers India.

📜 TVS Supply Chain Solutions has received SEBI’s approval for an IPO.

💼 Over 4 crore income tax returns for fiscal 2023 have been filed so far. Around 7% of these are new or first-time tax filers, according to the Central Board of Direct Taxes (CBDT).

🌾 Number of beneficiaries under the PM-Kisan scheme increased to 8.11 cr in the 13th instalment period Dec-March of the last fiscal from 3.16 cr in the first tranche.

📲 India has exported telecom equipment worth ₹6,911 crore under the production-linked incentive (PLI) scheme till May 31, 2023.

🏢 Suraj Estate Developers has filed draft papers with SEBI to raise ₹400 cr through an IPO.

🏦 RBI has imposed restrictions on The National Cooperative Bank in Bangalore. It won’t be able to grant or renew any loans and advances, make any investments, borrow funds, and accept fresh deposits.

🧾 Over 8.75 lakh Hindu Undivided Families (HUFs) have filed income tax returns and claimed deductions worth Rs 3,803 cr during 2022-23, as stated by the Finance Ministry.

🌱 Sustainability Corner

🔹 Tata Elxsi joins leading OEMs, Tier-1 suppliers & technology companies as an eSync Alliance member; eyes the opportunity to accelerate the deployment of OTA, which is a critical component in the broader adoption of Software-Defined Vehicles worldwide.

🔹 Semiconductor PLI to help India do in 10 years what China did in 30: Rajeev Chandrasekhar, Union Minister of State for Electronics & Technology.

🔹 Even with the reduced FAME II subsidy, electric two-wheelers’ operating economics are better than their petrol-engined siblings, says Rakesh Sharma, executive director of Bajaj Auto, who expects India’s e-two-wheeler market to grow by 15-25%.

🔹 ZF to set up an airbag plant and R&D centre in Wuhan, China. It will become the largest prototyping centre for new airbag products in the APAC region, with projects and products for major domestic and global OEMs.

🔹 Samvardhana Motherson makes its fourth acquisition this month – Germany’s Dr Schneider Group (high-end, electronic interior polymer components).

🔹 No particular policy for Tesla in India. It can seek incentives under existing schemes: GOI.

🔹 TVS iQube has sold over 150,000 units since launch; TVS Motor Co’s electric scooter has taken 43 months to ride past the milestone in the Indian market.

💡Knowledge Candy🍬: Metals Glitter with Optimistic Global Outlook

Metal stocks have experienced a strong comeback this month, with major players like Tata Steel, Hindalco, and Hindustan Copper witnessing an impressive rise of 8-10%. The NIFTY Metal index has also surged over 6% in July. Several key factors are driving this rally.

Firstly, China’s efforts to stabilize its property market have injected confidence into investors. As China is a significant metal producer, supporting its struggling real estate sector boosts metal demand in construction and infrastructure, benefiting the market. 🏗️

Secondly, the weakening US dollar has made metals more appealing to foreign investors seeking safe havens against currency depreciation and inflation. This has further fueled the demand for metals, especially amid ongoing global supply chain disruptions that limit supply and increase prices. 💹

Lastly, the growing focus on green energy and sustainable infrastructure has increased the demand for specific metals like copper and lithium, used in electric vehicles and solar panels. 🌱🚗☀️

These combined factors have contributed to the renewed shine of metal stocks, attracting investors and propelling the metal market forward. 🚀

Happy reading!

Also Read: Understanding ESG Investing & Its Emergence in India