Yatharth Hospital and Trauma Care Services Limited IPO is live. Should you Invest?

Yatharth Hospital and Trauma Care Services Limited IPO is live.

In this article

- IPO details

- Issue details

- Offer Breakup

- IPO Strengths

- Key Risks

- Yatharth Hospital and Trauma Care Services Ltd Financials

📃About Yatharth Hospital and Trauma Care Services Limited

Incorporated in 2008, Yatharth Hospital and Trauma Care Services Limited is a multi-care hospital chain. Yatharth Hospital operates through its super speciality hospitals. These hospitals are in Delhi NCR, i.e., at Noida, Greater Noida, and Noida Extension, Uttar Pradesh. The hospital located in Noida Extension Hospital has 450 beds and is one of the largest hospitals in the area.

Yatharth Hospital and Trauma Care Services provide patients with various Amenities and facilities. The NABH accredits all of their hospitals. And the ones located at Greater Noida and Noida Extension are accredited by NABL. The hospitals comply with all necessary international quality standards to ensure the safety and recovery of the patients.

The company acquired a 305-bedded multi-speciality hospital in Orchha, Madhya Pradesh, to extend its operations and services.

A team of 370 doctors is engaged with the company. They offer healthcare services across numerous specialities and super specialities.

The super speciality or Centres of Excellence (COE) of the hospital includes:

Centre of Medicine, Centre of General Surgery, Centre of Gastroenterology, Centre of Cardiology, Centre of Nephrology & Urology, Centre of Pulmonology, Centre of Neurosciences, Centre of Paediatrics, Centre of Gynaecology, Centre of Orthopaedics and Spine & Rheumatology.

💰Issue Details of Yatharth Hospital and Trauma Care Services Ltd IPO

- IPO open from 26th July 2023 – 28th July 2023

- Face value: ₹10 per equity share

- Price band: ₹285 to ₹300 per share

- Market lot: 50 shares

- Minimum Investment: ₹15,000

- Listing on: BSE and NSE

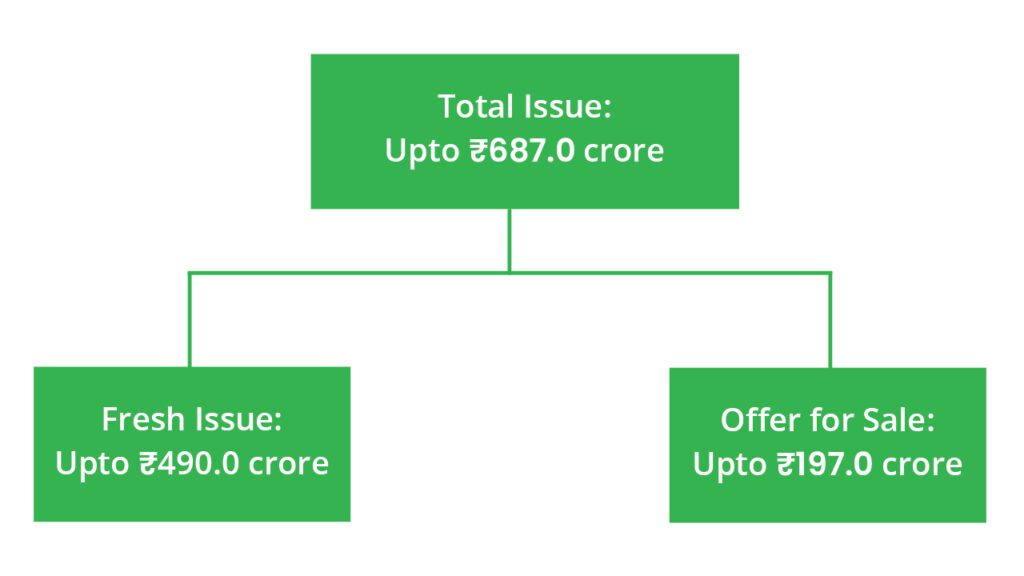

- Offer for sale: ₹687 Cr (Fresh Issue of ₹490 Cr+OFS aggregating up to ₹197 Cr)

- Registrar: Link Intime India Private Ltd

🪙Total Issue Price

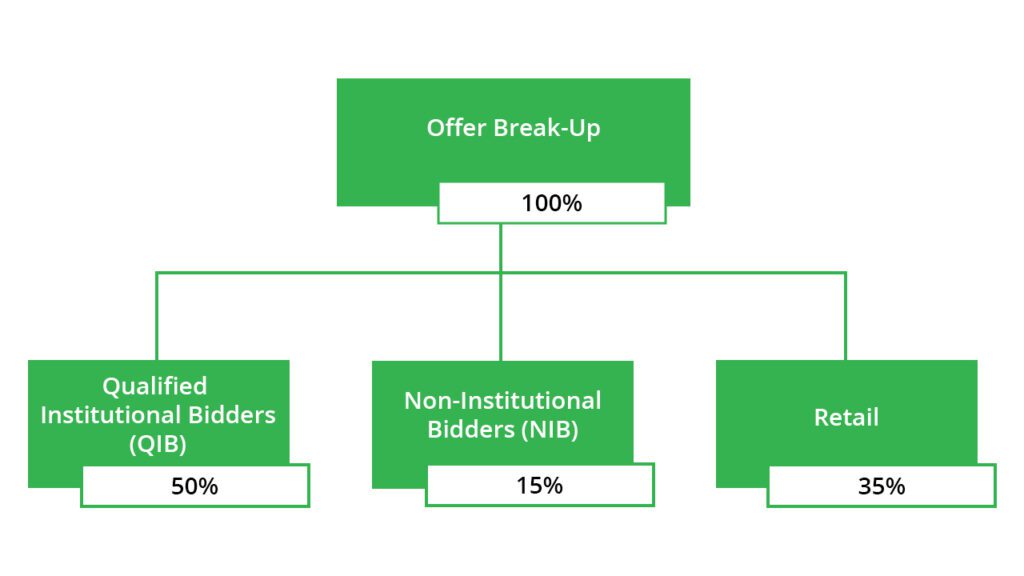

🪚Offer Breakup

🔭IPO Object

The company intends to utilize the net proceeds from the issue towards the funding of the following objects:

- Repayment/ prepayment, in whole or part, of certain borrowings availed by the company.

- Repayment/ prepayment, in whole or part, of certain borrowings availed by the Subsidiaries, namely, AKS Medical & Research Centre Private Limited and Ramraja Multispeciality Hospital & Trauma Centre Private Limited.

- They are funding the capital expenditure expenses of the company for two hospitals, namely, Noida Hospital and Greater Noida Hospital.

- Funding capital expenditure expenses of the Subsidiaries, AKS and Ramraja, for respective hospitals operated by them.

- They are funding inorganic growth initiatives through acquisitions and other strategic initiatives.

- General corporate purposes.

⛓️IPO Strength

Some of the qualitative factors and strengths which form the basis for computing the Offer Price are:

- Among the leading super-speciality hospital in Delhi NCR with diverse speciality and payer mix

- Experienced and qualified professional management team with a strong execution track record

- Track record of stable operating and financial performance and growth

- Advanced and high-end medical equipment and technology

- Ability to attract quality doctors, nurses, paramedical, and other staff

🧨IPO Risk

- They are highly dependent on doctors, nurses and other healthcare professionals, and their business and financial performance will be impacted if they cannot attract, retain or train such professionals.

- Their operations are concentrated in the Delhi NCR region. They are also significantly dependent on certain specialities for most of their revenues. Any impact on the payments from these hospitals or earnings from their top things could materially affect their business, financial condition, results of operations and cash flows

- Their business depends on the strength of their brand and reputation. Failure to maintain and enhance their brand and reputation, and any negative publicity and allegations in the media against them, may materially and adversely affect the level of market recognition, and trust in, their services, which could result in a material adverse impact on their business, financial condition, results of operations and prospects.

- They compete with other hospitals, pharmacies and healthcare services providers. Any adverse effects on their competitive position could result in a decline in their business, revenues, profitability and market share

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-21 | ₹308.77 | ₹229.19 | ₹19.59 |

| 31-Mar-22 | ₹426.02 | ₹402.59 | ₹44.16 |

| 31-Mar-23 | ₹485.97 | ₹532.10 | ₹65.77 |

PEER COMPANIES

- Apollo Hospitals Enterprise Limited

- Fortis Healthcare Limited

- Max Healthcare Institute Limited

- Narayana Hrudayalaya Limited

- Krishna Institute of Medical Sciences Limited

- Healthcare Global Enterprises Limited

📬Also Read: Sustainable Investing in India: ESG Investments