FIIs Go Big: 💰 $733M Short Play in September! 📉| Stock Market Weekly Update Sep 30

Hello Readers!

We hope you had a great week!

In September, foreign institutional investors (FIIs) adopted a cautious stance in the Indian market, displaying their highest net short position since the market’s low point in March. Their net short position amounted to $733 million, a notable shift from the net long position of $20 million they held in the preceding period.

This data indicates that FIIs leaned towards short bets, holding 57,300 contracts in index futures at the beginning of September, compared to only 1,700 long contracts. On the other hand, retail investors and high net worth individuals (HNIs) drove an increase in market-wide open interest, following the trend from the previous series.

As the market transitioned into October, it commenced with an open interest base of Rs 20,400 crore (10.4 million shares), with market-wide futures open interest totaling Rs 2.863 trillion. However, a sense of caution prevailed, especially concerning midcap and smallcap segments, suggesting potential volatility and limited upward movement.

Looking ahead, it appears that market experts anticipate sustained volatility. They foresee heavyweight stocks trading within a broader range, highlighting resistance at 19,900. Adverse developments could potentially lead the Nifty Index towards the 18,800 level in the short term.

In summary, the cautious approach of foreign investors, coupled with the evolving dynamics of the market, suggests a prudent and watchful stance amidst potential fluctuations and challenges in the near term.

🧾In this Article

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

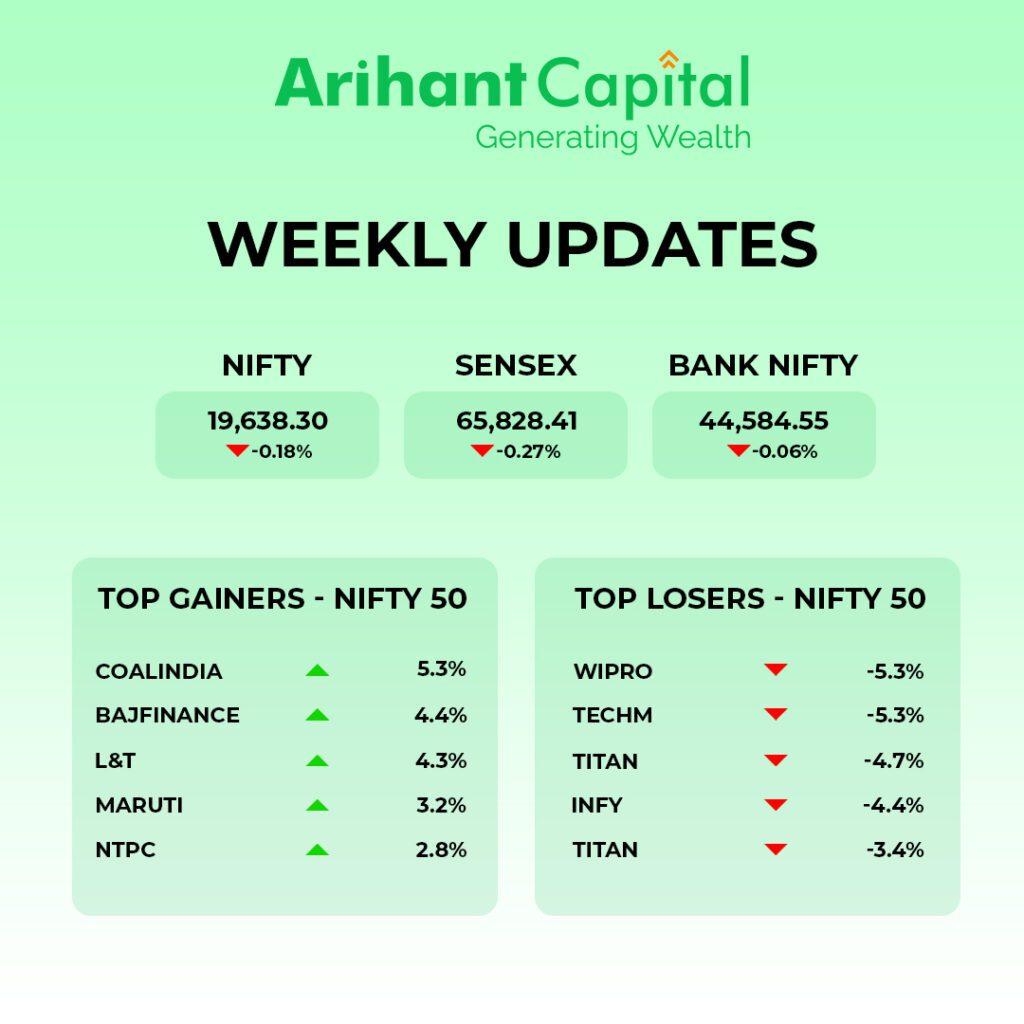

Nifty

If we look at the daily chart of Bank-Nifty, we observe prices closed below 50 DMA & “Doji” candlestick formation on the weekly chart also shows “Doji” candlestick formation. Analyzing both chart patterns indicates that bank-nifty can see more pressure than Nifty. Bank-nifty starts trading above 44,750; then it can touch 44,950 and 45,200 levels. However, downside support comes at 44,300; below that, we can see 44,100 and 43,900 levels.

Bank Nifty

If we look at the daily chart of Bank-Nifty, we observe prices closed below 50 DMA & “Doji” candlestick formation on the weekly chart also shows “Doji” candlestick formation. Analyzing both chart patterns indicates that bank-nifty can see more pressure than Nifty. Bank-nifty starts trading above 44,750; then it can touch 44,950 and 45,200 levels. However, downside support comes at 44,300; below that, we can see 44,100 and 43,900 levels.

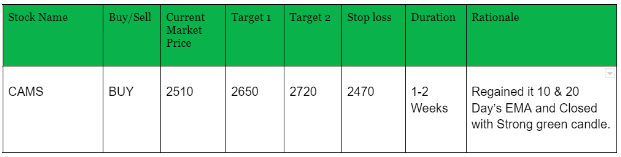

💰Stock Picks

– Ms. Kavita Jain, Sr Research Analyst and Learning Head, Arihant Capital.

🔎Stocks in News

💼 South Indian Bank: The Board approved the appointment of PR Seshadri as MD and CEO.

⚡ NLC India: Plans to establish three 800 MW power plants in Odisha.

💰 Sterling and Wilson: Secured an order valued at ₹1,535 cr from NTPC.

🚌 Ashok Leyland: Ordered 1,282 fully assembled buses from Gujarat State Road Transport Corporation.

🚇 L&T: Won an order to design and construct an underground road tunnel in Mumbai.

🏦 Federal Bank: RBI has granted the International Finance Corporation (IFC) permission to acquire a 9.7% stake in Federal Bank.

💵 Canara Bank, PNB: Raised funds worth ₹8,000 cr through different debt instruments.

💸 IL&FS: Approved an interim distribution payout to creditors of ₹807 cr.

🏦 Dhanlaxmi Bank: RBI cleared the appointment of KN Madhusoodanan as a part-time chairman of Dhanlaxmi Bank.

💸 Aditya Birla Capital: Invested ₹750 cr into its subsidiary AB Finance.

✍️ REC: Signed a memorandum of understanding (MoU) with PNB to jointly fund projects in the power sector and infrastructure & logistics sector.

📈 Tata Steel: Moody’s revised the company’s outlook to ‘stable’ and upgraded its long-term rating.

🏢 Century Textiles: Announced the launch of a real-estate project in Bengaluru by its subsidiary Birla Estates.

⚙️ Salasar Techno Engineering: Announced commissioning its new zinc galvanisation facility at the Hapur plant in UP.

💊 Gland Pharma: The Pashamylaram facility in Hyderabad has received an Establishment Inspection Report (EIR) from the USFDA, indicating the inspection closure.

🏥 Fortis: Gained board approval to acquire a 99.9% stake in Artistry Properties for ₹32 cr.🚌 Indian Oil: Launched India’s first green hydrogen-powered bus that emits just water.

💸 Aditya Birla Capital: Subsidiary Aditya Birla Finance plans to raise to ₹2,000 cr.

🏗️ Gordej Properties: Sold about 670 flats worth more than ₹2,000 cr in its new housing project in Noida.

🏭 Shree Renuka Sugar: Entered an agreement for 100% acquisition of the equity shares of Anamika Sugar Mills for ₹235.5 cr.

💰 L&T: ₹10,000 crore buyback was oversubscribed on the last day, led by qualified institutional buyers.

💸 Delta Corp: Received a tax notice totalling ₹16,822 crore from the Directorate General of GST Intelligence.

💡 Strides Pharma: The Board approved a scheme of arrangement amongst Strides Pharma Science, Steriscience Specialties, and Stelis Biopharma.

📰 Quick Bites

📊 S&P Maintains India’s GDP Forecast: S&P keeps India’s GDP forecast at 6% for this fiscal year, citing global slowdown, unusual monsoons, and delayed rate hike effects as potential growth dampeners.

💻 Indian Government Postpones Laptop Import Restrictions: The Indian government delays laptop import restrictions by a year.

🏗️ Budget Overruns in Infrastructure Projects: In Aug 2023, 412 major infra projects in India (₹150+ cr each) exceeded budgets by ₹4.77 lakh cr; 830 of 1,762 faced delays: Ministry of Statistics.

💸 GST Notices to Online Real Money Gaming Companies: DGGI sends pre-show cause notices to online actual money gaming firms over GST dues of about ₹55,000 cr.

🌾 Export Restrictions on Non-Basmati Rice Lifted: DGFT lifts export restrictions on non-basmati white rice, allowing the export of 75,000 tonnes to the UAE.

🔒 SEBI Extends Nominee Deadline: SEBI extends the deadline for adding nominees for demat account holders till December-end.

💰 Government Borrowing Plans: Indian government to borrow ₹6.55 lakh cr (42.45% of the total budget for FY24) in the second half: Finance Ministry.

🏦 RBI Sets Limit for Ways and Means Advances: RBI sets Ways and Means Advances limit for H2 FY 2023-24 at ₹50,000 cr, a lending facility for the government.

💡🍬 Knowledge Candy: 🤔 What are outstanding shares, and how do they relate to float shares?

Outstanding shares refer to the total number of shares a company has issued and are available in the market for trading, investment, or purchase. It encompasses shares held by all entities, including individual investors, institutional investors (like banks and mutual funds), and insiders (such as founders, CEOs, and executives).

To illustrate, let’s take the example of ABC Ltd., which has:

- 20,000 shares owned by individual investors,

- 10,000 shares owned by institutional investors, and

- 10,000 shares owned by insiders.

In this scenario, the outstanding shares for ABC Ltd. would be the sum of these, totalling 40,000 shares.

On the other hand, Float represents the portion of outstanding shares readily available for trading on the stock market. It excludes shares held by insiders or those subject to specific restrictions on trading. In the case of ABC Ltd., if 10,000 shares are held by insiders and are not available for trading, the float would be the outstanding shares minus these restricted shares, giving us 30,000 (40,000 – 10,000).

Understanding both outstanding and float shares is crucial for investors as it provides insights into a company’s stock’s liquidity and market dynamics. A lower float can suggest higher insider ownership, potentially signalling confidence in the company’s prospects. However, a low float may also result in higher stock price volatility, which may not be suitable for all investors. Considering these factors is essential when analyzing a company’s shares and making informed investment decisions.

Happy reading!

Also Read: How to Trade Above Freeze Quantity in Options on Arihant Plus?