Honasa Consumer Limited IPO is live. Should you Invest?

In this article

📃About Honasa Consumer Limited

Incorporated in 2016, Honasa Consumer Limited (HCL) provides beauty and personal care products through its digital platform.

Honasa Consumer was founded on the values of Honesty, Natural ingredients, and Safe care and currently serves over 500 cities in India. The company has grown several consumer brands internally, including Mamaearth, The Derma Co., Aqualogica, Dr. Sheth’s, and Ayuga. It has recently acquired shares in BBLUNT and the content platform Momspresso. With the support of Sequoia Capital India, Sofina SA, Fireside Ventures, and Stellaris Venture Partners, HCL is positioned to become a $1 billion company.

As of June 30, 2023, the company’s product portfolio includes baby care, face care, body care, hair care, colour cosmetics, and fragrances.

The core strength of the company lies in:

- Building Innovative products.

- The company has multiple distribution channels to cater to customers’ needs online and offline.

💰Issue Details of Honasa Consumer Limited

- IPO open from 31st Oct 2023 – 02nd Nov 2023

- Face value: ₹10 per equity share

- Price band: ₹308 to ₹324 per share

- Market lot: 46 shares

- Minimum Investment: ₹14,904

- Listing on: BSE and NSE

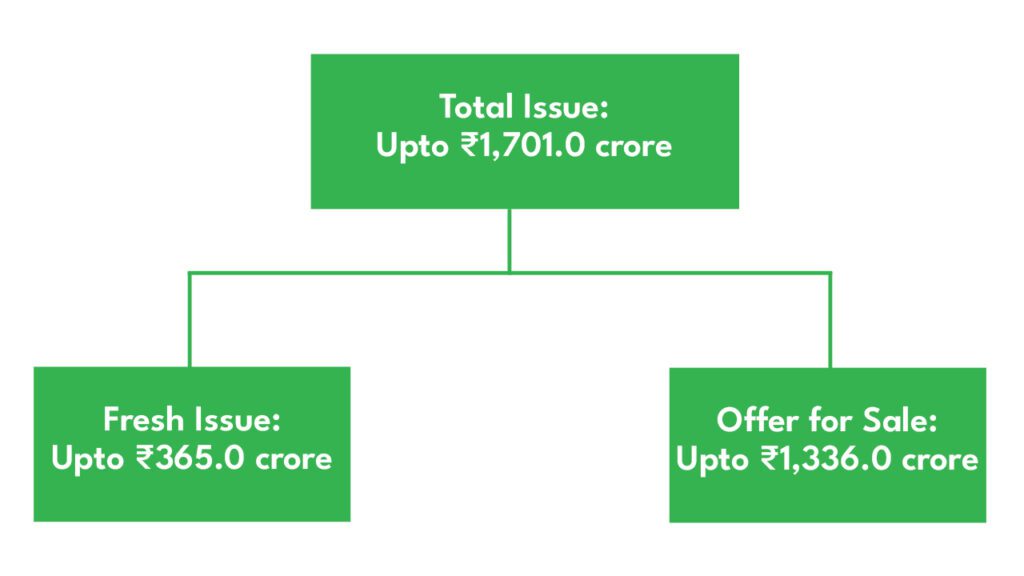

- Offer for sale: Approx ₹1701 Cr (Fresh Issue: ₹365 Cr + OFS: ₹1336 Cr)

- Registrar: Kfin Technologies Limited

🪙Total Issue Price

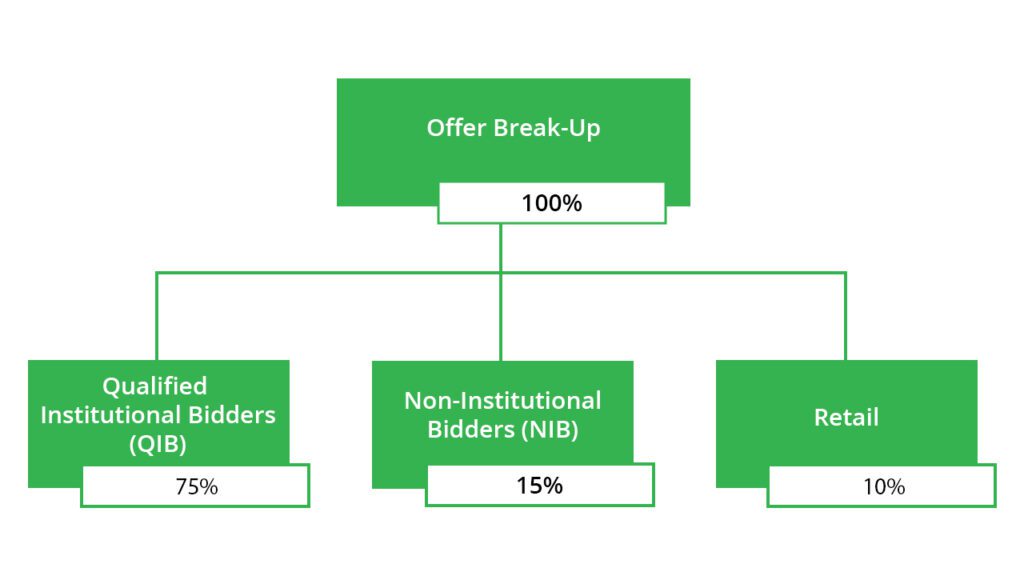

🪚Offer Breakup

🔭IPO Object

The Company proposes to utilize the Net Proceeds towards funding the following objects:

- Advertisement expenses towards enhancing the awareness and visibility of the Company’s brands;

- Capital expenditure to be incurred by the Company for setting up new EBOs;

- Investment in the Company’s Subsidiary, Bhabani Blunt Hairdressing Private Limited (“BBlunt”), for setting up new salons and

- General corporate purposes and unidentified inorganic acquisition.

⛓️IPO Strength

Some of the qualitative factors and strengths that form the basis for computing the Offer Price are:

- Brand-building capabilities and repeatable playbooks

- Customer-centric product innovation

- Data-driven contextualised marketing

- Ability to drive growth and profitability in a capital-efficient manner

- Digital-first omnichannel distribution

🧨IPO Risk

- Their brands and reputation are critical to the success of their business. They may be adversely affected for various reasons, which could harm their business, financial condition, cash flows, and results of operations.

- They are dependent on several third-party service providers to sell or distribute their products to consumers and on third-party technology providers for certain aspects of their operations. Any disruptions or inefficiencies in these operations may adversely affect their business, financial condition, cash flows and results of operations.

- Reliance on celebrities and social media influencers as part of their marketing strategy may adversely affect their business and service demand.

- The success of their business depends substantially on their management team and operational workforce. Failure to retain them could adversely affect their businesses.

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-21 | ₹302.64 | ₹472.10 | –₹1324.61 |

| 31-Mar-22 | ₹1035.01 | ₹964.35 | ₹14.44 |

| 31-Mar-23 | ₹966.42 | ₹1515.27 | –₹150.97 |

PEER COMPANIES

- N.A.

📬Also Read: A Simple Guide: Opening a Demat Account for Minors in Bharat