How to manage money in volatile times: Lessons for every investor type

They say risk-taking ability and the perception of risk for individual changes with time, earnings, education, experience – however it is also firmly believed that an individual’s risk preference is like his General Intelligence quotient – it is something he/she is born with and remains stable through his/her life.

What is risk?

The possibility of something bad happening.

What is volatility?

Rapid changes in the state of something/someone.

What joins the two?

The direction in which these “rapid changes” take you, is the unknown called risk and hence when we merge the two, the outcome is fear!

Let us understand how risk affects us. Our advice to others on a situation and how we ourselves react to it, often times, don’t match. When someone else is in the same situation, same circumstances – we tend to advise differently. But when we are in it ourselves the segregation of emotion from practicality goes for a complete toss. A medical emergency in the family, a teacher’s call for your child’s ill-behavior, an announcement of layoffs at work – different situations that have tested our mettle at differing degrees of distress.

So then, let me throw in a simple statement – “You have lost Rs. 1 lac rupees.”

Now, what would be your immediate response?

- What? How? Are you insane? Give me the rest of it right now.

You fall into CONSERVATIVE CATEGORY

- Okay, get my money out and let us understand why this happened. We should also learn what can be done to avoid similar losses in the future.

You fall into MODERATE CATEGORY

- Do whatever you want, and if it’s a good time to invest more, I am ready to put some more money in.

You fall into AGGRESSIVE CATEGORY

It is possible that you may have a second thought after reading all the options mentioned above and give a different reaction a few minutes later – but the first reaction is what comes straight from your gut and is part of your inherent nature.

Now, if this is indeed the case, then shouldn’t you and your financial advisor customize your investment plan to suit this behavioral trait? Of course, you should.

Reading a generic article about why you should increase your investments during a market fall or why you should NEVER stop your SIPs and why you should not keep any money in the bank FD because it is tax-inefficient – may not be of much help to you. Because when you read generic thumb rules, you try to emulate what may be workable for someone else. And give up on this borrowed wisdom, at the first sign of distress – thus losing more money, health, peace of mind, and even relationships in the bargain.

The first step in managing volatility and risk – is to accept that it exists.

Most of us tend to be acutely human – always stretching current situations to perpetuity. If the markets are falling, we assume they will continue to fall forever.

The very next week, when markets begin to pick up – we start feeling a gush of positivity assuming that will stay on forever.

Often we feel a FOMO (fear of missing out) on what we could have done if we would have behaved rationally instead of panicking at a point. But I wouldn’t discredit those who panic either – these are two different personalities at play.

So let’s break this question down – How to manage money in volatile times, as per the 3 personality types because I firmly believe that there is no one size that fits all. Investment advice in any scenario has to be customized to suit one’s individual traits for the decided program to last long.

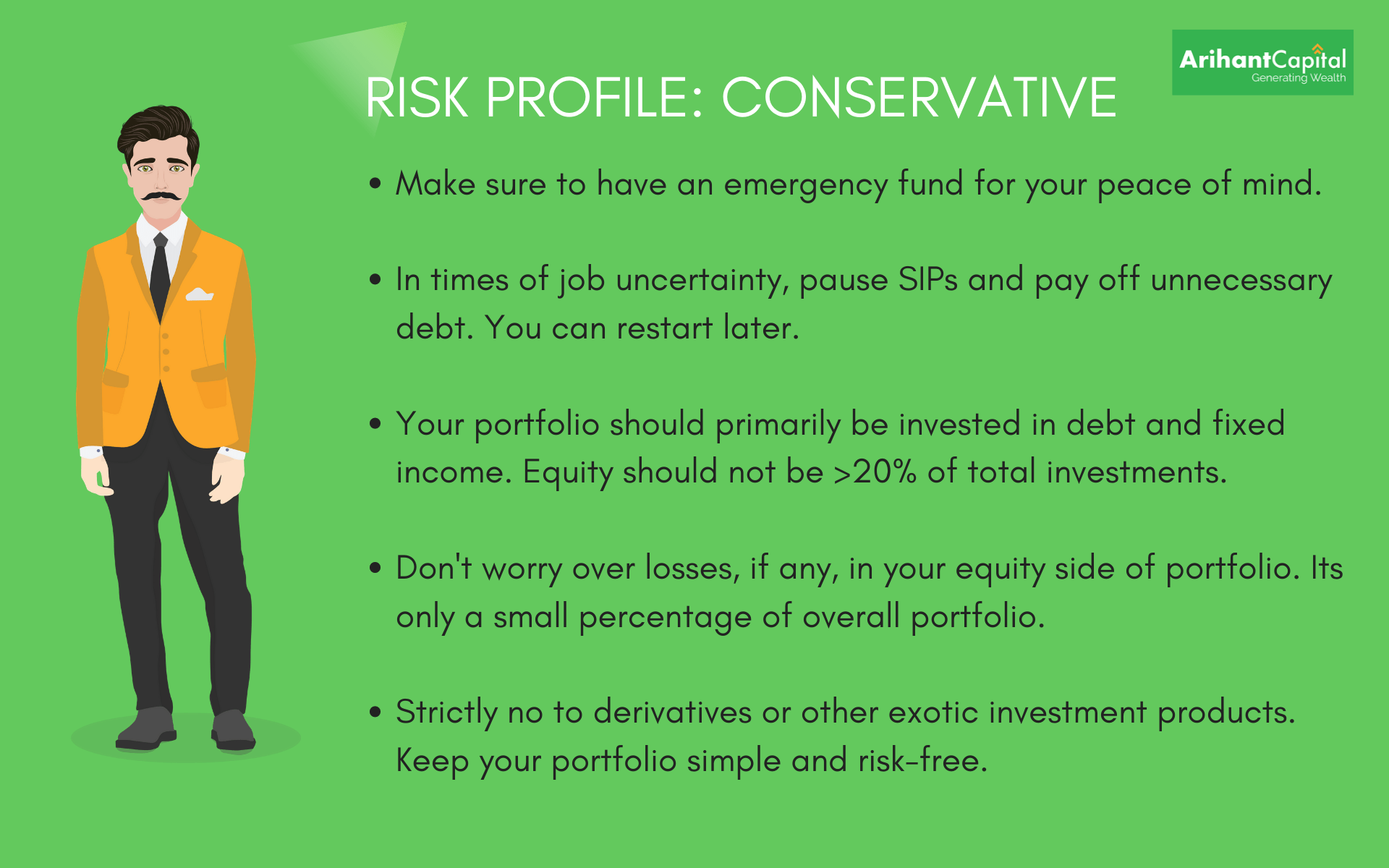

Ways to manage volatility for Answer 1 – Type: CONSERVATIVE

- Begin with the belief that you cannot handle extreme risk – avoid exotic investments that you don’t understand: locked-in products, leverage, short selling, derivatives, penny stock tips, and similar such unconventional “opportunities.”

- ALWAYS have some money in the bank – fixed deposits and savings accounts may be return and tax-inefficient but they are important to your peace of mind.

- Use reminders effectively – credit card bills, rent, EMI payments, SIPs should all go on fixed dates – preferably set for 5 days after your scheduled salary credit date. Avoid risk where there is none.

- In times of doubt on retaining your job, pause SIPs, defer non-essential purchases, and close unnecessary loans for the time being. You can always restart it later.

- The majority of your portfolio should be debt or fixed income with some portion (20-30%) being in equities. Determine this equity percentage based on what you can accept becoming half of what it was. If the answer is 10%, then let it be 10%.

- When you make profits on equity, take the profits off the table – consider this your principal being taken off. You can reassess your asset allocation and rethink on that equity percentage, without going overboard.

- When markets fall, since the monies in equity were designed and accepted to lose half value – shut your eyes to it and concentrate on protecting debt instead.

- Accept that anyone giving you a significantly higher return above the government rate on a fixed income is taking one of the three risks – credit, duration, or market. When making an investment in any such high yielding debt instruments, consider them to be a part of your equity allocation since it is equally capable of losing/blocking capital. Or rather, just stick to equity.

- Invest in traditional fixed income instruments. A good bank FD, gold, post office deposits, provident funds, new pension schemes (NPS), balanced hybrid mutual funds, tax-free bonds, physical real estate, giant cap stocks, dividend yield mutual funds, liquid, and arbitrage schemes, traditional insurance policies, etc.

- Stay away from derivatives altogether. Not even for hedging. Your existing fixed-income investments are a natural hedge already.

Ways to manage volatility for Answer 2 – Type: MODERATE

- You’re an exemplary investor, a trusted family member, a formidable friend – most of the people you know perhaps count on you for being rational in distress. But do understand, the above rules apply to you too.

- Decide your asset allocation with careful consideration of your age, stage of life, assets, and liabilities, major expenses like a house upgrade, or a child’s college coming up. Derive your asset allocation scientifically and follow it like a bible.

- Getting into exotics continues to be a “no-go” zone for you too. Reserve your risk appetite and rationality for better things

- You should have a fair allocation to equities, so you can earn a good compounding rate of return on your investments. Stick to your strategy even when the going is not good. Think things through in times of volatility before making any rash decisions, remember these are temporary shocks that will blow over.

- Allocating more monies during market falls may seem like a braveheart’s game – but you can do it. Just remember to not go beyond your pre-decided asset allocation.

- Longer-term debt instruments like market linked debentures and corporate bonds, long term portfolio-balancing instruments like hybrid funds, offshore fund of funds, etc. can be done for a small portion of the portfolio. Don’t go overboard on it, because such instruments come at higher risk, and for that equity is a better choice.

- Follow your gut. It is the best guiding light for you. If something doesn’t feel right, don’t give in to the sales pressure and do it.

Ways to manage volatility for Answer 3 – Type: AGGRESSIVE

- You are the risk-taker of the lot. You have the capability to lose, the tenacity to withstand the loss and the courage to accept a mistake. This unique capability opens up the horizon for you to do so much with your money. And yes – higher risk equates higher returns! Just make sure to sleep over your decisions before you finalize.

- Exotics like leveraged investments, excessive day trading, derivatives trading may not be what you need to keep the adrenaline up. There are other forms of entertainment. Unless you have an investment strategy, you understand numbers, graphs, volatility, market movements and you know what you are doing – stay away from it.

- Your allocation could be skewed towards growth-oriented assets – equity and real estate. For ad-hoc expenses or an emergency withdrawal, equities are as liquid as fixed income. So, no need to park excess monies into debt, barring an emergency fund.

- Since you can end up heavily in equity, hedging your portfolio for a downside of beyond a 20% drop in the markets may be a cost you should incur.

- Scheduled payments of cards, EMIs, loan repayments, etc. apply to you as well since your funds may have a tendency of being diverted towards short-term trading making you vulnerable towards defaulting on these time-bound obligations.

- Monies meant to go into equities can be parked in liquid funds for timing. FDs and debt investments are not for you.

- International funds, investments under the Liberalized Remittance Scheme, commercial real estate, market-linked debentures, midcap & Small-cap funds, short-term sectoral bets are some of the instruments you can explore with your risk-taking ability. However, understanding the liquidity and transparency of the instruments being invested into is critical before taking such decisions.

We often think we will be better prepared the next time we are stuck with a calamity because of past experience. But what we forget is volatility is the calamity that strikes in a different manner every time.

There won’t be any volatility if history kept repeating itself in the same predictable way.

The only constant is our inherent nature.

The volatility is not in the markets, it is in your mind. It is up to you, how much you allow yourself to feel the shock. Find out what kind of investor you are – conservative, moderate, or aggressive. Measure the depth of that appetite before-hand, since then you will serve yourself only as much as you can digest!

Investing in volatile times can help you get higher returns, but it can also cause a lot of stress and sleepless night, which none of us want. So make sure you stick to your asset allocation plan and understand the strategy suited to your profile.

Like Elon Musk once said – “it is ok to have all your eggs in one basket as long as you control what happens to that basket.”

Most importantly, no matter what kind of investor you are remember compliance and regulations are important. A fraudulent transaction or non-compliance with the laws can hurt you unnecessarily. Always ask for the full disclosure and keep a signed copy with you for future reference.