What is a Demat Account And How to Open it?

A Demat account is like a bank account for your shares. Instead of physically storing lots of share certificates and sending them physically to your broker every time you make a trade, they are electronically stored in a safe account. Whenever you want to buy/sell shares they are deposited or withdrawn from this account almost instantly, with the help of a trading account.

Here is a quick guide to everything you need to know about opening a Demat account with Arihant.

How to Open a Demat Account

Struggling to earn extra cash? Rising prices burning a hole in your pocket? Can’t afford to tie your money up in safe but low-yielding Fixed Deposits that can’t even beat inflation? Looking for a higher return on investments? Investing in equities is all you need – Welcome to the exciting world of stock markets!*

Lifetime Free/Zero AMC Demat Account

At Arihant, we are offering a lifetime Free AMC Demat account in India. This account is the best Demat account for beginners who want to trade in the stock market.

To start investing, all you need is your very own Demat and trading account!

Benefits of opening a Demat account

A Demat account is just like email: safe, secure, and FAST. No need to wait for weeks for one transaction to be executed, or worry about theft of a share certificate. With Demat, your shares are stored electronically and all transactions are settled within 2 days! Whether you shift your address or want to sell just a single share, Demat accounts make the process seamless and hassle-free. And what’s more, it is FREE!

How to open a lifetime free Demat account online

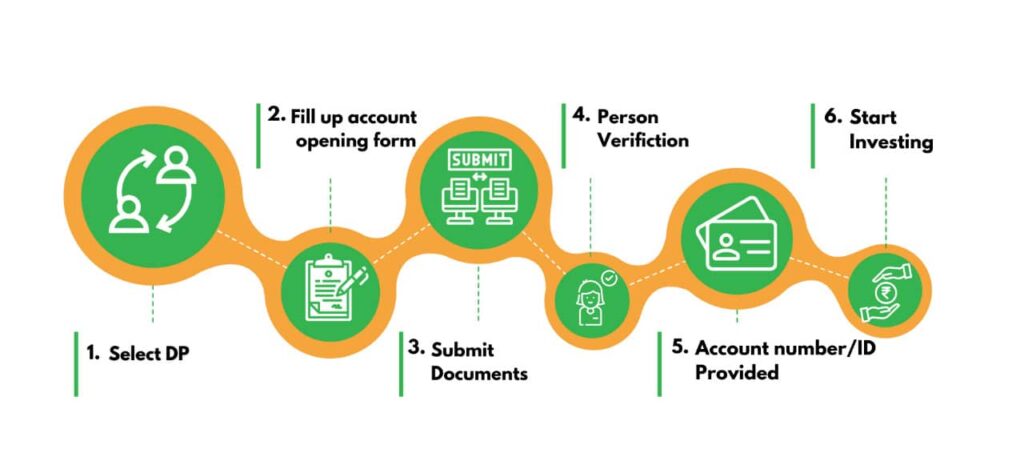

Demat account opening procedure:

Step 1: Fill out some basic details in the account opening form and our team will assist you.

alternatively, you can directly fill out an application form(link to Freedom 300 application form) where you can specify which depository you want to use. There are two depositories in India, namely the Central Securities Depository Limited (CDSL) and the National Securities Depository Limited (NSDL). You can also choose if you want to trade in capital markets, futures and options (F&O), stocks lending & borrowing or derivatives.

Step 2: Document Submission:

You will need to submit the following documents for KYC

- PAN card

- Address proof (ration card/passport/driving license, electricity/telephone bill)

- Bank Statement

- Demat Account Statement or slip (if any)*

- Latest passport-size photograph (one)

Along with these, you must sign a power of attorney to Arihant allowing us to initiate trades on your behalf.

Step 3: In-person Verification:

To fulfil this mandatory SEBI requirement, you can visit the nearest Arihant branch or we can send a representative to verify that your identity proofs match yours.

We even offer door pickup, virtual IPV, accept digital signatures, and use auto verification with Aadhar for your convenience.

Once your application is processed fully, you will have an active Demat account, trading account, and a client ID within 24 hours.

To open your FREE Demat account today, simply go to Arihant’s website and click on “Open an account”

How to operate a Demat account online

A Demat account is linked with a trading account that enables buying or selling after your trading account is active you can easily transact at the touch of a button. Arihant offers a free mobile app and Invest Ease for Web makes trading a breeze (app blog backlink). If you are a seasoned professional you can also choose to get the desktop application, Ari-Trade Speed. These applications offer a powerful platform to make your trading experience fast and seamless

What are the charges for running a Demat account?

Special offer: Open a Lifetime free Demat account

With our new Freedom 3000 plan, you get a Zero opening fee, Zero maintenance fee account. You can open an account with an interest-free refundable deposit of Rs 3000/- only if you decide to close your account, and your account is active for more than a year this amount will be refunded to you fully, else a small fee of Rs 500/- will be charged. You can convert your paper shares to Demat form at a charge of Rs 10 per certificate and postage charges. Should you need to get back to your roots and convert to a share certificate you can do that for a mere Rs 20 for every 100 securities. GST will be levied on the total bill amount at the rates as may be notified by the government from time to time.