Infosys Q1 FY23 Results Misses Estimates. Should you stay Invested?

In this article

India’s second-largest IT company Infosys by market cap posted its Q1 FY23 results. Infosys Q1 FY23 results failed to impress the analysts at Arihant Capital and the numbers were below our estimate on all fronts. The company has raised its revenue guidance but has reduced its margin guidance band for FY23.

Infosys reported a stable growth in its net profit, which increased 3.17% YoY (year on year) to ₹5,360 crores in Q1 FY23 from ₹5,197 crores in Q1 FY22. The revenue from operations of the company came in at ₹34,470 crores, jumping 23% YoY from ₹27,896 crores reported in the same quarter of the previous year.

Key Financial Highlights of Infosys Q1 FY 23 Results

Hits

- 😊In constant currency terms the revenue grew by 18.5% YoY and 0.7% QoQ to $4,280 mn against our estimate of $4,352 mn.

- 😊Infosys has reported consolidated revenue of ₹32,276 crores, up 22.7% YoY against our estimate of ₹32,658 crores supported by continued momentum in large deal wins with TCV of $9.5 billion.

- 😊Consolidated EBIT stood at ₹6,956 Cr, up by 8% YoY/-7.1% QoQ against our estimate of ₹7,527 Cr.

- 😊Consolidated PAT stood at ₹5,695 Cr, up by 12.2% YoY/2.2% QoQ against our estimate of ₹6,082 Cr.

- 😊 The IT giant added 85,000 freshers in FY 22 and will add over 50,000 freshers in FY23. The company net added 85,000 employees in FY22. It plans to hire upwards of 50,000 employees in FY23

- 😊Raised revenue growth guidance to 13-15% in cc terms and operating margin guidance of 21%-23% for FY23.

- In Geography the US and Europe grew over 20%, and North America cross $10 mn revenue while financial crossed $5 mn revenue milestones.

- Basic EPS was published at ₹12.78, growing 4.4% YoY.

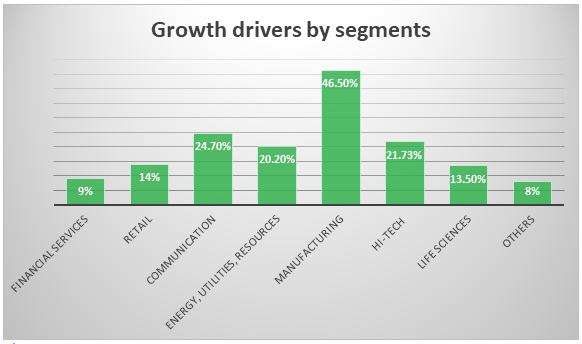

- Looking at the segment-wise performance, on a yearly basis, the growth was in double digits across all business segments in constant currency terms. The digital segment alone accounted for 61.0% of overall revenues, growing at 37.5% in terms of constant currency.

Misses

- ☹ EBIT margin contracted by 2.92% from the first quarter of the last year and 1.93% from the last quarter to 21.6% against our estimate of 23.0%.

- ☹ Attrition zooms to 27.7% ìn Q4. The company’s attrition remains high but annualized quarterly attrition came down by 5 pp QoQ.

💬Management Speak

- Lower sequential revenue growth was due to adverse impact from the 3rd wave and some contractual client obligations which are expected to be recovered in the coming quarters.

- Raised revenue growth guidance to 13-15% (in constant currency terms) for FY23 supported by large deal wins and a robust pipeline.

- 21-23% EBIT margin guidance band includes certain cost savings related to the pandemic.

- Q1FY23 has seen wage hikes across the offshore and onshore centres which has an impact on the sequential margin for Q1FY23.

- The company’s fresher hiring will continue to remain elevated for FY23.

- The company’s digital revenue which accounts for 59.2% of the total revenue, grew by 41.2% for the year. The digital revenue crossed the $10 mn run rate. Within the digital, the company’s cloud segment is growing faster.

- The company has had a very limited impact on its operations during the Russia-Ukraine war. It is transitioning a 100-employee centre out of Russia. Although, there was no impact on demand from the war. The company’s delivery centres in Romania and Poland are actively recruiting for them.

- The company’s focus remains on scaling up its cloud offerings and its automation tools.

- The subcontracting cost has started stabilizing at around 11% of revenue

Valuation and Outlook

At a CMP of ₹1,749, currently, Infosys is trading at a PE of 25.3x to its FY24E EPS of ₹69.1. The company has upgraded the guidance for revenue growth from 13-15% for FY23 in cc terms. This is higher than the initial FY22 revenue guidance of 12-14% YoY CC revenue guidance. The increase is supported by strong deals and healthy demand. However, the EBIT margin guidance range was reduced to 21-23% for FY 23 against 22-24% in FY22 led by supply-side challenges. The company’s fresher hiring will continue to remain elevated for FY23, indicating a better tech demand cycle, which is positive for the company in the medium term.

Considering expensive valuations and margin pressure, we value Infosys at a P/E of 24x to its FY24E EPS of ₹69.1, which yields a target price of ₹1,659 per share. We downgrade our rating to Neutral from Accumulate earlier on the stock.