Persistent Systems Q1 FY23 results are out. Should you stay invested?

Persistent Systems announced its Q1 FY23 results, check out the key highlights.

Persistent Systems is an Indian multinational technology services company. Its results show strong sequential growth in the fifth consecutive quarter and an expansion in the margin.

Key Financial highlights of Persistent Systems Q1 FY 23 results

Hits

- 😊Persistent System (PSL) reported revenue of $241.5Mn (up 11.1% QoQ/44.8%YoY in USD terms) against our estimate of $235 Mn. Reported revenue of ₹18,781 up 14.7% QoQ/ 52.7% YoY against our estimate of ₹1,873 crores.

- 😊EBIT margin was up by 27bps QoQ and 77bpsYoY at 14.3% above our estimates of 13.5% despite various headwinds, including continued supply side challenges and higher costs of travel and Visa

- 😊Healthy revenue growth and currency with the key tailwinds aided margins.

- 😊Robust order booking: The order booking for the Q1FY23, was at $394 mn in Total Contract Value (TCV) and at $263 mn off with the new bookings ACV contributed $239.8 mn.

- 🙂 Persistent Systems added 3,039 new employees including 545 from the acquisition of media agility, with this, the total strength stood at 21,638 at the end of Q1FY23. This is an increase of 45.2% YoY. This is the first quarter where Persistent’s employee count has crossed 20k.

Misses

Utilization for the quarter came in at 79.5% a 1.1% decline from 80.6% last quarter.

Travel expenses were higher due to the seasonal nature of visa filing costs.

💬Management Speak

- The company has spent about ₹400 crores on acquisitions in the past few quarters. This quarter has the full quarter impact of the Data Glove acquisition and about 2 months’ impact of the Media Agility acquisition.

- The company expects to add another 1,350 fresh graduates in Q2 as a part of the fresher hiring program. Both fresher addition and increased utilization over time will be key operational levers for the company to absorb the impact of wage hikes in Q2 and other margin headwinds going forward while giving the cushion to grow in the way the company bookings.

- In terms of the nature of revenue, offshore linear revenue grew by 11.1% primarily on account of volume growth of 9.3% while the billing rate increased by 1.6%. On-site linear revenue grew by 17.4% comprising of volume growth of 17.2, while the billing rate increased by 0.2%.

- Currency movement had a 90bps positive impact on the margin.

- Persistent could collect some of the receivables, which were provided for earlier losing some bps to the margin.

- The demand environment for the company stays very healthy. The company has not seen any material delays to any client decision making and pipeline and deal win reflect the same.

- The company was recently chosen as an engineering partner for one of the leading European enterprise software companies for 7 years, with a deal size of more than $50 mn. It is the largest single deal by far for the company from the European continent.

Valuations

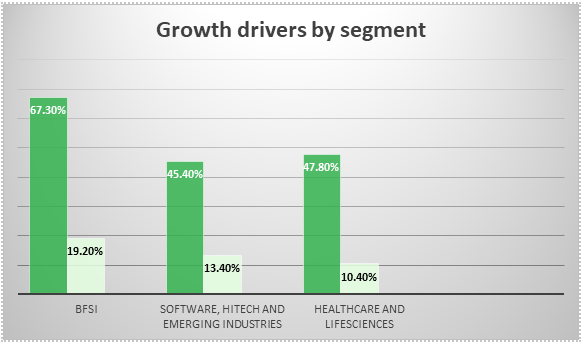

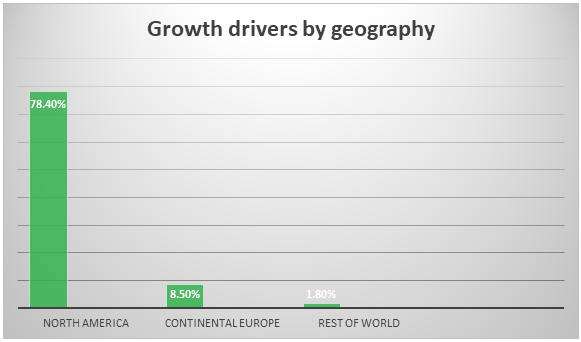

We believe that Persistent Systems has a resilient business structure from a long-term perspective and has multiple long-term contracts with the world’s leading brands. Persistent is continuously delivering strong sequential growth in the fifth consecutive quarters. We expect it will deliver 34.6% YoY USD growth in FY23E led by robust deal wins across focus industry segments, a healthy pipeline, and stable profitability. It will sail through while it faces challenges of increasing amortization on the account of acquisitions. However, the company will continue its aggressive hiring, which will help in overcoming project delivery challenges going ahead. Management’s priority will be to focus on growth while sustaining margins.

This coupled with the recent correction in prices prompted us to upgrade the stock from Neutral to Hold with a revised target price of ₹3,910 per share (PE of 30x on FY24E EPS).