Bulls Reign, India Gets a New President | Weekly Market Wrap-up | 24 July

Arihant Capital’s Weekly Market Wrap-up – catch up on all that’s happened in the stock markets this week before Monday hits us again.

In this article

Markets closed on a positive note for the week ended 24 July, with a 5-day winning streak.

There is a new president in the house. Draupadi Murmu is set to become the first tribal and second woman to hold India’s highest office. She was NDA’s presidential candidate who won the presidential race against the opposition candidate Yashwant Sinha and will take oath as India’s 15th President on July 25.

Do you wait till the last minute to file your income tax returns? It seems the government is in no mood to extend the ITR filing deadline this year. So avoid the last-minute rush and fill your returns today.

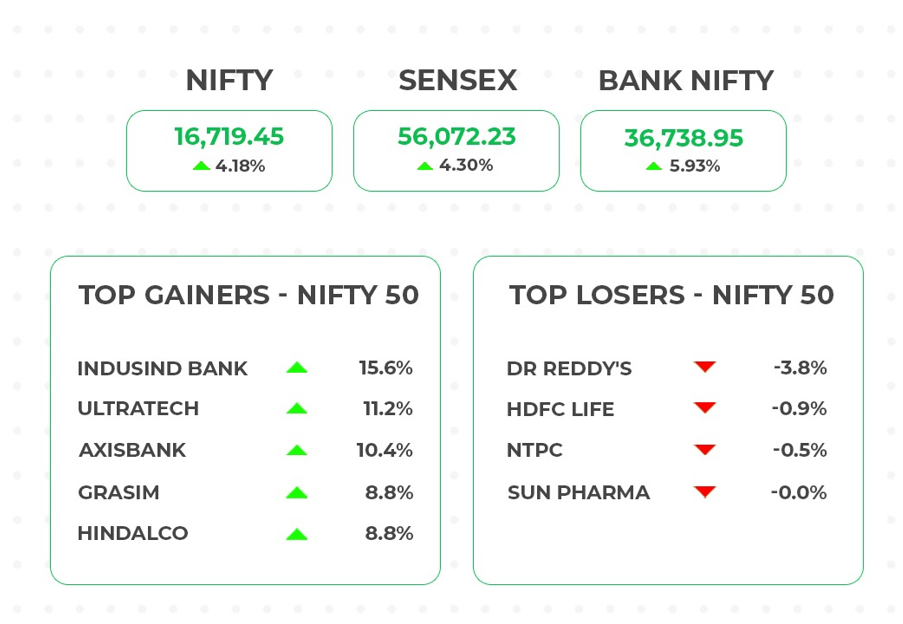

Nifty closed the week at 16,719 points a 4.18% increase from the last week. Sensex zoomed 4.30% to end above the 56,000 mark. Bank Nifty rose to 36,739 points, a 5.93% upward movement.

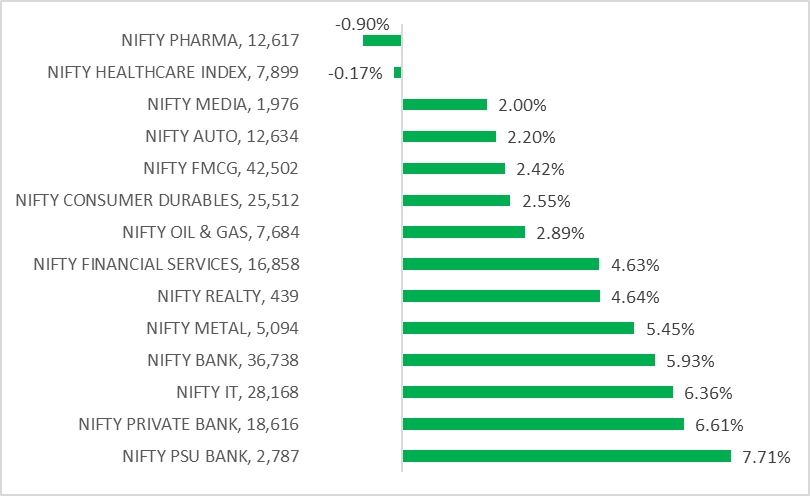

The leaders of the bullish streak this week were: Nifty PSU Bank gaining 7.71%; Nifty Private Bank gaining 6.61% and Nifty IT gaining 6.36%. The only laggards in the markets were the pharma and the healthcare sector, with a meagre -0.9% and -0.17% downside.

What to expect from the Markets

What to expect from the Markets

-Mr. Abhishek Jain, Head Research, Arihant Capital

This is the finest week for the stock benchmarks in at least a year, with a rise of over 4%. Global markets also remain positive with a dip witnessed in the early part of the week.

We believe now a more stock-specific approach is better at current levels. The Market is expected to react to Infosys, Reliance, ICICI Bank & Kotak numbers.

💰Stock Picks

From the Fundamental Desk

-Mr. Abhishek Jain, Head Research, Arihant Capital

Reliance has posted mixed numbers for the quarter where O2C business Ebidta was lower than our estimates while B2C businesses ( Retail & Telecom) have posted in-line performances. We continue to believe in Reliance’s long-term story and advice investors to accumulate at lower levels. Singapore GRMs have crashed to USD 5 dollars in the last months and profitability of O2C business is expected to be lower going forward.

Infosys has posted mixed numbers with margins below our estimates while they have increased their revenue guidance for FY23.

ICICI bank continues to deliver robust performance in terms of NII growth and profitability. We have upgraded our price objective to INR 971 for the stock. Add in tranches.

We continue to remain positive on Asian Paints post 10 pc rally and advice profit booking post results which are expected to be strong. Post recent rally some profit booking is not bad at current levels. Our outlook remains positive.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital

Nifty

On the daily chart of the Nifty, it is trading above all the moving averages. While on the weekly chart a “bullish candlestick” formation is visible. We believe the market will follow a “buy on dips” strategy and we are likely to see stock-specific activity. Nifty can face resistance around 16,800 levels if it starts to trade above it, then it can touch 16,880-17,000 levels. On the downside the support is 16,620 if it touches this level, it can test the level of 16,500 and 16,350 levels.

Bank Nifty

On the daily chart of Bank Nifty, it has closed above the 200 SMA and on the weekly chart, a “Hammer formation” is visible. We conclude that Bank Nifty’s outperformance is likely to continue in comparison to Nifty. In the coming trading sessions, if it trades above 36,850 then it can touch 37,100 and 37,500 levels. However, the downside support comes at 36,650 below that we can see 36,400-36,100 levels.

🔎Quick Bites

Global

- China attempts to defuse the mortgage boycott.

- Less bad news for Netflix and Mega naming trouble for Meta: Meta is sued by another company called Meta, and Netflix loses fewer subscribers than in previous quarters.

- UK inflation stood at 9.4% in June as compared to 9.1% in May

- International gold prices declined to their lowest level since August 2021.

- Another PM had a great fall: Italian prime minister Mario Draghi calls it quits.

- An Apple a day keeps a doctor away? Apple and Amazon announced a foray into healthcare. Amazon to buy healthcare provider One Medical for nearly $4B.

- The European Central Bank raised interest rates by 50 bps for the first time in 11 years.

- At $87 B, India is the top remittance recipient in 2021 according to a UN Report.

Economy

- GST hike on pre-packaged food items to hit home budgets. Health services are now under the GST ambit.

- Joint international efforts needed to ban crypto: FM

- India’s electronic goods exports rose 42% to nearly 1.17 lakh crore in 2021-22

- Govt cuts windfall taxes on domestic crude and fuel exports, and oil company stocks soar.

- Forex reserves are down for a third straight week at $572 billion.

- Aviation turbine fuel prices reduced 2.2% on the back of easing international crude oil prices. Crude is down nearly 20% from its June 2022 high. Edible oil prices could be further reduced.

- Exports of finished steel from India jumped over 25% YoY to 13.49 million tonnes in 2021-22.

Automobile

- TVS Motor to invest ₹1,000 crores in the current financial year for capacity expansion and building of EV product portfolio.

- DHL has filed a lawsuit against Eicher Motors at NCLT over a payment dispute.

Banking and Finance

- The Yes Bank plans to invest ₹350 crores to acquire a 20% stake in JC Flowers Asset Reconstruction Company (ARC). The bank plans to raise $1 billion in the capital during the current financial year.

- The gross non-performing assets (GNPA) of Indian banks are at a six-year low of 5.9% as of March 2022 and are likely to fall to 5-5.5% by 31 March 2024.

- Sebi Proposes Rules for Fintech Platforms. Fintechs should operate under the licenses granted: RBI Governor Das

- Carlyle and Advent International are on the verge of picking up a 10% stake in Yes Bank for $1B.

- IndusInd Bank to raise ₹20,000 crores in debt. Manappuram Finance to raise ₹770 cr via debt securities. Canara Bank has raised ₹2,000 cr by issuing bonds. SBI to raise ₹11,000 cr by issuing debt.

- Ashok Leyland and Adani Capital partner for customised financial solutions for its customers.

Energy and Infrastructure

- NTPC, Indian Oil to form a JV for meeting the electricity requirements of the oil major.

- The power ministry asks states to formulate plans for biomass co-firing in power plants ahead of the Kharif harvest season to reduce stubble burning and air pollution.

- India’s gencos saw 92 lakh tonnes of coal import during April-June, says power minister.

- ONGC inks gas sale agreements for Khubal field in Tripura with GAIL and Assam Gas Company Ltd (AGCL) who will both receive 50,000 standard cubic metres of gas each.

- PNC Infratech signed an agreement with NHAI for 2 projects worth ₹1,623 cr.

IT and Telecommunications

- 5G Auction: Jio has submitted an earnest money deposit of ₹14,000 crores. Bharti Airtel has put in ₹5,500 crores followed by Vodafone Idea (₹2,200 crores) and Adani (₹100 crores).

- In May, Jio gained 31.11 lakh, mobile subscribers. Bharti Airtel added a net of 10.27 lakh users. Vi and BSNL lost 7.59 lakh and 5.3 lakh subscribers in May.

- Global electronics and hardware makers seek PLI payments

- Airtel Ads, a newfangled division of the telecom major, is counting on ads to propel a multibillion-dollar revenue stream in the next 10 years.

- Sterlite Technologies has signed a ₹250 crores multi-year deal with an Indian telecom operator.

- Mindtree has partnered with Rubrik to launch a unified cyber-recovery platform.

Industry

- Aditya Birla Group flagship Grasim announces foray into B2B e-commerce platform for building materials with an investment of ₹2,000 crores.

- Tribunal grants relief to 2 Adani cos in DRI case.

- Meghmani Finechem Ltd has set up the largest CPVC resin plant at Dahej in Gujarat with a capacity of 30,000 tonnes per annum.

Other

- Reliance Brands to bring Maison Valentino to India.

- Zydus Lifesciences Ltd gets a USFDA nod for the antifungal solution and low BP injection.

- Jubilant FoodWorks subsidiary arm raises its stake in DP Eurasia N V by 2.06% to 44.75%.

- Doggo love: Emami has acquired a 30% stake in petcare startup Canis Lupus Services India for an undisclosed sum. The FMCG major is also foraying into India’s cutthroat, ₹30,000 branded powdered spice market.

- Gautam Adani has surpassed Bill Gates to become the 4th richest person in the world

- ITC open to hotels biz demerger, IT arm listing

- Future Retail has formally slipped into insolvency, and NCLT starting its insolvency proceedings.

- Kajaria Ceramics acquire 51% equity shares of South Asian ceramic tiles at ₹28.5 crores.

Key Results

Key Results

- Reliance Industries net profit surged by 46.3% in Q1 at ₹17,955 crores, EBIDTA at ₹40,179 crores, a 45.8% YoY hike.

- IndusInd Bank Limited Q1FY23 results in profits up 64%. Click here for full results.

- ACC reported a PAT decline by 60.6% YoY, and revenue from operations growth by 15% YoY.

- Q1FY23 performance of HDFC bank was marked by treasury loss, resulting in lower operating income.

🔌Sustainability Corner

- Surya Roshni bags orders worth ₹91.27 crores from Bharat Gas Resources.

- There are over 13 lakh EVs registered in India and 2,877 public EV charging stations in 68 cities excluding the data of Andhra Pradesh, MP, Lakshwadeep and Telangana.

- India’s renewable energy capacity stood at 114.07 GW till June end.

- Ola electric will invest $500 million in setting up its Battery Innovation Centre.

- Tata Steel may shut its UK operations if it doesn’t receive aid from the British government to reduce its carbon emissions.

- Ford pleasantly surprised investors by securing enough battery supplies to churn out 600K electric cars a year by 2023.

- Murugappa Group is venturing into electric trucks next with the acquisition of a 65% stake in electric heavy commercial vehicle startup lPLTech Electric (IPLT)for ₹246 crores.

- NHPC and Damodar Valley Corporation to explore JV for setting up hydropower and pump storage projects.

- Tata Steel and Australia-based BHP jointly explore low-carbon iron and steelmaking technology.

- The Olectra Greentech bags ₹500 crores order for electric buses to Telangana State Transport Corporation.

- EV sales in India are headed for a record year – have crossed 210,000 units in Q1 FY2023 (April-June) & are already 49% of FY2022’s total sales.

- Hindalco, Phinergy and IOP join forces to make aluminium-air batteries for EVs and energy storage

- Mahindra Electric’s 3-wheelers charge past 50K sales in India, with nearly 40K coming in the past 3 years.

- Mahindra releases teasers of 5 all-new electric SUVs before the global reveal on August 15.

- Tata Motors wins CESL tender for supply, operation and maintenance of 1,500 electric buses to Delhi Transport Corporation; this is DTC’s largest order to date.

- Hero Electric is setting up its second plant in Ludhiana with a capacity of 200K two-wheelers.

- eMobility, Lucas TVS has started its series production of hub motors and controllers at its Puducherry plant.

- M&M plans to introduce ADAS 2+ level for ICE, electric that enables hands-free driving or what is called “full self-driving”.

- Omega Seiki Mobility opens its third EV plant in Faridabad and a Chennai plant is also on the cards.

- Convergence Energy Services (CESL) signs MoU and Three Wheels United (TWU) to procure 70,000 electric three-wheelers to be deployed in multiple phases across India.

- The new entrant in the 2W EV space: Elysium Automotives launches the EVeium brand.

That’s all for now folks! See you next week! To get the latest updates in the markets, follow us on Facebook, Instagram, and Twitter.

What to expect from the Markets

What to expect from the Markets Key Results

Key Results

Reliance Industries Q1 FY23 results declared. Should you invest?