🏦RBI Holds Interest Rates Steady | Indian Stock Market Weekly Update Aug 12✨

Indian Stock Market Update | RBI Holds Interest Rates Steady

Hello Readers!

We hope you had a great week!

The Reserve Bank of India (RBI) has maintained its key policy rate at 6.5% for the third time, indicating a pause in rate hikes. This decision reflects a desire to let previous rate increases settle and maintain stability in the economy. Despite global economic challenges, the Indian economy continues to perform well.

Additionally, the recent favourable southwest monsoon has led to successful kharif crop sowing in July. This positive development prompted the RBI to keep policy rates unchanged, considering the overall economic picture.

However, there is a slight uptick in the central bank’s retail inflation forecast for the fiscal year FY24. This is attributed to factors like vegetable prices, cereals, pulses, and fluctuations in crude oil prices, which are currently above $87 per barrel.

The RBI projects a growth rate of 6.5% for the Indian economy in FY24, driven by a strong kharif sowing season and improved rural incomes. Banks, businesses, and government investments are contributing to this positive outlook.

In response to the RBI’s announcement, the market displayed a mild decline, with the NIFTY Bank decreasing by 0.7%. The RBI’s mention of an incremental cash reserve ratio (ICRR) of 10% for banks caught attention. This measure aims to withdraw around ₹90,000 crore from the banking system and was introduced due to excess liquidity after the discontinuation of ₹2,000 notes.

In a nutshell, the RBI’s decision to maintain rates had a measured impact on the market, and the focus on managing liquidity through measures like ICRR adds an interesting dimension to the situation.

🧾In this Article

Mr Abhishek Jain, Head of Research, Arihant Capital

On a weekly basis, India’s benchmark ended lower for the second consecutive day on Friday due to negative international signals and the strengthening of the US dollar against other major currencies following stable US inflation. Consumer prices in the US increased moderately last month, raising expectations that the US Federal Reserve will maintain the current interest rates in the upcoming month.

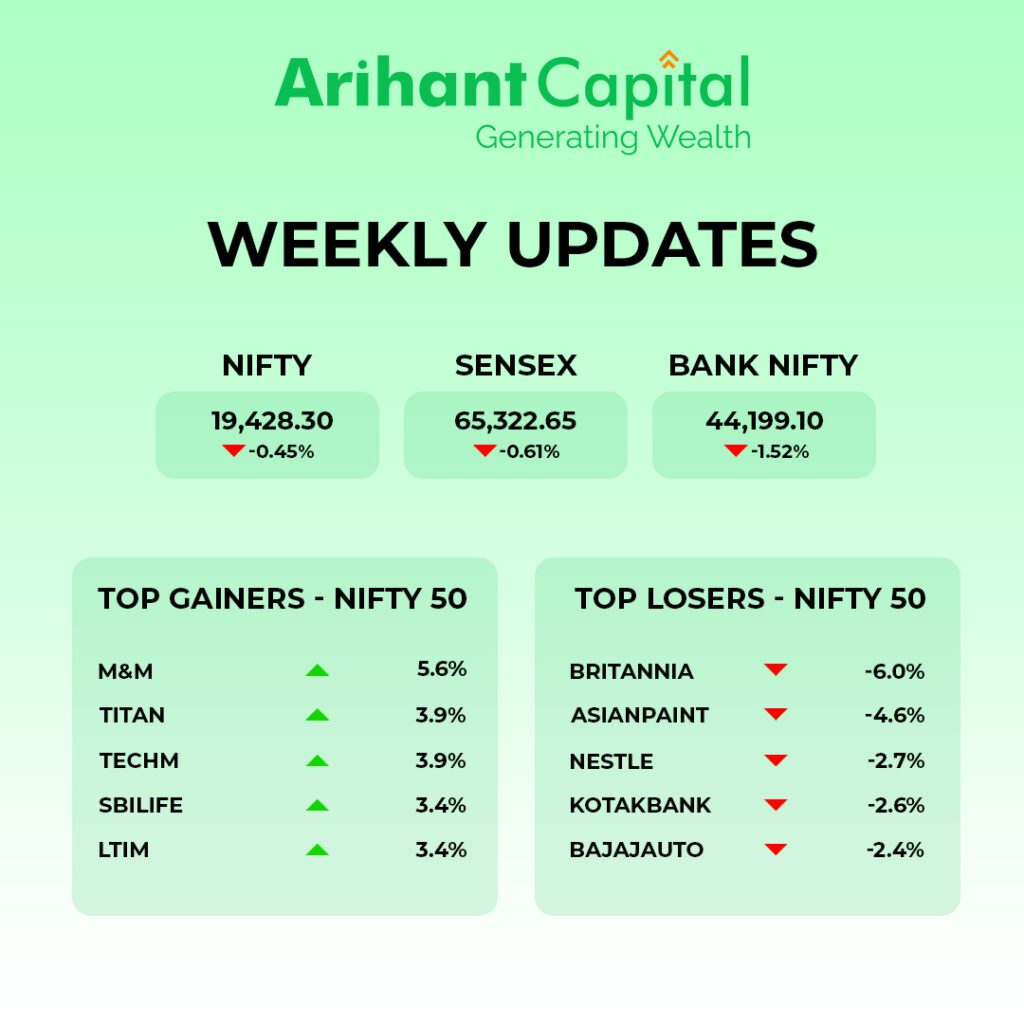

Nonetheless, the initial positivity regarding decreasing inflation diminished, and worries about worldwide economic expansion burdened market sentiment. Nifty ended down by 0.59% at the 19,428 level. Sensex was down 0.56% at 65,323, and Nifty Bank was down 0.77% at 44,199.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

Nifty

The daily chart shows that the 19300 to 19500 levels were initial resistance for the market. On 14 July 2023, we saw a breakout of the mentioned zone, and nifty made a high of 19991, and now, again, prices are trading within the said zone. Hence, 19300 on a daily closing basis remains a make-or-break level. Since the following week is truncated, we may witness a consolidation within this range.

Further, after four days of consolidation below the 20-day SMA(19656), we see a bear candle well below the consolidation zone(shown above in the graph). Nifty now has resistance at the 19656 & 19795 levels. Hence, as long as nifty holds the 19300 level, it is highly probable to test the 19656 – 19795 level. On the flip side, if nifty breaks the 19300 level, it may test the 19200 – 19100 levels. However, stock specific is likely to continue in mid-small-caps.

Bank Nifty

The daily chart shows that Bank-Nifty has closed below the 50-day SMA (44820). Further, it has confirmed a lower-top lower-bottom formation on the daily chart. This reflects a shift in trend. Even the weekly momentum indicators are negatively poised. Combining all the above parameters, it is evident that bank nifty is on weak ground.

If Bank-Nifty breaks the 44380 level, it may test 44000 – 43790 levels. On the upside, 44650 – 45300 levels may act as resistance for the week. Hence one needs to adopt a cautious approach at the current level.

🔎Stocks in News

💼 HCL Tech: Secured a $2.1 billion deal with Verizon Business.

📊 LIC: Recorded a robust consolidated net profit of ₹9,635 cr for April-June, compared to Rs 603 cr last year.

📈 Reliance: Successfully credited Jio Financial Services shares to eligible Reliance shareholders’ demat accounts.

🏢 Indus Towers: Deployed an impressive 2 lakh macro towers across all 22 Indian telecom circles.

📜 ZEE: Receives NCLT approval for the exciting ZEE-Sony merger.

💰 Page Industries: Announced a dividend of ₹75 per share.

🏭 Godrej Consumer: Set to invest ₹515 cr for a new manufacturing plant in Tamil Nadu.

🛡️ Adani Group: Establishes “Atharva Advanced Systems and Technologies,” a wholly-owned subsidiary of Adani Defence Systems and Technologies.

⚡ Suzlon: Plans to raise ₹2,000 cr via qualified institutional placement (QIP).

🏦 Axis Bank: Increases its shareholding in Max Life to 16.2% from 9.99%.

💸 Union Bank: Pays a record dividend of ₹1,712 cr to the government for 2022-23.

📊 BSE: Achieved a consolidated net profit of ₹440 cr for April-June, marking a substantial growth from Rs 40 cr last year.

🔌 Eicher Motors: VE Commercial Vehicles to supply up to 1,000 electric trucks to Amazon over five years.

🛫 GMR Airports: Board to discuss raising funds to ₹5,000 cr on August 14.

🏦 Tata Group: Competition Commission of India approves the merger of Tata Cleantech Capital and Tata Capital Financial Services with Tata Capital.

⚡ Power Grid: Seeks shareholder approval to raise to ₹12,000 cr through a bond issue.

🍟 Quick Bites

📅 IPOs will now list 3 days after their closing date vs 6 days before SEBI.

💰 Open-ended equity funds saw a net inflow of Rs 7,626 cr in July, while open-ended debt funds saw net inflows of ₹61,440 cr.

📢 Pyramid Technoplast IPO will be open for subscription between 18 and 22 August.

🏦 Banks have collected over ₹35,000 cr in penalties since 2018 for non-maintenance of minimum balances, additional ATM transactions, and SMS services: Government.

📉 Indian government lost around ₹1 lakh cr in 2020-21 due to a corporate tax cut: Minister of State for Finance Pankaj Chaudhary.

📊 TVS Supply Chain Solutions IPO subscribed 0.55 times, with retail investors at 1.71 times.

🍅 India started importing tomatoes from Nepal to reduce domestic prices: FM Nirmala Sitharaman.

🚗 India’s passenger vehicle wholesales rose 2.94% YoY in July to 3.02 lakh units: SIAM.

💳 RBI proposes to increase the offline UPI Lite payment limit to ₹500, along with steps to boost digital payments.

🛡️ Life insurance companies report a 28.69% YoY decline in first-year premium to ₹27,867.10 cr in July: IRDAI.

✈️ Tata Group Airlines record a loss of ₹15,530 cr in FY2023, Air India posts a loss of Rs 11,216.32 cr.

🎮 India’s toy exports rose 60% to $325.72 million in 2022-23, and imports fell 57% to $158.70 million: Minister of State for Commerce and Industry Som Parkash.

📊 Concord Biotech IPO subscribed 24.87 times, with retail investors at 3.78 times.

💳 Credit card defaults rise to ₹4,072 cr at the end of March 2023 vs ₹3,122 cr in March 2022: Minister of State for Finance, Bhagwat Karad.

⛽ India’s fuel consumption rose by 1.9% YoY in July to around 18.09 million tonnes: Petroleum Planning and Analysis Cell.

🏦 Indian banks write off bad loans worth ₹14.56 lakh cr in last nine financial years: Minister of State for Finance, Bhagwat Karad.📈 Aeroflex Industries receives SEBI’s approval for its ₹350 cr IPO.

🌱 Sustainability Corner:

🚀 Maturing India EV market sees 54,272 e2Ws sold in July, up 18% on a tough June; Ola, TVS, Ather, Bajaj, Greaves & Hero MotoCorp see strong growth; 100,256 e2Ws bought in June-July despite reduced FAME II subsidy. Sales this month till Aug 12: 20,834 units.

⚡ Electric motorcycle manufacturer Tork Motors introduces new ‘Urban’ trim on its Kratos-R, priced at INR 167,000.

🚗 Ashok Leyland gearing up to launch its electric Dost LCV, which was first revealed at Auto Expo 2022 and has been snapped testing recently.

🌟 Tata Motors achieves 1 lakh EV milestone in the last 5 years; expects to bring in the next 1 lakh units in the next 12-14 months.

🔋 Mahindra to launch the ‘Born Electric’ EV range with BYD blade cells, and Valeo electric motors.

🌎 BYD becomes the world’s first automaker to produce 5 million EVs – while its e-buses ply in over 400 cities across 70 countries, its cars & SUVs are currently sold in 54 countries including India. As of July ’23, BYD’s global sales are over 4.8 million units.

🌱 Mahindra Last Mile Mobility expands its electric 3-wheeler portfolio with the new e-Alfa Super. Priced at INR 161,000, the zero-emission e-Alfa Super travels over 95 kilometres on a single charge.

📈 Federation of Automobile Dealers Associations (FADA) urges Minister of Road Transport & Highways Nitin Gadkari & the government to reduce GST from 28% to 18% on entry-level two-wheelers in the 100-125cc segment to revive demand, especially in rural India.

🚗 EV sales in India charge past 800,000 units in first seven months of 2023: – e2Ws: 489,640 units already 77% of CY22 – e3Ws: 300,099 units 85% of CY22 total – ePVs: 46,163 units surpass year-ago sales – eCVs: goods carrier & bus sales revealed.

🏭 Lumax-DK Jain Group expands into transmission-shift towers, and claims to have received orders for 500,000 units from two Japanese and an Indian passenger vehicle OEM. Vikas Marwah, CEO, of Lumax Auto Tech details the strategic growth plan.

🚀 Tata Motors to launch 4 new EVs within two quarters, says Chairman N Chandrasekaran. Also, by 2030, 50% of Tata Motors’ car business and 65% of JLR’s business will comprise EVs.

💳 Tata Motors, which aims to also tap demand for its EVs in Tier 2 & 3 cities, partners with South Indian Bank to offer a financing programme for its electric car and SUV dealers, and retail finance solutions for EV buyers.

🌏 The ‘China+1’ de-risking strategy of OEMs augurs well for India to become a global manufacturing hub for auto components. There is definitely a drive towards localisation. The endeavour is to increase exports & reduce imports.

📊 India’s auto component industry records its best-ever turnover of INR 560,000 crore, up 33% in FY2023 – strong domestic market vehicle sales, robust aftermarket & steady exports drive growth; supplies to the EV industry now account for 2.7% of turnover.

💡Knowledge Candy🍬:

Record Retail Investor Participation: Surge in Mutual Funds and Demat Accounts Reflects Growing Confidence in Indian Markets

Retail investors display a strong affinity for the Indian markets, evident in the record-breaking inflow of ₹15,245 crore via the systematic investment plan (SIP) route in July 2023.

This surge underscores their determination to foster long-term wealth through consistent mutual fund investments. Concurrently, over 30 lakh new demat accounts were initiated, reflecting an escalating interest among investors to engage with the stock markets.

The buoyant momentum in the domestic markets serves as a significant draw for mutual fund investments, yielding commendable returns, with the NIFTY50 advancing by 7.3% in 2023 thus far. Additionally, the robust economic outlook projected by the RBI, forecasting a 6.5% growth rate in FY24, contributes to the positive sentiment in stock market performance. This, coupled with heightened awareness about the advantages of long-term investment, is propelling retail participation.

Total assets under management (AUM) have surged to 8.32 lakh crore through the SIP route, further substantiating the trend. 33 new SIP accounts were registered in July 2023 alone, while the mutual fund industry’s overall AUM reached 46.3 lakh crore, marking a substantial 22% YoY increase.

The spike in demat accounts, with over 30 lahks opened in July, corroborates the trend of direct participation in stock markets. This surge can be attributed to younger generations entering the equity arena, heightened interest from Tier-2 cities, and facilitating account opening through digital means.

Despite these encouraging figures, stock market penetration in India remains below 5%, in contrast to 55% in the US and 13% in China—consequently, the trajectory points toward the potential for increased retail involvement in the future.

Happy reading!

Also Read: TVS Supply Chain Solutions IPO is live. Should you Invest?